Bitcoin traded unchanged across the last week. The largest cryptocurrency started the previous week at 61.3k before rising to a high of 63.5k on Friday and falling back to 62k on Sunday. Bitcoin has started the new week on the front foot, rising above 64k.

Altcoin experienced a similar pattern, with Ether and BNB unchanged across the last week. Meanwhile, other altcoins fell. Solan dropped 1%, Cardano fell 2.9%, and NEAR tumbled 6%. However, there were also pockets of positivity, with UNI and TRX up 10% and 5%, respectively. Meanwhile, SUI soared 21% last week.

Bitcoin ETFs post weekly net inflows

Bitcoin ETFs experienced net inflows of $308.76 million in the week ending October 11, following net outflows of $301.54 million in the previous week. Net inflows point to a recovery in institutional demand. Delving deeper into the data, Bitcoin ETFs saw net inflows on Monday and Friday, overshadowing net outflows on Tuesday, Wednesday, and Thursday. On Friday, Bitcoin ETFs saw net inflows of $253.54 million, coinciding with a 3% price rise.

Distributions

Mount Gox has delayed its distribution deadlines until October 31st, 2025, which could help alleviate near-term concerns about oversupply and is helping Bitcoin rise at the start of the week. The defunct exchange had started returning $9 billion worth of stolen tokens to creditors in July and still holds $2 .8 billion worth of tokens.

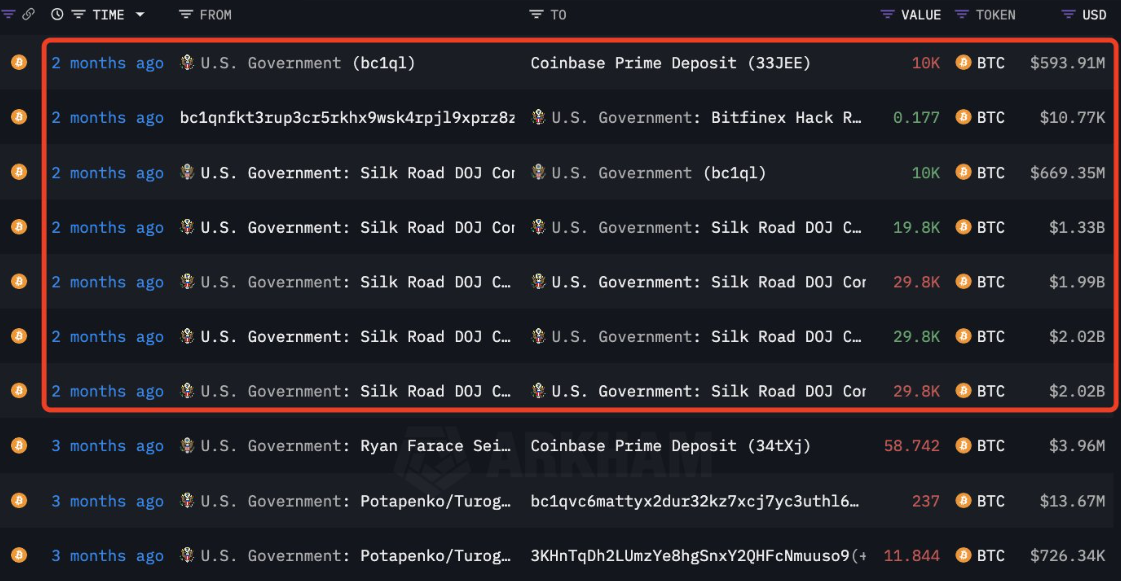

The news of the delay is offsetting on-chain data from last week, which shows that the US government appears now ready to sell 69,370 Bitcoin worth $4.33 billion confiscated from a Silk Road user called Individual X.

Should the US government decide to sell the new Bitcoin as it did two months ago when it transferred 10,000 Bitcoin to Coinbase Prime, it could generate bearish sentiment in the market.

Regulatory headwinds

Separately, US enforcement actions are also looming. The SEC announced a fraud charge against three crypto market makers and nine individuals for promoting tokens by creating “the false appearance of an active trading market,” aka wash trading. This comes as the first-ever criminal charges for market manipulation in the cryptocurrency industry, directed by the Department of Justice (DoJ) US Attorney’s Office, led to 18 individuals and entities being charged.

Such developments could mean that trading volumes in those cryptocurrencies with low market capitalization, particularly unvetted tokens in decentralized exchange (DEX) environments with low regulatory quadrilles, are an area to be cautious of.

Macro backdrop

Bitcoins remained unchanged across last week, decoupling from stocks, which extended gains for a fifth straight week, and the US S&P500 reached a fresh record high. The divergence in risk assets came as the markets digested geopolitical tensions, disappointment from China, and US inflation data.

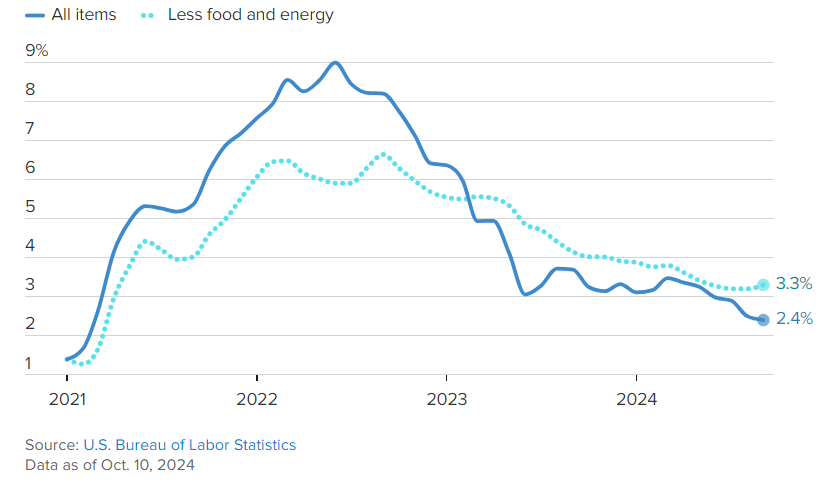

US inflation eased but by less than expected to 2.4% YoY in September, down from 2.5% in August, and core inflation rose to 3.3% annually, cementing expectations that the Federal Reserve will cut interest rates by 25 basis points at its November meeting. The figure is the last inflation reading before the November 5th presidential elections and came after the Federal Reserve cut rates by a larger-than-usual 50 basis points in the last month, suggesting it was succeeding in its battle to tame price pressures.

Following the data and a jump in jobless claims, investors increased their bets on a 25-point cut at the US central bank’s November meeting.

Still, current macro factors affecting crypto are shifting away from US monetary policy to the upcoming elections. The race remains incredibly tight, with Kamala Harris just a touch ahead in the polls. With four weeks to go, it is still too close to call.

China stimulus

China’s keenly awaited Finance Ministry briefing on Saturday lacked the firepower the markets hoped for, suggesting that recent volatility in risk assets would likely continue. Finance Minister Lan Fo pledged more support for the struggling property market and signaled more government borrowing to shore up the economy. However, the briefing didn’t produce the headline dollar figure the market sought. The announcement also lacked incentives to boost consumption, which could add to the disappointment. This pulled Bitcoin lower on Sunday, back to 62k, although the price has since recovered.

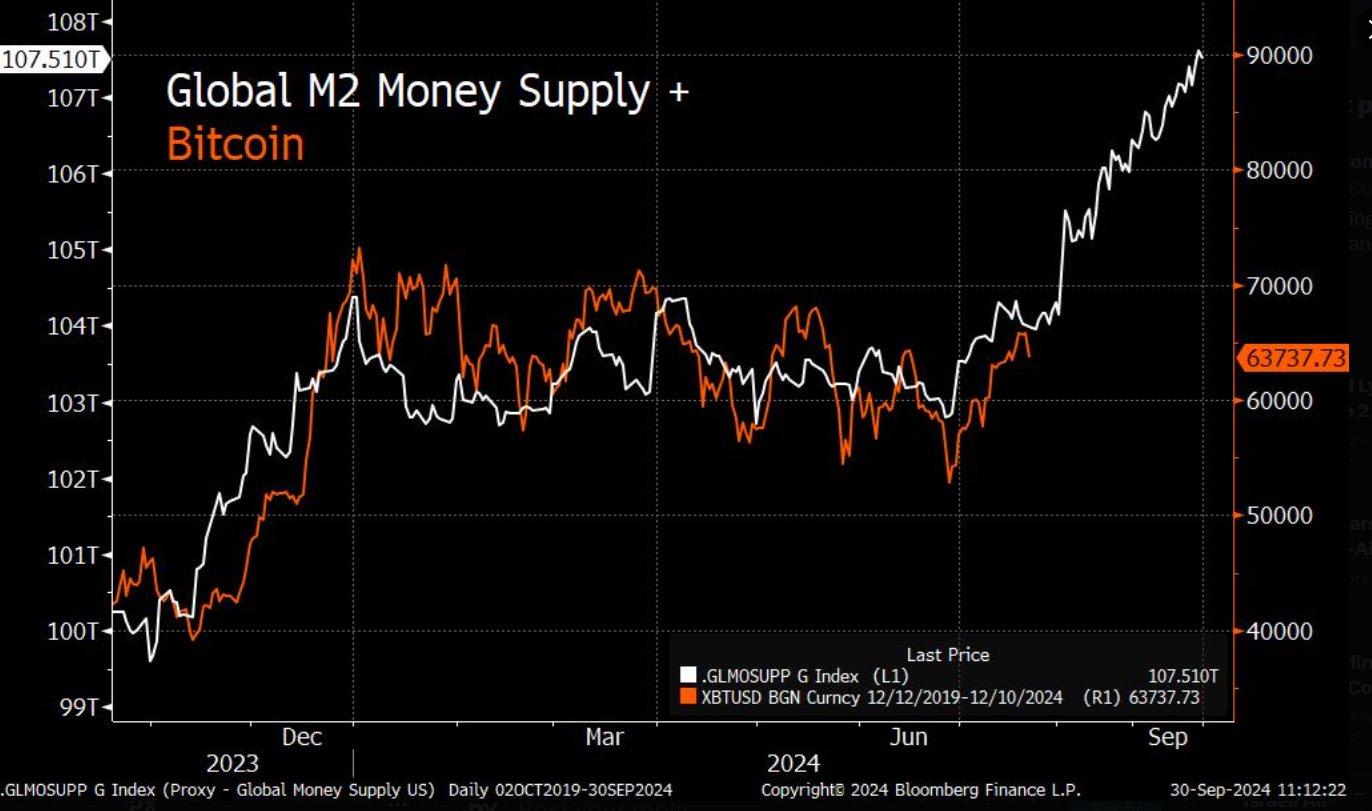

Money supply rises to record level – a reason to be positive?

With the Fed cutting rates and China announcing stimulus, liquidity is improving. According to the Kobeissi Letter, the total money supply in the United States, the euro area, Japan, and China reached a record $89.7 trillion, up $7.3 trillion over the past year. Historically, Bitcoin has risen alongside the M2 money supply with a lag of around 75 to 90 days. With this in mind, expectations are for a healthy rally for Bitcoin towards the 2024 close despite the several headwinds it’s facing.

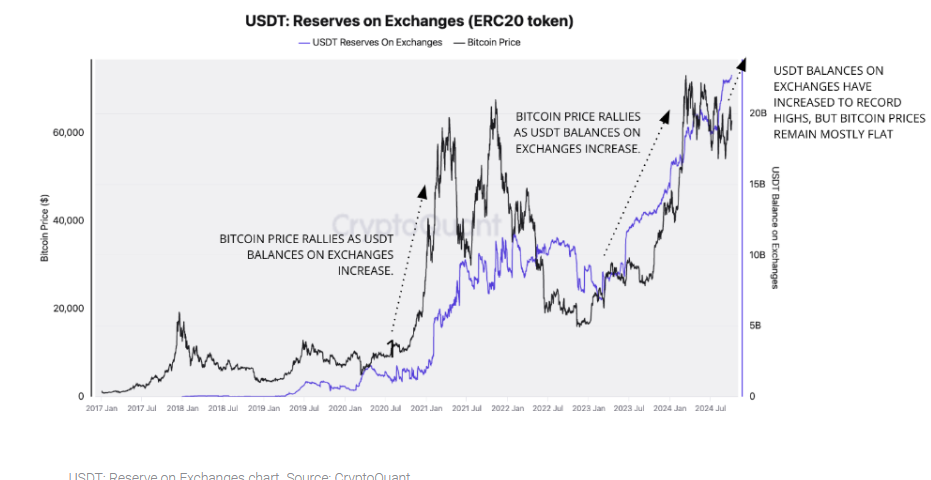

Meanwhile, according to Crypto Quant, the rising stable coin market capitalization could be a positive sign for Bitcoin and cryptocurrencies in general. The report explains that liquidity in the crypto market, as measured by stable coin value, reached a record high in September. The total market capitalization of major U.S. dollar-backed stablecoins is now $169 billion, up $40 billion year to date, which equates to a 31% increase. An increase in the stablecoin market cap is often associated with higher Bitcoin and crypto prices as it provides more liquidity to the market.

UNI soars

Uniswap has outperformed the broader market, experiencing gains of 17%, as it gathers larger retail interest. This has been caused by a recent development that provides a new level of user experience on the platform.

Last week, Uniswap announced Unichain a new Layer- 2 with faster block times and cross-chain interoperability.

Unichain is designed to support Ethereum scaling, which draws transaction fees to be as low as 95% compared to the Ethereum mainnet, with the goal for it to fall even further. This brings faster transaction times thanks to Unichain’s one-second block times. Unichain aims to release 250 millisecond block times in the future, further decreasing transaction times while increasing the number of transactions the platform can handle.

From a user’s perspective, Unichain enables faster transaction speeds and lower costs and aims to address liquidity fragmentation issues in Ethereum’s defined ecosystem.

Looking Ahead

US retail sales

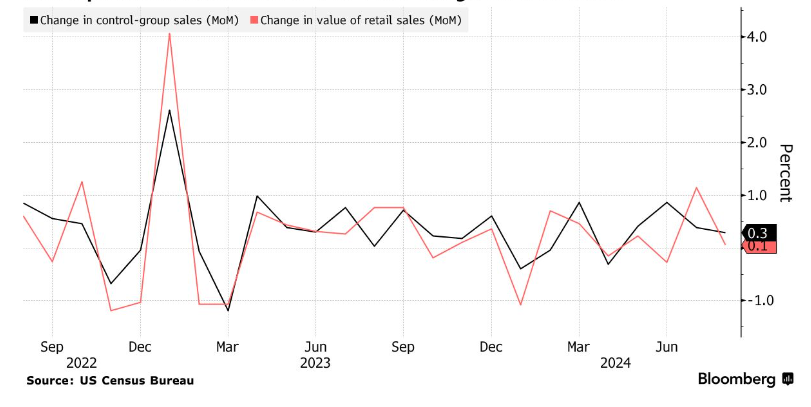

The US economic calendar is relatively quiet this week, with just US retail sales in focus. Expectations are for retail sales to rise 0.3%, up from 0.2%, supporting the view that the US consumer remains resilient. Data in line with expectations supports the Goldilocks view that the US economy is holding up well even as inflation cools, supporting gradual rate cuts from the Federal Reserve, which might benefit Bitcoin.

China

This week will be focused on China. After the stimulus announcement this weekend, several key data points from the world’s second-largest economy, including inflation figures, GDP, retail sales, and industrial production, are due on Frida. Disappointing data after the stimulus announcement this weekend, underwhelmed, could hurt market sentiment and pull Bitcoin lower.

US elections

As mentioned earlier in this report, US elections are moving closer with just four weeks to go and a noticeable calmness in the market. Bitcoin has moved less than 5% for 34 straight sessions as of Friday. Within the next 14 days, this will mark the longest sideways move in a halving year. One such reason could be investors sitting on the sidelines ahead of the elections, particularly given the polls are so close.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.