Bitcoin is experiencing elevated volatility. After falling 10% in the previous week to a 3-month low of 78,000, Bitcoin surged 10% on Sunday, rising to a high of 95,000. However, BTC was unable to maintain those gains and plunged back to 83k at the time of writing.

The high levels of volatility haven’t been confined to Bitcoin, which shed 6% over the past seven days. Altcoins have seen a mixed performance. Ethereum continues underperforming, dropping 12% over the past week despite a 13.5% rally on Sunday. Meanwhile, XRP jumped 8% over the past seven days, helped by a 34% rally on Sunday, and Solana is flat despite a 24% gain on Sunday, which has been fully reversed.

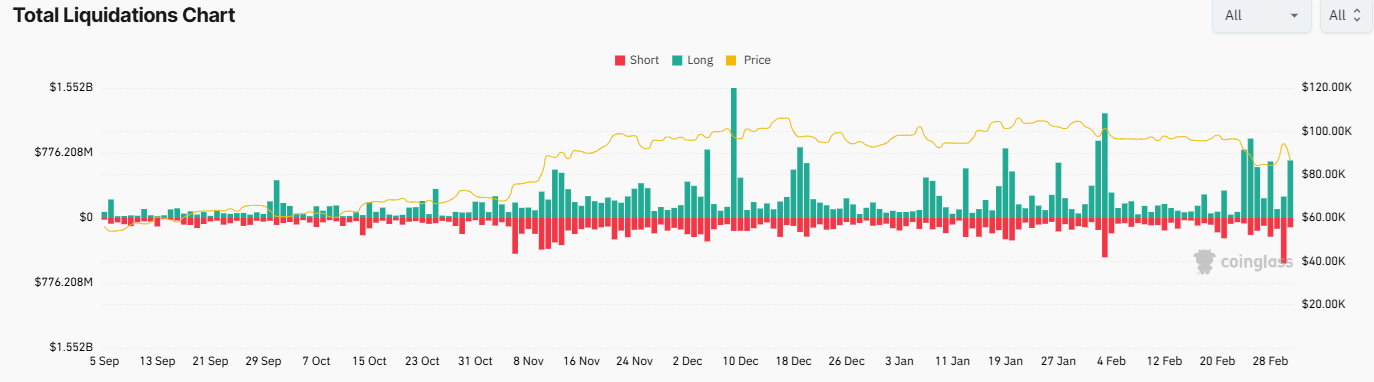

Last week’s price correction wiped $660 billion of market capitalisation from the overall crypto market and saw $3.86 billion in total liquidations, most of which were long positions. However, the recent rally higher saw a change in fortunes. On Sunday, liquidations of short positions reached $543 million, compared to $256 million in long positions. This was then reversed with Monday’s selloff resulting in 693.9 million in long crypto liquidations and $118.6 million short. These figures highlight the choppy nature and elevated volatility in the market.

Institutional demand falls

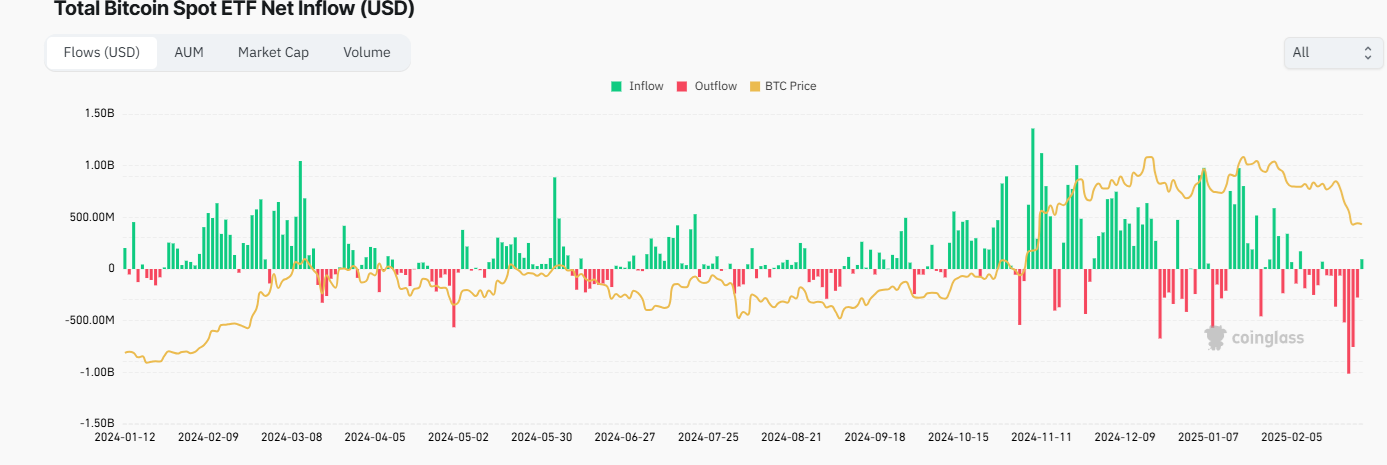

Bitcoin ETFs saw 2.6 billion in outflows in the previous week, marking the third straight week of outflows with a single day withdrawal of over $1 billion from Bitcoin ETFs on February 26th. These figures underscore the bearish sentiment in the market. The substantial withdrawals contributed to a decline in net assets for Bitcoin ETF, which fell below the $100 million mark to $95.38 billion.

Basis trade unwinds

The sell-off in Bitcoin ETFs can be attributed to bearish fundamental factors and the ongoing unwinding of a neutral hedge fund strategy, which saw professional traders seize on the so-called market-neutral basis trade.

This strategy exploits the premium between the short-term contracts of CME Bitcoin futures and the real-time price of Bitcoin. According to 10x Research estimates, 56% of Bitcoin ETF buying activity so far has been tied to hedge funds applying arbitrage strategies such as the basis trade. The CME basis strategy worked particularly well in the final quarter of 2024. However, demand for CME Bitcoin futures has slumped 25% since peaking in mid-December, and the gap between the prices of the futures contract and spot Bitcoin has shrunk with the lowest level since 2023. This trade will likely continue unwinding, putting pressure on the BTC price.

On a more positive note, BlackRock also announced it will incorporate its Bitcoin ETFs into portfolio allocations and allow for 1-2% exposure in alternative asset portfolios, which marks a significant step towards mainstream adoption.

Macro backdrop

Bitcoin strategic reserve headwind

U.S. President Trump once again touted his plans for a strategic crypto reserve, sending the cryptocurrency market surging on Sunday. The market recouped some of its losses from February, which was the cryptocurrency’s worst month since 2022.

In a post on Truth Social on Sunday, Trump said that his executive order on crypto directed the presidential working group to move forward on a crypto strategic reserve, including XRP, SOL, and ADA. The inclusion of these tokens in Trump’s plans caught the market by surprise, resulting in massive rallies on Sunday and gains across most digital assets. Trump also said Bitcoin and Ether would be included in the reserves, helping those coins recover some of the recent steep declines.

However, the Trump-inspired crypto rally fizzled on Monday as investors questioned the feasibility of Trump’s plan. By the end of Monday, most crypto markets were back in the red, with XRP, SOL, and ADA suffering declines of over 10%.

The announcement contained few details on how the reserve would be created. Furthermore, any attempt to create a crypto strategic reserve will most likely require Congress to pass the bill, making investors sceptical that a robust US crypto reserve will actually come to fruition. The Trump administration’s options for creating a reserve are limited without congressional approval. The easiest move would be for the government to hold onto Bitcoin that it had acquired when busting fraud or hacker rings. The Justice Department has traditionally sold these.

Attention is turning to Trump’s first-ever White House crypto summit on March 7th. This marks a major step forward for US digital assets and policy, signaling the government’s pro-crypto stance and focus on creating a clear regulatory framework. The market will be watching closely to see if there are any further details regarding the strategic reserve at the crypto summit.

Crypto tailwinds – trade tariffs

Trade tariffs on Mexico and Canada went into effect today, as did an additional 10% trade tariff on Chinese goods. China retaliated with up to 15% trade tariffs on US imports, furling fears of a full-blown trade war between the world’s two largest economies. News that the tariffs would go ahead overshadowed any Bitcoin strategic reserve optimism that remained and sent risk assets, including cryptocurrencies, sharply lower. US stocks, particularly tech stocks, dropped sharply. The Nasdaq closed Monday 2.6% lower, extending losses of 4% in February.

Fears are rising that trade tariffs will slow the US economy. Forward-looking data such as business and consumer confidence are already showing weakness, raising worries that the period of US exceptionalism is ending.

Fear & Greed

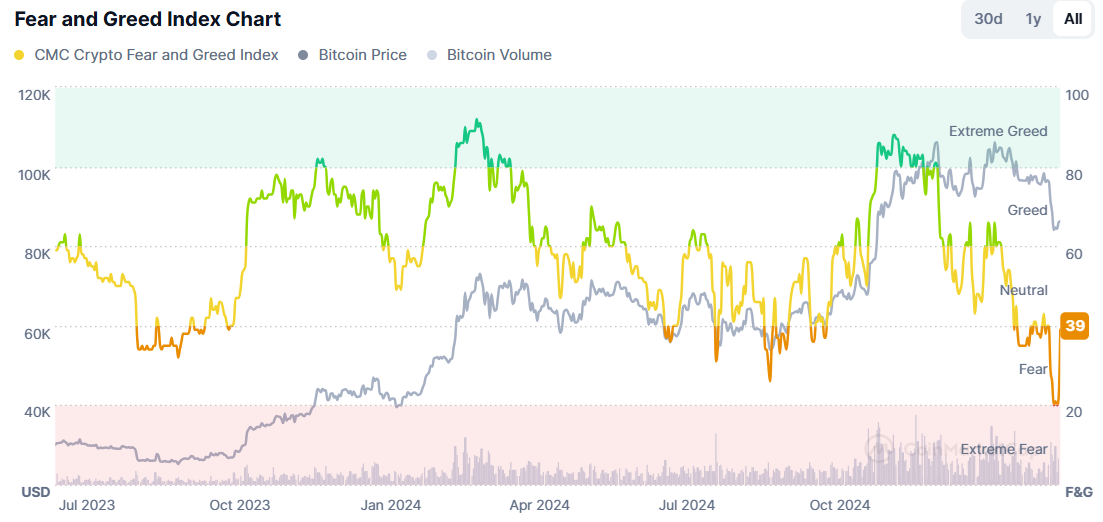

Enthusiasm following Trump’s announcement was short-lived and was quickly overshadowed by trade tariff worries. The crypto fear and greed index, a sentiment gauge among traders, showed that traders remain fearful.

Bitcoin remains in distribution, not accumulation

Data from Glassnode showed that Bitcoin’s accumulation trend score remained below 0.5 for the 58th straight day, underlining a long period of net distribution. This is a period of profit-taking by investors, which is often in line with market corrections. Glassnode states, “the accumulation and distribution phases have alternated within a 57-65 day window on average and there is no confirmed transition to accumulation yet.”

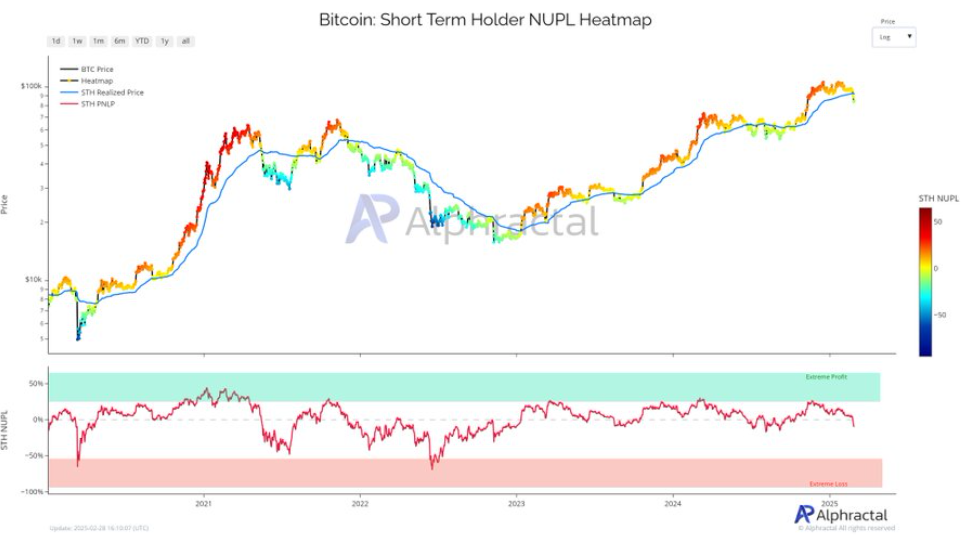

Data from Glassnode also suggests that Bitcoin short-time holders are struggling, as every investor who jumped in over the past 155 days is now facing unrealized losses. When the STH Net Unrealized Profit / Loss turns negative, it signals capitulation among recent buyers, often coinciding with local bottoms. Historically, the STH realised prices acted as a critical support level, as seen in 2017 and 2021.

Trading below the key 92k, which is the STH Realised Price, Bitcoin has struggled to recover, marking a critical psychological shift. If it fails to reclaim this level, short-term holders may continue to sell, amplifying downward pressure.

A bullish case for Bitcoin could emerge if it rises above 92K, restoring confidence among short-term holders and shifting the sentiment from uncertainty to renewed accumulation. However, this appears a long way off. Failure to reclaim this level could confirm a short-term downtrend, reinforcing profit-taking and adding selling pressure.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.