Bitcoin is holding steady in consolidation mode above 83k at the start of the new week, having recovered 8% from its weekly low of 77k. The price has risen 1.3% over the past 7 days but trades over 23% lower from its record high of 109.5k, reached on January 20.

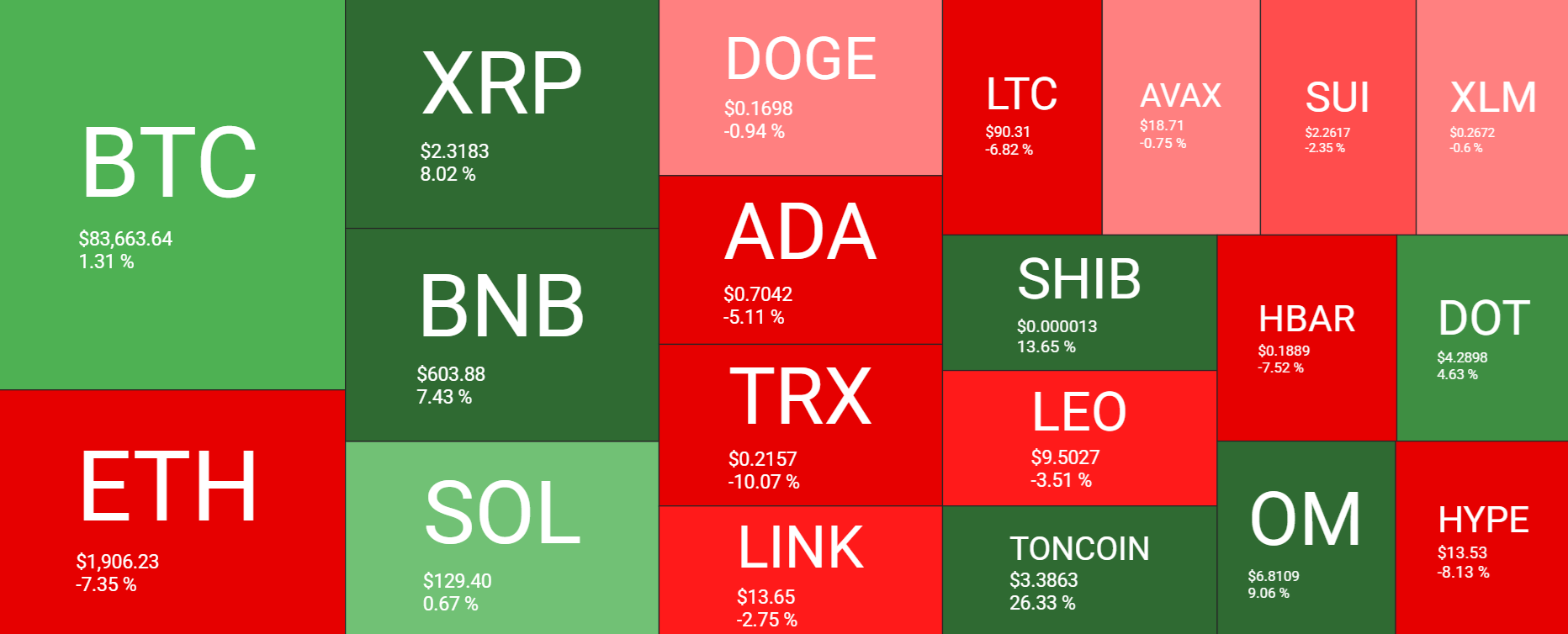

While Bitcoin has booked modest gains, altcoins are showing a mixed picture. XRP gained 8%, and Solana jumped 7.5%. TON outperformed, rising 26%. However, Ethereum underperformed, falling 7%. ADA fell 5%, and TRX declined 10%.

Bitcoin dominance remains elevated at 61.90%, although it eased slightly from the monthly high of 62.23% reached earlier in the week. Bitcoin dominance remains around levels last seen in 2021. This suggests that investors are gravitating toward the relative safety of Bitcoin amid an otherwise sluggish market.

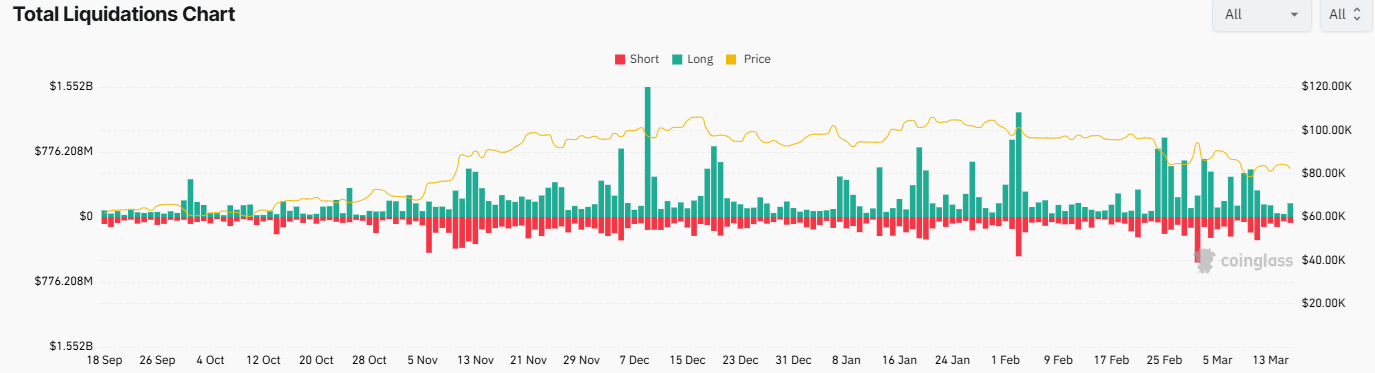

Crypto liquidations ease across the week

The sharp fall in Bitcoin’s price at the start of last week meant that long liquidations across the crypto market were elevated at $568.35 million compared to $185.2 million in short liquidations. However, the more stable price action toward the end of the week meant that liquidations were significantly lower, at $45.73 million in long liquidations and $118.5 million in short liquidations. The weekly total for liquidations was substantially less than the previous week.

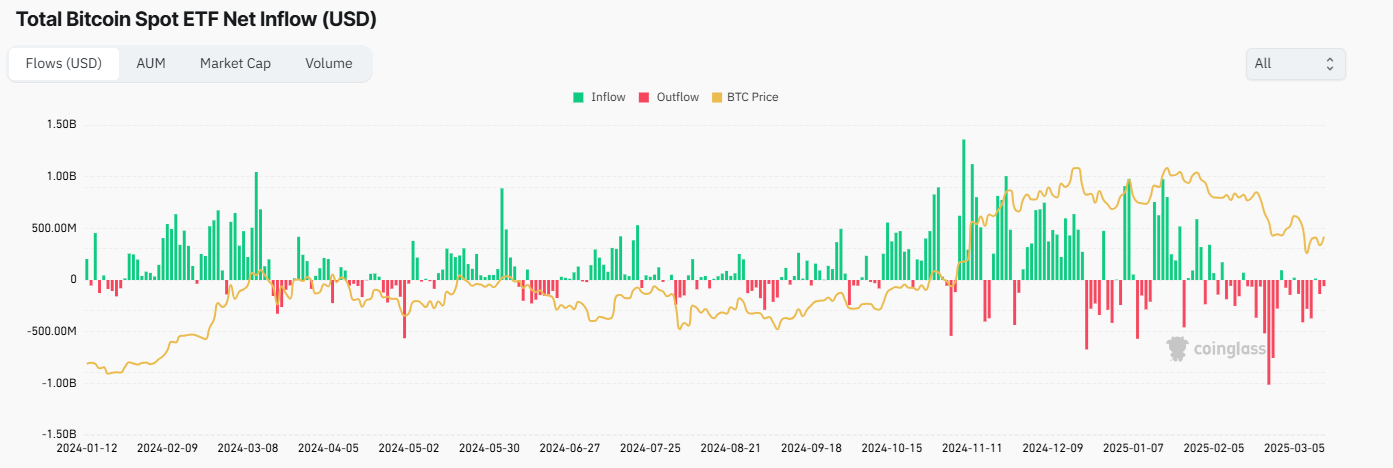

Institutional demand falls

Institutional demand continued to evaporate last week. According to Coinglass, Bitcoin ETFs experienced outflows of $938.80 million last week, marking the fifth straight week of outflows and the longest stretch of weekly outflows since BTC launched in January 2024. The prolonged slump sees net inflows since the start of 2025 almost completely wiped out.

The data suggests that institutions are rethinking their Bitcoin Strategy. While outflows are showing signs of slowing, they are not turning positive. Persistent Bitcoin ETF outflows could keep the BTC price under pressure.

As demand for BTC and ETH ETFs has fallen sharply, a rising number of asset managers are aiming to diversify ETFs further. Proposed funds include Litecoin, Ripple Solana, and Dogecoin ETFs. If approved, these could inject fresh momentum into crypto investment.

Macro backdrop – FOMC rate decision & trade worries

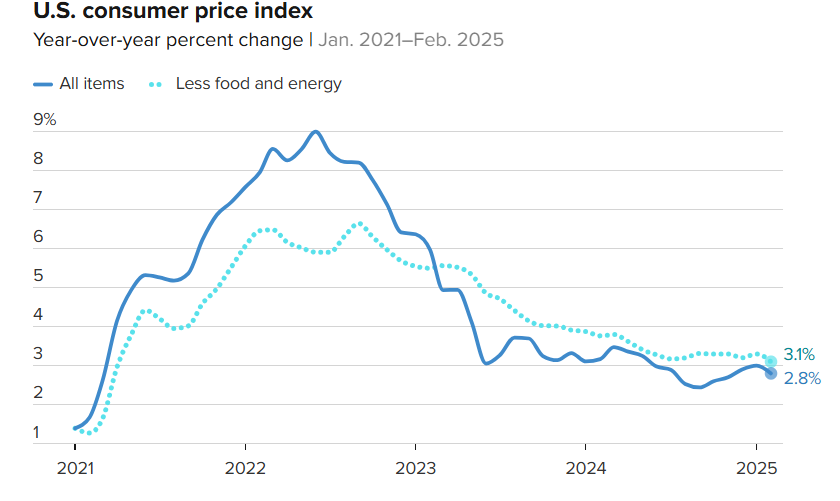

US consumer inflation for February was lower than expected, prompting a brief recovery in hammered stocks and crypto assets. CPI eased to 2.8%, down from 3% and below forecasts of 2.9%. Meanwhile, underlying inflation eased to 3.1%, down from 3.2% and below the 3.2% expected. Delving deeper into the data, we see that services and transportation prices have decreased due to weaker consumer demand, which indicates slowing economic activity. Furthermore, this data does not include the expected inflationary impacts of tariffs, which are yet to be felt in the economy or show up in the data.

With this in mind, it’s uncertain whether the markets have really bottomed out, particularly ahead of the Federal Reserve’s upcoming FOMC meeting this week and Q1 2025 earnings in April. The Fed is widely expected to leave interest rates unchanged. As a result, attention will be paid to Federal Reserve Chair Jerome Powell’s comments, particularly those surrounding trade policy and fiscal policy changes. A cautious-sounding Powell could keep risk assets out of favour.

There haven’t been many crypto-specific catalysts and announcements following the White House Digital Asset Summit 10 days ago. The Trump administration’s strategic reserve announcement before the summit marked a key policy shift, and catalysts have slowed considerably. However, many regulatory developments are still in progress, which points to an environment that is becoming increasingly accommodative. This supports the longer-term outlook for crypto.

Meanwhile, persistent weakness in US equities, with the Nasdaq and the S&P 500 in correction territory, appears to be keeping a cap on crypto prices. U.S. trade tariffs and reciprocal foreign tariffs are creating uncertainty and repricing across most asset classes. Amid a lull in the crypto-specific narrative, crypto will likely continue to trade with a high correlation to US equities.

Is the peak of this cycle already in?

Historically, Bitcoin’s most substantial gains are recorded in the 12 to 18 months post halving event. Each cycle has seen significant price growth, culminating in peaks long after the initial hype surrounding halving had cooled. In this respect, the timeline places a potential market top sometime between mid and late 2025. Therefore, historical precedent tells us that the peak has not yet been reached. However, it is worth keeping in mind that institutional flows and regulatory developments may have altered the cycle.

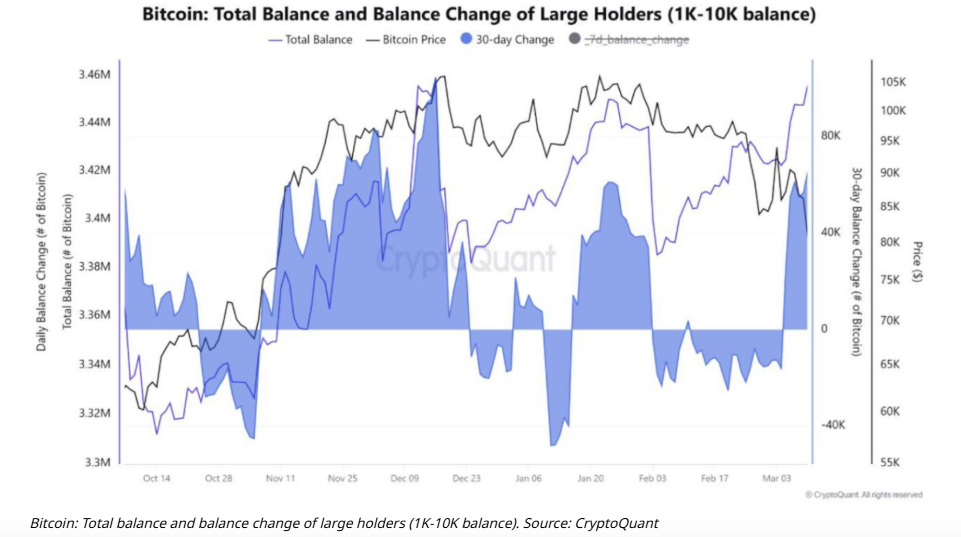

Whales accumulate

Over the past week, whales have accumulated more than 60,000 Bitcoin, showing a strong vote of confidence in BTC. This takes whale holdings above 3.45 million, which is a notable positive swing in the 30-day percentage change. Rising accumulation typically is a bullish signal from long-term investors and tends to front major moves. This could support the view for a late 2025 cycle peak.

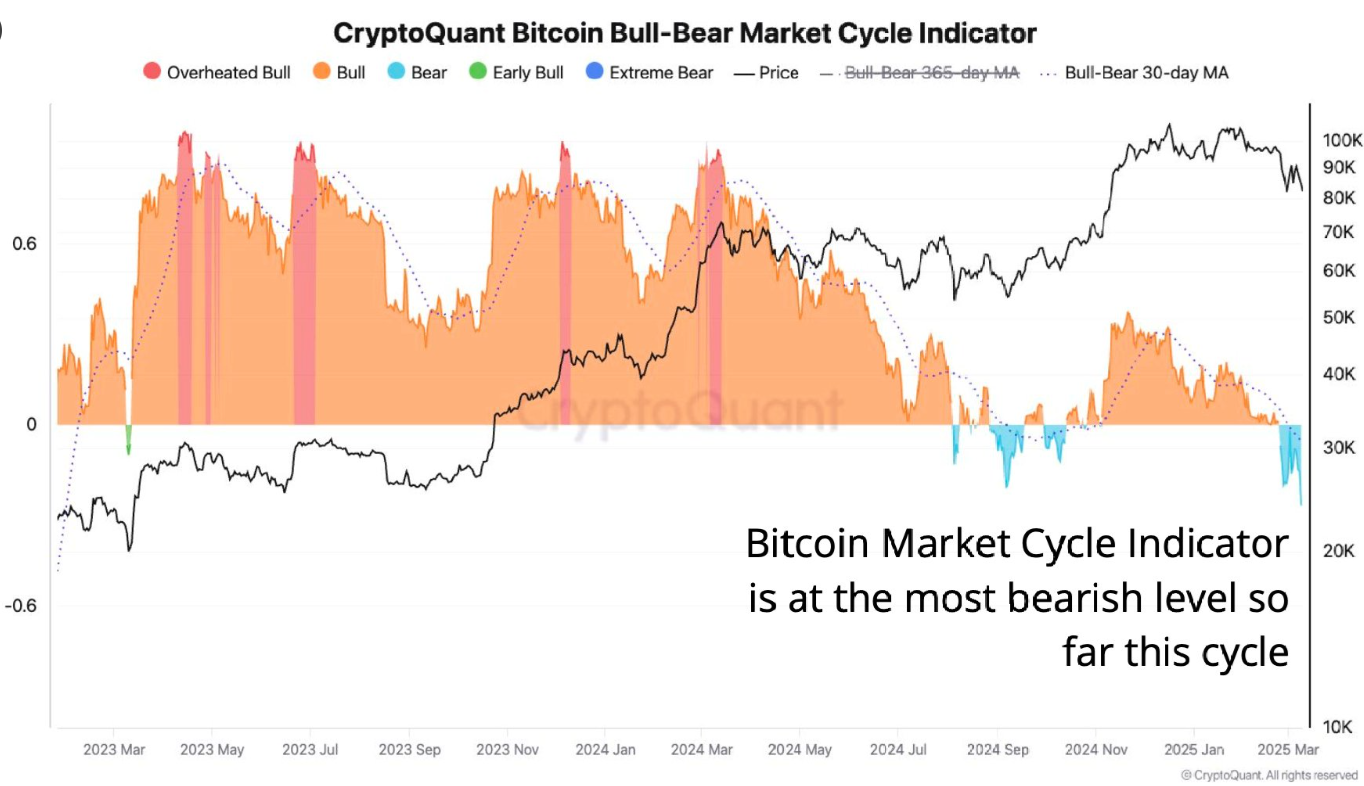

Deep correction or the start of a bear market?

However, other data points offer differing signals for Bitcoin. Data from CryptoQuant shows that the Bitcoin bull-bear market cycle indicator fell to its most bearish level so far this cycle last week. Furthermore, the MVRV ratio Z-score crossed below its 365-day moving average, signaling that the upward price trend has lost momentum. Historically, valuation metrics at these levels have signaled a steep correction or the start of a bear market.

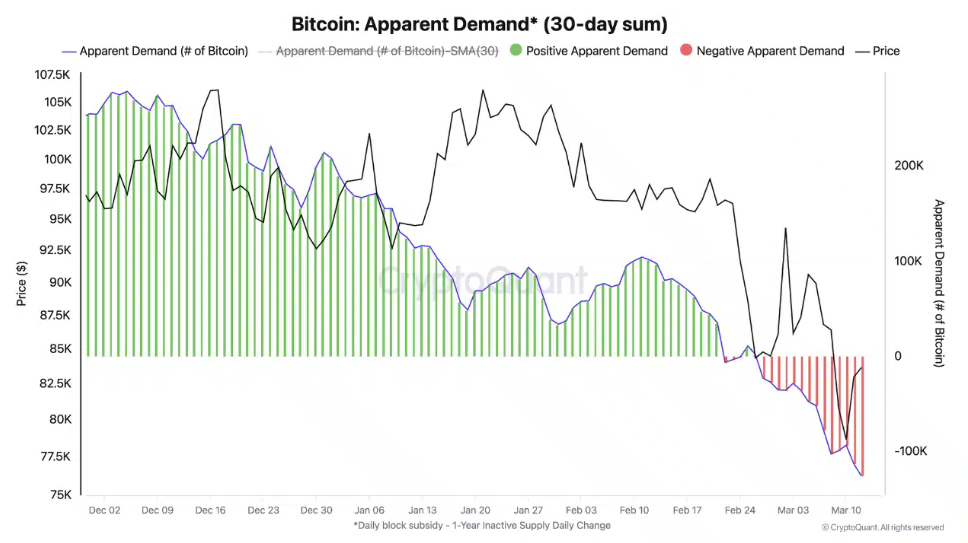

Apparent demand declines

Technical indicators such as the OBV showed that selling pressure has been dominant, and more losses could be ahead. Apparent demand has been on the decline since December. The apparent demand chart compares new supply to supply that’s been inactive for a year and identifies whether the new BTC is being absorbed into the market owing to increased demand or if there is a lack of buying pressure. The apparent demand fell below zero at the end of February, coinciding with the loss of the 92K support, and has remained negative since.

Bitcoin’s first test could come at 81,400, offering some support. Staying above this level keeps the uptrend in play

Technically, Bitcoin continues to hold above the 50 SMA on the weekly chart, around 75k, which is considered a key gauge below which the price could enter a bear market. This would be a level to keep monitor, especially if the Fed adopts a cautious tone and US recession worries continue to rise. A break below here could signal the start of a deeper selloff.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.