Bitcoin has started the new year on the front foot, posting seven straight days of gains. Across the past week, BTC rose just shy of 3%, after falling around 10% in two consecutive weeks of losses. As the new week begins BTC/USD has risen above the key 100K level, after recovering from a low of 91.3K as investors bought the dip.

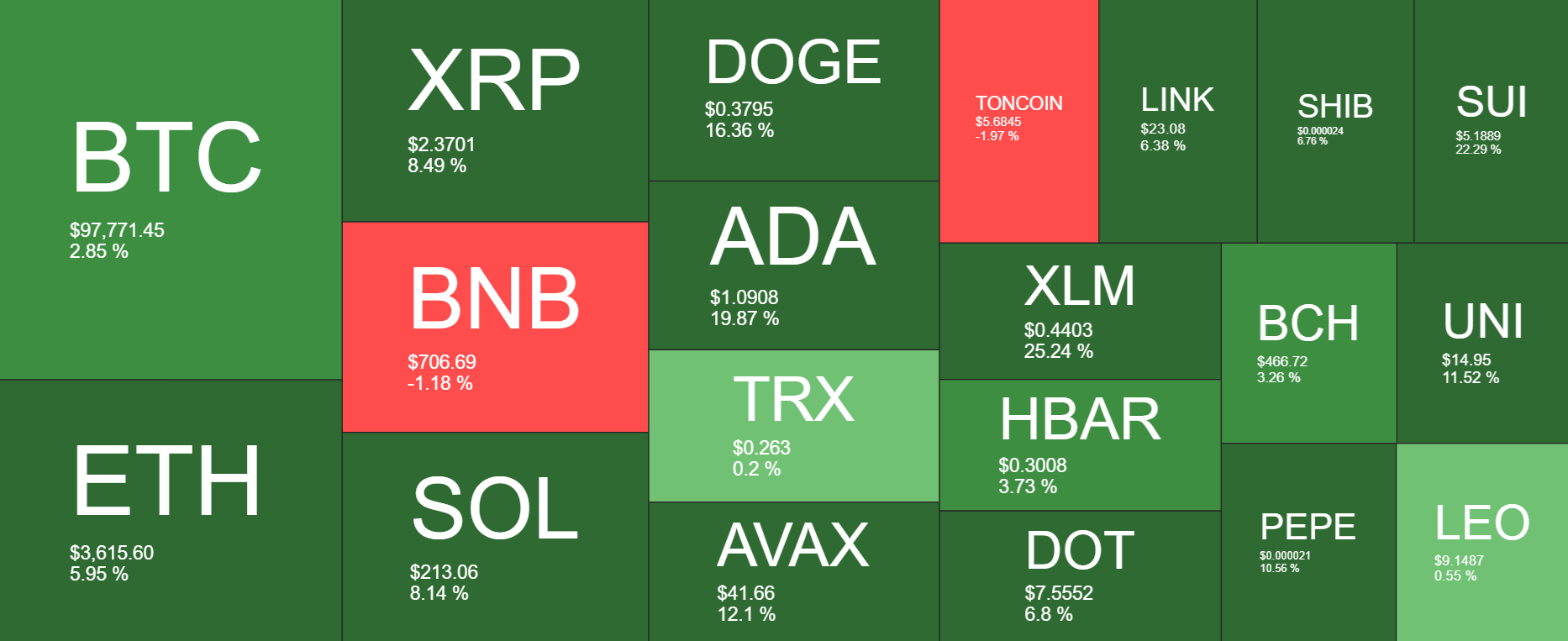

While Bitcoin booked gains, altcoins outperformed as investors expanded their holdings at the start of the new year—market participants diversified by putting capital into alternative coins and more speculative assets. Ethereum, XRP, and Solana rose 6%, 8.5%, and 8%, respectively, last week. Solana’s recent rise of just shy of 60% in recent weeks has helped to solidify its position as a key player while flipping Binance Coin’s (BNB) market cap.

Meanwhile, DOGE was up 16%, ADA rose almost 20% last week and XLM hit boasted a rise of 25%.

Bitcoin ETF flows analysis

Spot Bitcoin ETF flows were mainly negative towards the end of December but have seen a solid start to the new year. Last week, BTC ETFs saw $245 million in net inflows, following $387 million in net outflows the previous week. Volumes were low, which is unsurprising given the public holiday and festive period.

Breaking this down on a daily basis, net outflows were $242 million on Thursday. However, Bitcoin recovered sharply on Friday, with $908 million recorded in inflows, according to data from SoSo Value. This marked the highest level of net inflows since November 21 and helped Bitcoin reclaim the key 100k price level.

American Bitcoin ETFs have seen a meteoric rise in 2024, accounting for a growing share of the global Bitcoin supply. US BTC ETFs now hold 5.7% of total BTC stock, capturing almost $110 billion in assets over the year. Bitcoin ETFs are becoming a key pillar to the market, boosted by massive institutional enthusiasm across 2024. ETFs are dominating the scene, absorbing around 75% of new Bitcoin investments. Highlighting the importance of these products, BlackRock’s Bitcoin ETF is now the 34th largest ETF in the world, overtaking many traditional financial products.

Bitcoin sentiment exits extreme greed

Bitcoin market sentiment remains optimistic, but it exited the “Extreme Greed Zone” for the first time since the “Trump pump trade,” which started in November. This extreme greed phase, marked by an overheated market, contributed to the cryptocurrency’s decline from the 108K record level to below 90K.

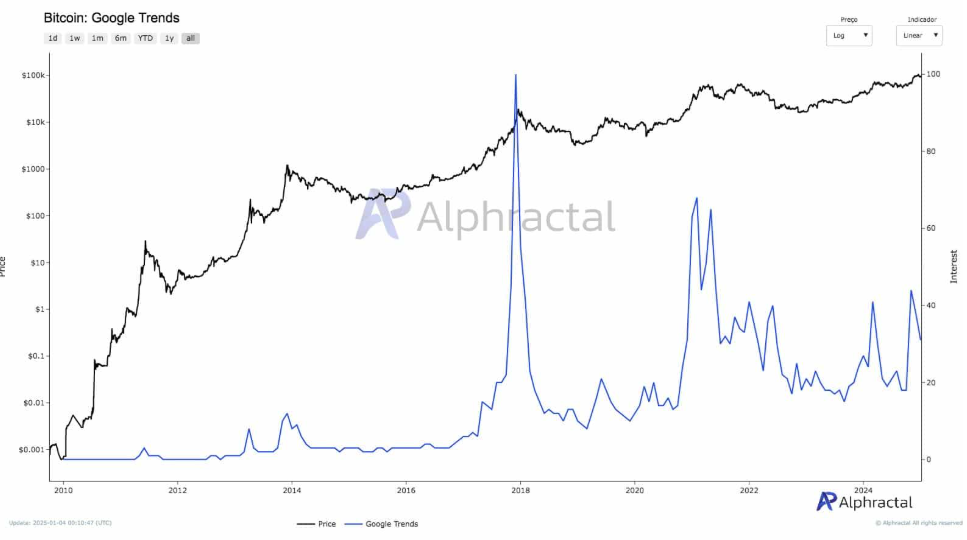

As well as the Fear and Greed index cooling from extreme levels, new interest in Bitcoin, as tracked by Google Trends, dropped significantly as Bitcoin declined below 100k. Historically, a surge across Google Trends is associated with euphoria and a potential market drop.

This shows that sentiment remains positive, yet interest from newcomers is low, which could lead to a continuation of the bullish phase across the medium term.

Similar conclusions can be drawn from the MVRV (Market Value to Realised Value), which can be used to gauge whether BTC is overvalued. The MVRV has previously indicated local market highs when it reached 4. In March and December, the tops were triggered when the MVRV reached 2. At the time of writing, the metric is at 1.7, down from 2 and well below 4, suggesting that the cycle top isn’t close.

Bitcoin miner HODL trends

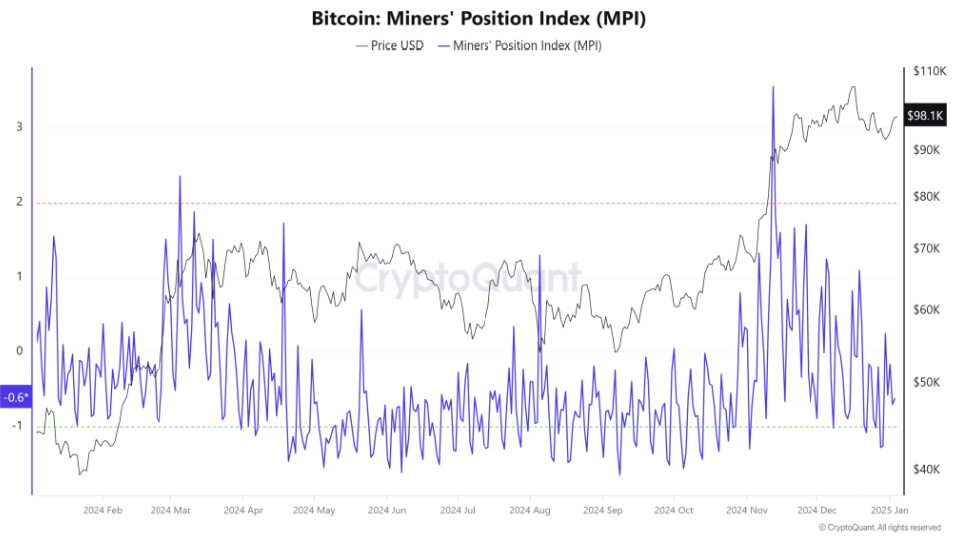

Bitcoin mining data can also provide critical market insight regarding sentiment and market confidence. Recent miner analysis from CryptoQuant revealed that Bitcoin miner flows into exchanges have fallen considerably since April 2024, suggesting miners have been holding onto BTC in the hope of selling at a higher price later on.

Net unrealized profit and loss metrics are still positive, which confirms that Bitcoin miners are still sitting on unrealized profit and, therefore, are not contributing much sell pressure in the market.

When the Miner Position Index, or MPI, is high, it signals that miners are transferring more BTC, which often translates to more sell pressure. The MPI peaked on November 12th, just a few weeks before the Bitcoin price achieved its record high. The peak confirmed strong sell pressure from Bitcoin miners. However, the MPI has since dipped considerably, and it closed December close to the bottom of its range, suggesting that minor outflows have eased considerably.

Macro Backdrop & Seasonality

European and American markets are gradually returning from the holiday period, which has been relatively quiet regarding fundamental developments.

At the end of 2024, the Federal Reserve cut interest rates by 25 basis points, marking the third rate cut this year. However, the Fed also pointed to a slower rate of cuts in 2025, with just two 25-basis-point cuts expected. This more hawkish stance from the US central bank hit demand for risk assets, pulling Bitcoin lower at the end of December and dragging US equities southwards. Lower interest rates are more beneficial for risk assets as it improves liquidity.

As the new year kicks off, President-elect Donald Trump will be back in the Oval Office on January 20th, and his return is expected to bring positive developments for both blockchain and crypto. Trump’s replacement for Securities and Exchange Commission chair – Paul Aitkin, has brought optimism to the sector. Atkin’s approach is expected to be more relaxed. He is expected to be receptive to working with crypto companies and finding a regulatory framework that will enable the sector to continue to thrive while setting safeguards to protect consumers’ and investors’ confidence.

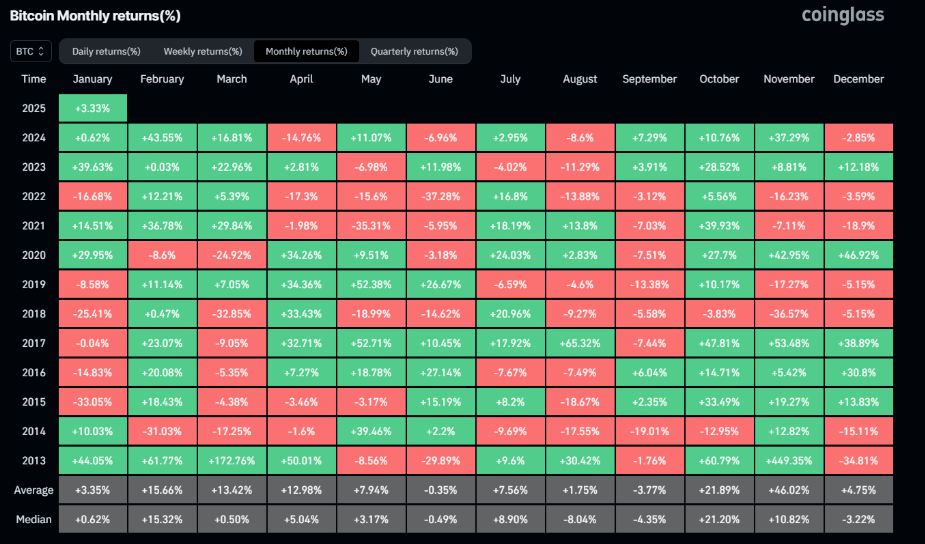

The fundamental picture remains supportive, and seasonality is favorable throughout January. According to historical monthly returns, Bitcoin generally recorded modest returns in January, averaging 3.35%.

Week Ahead

This week will likely see more volume return to the market. The economic calendar ramps up this week, bringing more clues about the health of the US economy and the outlook for rate cuts.

NFP Report

Friday’s US non-farm payroll report will be the highlight of the week and the first big test of the year. The markets will hope the closely watched report shows a stable but not overheated economy, which could help support risk sentiment. Expectations are for 150k jobs to have been added while unemployment is forecast to remain at 4.2%.

FOMC minutes

On Wednesday, the Fed is due to release the minutes of its December meeting, during which it delivered its third rate cut in what Fed Chair Powell described as a close call. The minutes could show divergent views and provide insight into policymakers’ more hawkish stance as they reined in rate cut expectations for next year.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.