Bitcoin surged 11% last week, its best weekly performance since the end of February. The largest cryptocurrency by market cap opened last week at 60,800 and scaled higher throughout the week, reaching a peak of 67,800 over the weekend, a monthly high. The Bitcoin price has recovered 23% from hitting the low of 53,500 on July 5th. Bitcoin is opening the new week above 67,000.

Gains were seen across the board, with Ethereum rising 9% and Solana outperforming, booking a 19% jump across the week. Meanwhile, XRP gained 10%, and BNB traded 11% higher.

Easing concerns over a Bitcoin supply overhang and some shifts in the US political landscape allowed Bitcoin to capitalise on declines previously seen in the US dollar. Despite rising 0.3% in the previous week, the US dollar index, which matches the US dollar against a basket of six currencies, still trades down 1.5% month to date.

US election – Trump ahead in the polls, Biden leaves the race

As we highlighted in the previous report, US elections will be a key driver for crypto markets in the second half of this year. Following Trump’s assassination, survival gains in US stock and crypto markets materialised on speculation that Trump’s chances of winning the presidency had increased.

Trump has maintained a pro-crypto stance throughout the election campaign. What’s been interesting is how crypto has started to feature prominently in this election cycle. President Trump will speak at the Bitcoin 2024 conference in Nashville next weekend. At the conference, Trump could announce that he would make Bitcoin a strategic reserve asset for the US government. According to 10xResearch, the US government holds $15 billion worth of Bitcoin compared to $600 billion in gold reserves. If the US government doubled its Bitcoin holding, the boost to Bitcoin could be similar to that of the boost of net inflows into spot Bitcoin ETFs.

Furthermore, the vice president candidate for Republican senator, JD Vance from Ohio, has revealed ownership of Bitcoin and appears to be pro-crypto again, supporting the sector.

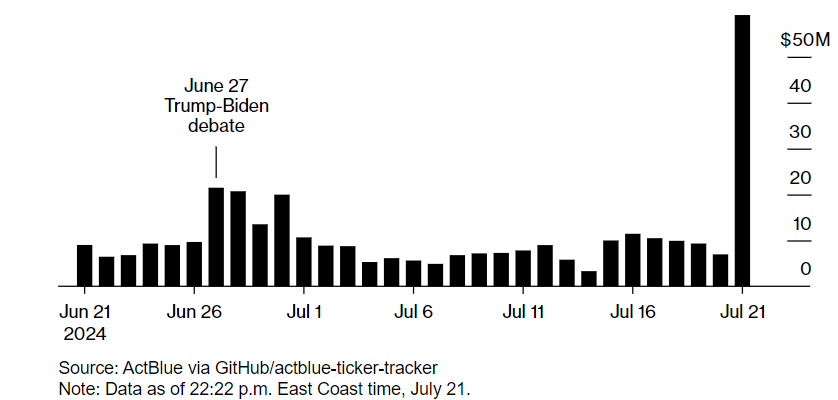

However, the latest twist to the election tale is that this weekend, President Biden stepped down as the Democratic candidate for the presidential elections, instead endorsing Kamala Harris. Democratic donations jumped after Biden’s exit.

Harris is considered a bigger challenge to Trump than Biden. However, it isn’t easy to see Kamala Harris overturning Trump’s lead in the polls in the three months that remain in this election race. That said, a lot can happen in that time frame, so nothing is off the table yet. Bitcoin initially dropped 2.8% following Biden’s announcement but has since regained that loss and more.

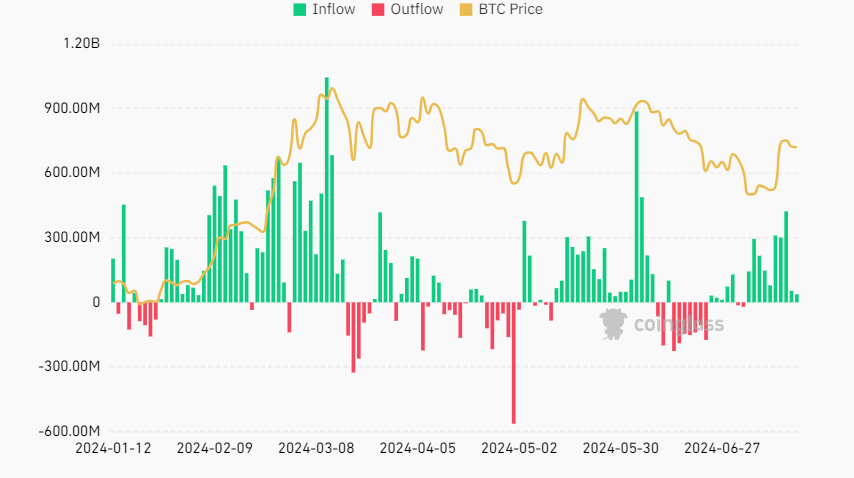

ETF flows attract $2 billion in 2-weeks

US spot Bitcoin exchange-traded funds (ETFs) have attracted over $2 billion from investors over the past two weeks, marking renewed market optimism. Bitcoin ETFs started the week with $301 million capital flowing into them on Monday. Tuesday witnessed the largest daily inflow of over $422 million.

US spot bitcoin exchange-traded funds have netted over $17 billion in inflows, setting a new record. Net flows were driven primarily by BlackRock’s IBIT, which has accumulated $18.968 billion. Fidelities FBTC also contributed significantly, with net inflows of $9.962 billion. Grayscale’s GBTC experienced substantial net outflows of $18.694 billion.

Consistent inflows into Bitcoin spot ETF signal robust and growing demand for the investment vehicle. While this is a positive sign, there are also signals in the market that Bitcoin could be overvalued for now.

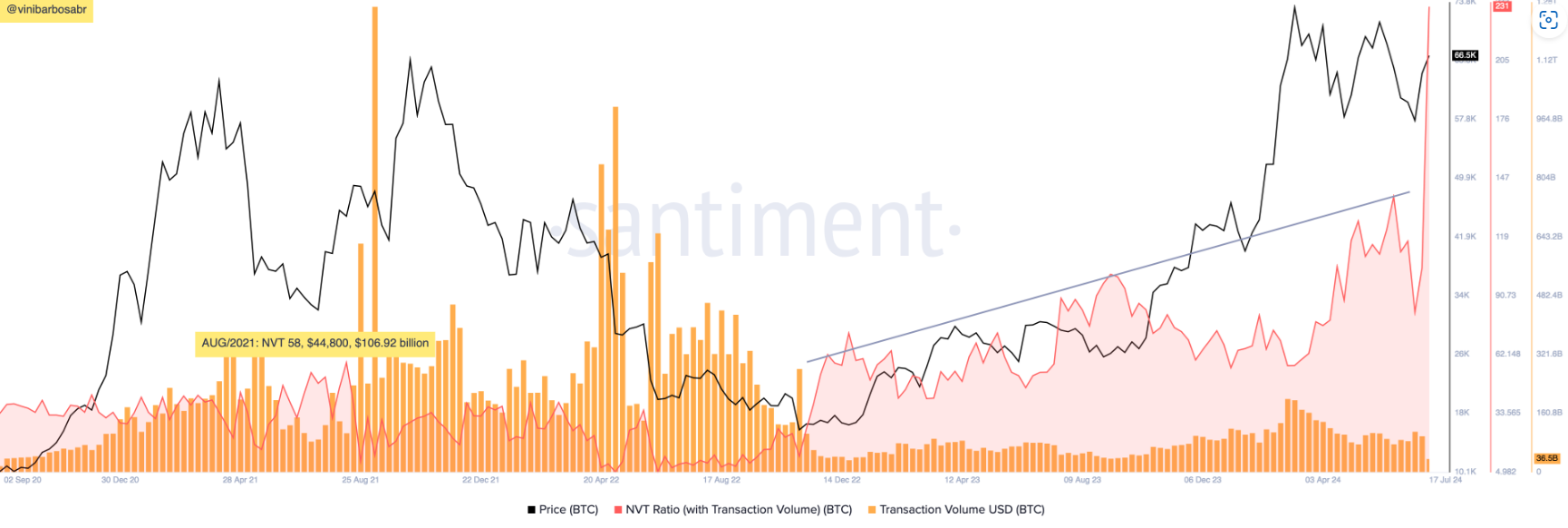

Bitcoin is overvalued, according to NVT

Bitcoin’s network value to transaction (NVT) ratio rose to an all-time high this past week. This indicator is often compared to the price-to-earning (P/E) indicator for stocks and is useful for fundamental analysis.

Bitcoin’s 7-day NVT ratio was 231, considering a $36.5 billion transaction volume at $66.5k. In 2021, the NVT peaked at 58, with the BTC price at $44,800 and $106.92 billion transacted on change. This could be a direct result of an aggressive increase in the Bitcoin price, which has not been followed by network activity. In short, cryptocurrency prices are rising while Bitcoin’s transaction volume is holding at historically low levels.

This suggests speculative demand without proportional organic demand and could indicate a correction if transaction activity doesn’t rise.

Mt Gox remains a concern

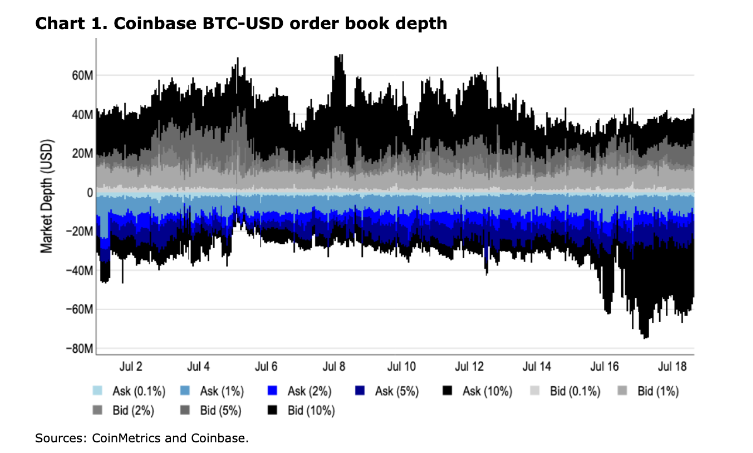

Following the distribution of around 50,000 Bitcoin to exchanges since the 5th of July, the trustee has been left with a balance of 90.3k, according to Arkham Intelligence data. Coinbase believes this may help explain why there’s been a slightly higher imbalance between bids and asks seen recently, with an increase in sell orders placed. This suggests that we could start seeing some profit-taking at current levels and a greater market willingness to sell into price appreciation, which could limit the upside. This supports the view that the Bitcoin market is likely to be choppy in the third quarter. Meanwhile, there is still low transparency on the distribution from exchanges to creditors, but sales will likely be gradual.

ETH ETF launch July 23rd?

Ethereum performed strongly across the week ahead of the expected launch of the spot Ether ETFs on July 23rd. The CBoE exchange has published listing notifications for five spot Ethereum ETFs, which are set to start trading on Tuesday after securing final regulatory approval.

Introducing these ETFs is anticipated to boost Ether’s liquidity and market depth. It could, therefore, attract a broad range of institutional investors who’ve been cautious about direct cryptocurrency investments owing to regulatory uncertainty. The ETFs could pave the way for further institution adoption, potentially driving higher prices, with some even forecasting gains to $5000.

Gold’s ATH as money managers buy-in

Gold prices rose to a record high last week, $2483, amid the growing prospects of a series of interest rate cuts from the Federal Reserve this year and a potential second Donald Trump presidency. The latest gains come after weaker-than-forecast US inflation data earlier in the month, which boosted expectations that the Federal Reserve could lower borrowing costs, which is beneficial for non-yielding assets such as gold (and Bitcoin). Meanwhile, President Trump’s plans and tax-cutting agenda can increase its budget deficit and inflame geopolitical tensions, potentially fueling inflationary pressures and driving safe haven flows further.

Money-manager wagers in Gold jumped to the highest level in four months, often used as a hedge against political uncertainty.

The latest all-time high caps a 20-month rally for the precious metal as central banks bought record volumes to reduce their dependency on the US dollar in their reserves.

Week ahead

As the week kicks off, the focus will be on the latest political developments in the US and the market reaction to the news that Biden has stepped down from the election race.

On the economic calendar, US core PCE, the Fed’s preferred gauge for inflation, will be the focus. The market will look for core PCE to confirm that inflation is cooling, further supporting the view that the Fed will cut rates in September. This could help boost risk sentiment and demand for non-yielding assets.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.