Bitcoin fell 1.5% last week as it continued to trade within a familiar range of 94k to 98k, within which it has traded for the past 3 weeks. Bitcoin briefly spiked to a low of 93.3k before quickly recovering back above 95k the same day. BTC then briefly rose to a peak of 99.5k but again could not sustain the move, dropping 2% on Friday and falling back into its range. The world’s largest cryptocurrency remains in its holding pattern at the start of the new week at 95.5k.

The broader crypto market was more mixed. On a rare occasion, Ethereum outperformed Bitcoin, rising 4% across the week. Meanwhile, Solana fell 11%, XRP fell 6%, and DOGE dropped 9%. Alongside ETH, LEO gained 2%.

Bitcoin liquidations surge

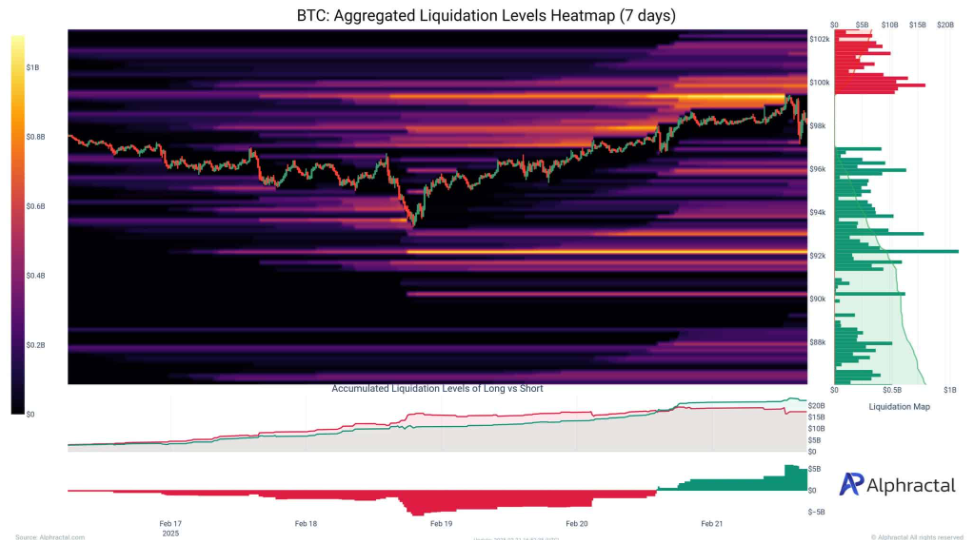

While Bitcoin and Ethereum prices were holding broadly steady on the price front, liquidations have hit unprecedented levels due to market volatility. Both short and long positions have been closed at an unprecedented rate. While the surge in Ethereum liquidations can be partly linked to the Bybit hacker case, broader market trends are still at play. Traders have been closed out of positions due to insufficient margin, triggering further liquidations and heightened volatility.

Bitcoins liquidation levels appear to reflect a broader deleveraging cycle, with short positions taking the brunt of the impact before longs were liquidated near 100K. Bitcoin’s heatmap revealed a prolonged liquidation event with over $100 billion in liquidations near 100K. Meanwhile, short positions have been aggressively cleared at lower price levels. The liquidation maps confirm heavy positioning between 92k and 96k and high market sensitivity to leverage.

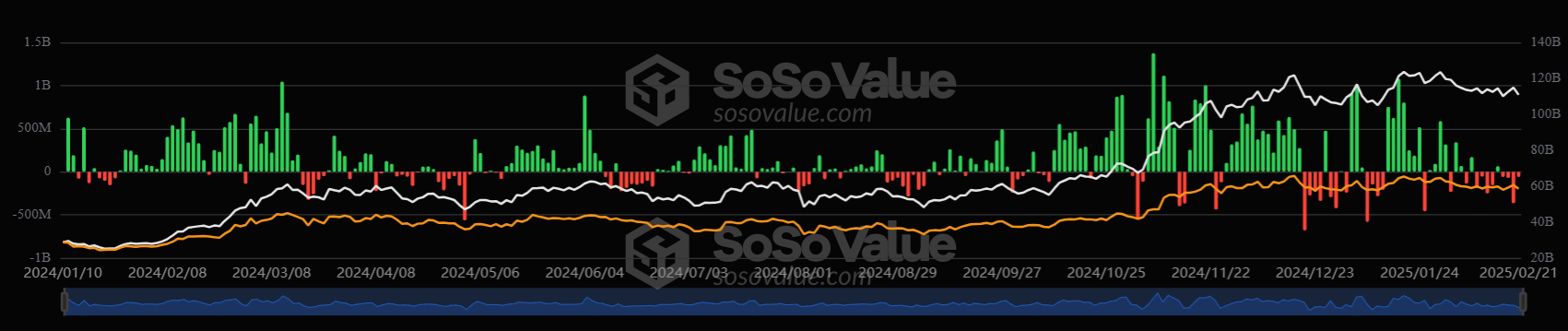

BTC ETFs see a 2nd week of net outflows

Bitcoin spot ETFs experienced net outflows of $559.41 million, marking the second straight week of outflows. Breaking this down on a daily basis, BTC ETFs experienced four consecutive days of outflows last week (the market was closed on Monday in observance of Presidents Day). Bitcoin ETFs saw $364.93 million in net outflow on Thursday alone, the largest net outflow since late January. BTC ETF demand would need to rise for the Bitcoin price to gain momentum.

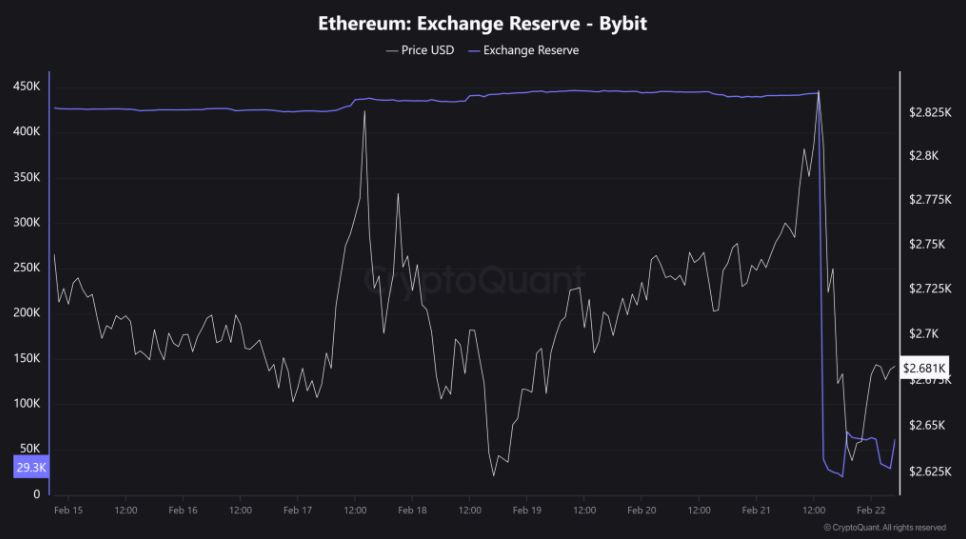

Bybit Hack & Macro backdrop

Bybit, a major cryptocurrency exchange, was hacked on Friday to the tune of $1.5 billion in digital assets in what appears to be the largest crypto heist in history. The stolen funds were primarily in Ether and were quickly transferred across multiple wallets and liquidated through various platforms. Arkham intelligence analysts later linked the attack to North Korea’s Lazarus group. A state-sponsored group known for exploiting security vulnerabilities, often using sophisticated laundering methods to obscure the flow of funds. The breach immediately triggered a rush of withdrawals from Bybit as users fretted over solvencies.

Hack aside, a lack of crypto-specific catalysts has meant the macro environment has continued to shape the performance of digital assets. With just a few days until the end of February, the usual seasonal tailwinds that benefit crypto in February have failed to materialise. Bitcoin trades 6.4% lower month to date compared to average gains of around 13.9% in February for the past 12 years.

Last week was a relatively slow week as far as economic data was concerned. The minutes of the most recent FOMC meeting from January 28 – 29 suggested there could be more upside risk for inflation and supported the view that policymakers were in no rush to cut interest rates with a more cautious approach to policy easing likely.

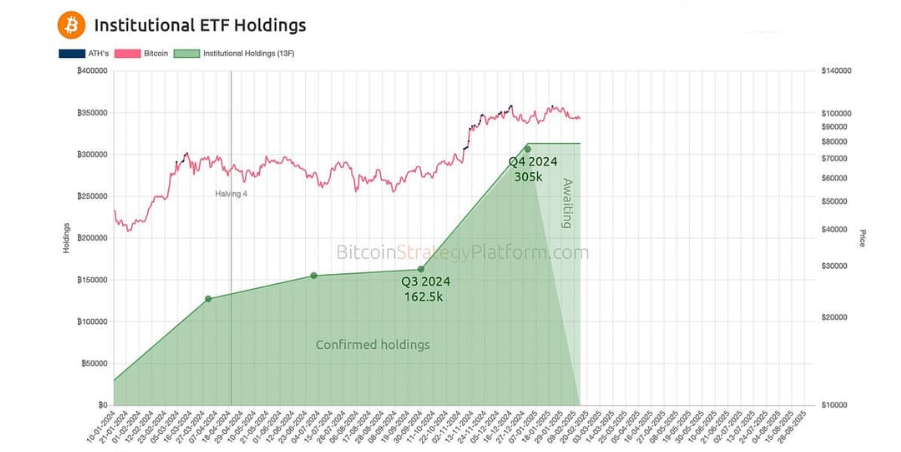

Institutional adoption rises in Q4

Recent 13F filings for Q4 2024 have revealed increased institutional demand for spot ETFs. Institutional ownership of spot BTC ETF shares increased from 25.9% to 28.6%. Meanwhile, ETH ETFs experienced this sharper increase from 13.7% to 23%. BTC ETF holders rose from 1202 to 1669, while ETH ETF holders rose from 349 to 483.

Hedge funds and investment advisors expanded their presence in the crypto market, with hedge fund holdings in BTC ETFs rising to 10.6% from 8.3% and to 6.2% from 2.5% in ETH ETFs in the final three months of last year.

Goldman Sachs is now the fourth largest holder of spot crypto ETFs, with $2 billion in holdings across Bitcoin and Ethereum. These will likely be held mainly on behalf of high-net-worth individuals and other private banking clients.

Meanwhile, Abu Dhabi’s sovereign wealth fund disclosed $437 million of purchases in spot BTC ETFs, highlighting a growing interest in the asset class’s legitimacy.

The data provides mounting evidence of institutional and national acceptance of Bitcoin, which will likely support the price over the long term.

Bitcoin trading activity falls

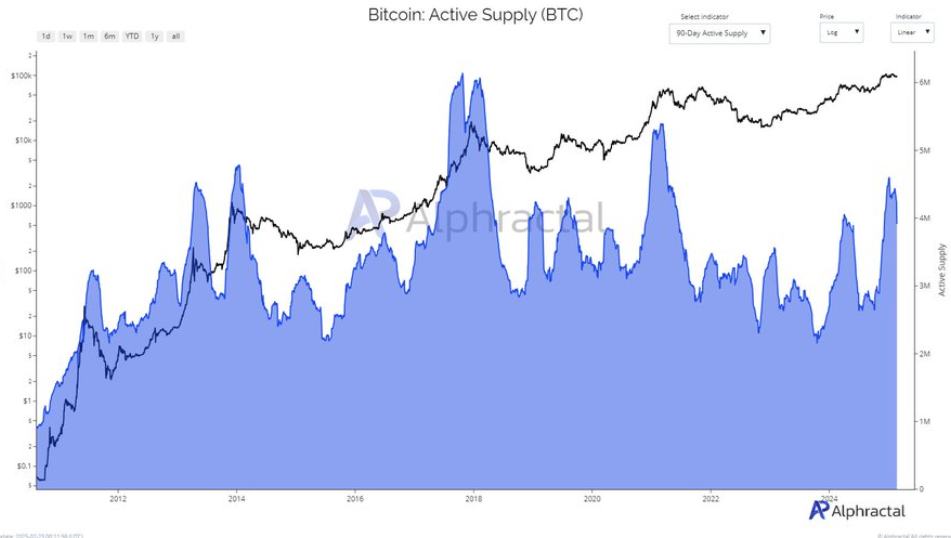

However, the outlook for Bitcoin is less clear in the near term. Bitcoin’s 90-day active supply has declined, raising questions about demand and investor sentiment. This metric is often used to assess the level of new market interest and the mood of traders. It tracks Bitcoin that has been transacted at least once within 90 days.

Highly active supply often signals increased market participation and rising demand from new or short-term traders. However, a fall in active supply could point to reduced interest or a shift in sentiment, as long-term holders are less likely to sell in periods of low activity.

The 90-day active supply chart for BTC from 2012 to 2025 shows a notable decline in recent months. Active supply is hovering around 4 million BTC, down from 4.6 million in late 2024. This metric points to decreased trading activity, which points to reduced interest.

This trend implies that short-term holders have largely exited, potentially reducing selling pressure. The pattern mirrors that of 2018, when declining active supply preceded price stabilisation and reinforced the short-term bottom.

Week Ahead:

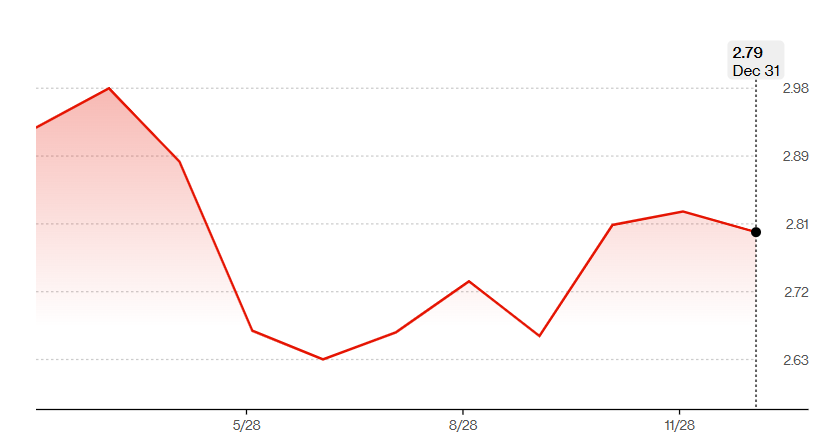

The coming week sees the release of several US data points, including consumer confidence on Tuesday and core PCE on Friday. Core PCE, the Fed’s preferred gauge for inflation, will be the highlight of the economic calendar. Economists expect inflation to ease to 2.6% YoY in January, down from 2.8% in December. Any signs of cooling inflation could be well received and may support the view the Fed is still on track to cut rates at least once this year. This could support risk assets such as Bitcoin, which perform better in low-interest-rate environments owing to improved liquidity.

US Core PCE chart

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.