Bitcoin rose 0.5% last week, adding to the 8% rise in the previous week and marking the fourth straight weekly gain. BTC has risen 10% so far in July. The price started last week at 117k, briefly rose to a record level of 123k on Monday before easing back to 115k by Friday. The price is rising to 118.5k at the start of the week as consolidation below the record high continues.

Over the past seven days, BTC has traded flat, while altcoins have outperformed. ETH jumped 25% over the past 7 days, XRP soared 24% to a fresh record high, and SOL rose 10%. Smaller altcoins also performed well, with DOGE increasing 25% and ADA rising 15%.

The cryptocurrency market cap rose to $4 trillion as the BTC price reached a record high of 123k. The crypto market cap is $3.91 trillion at the time of writing, up from $3.72 trillion the previous week and significantly higher than $3.08 trillion a month ago. The Fear and Greed Index has risen to 68, indicating Greed, in line with its position last week and up from 48, Neutral a month ago. Greed implies a steady state of demand to continue supporting the price higher, but without the wild volatility and FOMO that can come from Extreme Greed.

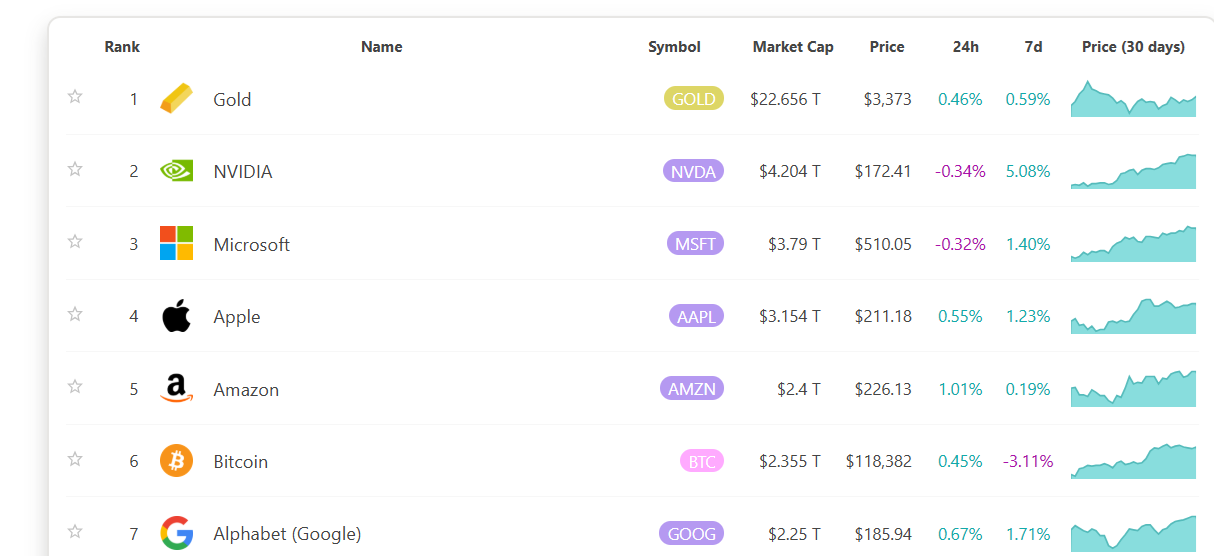

As of Friday, Bitcoin ranks as the 6th largest asset globally by market capitalization, surpassing Google parent Alphabet and silver, while also nearing Amazon.

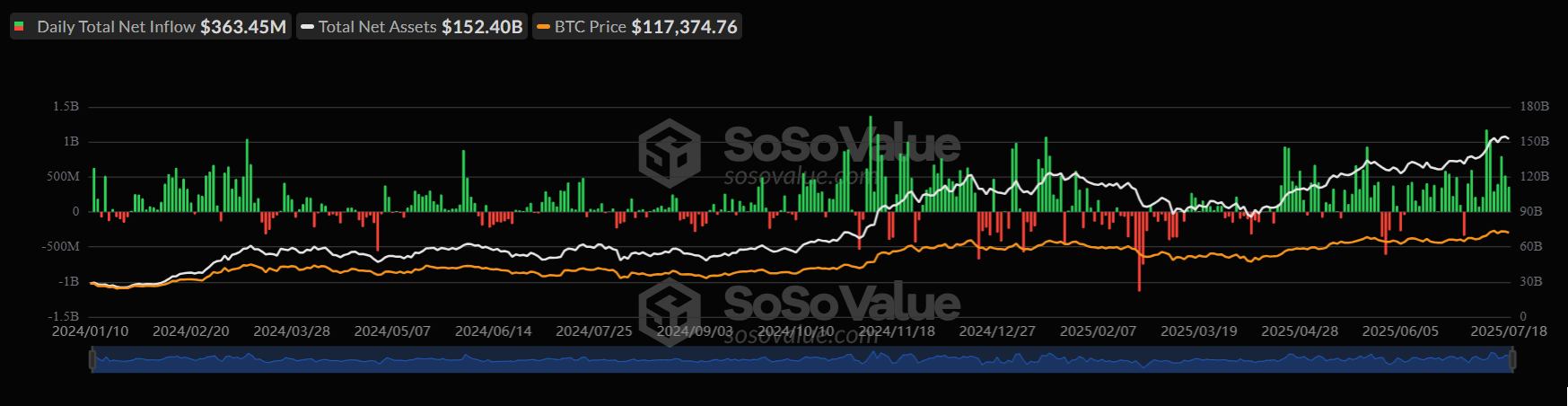

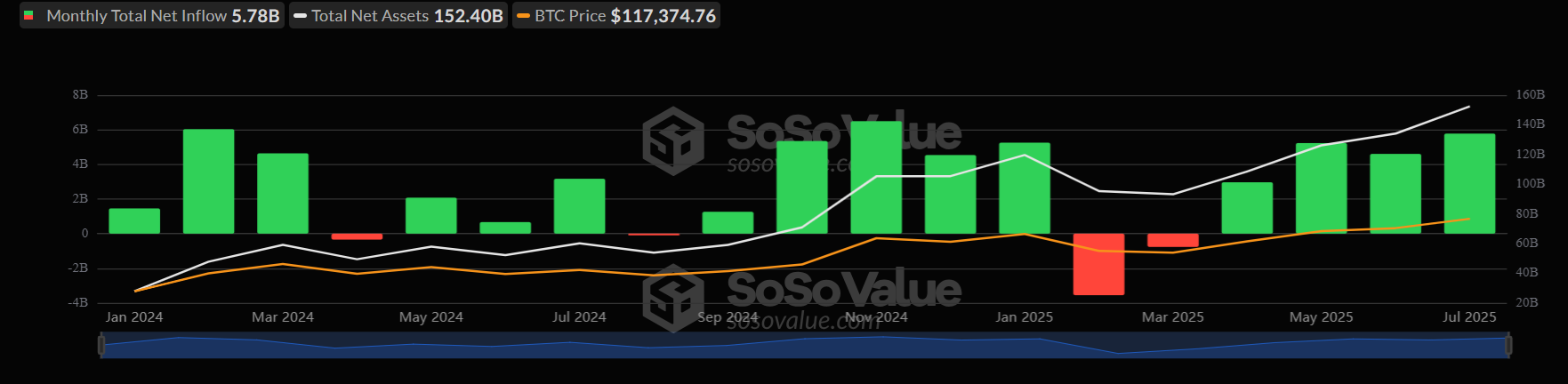

BTC ETFs 12 days of inflows

Spot Bitcoin ETFs reported net inflows of $363.4 million on Friday, marking the 12th straight day of net inflows amid strong institutional interest.

Spot BTC ETFs have recorded a sixth straight week of net inflows totaling $2.39 billion. July spot BTC ETF inflows have reached $5.78 billion, marking the third highest monthly inflows in record. Strong and persistent ETF inflows continue to support the BTC price.

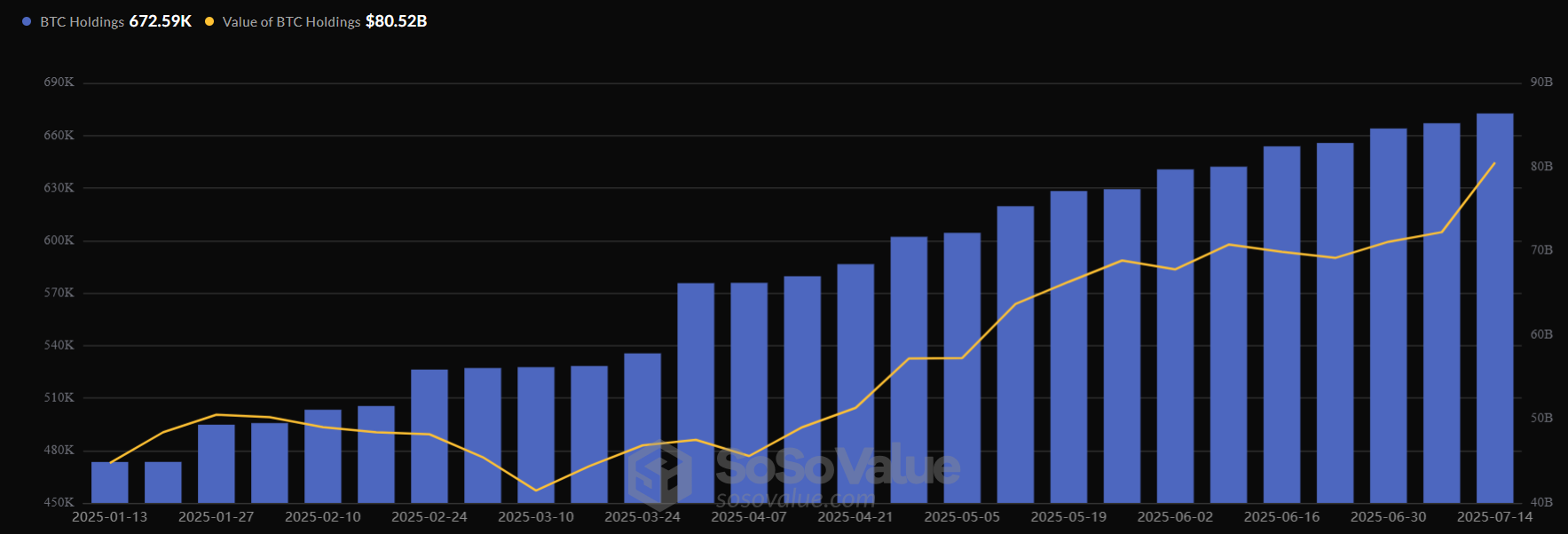

Bitcoin treasuries continue rising

Bitcoin Treasuries added approximately $810 million in BTC. The 21 companies included four new treasuries. Strategy topped the bitcoin treasury acquisitions with 4225 BTC, followed by Meta Planet with 797 BTC. France-based Sequans added 683 BTC, and the UK Smarter Web company purchased 325 BTC. According to SoSoValue data, public companies now hold $80.52 billion in BTC. Corporate demand continues to support the BTC price higher.

Crypto Week brings regulatory clarity

The approval of several crypto-related bills in the US last week further supports the price of Bitcoin. The US House of Representatives passed three key pieces of crypto legislation, including the Genesis bill, which was signed into law by President Trump on Friday, the Clarity bill, and the anti-CBDC bill.

These bills aim to establish a clear federal regulatory framework for digital assets, which would boost investor confidence among both retail, institutional, and corporate investors, promoting wider adoption and taking Bitcoin more mainstream.

The Financial Times also reported that President Trump is preparing to sign an executive order that would pave the way for American 401(k) retirement plans to invest in alternative assets, such as cryptocurrencies, in addition to stocks and bonds. Such a move would open the crypto market to the US retirement market, worth around $9 trillion. This would be the latest development in a series of reforms surrounding crypto to align with Trump’s pledge to make the US the global capital of crypto.

Can BTC sustain this move higher?

Bitcoin surged to a new record high and appears to rest on solid fundamentals. A tempered MVRV, long-term holder dominance, shrinking exchange balances, measured derivatives leverage, and growing M2 supply collectively suggest that the rise to record levels has been driven by structural strength and steady accumulation rather than runaway speculation and FOMO. While consolidation and pullbacks are likely to occur, on-chain and market signals suggest that the advances are on solid ground, rather than indicative of late-cycle euphoria, which means that more upside is likely.

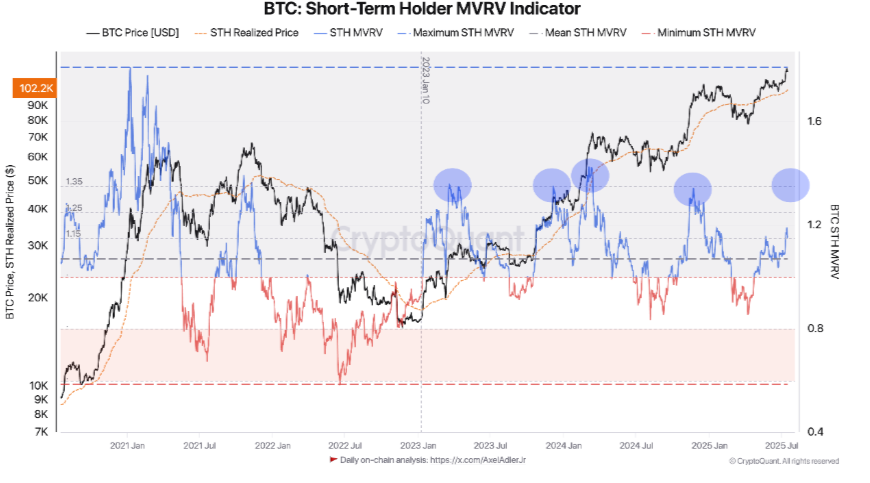

Short-term holder MVRV below prior peaks

In this cycle, unrealized profits of short-term holders have never exceeded the 42% threshold, as indicated by their MVRV. The MVRV ratio assesses the amount of unrealized profits by comparing Bitcoin’s market cap to its realized price.

Each time STH MRVR reaches around 1.35, which corresponds to 35% unrealized profits, it typically experiences short-term profit-taking, often reflected by a short-term correction.

Currently, the STH MVRV is sitting around 1.15, still some way from the profit-taking level. This is mainly because the realised price for STH pushed above 100K for the first time on July 11 and is now above 102 K. As a result, there’s potentially still room for BTC to rise 20 to 25% further to reach the threshold again.

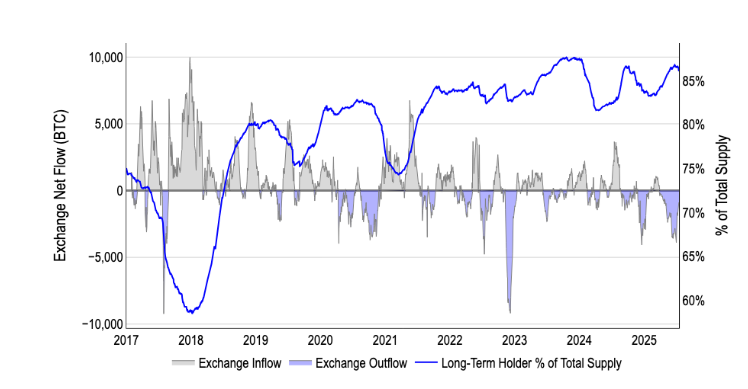

Long-term holders retain a growing amount of supply

Long-term holders control around 85% of circulating BTC, and their share continues to grow even as the price accelerates. Meanwhile, the exchange net flow remains a negative signal, amid persistent withdrawals rather than deposits. Together, these data points suggest that fewer liquid coins are available, so each new dollar of demand pushes the price higher.

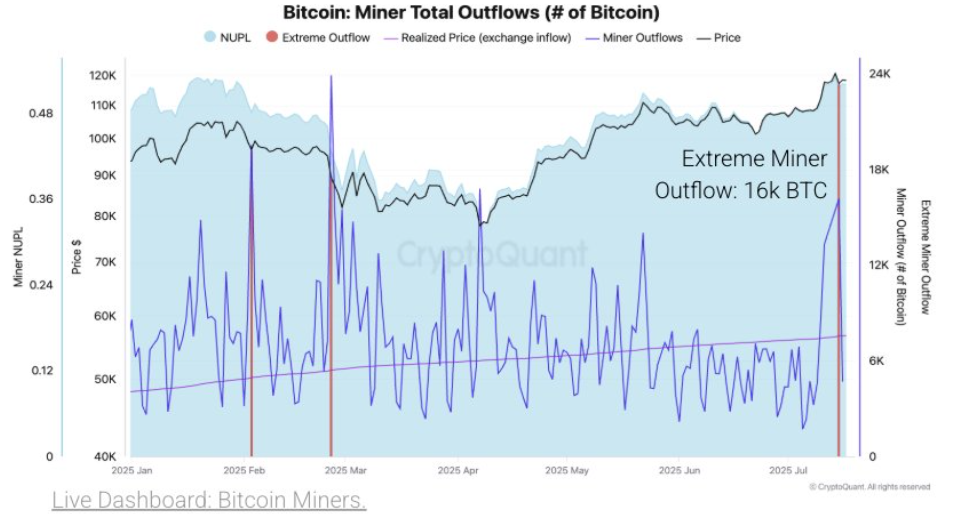

BTC Miners sell at a record pace

Despite many stars aligning, BTC miner selling pressure has risen to a yearly high, which could risk the BTC upside at least in the near term. CryptoQuant data showed that miner sales to exchanges reached 16k BTC on July 16, surpassing the high seen in April. This level of profit-taking could limit the BTC upside in the near term.

Delving deeper into the data, miners with 100-1k BTC have reduced their wallet holdings by 3k since mid-June, becoming a key source of selling pressure.

Ethereum breaks out and eyes 4k

Ethereum’s breakout has also been a key focus over the past two weeks, as tailwinds align for the second-largest cryptocurrency by market capitalization, pushing the price above $3,000 for the first time since February to current levels of $3750. Despite outpacing BTC last week, ETH remains below its 2021 record high of $4800.

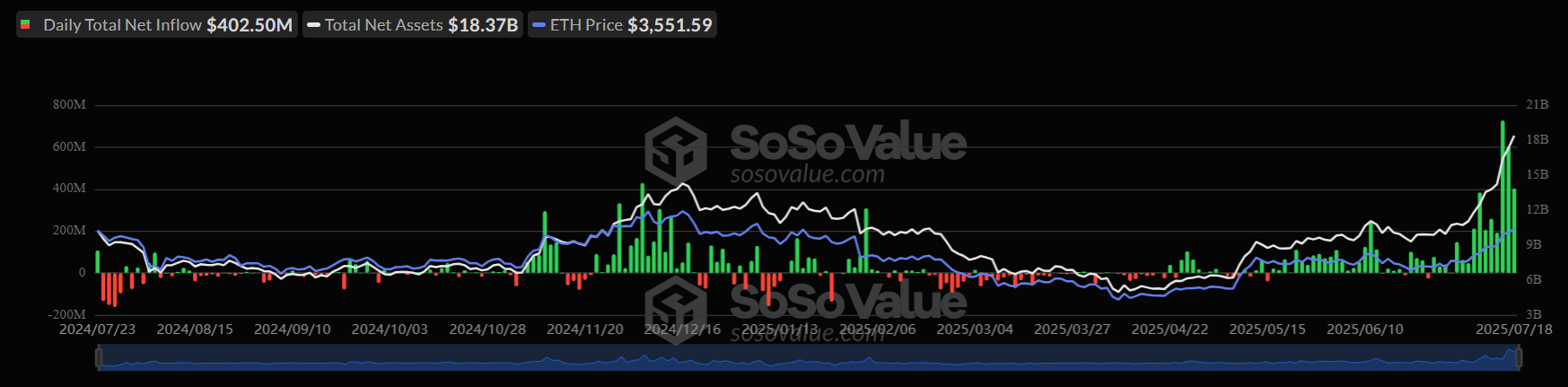

Corporate treasuries of ETH & institutional demand soar

Just as Bitcoin’s corporate treasury strategy is increasing in popularity, ETH is attracting corporate attention, with ETH corporate treasury strategies ramping up in a very short period. ETH has become one of the preferred assets for the stablecoin theme, with around 10 ETH-focused corporate treasury vehicles accumulating approximately 733k ETH, a value of around $2.5 billion year-to-date.

Demand for ETH’s yield is also high, with many companies committing to staking ETH to earn yield, and some even locking up their supply for DeFi integration, reflecting a significant shift from speculative trading to strategic asset allocation.

Spot Ether ETFs have also seen significant inflows over the past two weeks. On Friday, the Ethereum spot ETF recorded net inflows of $402.5 million, bringing its cumulative net total to $7.49 billion.

Additionally, the ETH base trade has become increasingly popular, with traders going long in the spot market versus shorting futures. Currently, the ETH base trades at a net estimated annual yield of 8%.

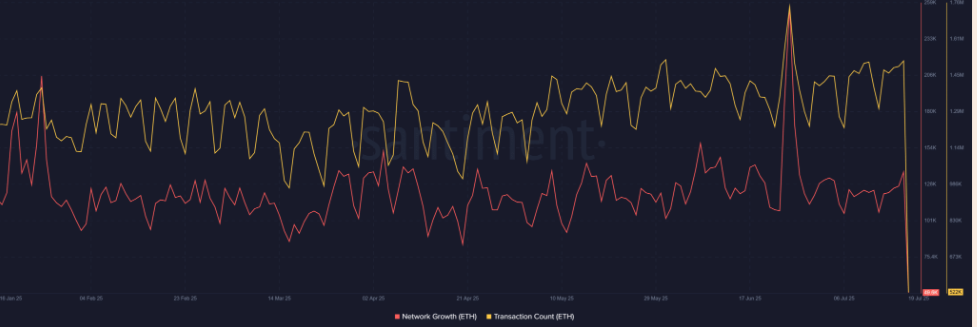

However, there are some risks to the 4K outlook, including declining network activity. Ethereum’s core network activity dropped sharply, raising some alarm. On Friday, the transaction count fell to 522K, and network growth dropped to 49.6K, the lowest number in six months. The dual drop reflects cooling engagement from existing users and stalls the onboarding of new participants. These dynamics, while the price pushes higher, could signal weakness beneath and raise some questions over Ethereum’s ability to surpass 4k in the near term.

Trading involves risk.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.