The BoE voted to cut rates by 25 basis points to 4.25%, in line with expectations. This marks the fourth rate cut since it began its rate-cutting cycle in August. The vote split was 7-2, with 5 voting for a 25-basis-point cut, 2 for a 50-basis-point cut, and 2 unexpectedly voting to leave rates on hold.

The central bank voted to cut rates despite inflation remaining above target at 2.6% YoY in March and stronger growth forecasts for Q1 at 0.6%. The decision comes as Trump is expected to announce a UK-US trade deal later today.

Crucially, the BoE left the wording of its guidance unchanged, telling investors to expect “gradual and careful” rate cuts. Some had expected the word careful to be dropped, which would have indicated a faster pace of rate cuts.

The market now sees the rate at 3.7% in Q4 2025, up slightly from 3.6%in February, implying less loosening.

GBP VS DOLLAR (GBP/USD)

If we take a closer look at the technicals, we can observe how price was trading just above 1.3280 before the announcements, and post the decision we have seen price action push higher into the 1.3325 region. GBP/USD trades 0.25% higher following the decision, recovering from -0.1% prior to the decision. As a result the price has recovered from its May low, but remains in a consolidation pattern on the 4-hour chart.

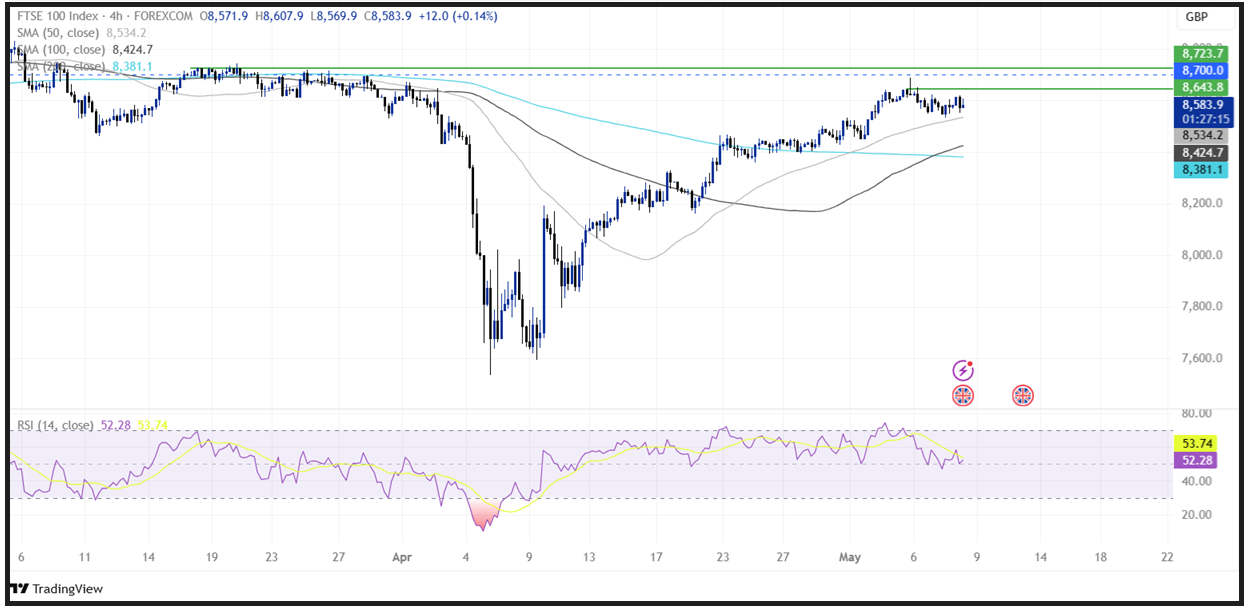

FTSE 100 (UK100)

The FTSE 100 has also seen a direct impact from this BoE interest rate decision. Before the announcement, the price was trading just below 8600, and currently, it is trading just above 8592, marking a slight fall of 0.1%. The FTSE is being guided higher by the 50 SMA on the 4-hour chart. However, the RSI suggests that momentum is slowing. A rise above 8650 could see buyers gain momentum.

*Trading involves risk.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.