Bitcoin rebounded last week, rising 7% after a four-week losing run. The price extended its recovery from the 80.5k low, rising to a high of 92k on Friday and holding those gains over the weekend. However, the picture has soured significantly with BTC plunging 6% at the start of the week to 86k.

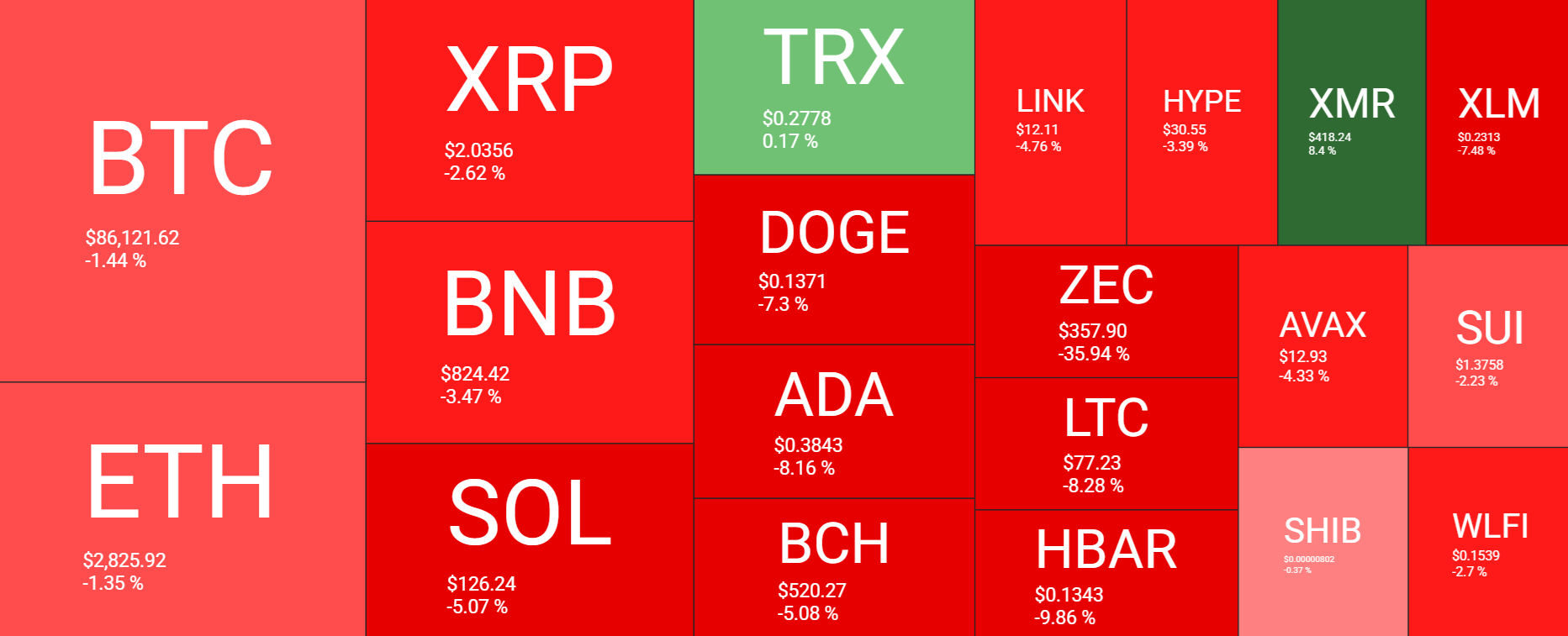

Strong gains were also seen across altcoins last week, only to slump at the start of the week and reverse those gains. Ethereum now trades 1.3% lower over the past 7 days, while Ripple wiped out gains of 7% and trades -2.5% over the past 7 days. BNB is now down 3.5% and Solana 5% over the same period.

The cryptocurrency market capitalization recovered from the $2.82 trillion low on 21 November to $3.11 trillion on Sunday, but has slumped 5% over the past 24 hours to $2.93 trillion.

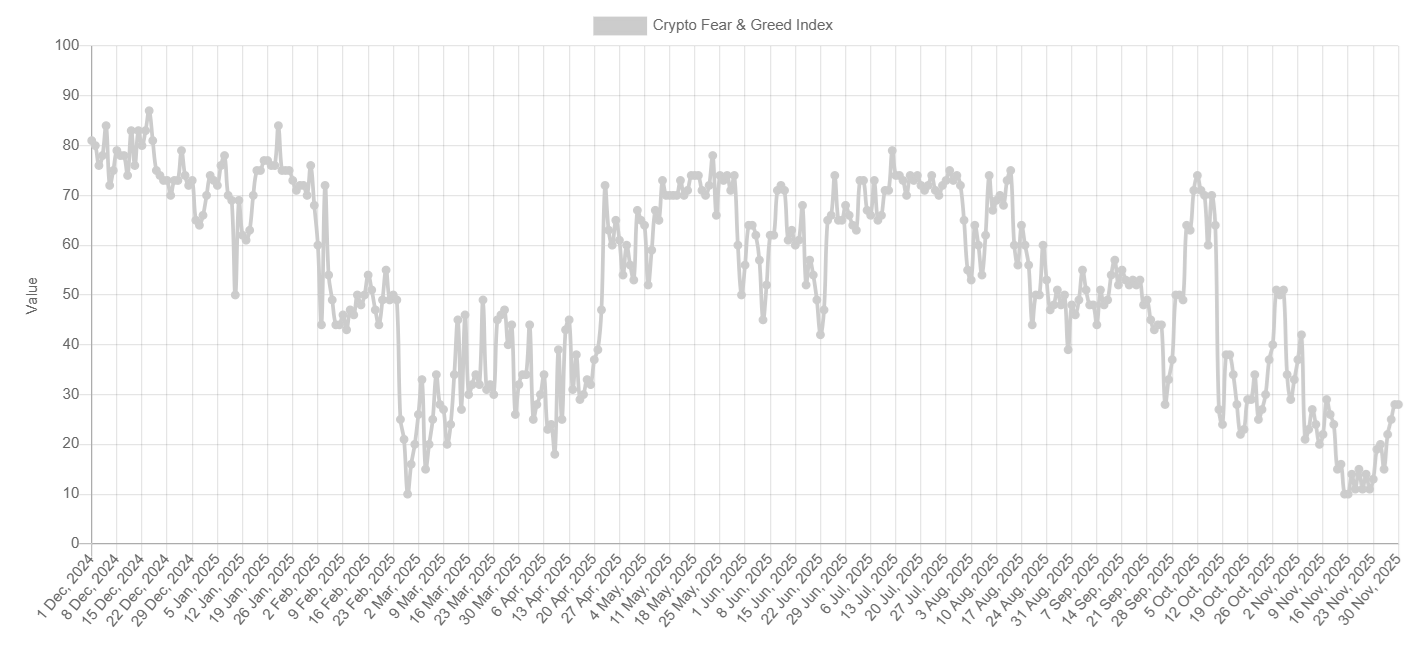

Sentiment analysis shows that the market mood is deteriorating once more, falling back into Extreme Fear at 24, down from 28, Fear at the weekend, but up from 13 and Extreme Fear last week. The market briefly moved out of Extreme Fear after 18 days, but was unable to maintain this move, which doesn’t bode well for the outlook.

Liquidations jump as BTC slumps

Liquidations have spiked over the past 24 hours as crypto prices slumped. $640 million in cryptocurrency was liquidated over the past 24 hours, of which $564 million were long positions and $76 million were short positions. 219,225 traders were liquidated. This comes after a relatively quiet previous week in terms of liquidation events and suggests that traders were caught out by the sudden drop in BTC price.

Macro backdrop – BoJ fears overshadow Fed optimism

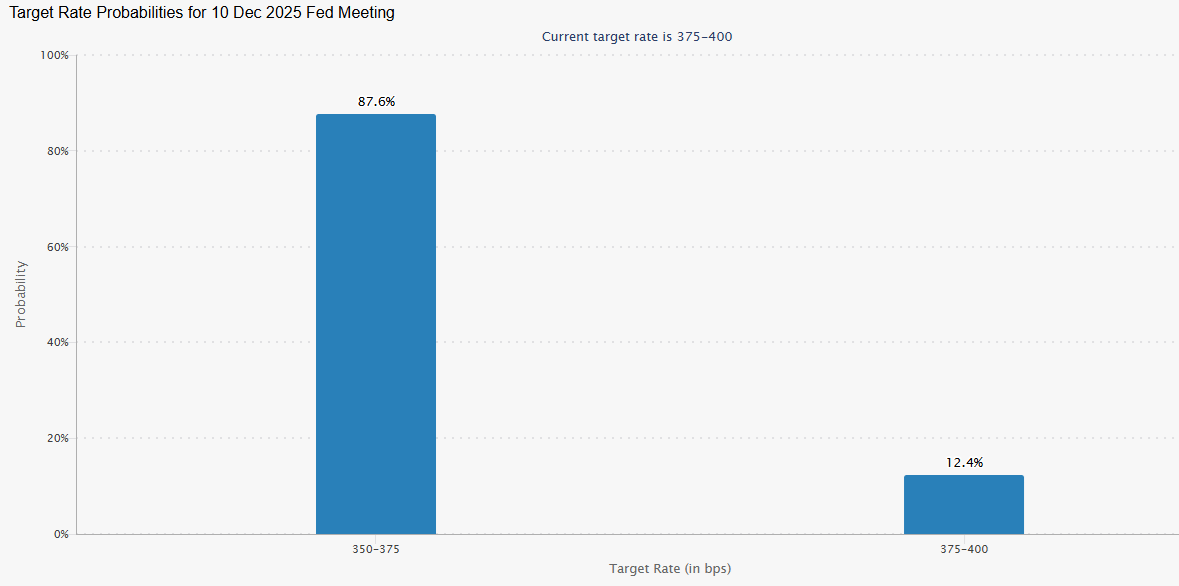

Bitcoin, along with other risk assets, rose last week, boosted by expectations that the Federal Reserve would cut interest rates at its December meeting. Dovish commentary from Federal Reserve officials, combined with weaker-than-expected U.S. data, including softer retail sales and a slump in consumer confidence to its lowest level since April, fueled bets that the US central bank will reduce rates by 25 basis points next month. According to the CME FedWatch tool, the market is pricing in an 87% probability of a rate cut, up from 30% just 10 days ago.

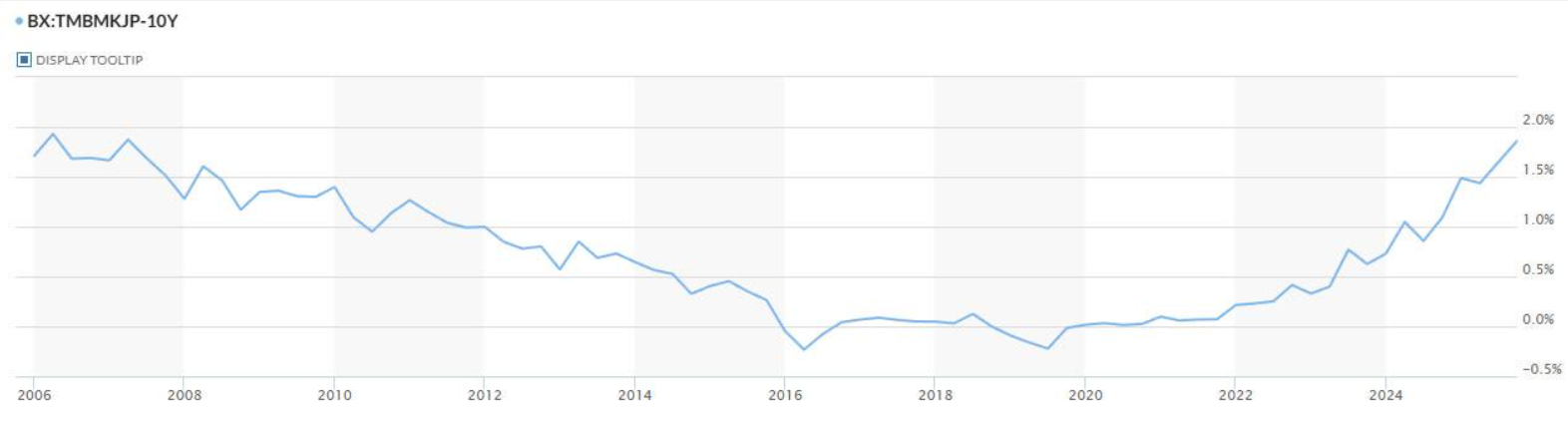

However, optimism over the rate cut has been tempered by concerns about the outlook for the global carry trade. BoJ Governor Ueda’s hawkish comments overnight spurred December rate hike expectations, and Japanese government bond yields jumped to their highest level in decades, prompting concerns over the end of the global carry trade.

Japan’s 10-year government bond yield hit 1.86% on Monday, its highest level since April 2008. The 10-year yield has doubled over the past 12 months. The 2-year bond yield hit 1% for the first time since 2008.

This marks a shift. Japan has had a very low interest rate environment for decades, with negative or near-zero rates and a very stable bond market. As a result, this has encouraged institutional investors across the globe to borrow low-interest-rate yen to buy higher-yielding, riskier assets in a strategy known as the “Yen carry trade”. However, this is now breaking, meaning huge amounts of capital that previously flowed into riskier assets such as crypto and tech stocks could now flow back to Japan. This means there will be less speculative capital available for crypto markets.

Crypto is often the first place that all this shows up. Even small shifts in liquidity can lead to sharp moves at the highest end of the risk spectrum. A surprise BoJ rate hike in August 2024 triggered a 20% Bitcoin crash to $49k. The market is pricing in a 53% chance of a BoJ hike in December.

Fed ends QT today

This timing couldn’t be worse for the Fed. Today, December 1st, the Federal Reserve officially ended quantitative tightening, freezing its balance sheet at $6.57 trillion after draining $2.39 trillion from the system. Typically, this would be a positive catalyst for the crypto market, as was the case in 2019. However, this could be overshadowed by concerns about the BoJ rate hike.

Federal Reserve Chair Jerome Powell is due to speak today. It remains to be seen whether he discusses any monetary policy matters.

Institutional demand

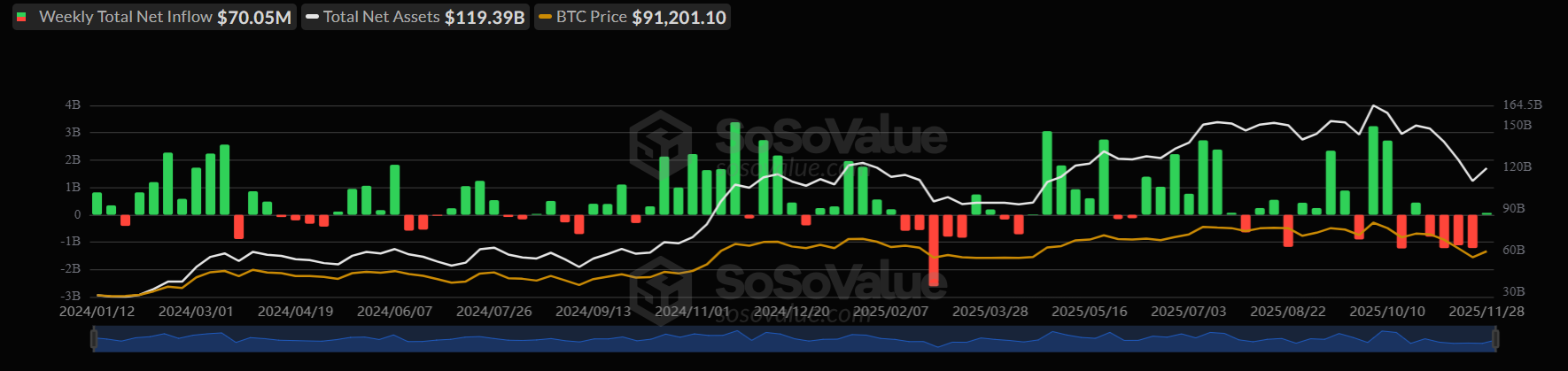

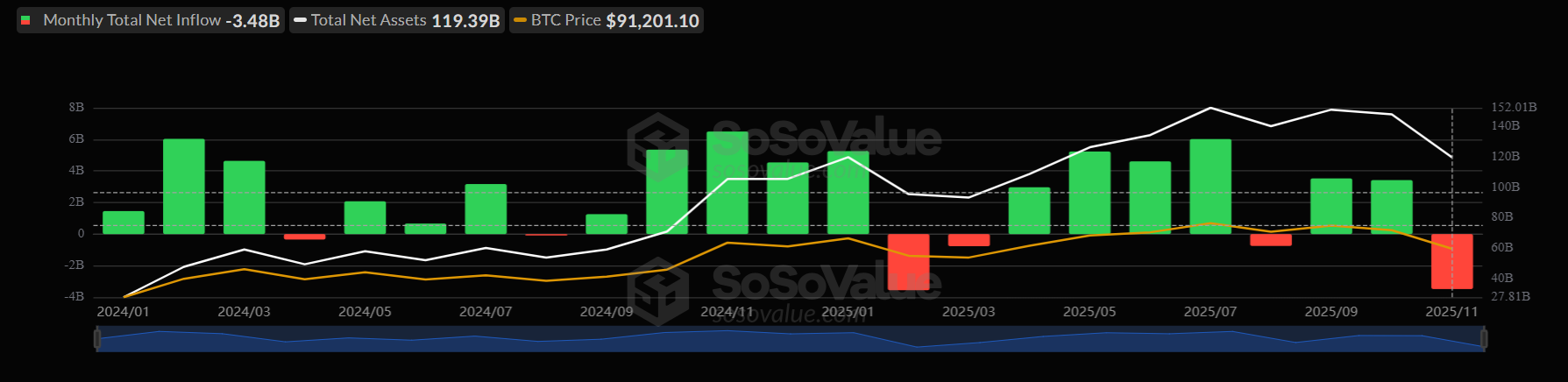

Institutional demand for Bitcoin showed a turning point, booking inflows after four straight weeks of outflows. According to SoSo value data, US spot BTC ETFs recorded inflows of $70.05 million, following net outflows of $1.22 billion in the previous week.

However, this still put ETF outflows for November at $3.48 billion, the second-largest monthly outflow recorded, only behind the $3.56 billion in net outflows in February. BTC ETF inflows would need to ramp up considerably for the BTC price recovery to have any chance.

Corporations are accumulating

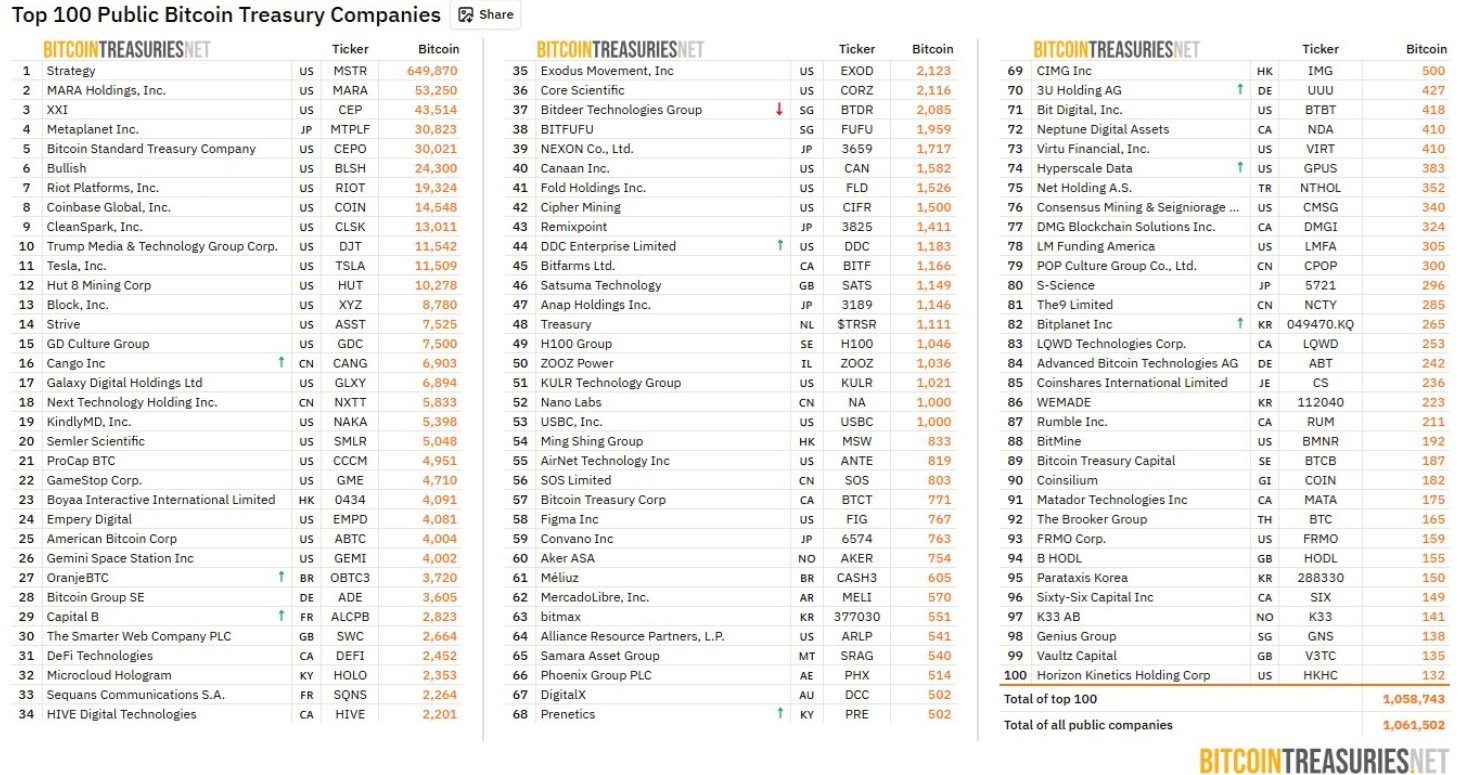

The latest data shows that the top 100 public treasury companies are now holding more than 1,058,000 BTC, a number that keeps rising despite market volatility.

Firms such as Strategy, MARA Holdings, and Metaplanet continue to dominate. It’s also noticeable how broad the accumulation has become from energy fiends to global conglomerates. Corporate purchases are a positive for BTC. But if BTC crashes and firms are forced to sell, this could have significant downward pressure on the BTC price.

Bitcoin Coinbase Premium recovery on edge

The Coinbase premium finally flipped back into positive territory after almost a month of being in the red. The Coinbase premium tracks how Bitcoin’s price on Coinbase compares to the global average as a read on US capital flows. A negative print typically signals domestic outflows or risk aversion among US institutions. Meanwhile, a sustained positive print tends to coincide with ETF-driven buying and renewed dollar liquidity.

Data from Coinglass on November 30th showed the premium and 0.0255% marking the first positive reading after 29 days. The negative premium suggested that selling pressure dominated in the US market, with traders and investors leaning towards caution.

However, the flip positive is seen as a sign that buying is picking up in the US, and more institutions are getting involved. Dollar liquidity is recovering, and overall investor confidence is improving. The question is whether it can remain in positive territory amid today’s selloff. If it can, this is a positive for the outlook.

Stablecoin dry powder at record levels

Flows line up with the move. Stablecoin balances on by Binance hit a record $51.1 billion in November, suggesting fresh firepower is on the sidelines.

Crypto quant contributor CryptoOnChain noted that the stablecoin parked on Binance relative to available Bitcoin is at its highest level in 6 years. Stable coin liquidity is often seen as a way to quickly deploy capital in the event of a market turnaround, implying ongoing confidence that such a move will eventually occur.

CryptoOnChain noted that green bars on the chart hitting such lows often precede powerful Bitcoin rallies, simply because the liquidity required to absorb a price surge is fully available on the exchange.

Seasonality – a word of warning

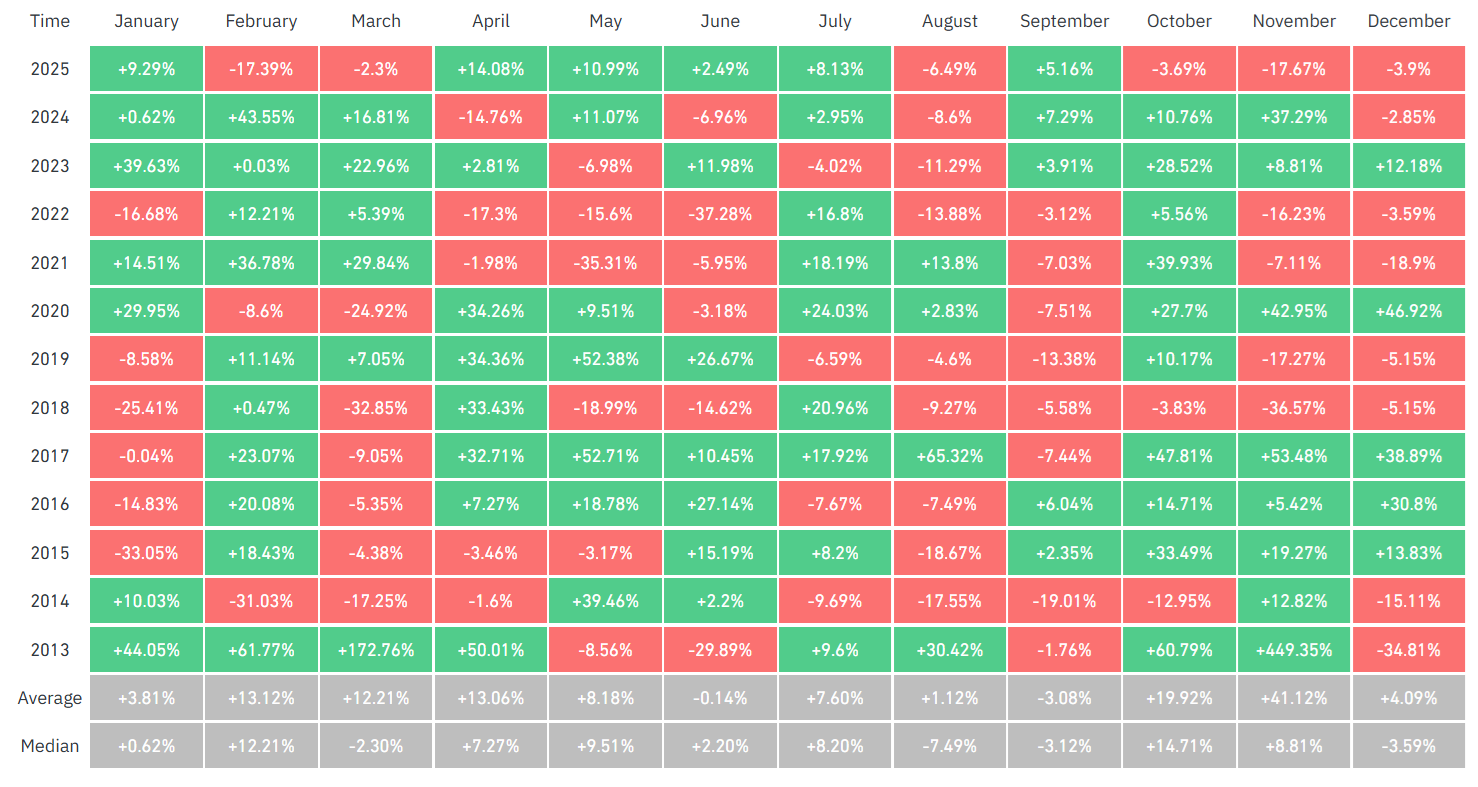

Data from Coinglass confirmed that BTC ended November down 17.7%, marking its worst November performance since the 2018 bear market. Typically, a red November can lead to a copycat performance in the last month of the year. Seasonality is a trader’s friend, not an absolute.

Trading involves risk.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.