Bitcoin has burst into new, uncharted territory again, closing its highest weekly candle ever. The achievement follows a powerful breakout, affirming the supremacy of the main trend. With that, it is the ideal moment to return to the higher time frames and look at where Bitcoin is and what essential levels could frame subsequent moves.

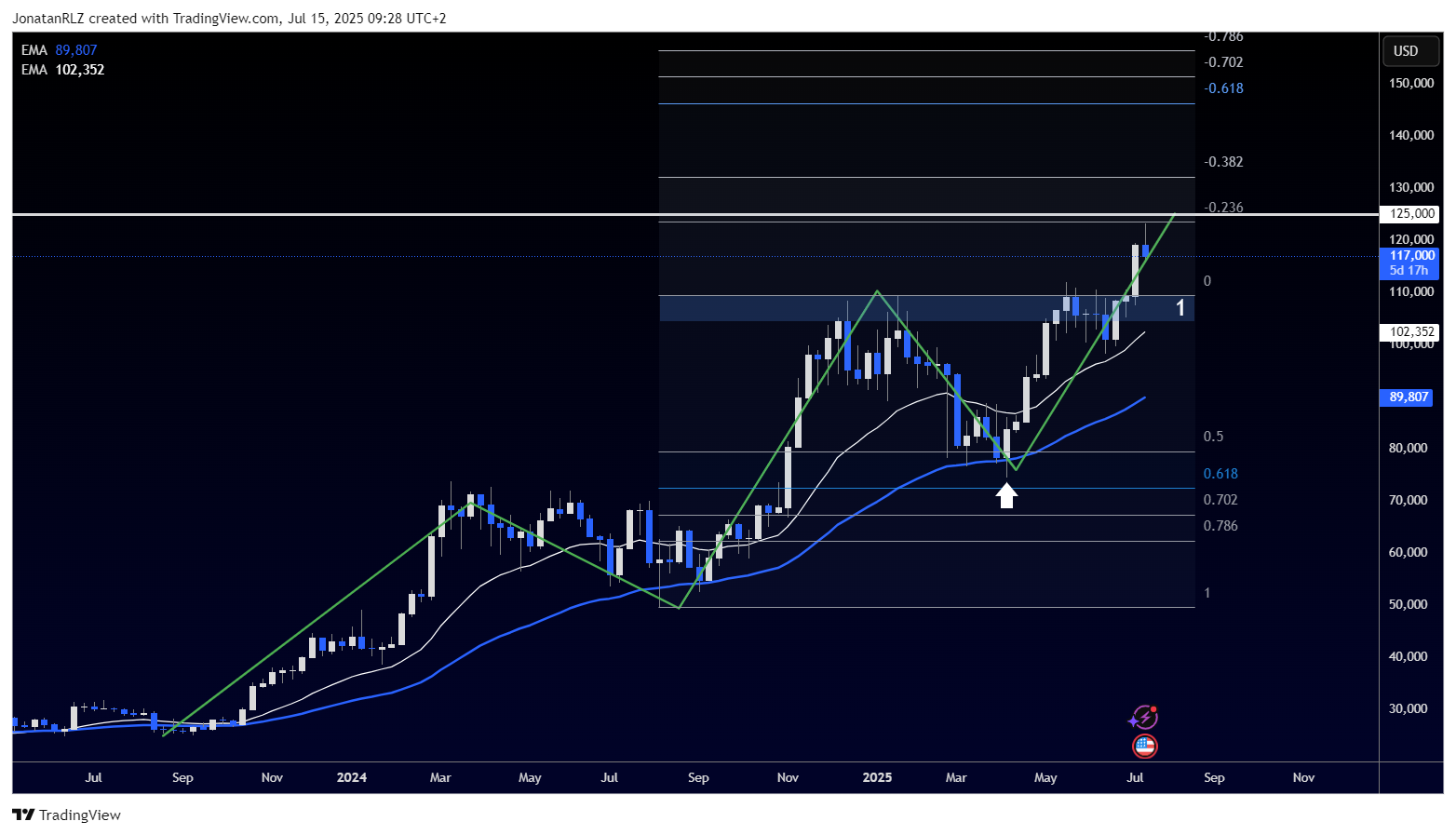

On the weekly chart, the overall trend is still strongly bullish, defined by a sequence of higher highs and higher lows. The 20 weekly EMA (white) and 50 weekly EMA (blue) are still sloping upwards, offering dynamic support. In the past, Bitcoin has tended to bounce within the zone of these two EMAs on pullbacks, forming new higher lows prior to resuming the trend.

Drawing Fibonacci retracement levels from the August 2024 low to the January 2025 high, we can see that price recently bounced nicely at the 50 percent retracement. This area, which also coincided with the weekly 50 EMA, yielded a bullish engulfing candle on the weekly time frame, a solid technical signal highlighted with a white up arrow on the chart.

The recent breakout has subsequently run up to the -0.236 Fibonacci extension level, where the price encountered initial resistance. The -0.236 extension falls just under the 125,000 zone, so this is a potentially important level to watch. A move above 125,000 may see the door opened to a drive towards the -0.382 level, but a rejection here would be no surprise as it aligns with a Fibonacci confluence zone. In the event of a deeper retracement, the breakout level around 110,000 marked with number one on the chart becomes an important support zone to watch. Additionally, the previous all time high area near 112,000 remains a probable support level where bulls may step in to defend the broader structure.

Zooming in to the daily chart, additional technical convergence can be observed. Drawing the Fibonacci retracement from the 98,000 low to the recent breakout high, the 50 percent retracement level intersects closely with the breakout area. The daily 20 EMA is already within this region, and in the next few days, the 20 and 50 EMAs should move closer together, forming an area of confluence. This coincidence may form a very firm support in case the price retreats.

On the 4-hour chart, two levels of interest present themselves. The first is labeled as number one, coinciding with the mid-zone of the Fibonacci reload zone (0.702 level) and the old all-time high area. This level may act as support on a pullback of the price, potentially front running the higher time frame breakout zone. The second level, labeled as number two, becomes significant if the price bounces higher. A reclaim of this level may indicate local strength and resumption of the bullish trend. If the price falls and is unable to reclaim it, the area may become resistance on any lower timeframe bounces.

For the time being, support around 112,000 would signify local strength, and the 117,000 to 118,000 range continues to be a significant horizontal area to watch, particularly if the price starts to retrace more deeply.

Trading involves risk.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.