Bitcoin fell on Wednesday, snapping a two-day winning streak and erasing this week’s modest gains as investors sought clarity over Trump’s trade tariffs, which have rattled risk appetite.

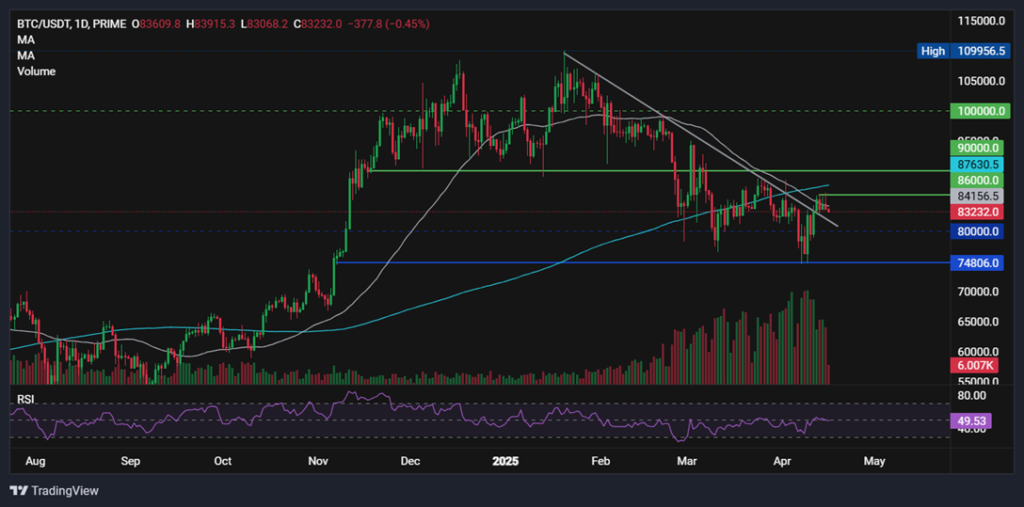

BTC rose to 86k on Tuesday but failed again to confirm a meaningful breakout above its falling trendline, which dates back to 109.5k at the start of January. At the time of writing, the price had dropped to 83k.

News flow over the past 24 hours suggests that the risk rebound will face a tough test.

Uncertainty fuels risk off trade

While President Trump has walked back some trade tariffs and hinted at possible exemptions for specific tariffs, such as the 25% tariffs on foreign car imports and some Chinese electronic goods, his administration continues to investigate the potential for tariffs on semiconductor and pharmaceutical imports.

Nvidia has warned that it faces a $5.5 billion hit as the US tightens China export rules on the AI giant whose chips have been at the heart of the AI boom. The share price has plunged 6% in after-hours trading, pulling Nasdaq futures 2% lower.

Given the correlation between US stocks, particularly US tech stocks, and Bitcoin, the cryptocurrency could struggle to break out while equities continue to fall.

Meanwhile, Gold, the safe haven of choice, has scaled to fresh record highs of $3300 as investors and central banks buy the precious metal amid rising economic uncertainty.

Fed Powell could disappoint

Looking ahead, attention will be on Federal Reserve Chair Jerome Powell, who will speak on the economic outlook later today. His speech could further hurt risk sentiment, as Powell is unlikely to cave to market expectations for a growth-supporting interest rate cut. Instead, Powell is likely to stick to a cautious approach towards inflation, which could increase due to Trump’s trade tariffs.

Solana ETFs launch in Canada

The first spot Solana exchange-traded fund will launch today in Canada. It will also have staking provisions. Currently, Solana staking fetch is an 8% annualised yield, nearly triple that of ETH staking rewards, although it remains to be seen how this provision will boost product demand.

Four asset managers, Purpose, Evolve, CI, and 3iQ, will launch the product, and these funds will trade on the Toronto Stock Exchange.

Bloomberg’s ETF analyst Eric Balchunas pointed out that these funds would offer a first look into how altcoins like Solana could perform in the ETF space and could help further institutionalise the crypto market in Canada.

Several issuers, including Grayscale, have applied for SOL ETFs in the US. The potential deadline for the Security and Exchange Commission’s (SEC) decision on these products is between May and October of this year. Unlike in Canada, US crypto ETFs are currently not allowed to state digital assets like Solana for additional yields.

SOL tests a key support

Despite the encouraging Solana-specific news, SOL’s price failed to break out above 135.00 and has broken down the 50 SMA support at 130. Below here, should sellers take our 120, a deeper selloff towards 100 could be on the cards.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.