Bitcoin consolidated around 90k last week, trading in a narrow range. The downside was limited by 87.7k while BTC failed once again to break meaningfully above 94k on the upside, a level that was also tested in the first week of December. BTC is hovering around 90k at the start of the week.

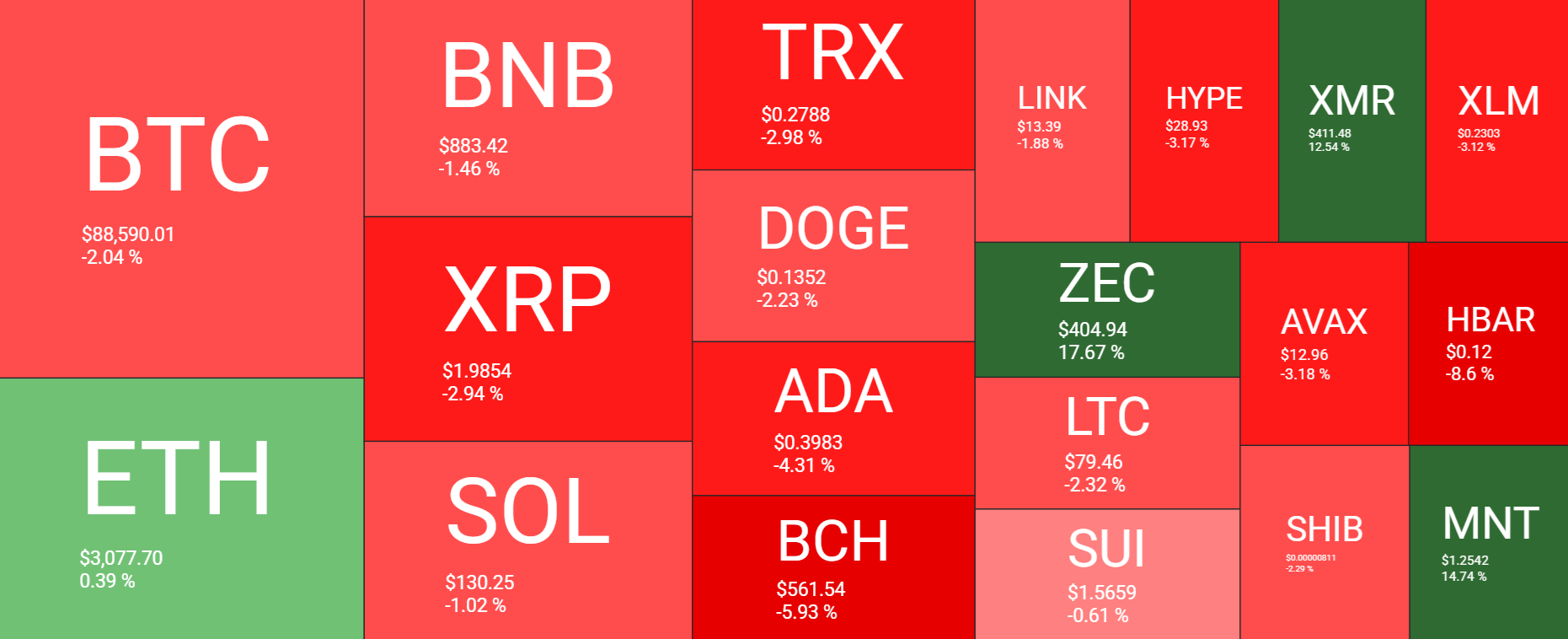

While Bitcoin fell over the past 7 days, the picture across altcoins was similar. SOL and XRP fell 1% and 3%, respectively, over the past week, while Ethereum gained a modest 0.39% over the same period; ZEC outperformed, jumping 17%.

The total cryptocurrency market capitalisation is $3.05 trillion at the time of writing, in line with its level at the start of last week and down from a high of $3.20 trillion on 13 December, when BTC topped $94.5k.

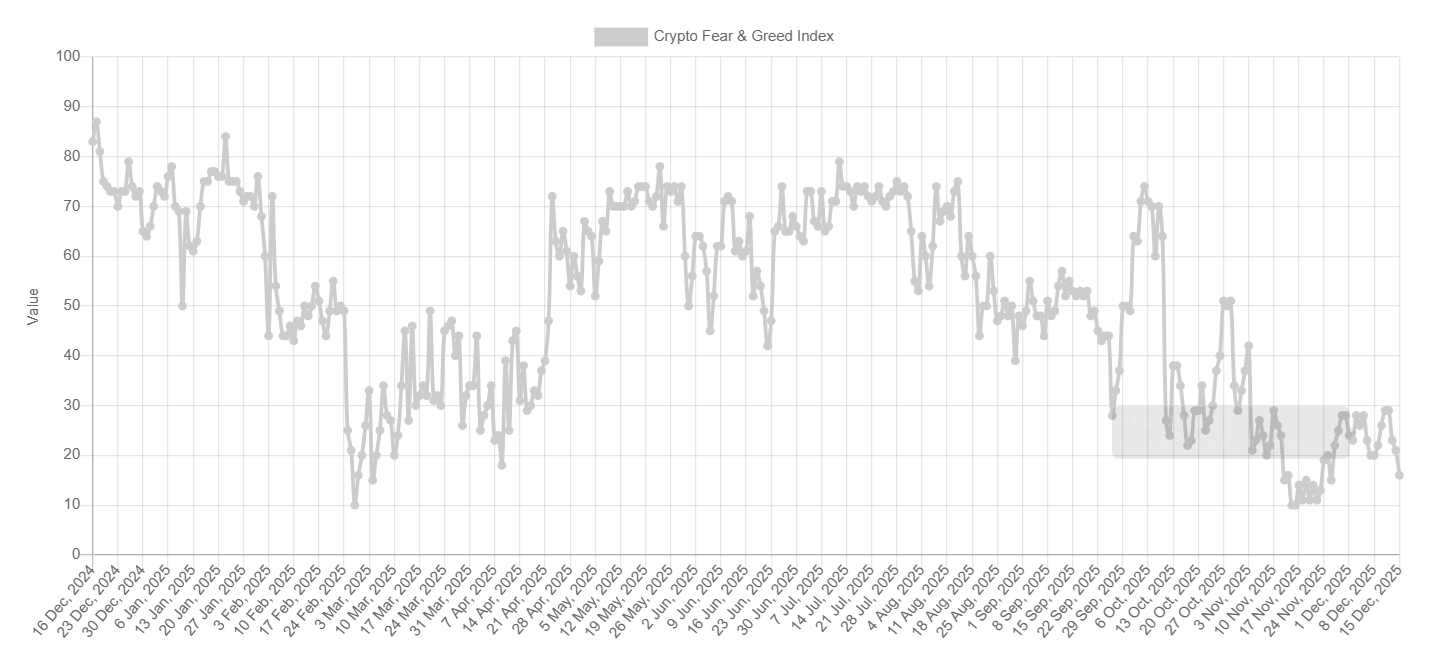

Sentiment analysis shows that sentiment remains extremely weak at 16, Extreme Fear territory. This is down from a week ago but remains above the 10 level observed in mid-November. Persistent extreme fear in the market could impede a meaningful recovery.

Macro backdrop

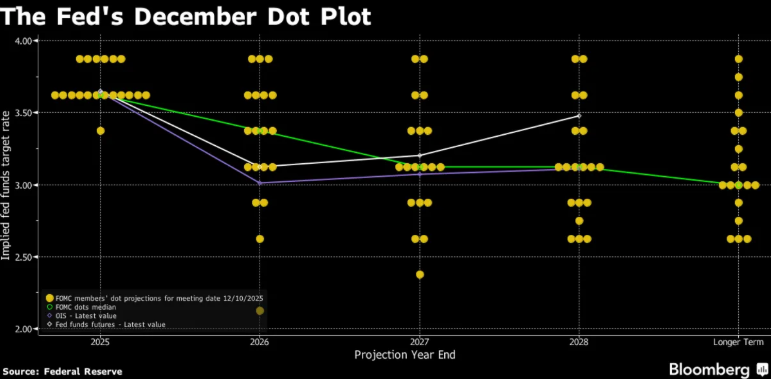

Bitcoin continues to consolidate despite the Federal Reserve cutting interest rates by 25 basis points to 3.5%-3.75%, in line with expectations. The move on Wednesday marked the Federal Reserve’s third consecutive rate cut, bringing the rate to its lowest level in three years. Policy makers, however, are projecting one 25 rate cut for 2026, leaving the outlook unchanged from the September dot plot, which is also below the two rate cuts the market is pricing in, contributing to short-term pressure on risk assets.

In addition to the Fed’s cautious tone, Oracle’s earnings also contributed to a brief pullback in US tech stocks, raising concerns about an AI bubble.

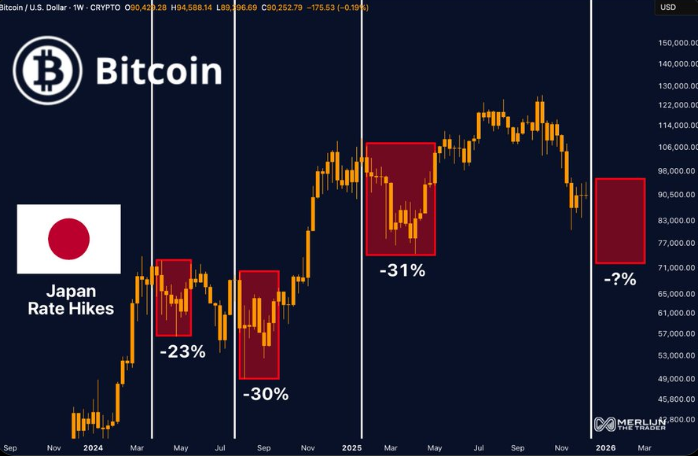

Will the BoJ trigger a 20% decline in BTC?

Whilst there are plenty of data points which could influence Bitcoin’s price this week, including November US CPI data as well as non-farm payroll figures which will be released for the first time since the US government shutdown, the key focus will be the Bank of Japan’s rate decision after a 2-day policy meeting on 18 -19 December.

The market is pricing in an 86% probability that the BoJ will raise rates by 25 basis points, which could have far-reaching effects beyond the domestic bond market, extending to global risk assets such as Bitcoin. If implemented, this would take Japan’s policy rate to 0.75%, a level not seen in almost 2 decades, and could prompt the unwinding of the yen carry trade.

For decades, the yen has been the primary currency that investors borrow and convert into other currencies and assets. Higher interest rates in Japan could invalidate the yen carry trade, and as Japanese bond yields also rise rapidly. Repatriating capital to Japan may force leveraged positions funded in yen to be unwound, prompting investors to sell global risk assets and potentially affecting the liquidity available for Bitcoin.

Considering previous BoJ hikes:

- After the March 2024 BoJ hike, the Bitcoin price fell 23% in

- After the July 2024 hike, BTC dropped around 25% and

- Following the January 2025 hike, Bitcoin fell by over 30%.

By these standards, a Bank of Japan rate hike could see Bitcoin to $70k, a 20% decline from current levels.

However, this may not necessarily be the case, given that Japanese tightening comes as the Federal Reserve rate cuts, which could balance out the bearish with the bullish for the crypto market and indicate a regime shift rather than a liquidity shock.

Institutional demand improves slightly

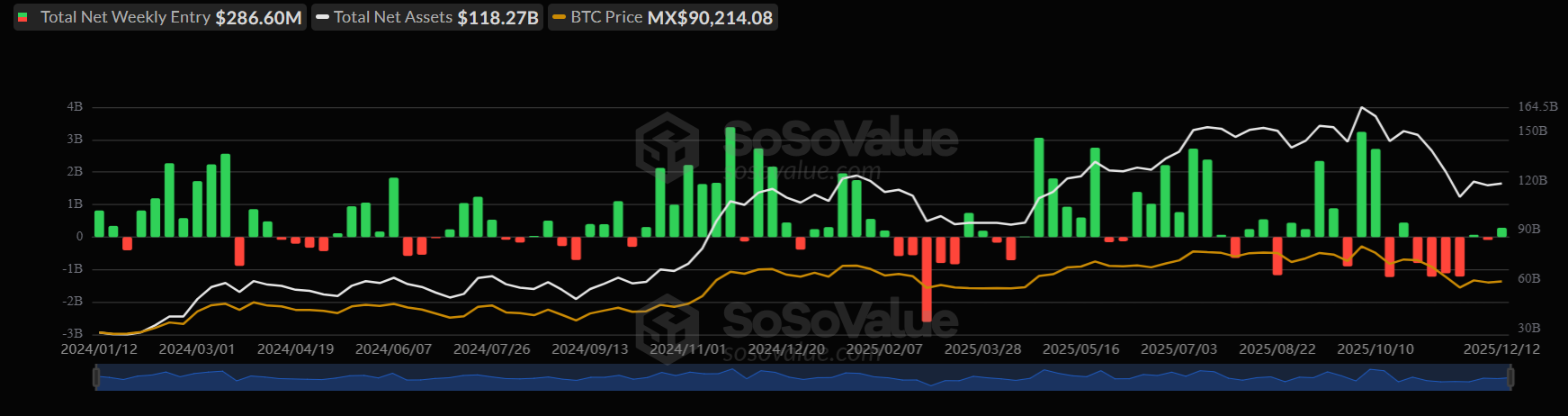

Institutional demand for Bitcoin showed signs of improvement last week, with total net inflows reaching $286.6 million after falling by $87.7 million in the previous week, signalling that institutional investor interest improved slightly.

However, these weekly inflows remain small compared to those observed earlier in the year, particularly around mid-September and October when BTC rallied to record highs. For the BTC price to sustain a move towards 100K, the ETF inflows need to intensify. BTC ETFs are currently trading below the asset value, which could point to weaker short-term momentum.

DATs step up acquisitions

Treasury net inflows have been trending lower since the start of the fourth quarter, with daily accumulations reaching 24,000 BTC at present, representing more than 1.69 million Bitcoin and approximately $153.4 billion, or 8.03% of the total supply.

Compared with Q4 of last year, accumulation in this quarter has been notably stronger, despite a more bearish market tone, particularly relative to December 2024, when Bitcoin first surged above the 100K level. Sustained accumulation by this group could be interpreted as supportive and help Bitcoin’s price to hold above the 90K region.

M2 supply hits a record high

Global liquidity has risen sharply, with global M2 supply recently hitting an all-time high of roughly $130 trillion. Rising global M2 reflects expanding liquidity as central banks ease financial conditions. Historically, this environment has favoured risk assets. As liquidity increases, a portion of this capital could rotate into risk assets such as Bitcoin, supporting demand growth.

Whales are stepping back but BTC remains resilient

Large Bitcoin holders are quietly selling, with whale support fading. On-chain data showed sustained distribution over the past few weeks. Despite this, Bitcoin has failed to break down. This may be because selling pressure is waning.

Bitcoin’s whale addresses data show weakness in the 30-day change, as addresses holding between 1000 and 10,000 BTC decline to -72. This marks the lowest level since late November. The total whale count is also near monthly lows, indicating that large holders have been reducing exposure rather than accumulating.

Interestingly, these whales are predominantly rotating into Ethereum, which indicates greater optimism for the second-largest cryptocurrency. Usually, this type of behaviour leads to a deeper pullback, but it hasn’t this time.

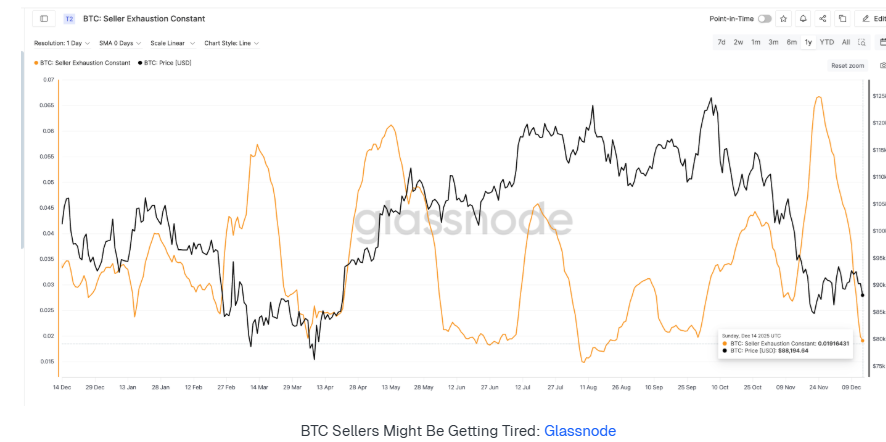

One reason could be the Bitcoin seller exhaustion constant, a Glassnode metric that combines loss-taking behaviour with price volatility. Historically, this combination appears near low-risk local BTC price bottoms. The metric is at the 0.019 level, last observed on April 5 when Bitcoin traded near 83.5K.

Over the following six weeks, the price rallied more than 33% to 111.6K. Today’s reading is modestly lower still, placing it firmly within the same historical exhaustion zone, although this does not guarantee a rally.

Demand is still lacking, so a recovery outlook is fragile

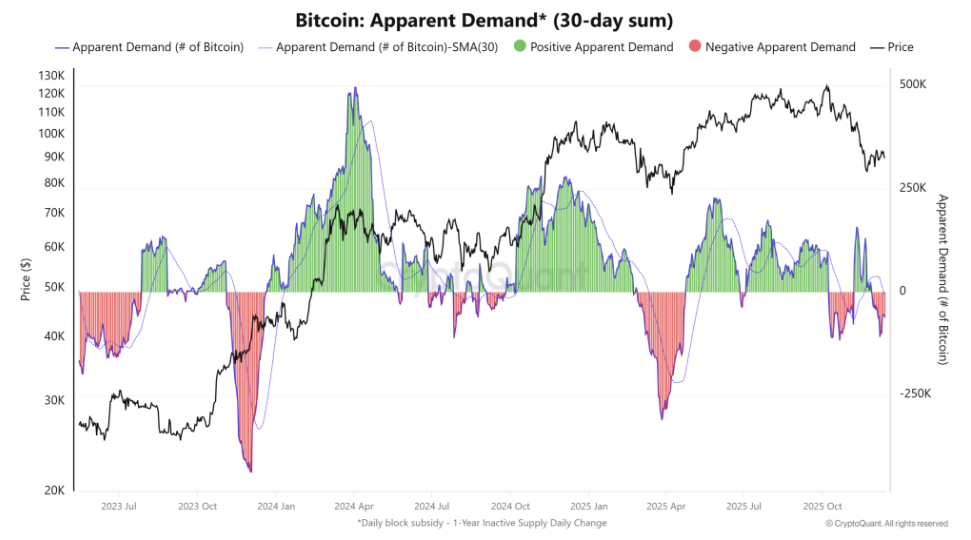

Bitcoin’s apparent demand is a metric that measures new demand relative to supply from newly mined BTC and from long-term holders. This metric has been negative since late November. Despite a brief recovery last month, this did not last.

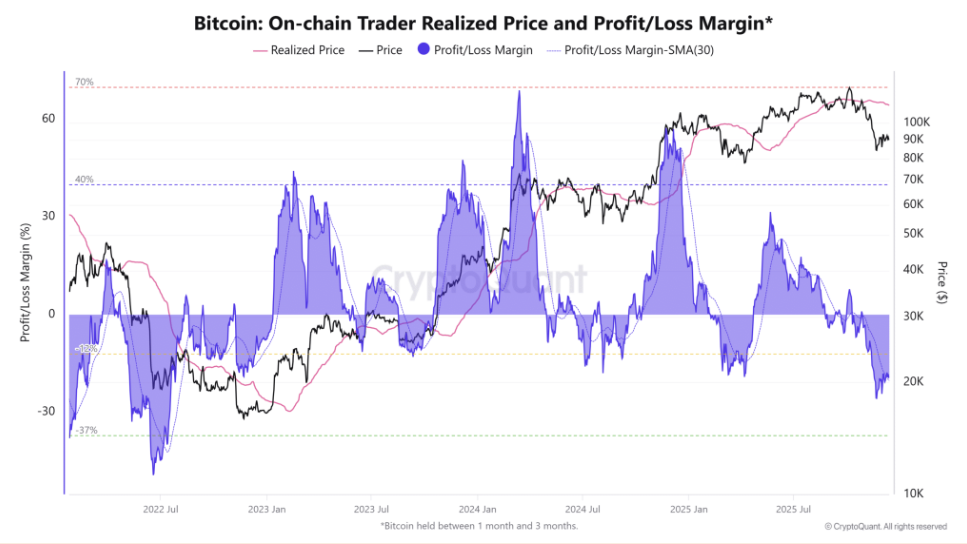

Meanwhile, the realised profit and loss for on-chain Bitcoin held between one and three months helps track market sentiment. It also captures flows into and out of the market. Over the past two months, the metric showed steady losses for holders.

When BTC fell to 84.5k, the profit margin declined to its lowest level since July 2022, as investors incurred deep losses and faced bearish market conditions. This indicates that conditions remain challenging and that substantial capital inflows are required to lift BTC toward 100k.

BTC price action

BTC needs to settle above 94k to open the door to 100k. Meanwhile, a break below 85k could spur a deeper selloff.

Trading involves risk.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.