Bitcoin kicked off the first full week of the new year on the back foot, falling 3.6%. The world’s largest cryptocurrency started the week at 98k before climbing to 102k on Monday, then falling sharply for three straight days to a low of 91.2k. The 9.5% decline in three days resulted in $1.49 billion in total liquidation in the crypto market and $340.8 million in Bitcoin alone. Bitcoin recovered to 93.5k at the start of the new week.

The selloff was seen across almost all tokens, with Ethereum falling 9%, Solana 10% and BNB performing better, falling just 0.9%. Meanwhile, XRP outperformed, rising over 7%. DOGE fell 10%, as did AVAX, while ADA fell 7%. Meanwhile, some meme coins experienced a smaller selloff, such as XLM, which dropped by 1.4%, and LEO gained.

ETF flows & institutional demand

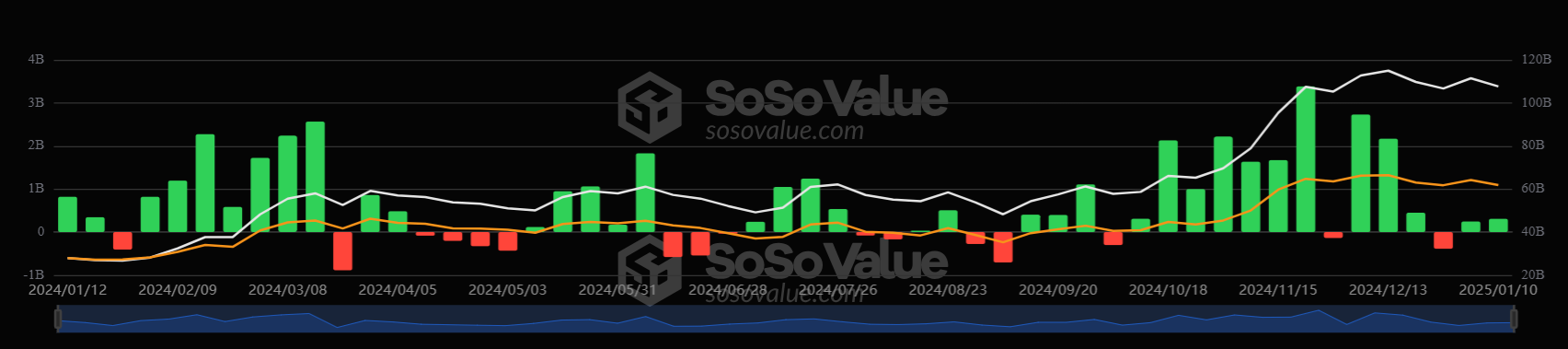

Bitcoin institutional demand recovered slightly last week but remained soft. According to SoSoValue data, BTC ETFs experienced their second straight week of net inflows, but these were just $307.2 million, up from just $245 million last week.

Breaking this down, the Bitcoin ETF saw strong inflows of $987 million on Monday, followed by modest inflows of just $52.3 million on Tuesday and a large net outflow of $582.9 million on Wednesday as the price fell to $91.2k. This was the largest outflow recorded since December 19. The magnitude of ETF inflows would need to intensify for Bitcoin’s price to recover and rally.

An impressive first year for BTC ETFs

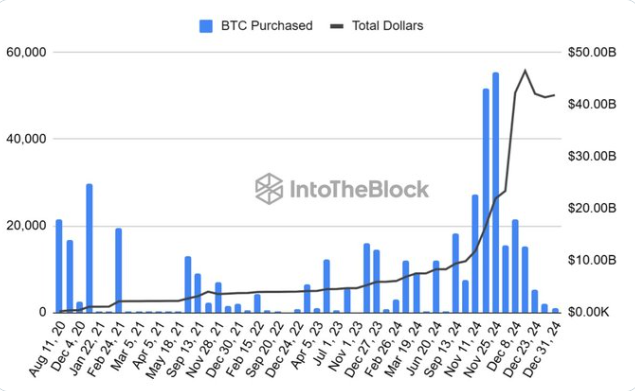

Despite the modest moves this week, the first year of spot Bitcoin ETFs in the US exceeded all expectations. Four spot Bitcoin ETFs figured among the 20 ETFs with the most significant assets under management (AUM) one year after their launch in the US.

BlackRock’s spot ETF IBIT was the best performer among the Bitcoin ETFs and almost 4000 other ETF funds. It boasts $52 billion in AUM. Meanwhile, Fidelity’s Bitcoin ETF FBTC was in fourth place with nearly $20 billion in AUM. The two largest spot Bitcoin ETFs by net flows, IBIT and FBTC, represented over 4% of the global $1.14 trillion flows. Both funds ranked within the top 20.

Another significant milestone was surpassing gold ETFs in their first year. Gold ETFs registered approximately $2.5 billion in flows in its launch year, while the US-traded Bitcoin ETFs secured over $37 billion in inflows, highlighting the strong institutional demand and the changing demand landscape for crypto.

MicroStrategy purchases

According to an 8K filing with the Securities and Exchange Commission (SEC), MicroStrategy purchased 1070 BTC for approximately $101 million at an average price of $94,004 per Bitcoin. The purchase follows the sale of a further 319,586 MicroStrategy shares during the same period for the same amount. The company now holds 447,470 BTC worth over $44 billion, with an average purchase price of $62,503. MicroStrategy holds 2.1% of the total supply.

Fundamental & Macroeconomic backdrop

Bitcoin started last week by reclaiming its 100K mark and climbing above 102K on Monday following the Federal Reserve announcement that Michael S Barr will step down from his position as Fed vice chair of supervision. The development positively impacted crypto markets because Barr is known for his strict regulatory approach towards banks engaging with and custody of cryptocurrencies. His exit further supports the view that the incoming Trump administration will have a more favourable stance towards crypto.

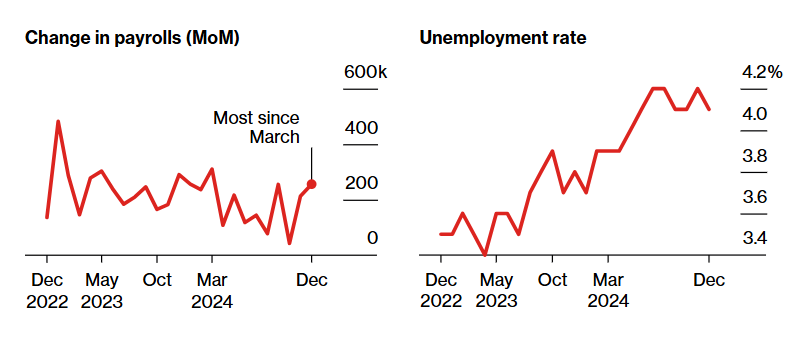

Meanwhile, the broad macroeconomic backdrop remains mixed. Strong data and sticky inflation mean the Federal Reserve is less likely to cut interest rates as much as was initially expected in 2025. This message was also conveyed in the more hawkish Fed minutes.

Stronger than expected, ISM services PMI data, with the prices paid subcomponent well above forecasts, raised inflation worries. This was followed by the US non-farm payroll report on Friday, which smashed expectations. 254K jobs were added, ahead of 164K forecasts, and unemployment unexpectedly fell to 4.1% from 4.2%.

Following the data, the market lowered rate cut expectations to 29 basis points from 38 basis points before the data release. The first-rate cut has been pushed out until October from June. The market lags behind the Fed’s recent call for two 25-basis point rate cuts in 2025.

The prospect of fewer rate cuts this year could temper demand for risk assets such as cryptocurrencies in the short to medium term. However, this narrative could shift later in the year towards AI-driven growth stories once again as monetary policy uncertainty diminishes. Until then, price action could be choppily driven by expectations of a lower interest rate environment.

Supply-side

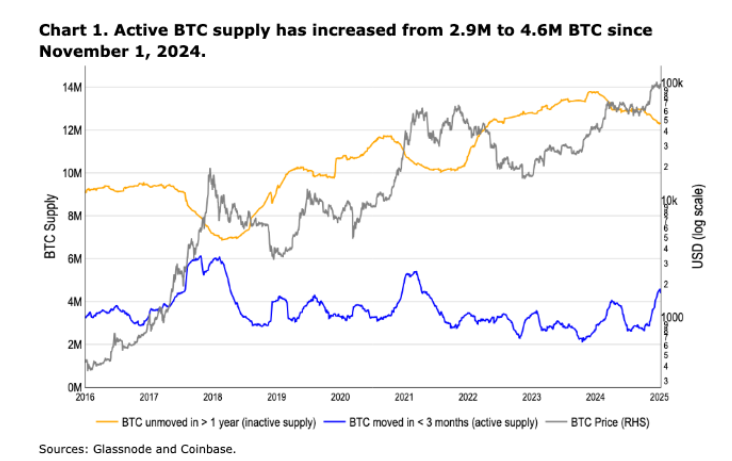

The supply-side narrative could also limit upside, at least in the near term. The active supply of Bitcoin moved on a chain in the past three months has increased to 4.6 million BTC, up from 2.7 million BTC in October last year. This is likely a proxy for increased willingness among longer-term holders to exit their positions around the 100K level. The 1.9 million BTC represents around $90 billion in national value and underscores the significance of the 100K level as a key milestone and distribution zone for longer-term holders.

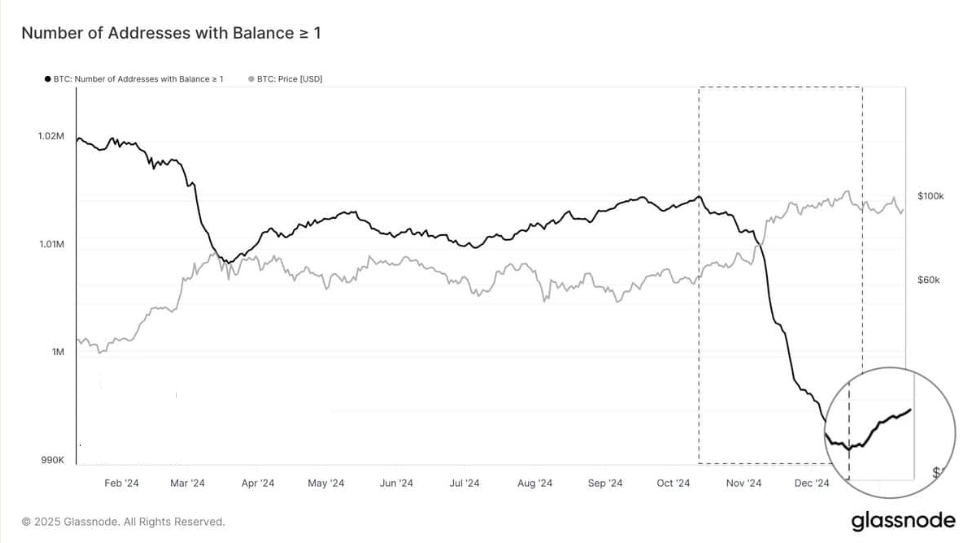

However, it is also interesting to note that according to Glassnode data, Bitcoin acquisition picked up at the start of this year. There has been a significant increase in the number of addresses holding more than one BTC. This marks a notable shift, particularly following a prolonged distribution phase that began in October when many BTC holders were selling.

Such accumulation often indicates a renewed sense of confidence in the market. When investors shift from selling to holding, it means they are expecting the price to increase, which could point to a potential uptake in BTC value.

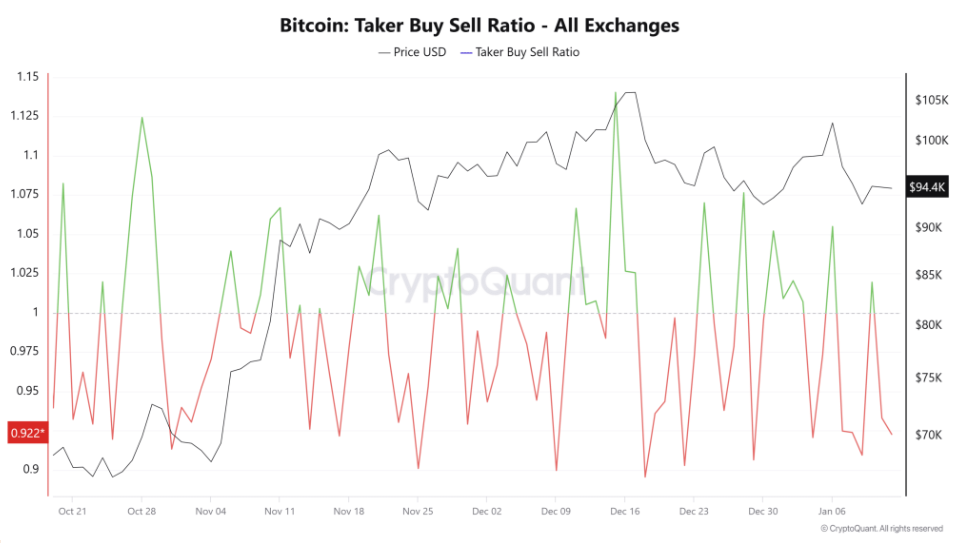

In contrast, sellers currently dominate according to the Taker buy-sell ratio on CryptoQuant, which measures the ratio of buying to selling in the derivatives market. The ratio has dropped below 1, with a reading of 0.922, indicating that selling outweighs buying. Should this trend continue, Bitcoin’s price could struggle to push higher.

Week Ahead

This week’s primary focus will be US inflation, with the release of wholesale inflation (PPI) and consumer price inflation (CPI), which could trigger volatile trading for Bitcoin and altcoins.

US inflation

Expectations are that the US PPI, released on Tuesday, January 14th, will show that it rose 0.3% MoM in December from 0.4% in November. CPI, scheduled for Wednesday, January 15, is expected to tick higher again to 2.9% YoY, up from 2.7%, moving further from the Fed’s 2% target.

These data points could provide fresh clues about the economy’s health and the likelihood of Fed rate cuts this year. The data comes after a stronger-than-expected U.S. jobs report and hawkish Fed minutes last week. Hotter-than-expected inflation figures could further dampen the market’s expectations for rate cuts, which could bode poorly for risky assets like Bitcoin.

Countdown to Trump’s inauguration

Attention will also be on Trump’s upcoming inauguration on January 20, which could be a buy-the-news event. Trump is widely expected to create a more crypto-friendly environment, and the market has cheered his key personnel appointments so far.

Trump’s election sparked Bitcoin’s rally from the 70k region to its 108k ATH. The risk is that Trump fails to live up to bullish crypto expectations.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.