Bitcoin may be on the verge of breaking out of a consolidation. BTC has traded in a tight range, around 85k and the 200-day moving average, a critical dynamic resistance level. Last week, Bitcoin recovered from Tuesday’s low of 81k, briefly rising above the 200 SMA to a peak of 87k mid-week before easing back to 85k. BTC is rising towards 87k at the start of this week amid cautious optimism in the market.

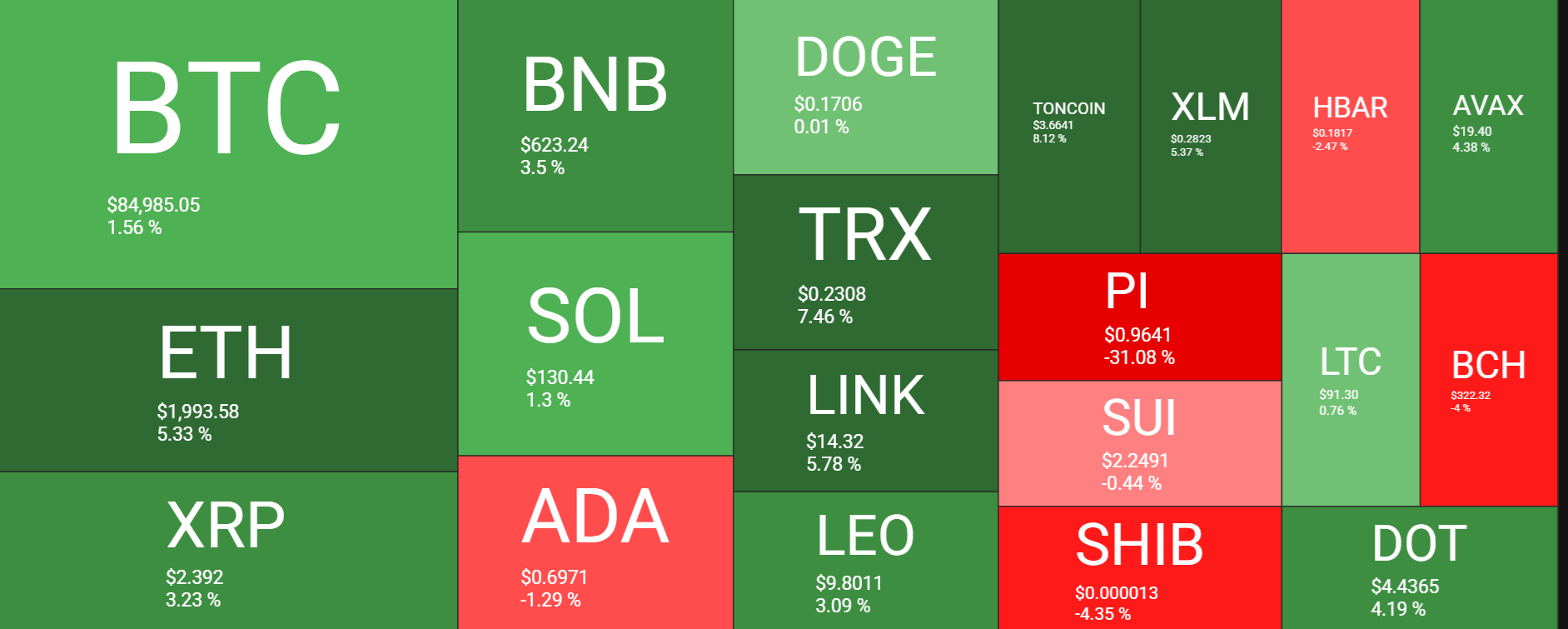

Altcoins posted a mixed performance across the week, with Ethereum gaining over 4% and Ripple jumping 3%, booted by the SEC dropping its case against Ripple. Solana posted a gain of just 0.9%. Meanwhile, ADA dropped 0.5%, as did Dodge, while PI tumbled 32% across the week.

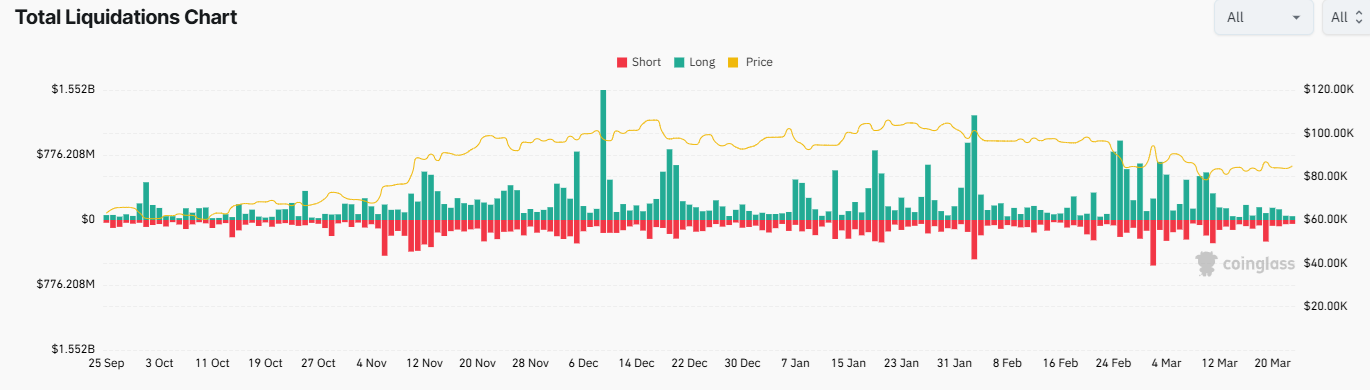

Liquidations fall

Volatility has calmed significantly over the past 10 days. As a result, liquidations have also dropped dramatically compared to the high levels of long liquidations seen across the end of February and the first two weeks of March. Data from Coinglass showed that total crypto liquidations last week fell to more moderate levels.

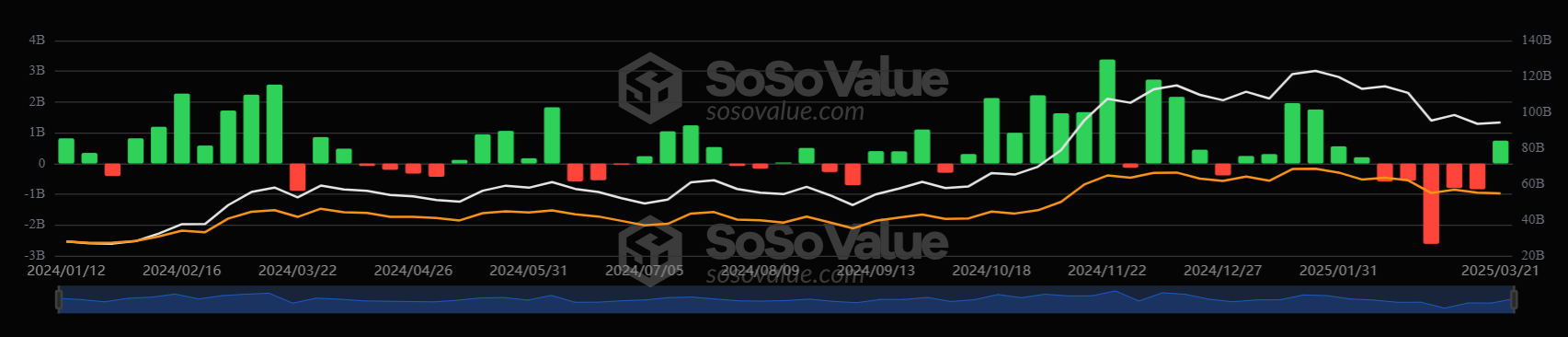

Institutional demand returns

Institutional Bitcoin investors had been cashing out of the BTC ETFs earlier this month, but that changed this week. Bitcoin ETFs saw inflows of $744.35 million following five consecutive weeks of outflows.

Every day last week, money was entered back into spot BTC ETF. Sentiment turned more positive, although this wasn’t the case for Ethereum ETFs, which are now nursing a 13-day losing streak.

Strategy buys BTC

On March 17, Strategy acquired 130 Bitcoin valued at $10.7 million, taking its total to 499,266 BTC. While this represents one of its smallest purchases on record, it came after a two-week break from buying. On March 21st, the company announced another capital raise and hinted that the funds would be used to purchase more Bitcoin. Despite the recent market downturn, Strategy still has $9.3 billion in unrealized gains.

Macro backdrop

1. Fed plays down recession risks

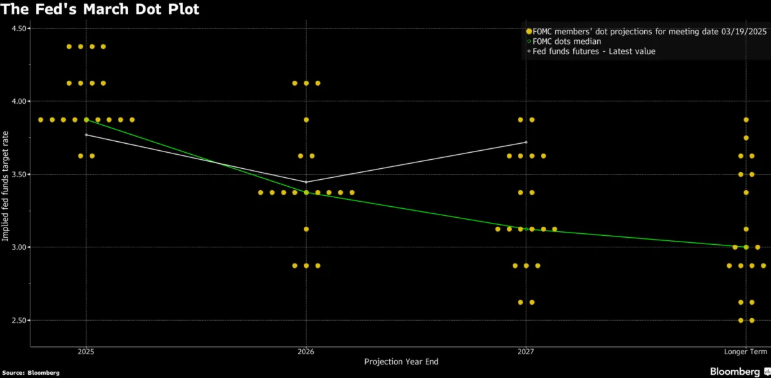

The latest Federal Reserve meeting brought several noteworthy economic projections and balance sheet management updates.

Policymakers, as expected, left the benchmark rate unchanged at 4.25% to 4.5% but decided to gradually reduce the pace of its balance sheet runoff. As of April 1, the Fed is lowering the monthly cap from $25 billion to $5 billion. This move should help support market liquidity and riskier assets such as crypto and equities.

Meanwhile, much to the market’s relief, the Fed’s dot plot maintained its median projection for 25 basis point rate cuts in 2025 and two further in 2026, although eight policymakers saw just one rate cut this year. The Fed raised its inflation outlook to 2.7% from 2.5% and cut its growth forecast to 1.7% from 2.1%, reflecting increasing uncertainty surrounding the outlook of the US economy. However, Powell also played down recession worries, supporting the market mood.

2. Less severe trade tariffs?

After the meeting, the market remained cautious, with Trump’s tariff announcements on April 2 as the next major catalyst. Uncertainty surrounding the global trade picture has made it difficult for investors to put money to work, leaving many on the sidelines last week. This uncertainty has overshadowed the positive developments on the regulatory side. Tariffs and Q1 earnings will likely be important factors for the market to watch in the coming weeks.

However, some optimism was feeding into the market at the start of the week based on reports that Trump could adopt less severe trade tariffs on April 2 than previously thought. Reports indicate Trump will not impose industry-specific tariffs, and reciprocal tariffs will be limited to 15 countries with major trade imbalances with the US.

The prospect of narrower tariffs, combined with Fed Powell’s reassuring assessment of the US economy, is helping lift BTC to 87k at the start of the week.

3. SEC drive for clarity

News that the US Securities and Exchange crypto task force will host a series of roundtables to discuss key areas of interest in regulating crypto and how it’s helping the mood. The spring Sprint towards Crypto Clarity series, which takes place just days after President Trump spoke at the Blockwork Digital asset on Thursday, is important that the administration is placing on crypto.

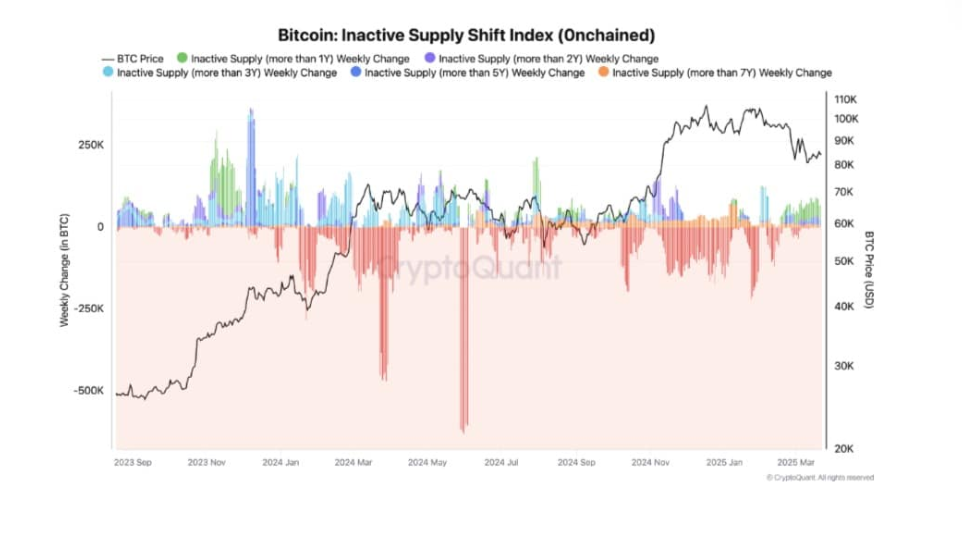

Long-term holders refuse to sell

Bitcoin long-term holders are refusing to close their positions despite Bitcoin still trading down over 20% from its full-time high of 109K.

According to data from QuantCrypto, the Inactive Supply Shift Index suggests there’s no significant selling pressure from long-term Bitcoin holders (LTH). Smart money isn’t exiting but could be strategically positioning for Bitcoin’s trajectory. Traditionally, LTHs’ holdings reflect strong conviction, which often precedes a major price rally. On the other hand, when long-term holders start to distribute, it typically aligns with the market top.

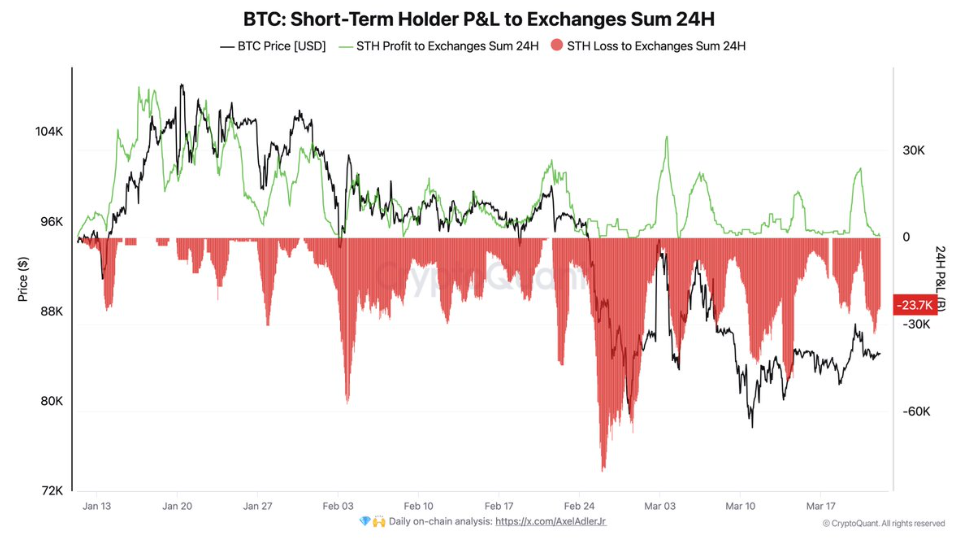

Short-term holders are still below a realised set price

Current positioning suggests long-term holders are optimistic, although short-term holders (STHs) are not. As mentioned in previous reports, short term holders realised set price is at 92K meaning this group has been in a loss since March 6.

Periods of uncertainty can be more challenging for weaker hands, forcing them to capitulate. This explains why each group behaves differently.

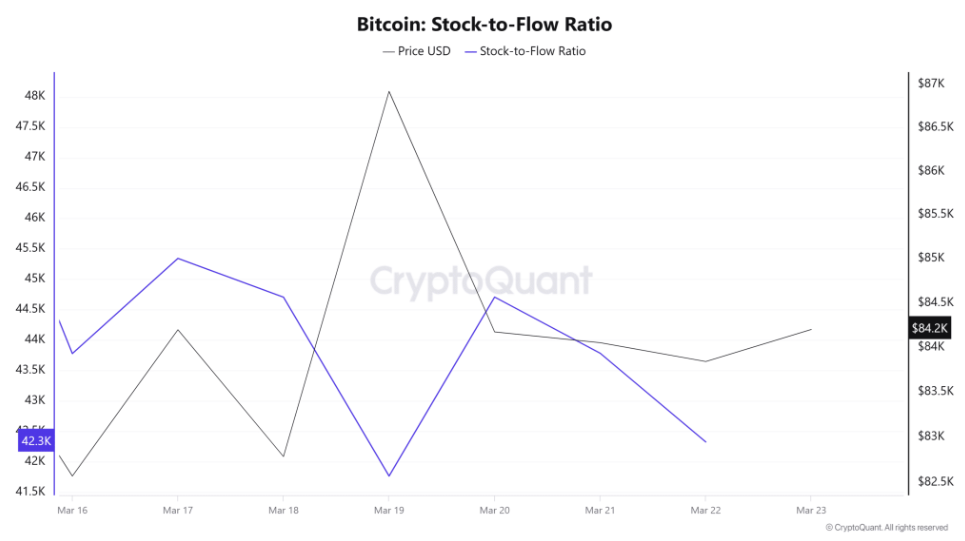

Meanwhile, Bitcoin’s Stock-to-Flow ratio is falling, which also points to reduced selling pressure. The ratio fell from 43K to 42K over the past week. When supply declines while demand remains constant or increases, prices are likely to rise.

With long-term holders refusing to sell while short-term holders capitulate, this points to continued consolidation. We could see Bitcoin continue to trade between its current levels of 82k and 87k.

A breakout above this range could push crypto back up to 92k, which is the short-term holders’ realised price.

RSI breakout

As Bitcoin pushes higher towards 87k, the daily RSI is pointing to early signs of breaking out from a downtrend that began in November 2024.

This is occurring as the BTC price is testing the 200-day moving average technical resistance level—a level that buyers need to close above to secure further gains.

Looking ahead

Attention will remain on Trump’s trade tariffs. A sense that they will be less severe will continue to support risk sentiment.

Investors will also watch the US core PCE data, the Fed’s preferred inflation measure, on Friday. Core PCE is expected to ease to 2.6% from 2.9%. Cooling inflation could also support the market mood, although the market knows that inflation could creep higher later in the year due to Trump’s trade tariffs.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.