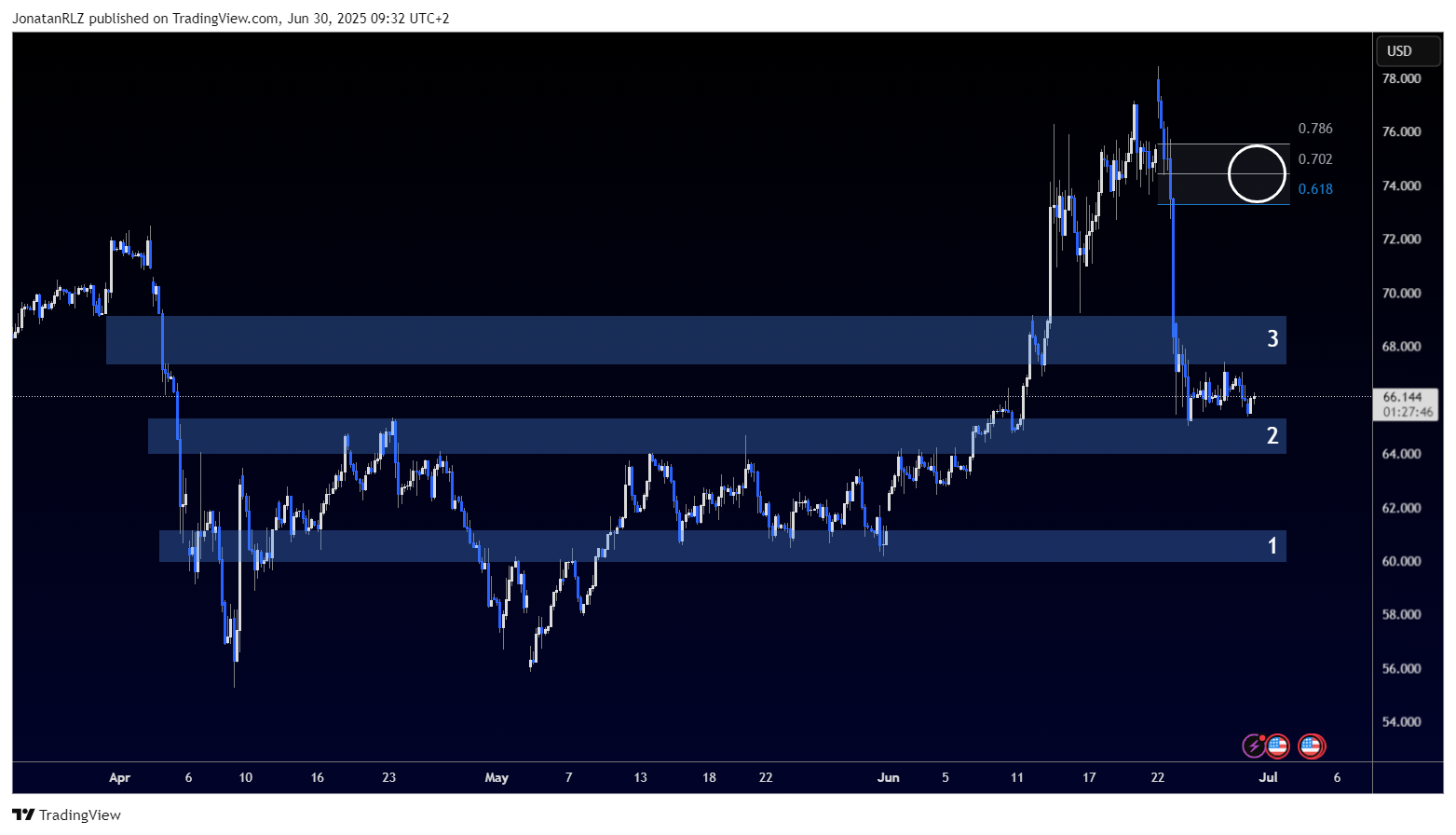

Following the recent escalation and subsequent truce in the Middle East, first with the US strike on Iran and then the peace agreement between Iran and Israel, crude oil experienced significant volatility. The price surged to a local high around $78, testing a long-term ascending trendline, marked as number 3, before retracing the entire move.

The pullback brought oil back down to the $66 area, marked as level 1, which we highlighted in previous updates. Notably, this zone aligns with the local long reload zone, sitting between the 61.8% and 78.6% Fibonacci retracement levels of the most recent impulse move, a classic area where buyers often look to re-enter.

The key question now is whether oil can hold this level as support or if it will break down and re-enter the broader trading range that began forming in early April.

At present, oil is consolidating within a defined range on the 4-hour chart, with range lows just above $64 and range highs near $68.

A reclaim of the $68 level, marked as level 2, would likely signal bullish momentum and open the door for continuation higher. On the other hand, a failure to hold above $66 and a breakdown below $64 could set the stage for a move back toward the $60.50 region. A level that, if lost, would signal a clear bearish shift in the high time frame structure.

If bulls manage to push the price back above the $78 zone and reclaim level 3, the next zone of interest is the short reload zone of the latest down move. This area, marked with a white circle, presents a confluence resistance level and could cap any upside attempts unless momentum expands further.

With geopolitical risks easing but still unresolved, crude oil remains highly sensitive to headline-driven volatility. Price action around $66 and $68 will likely determine the next directional phase.

Trading involves risk.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.