Bitcoin (BTC) began last week with a strong upward momentum, aggressively trading up to $70,000. This surge came after Bitcoin closed the previous week with a gain of just over 7%, marking the first time it revisited this key psychological level since May earlier this year. At the start of last week, Bitcoin was trading at $68,150. It quickly rose to a high of $70,000 during the market open. However, this rally was short-lived as Bitcoin encountered resistance at this level and subsequently declined, closing the week at $58,142. This marked the largest decline the cryptocurrency has experienced this year, with a drop of over 14.5% for the week. This movement highlights the volatility and sensitivity of Bitcoin around significant price milestones, influenced by recent monetary policy results and political developments.

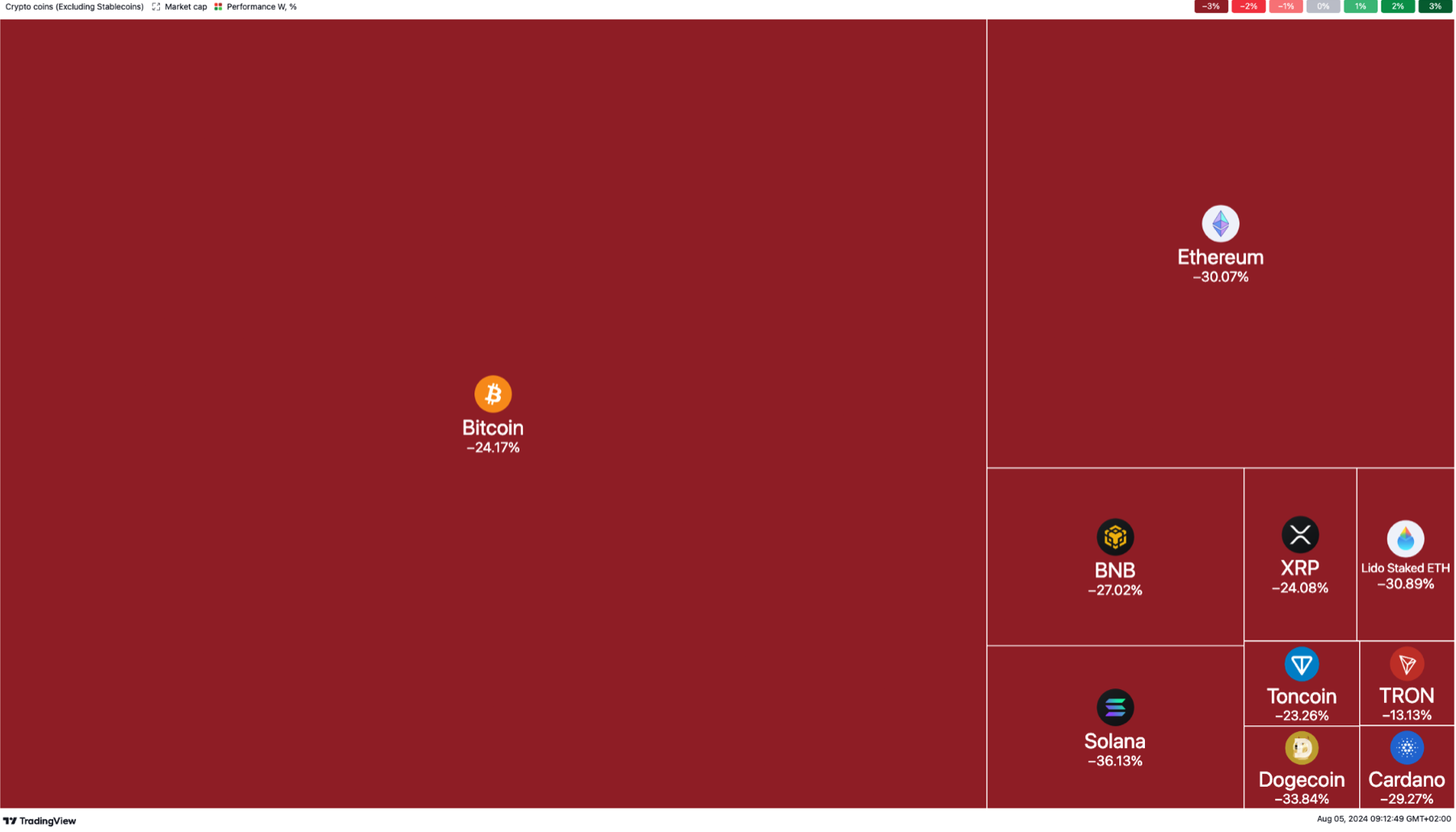

After the weekly close at $58,142, early Monday morning saw over $1 billion liquidated from the cryptocurrency market within the last 24 hours, resulting in an additional 10% decline in Bitcoins price, currently we are trading below $51,000. This compounded to a week-on-week decline of just over 24%. As the market reacts nervously and awaits further developments, rumours are circulating about a potential emergency meeting by the Federal Reserve to reconsider an interest rate cut.

As negative monetary policy results were released and political uncertainty in the Middle East increased, Bitcoin and the broader cryptocurrency market were notably impacted. Several large-cap altcoins experienced significant declines in value. For example, Solana dropped by a dramatic 36.13%, XRP decreased by 24.08%, and Ether fell by 30.07%. Despite the successful launch of the Ether ETF, this timing hasn’t been as favourable as the BTC ETF launch. This trend demonstrates the cryptocurrency market’s sensitivity to geopolitical developments and highlights the volatility among different digital assets during such events.

ETH ETF flow volatility picking up

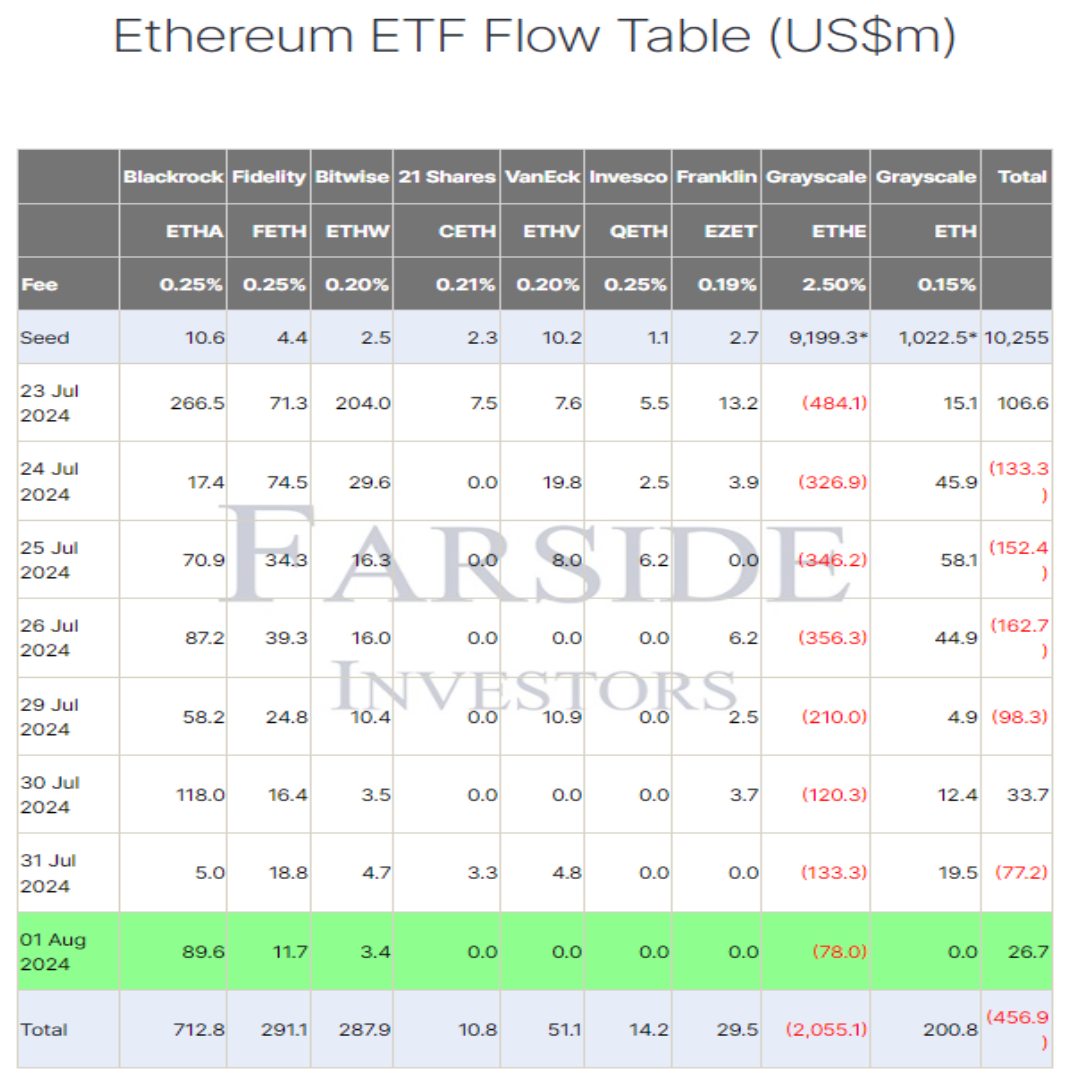

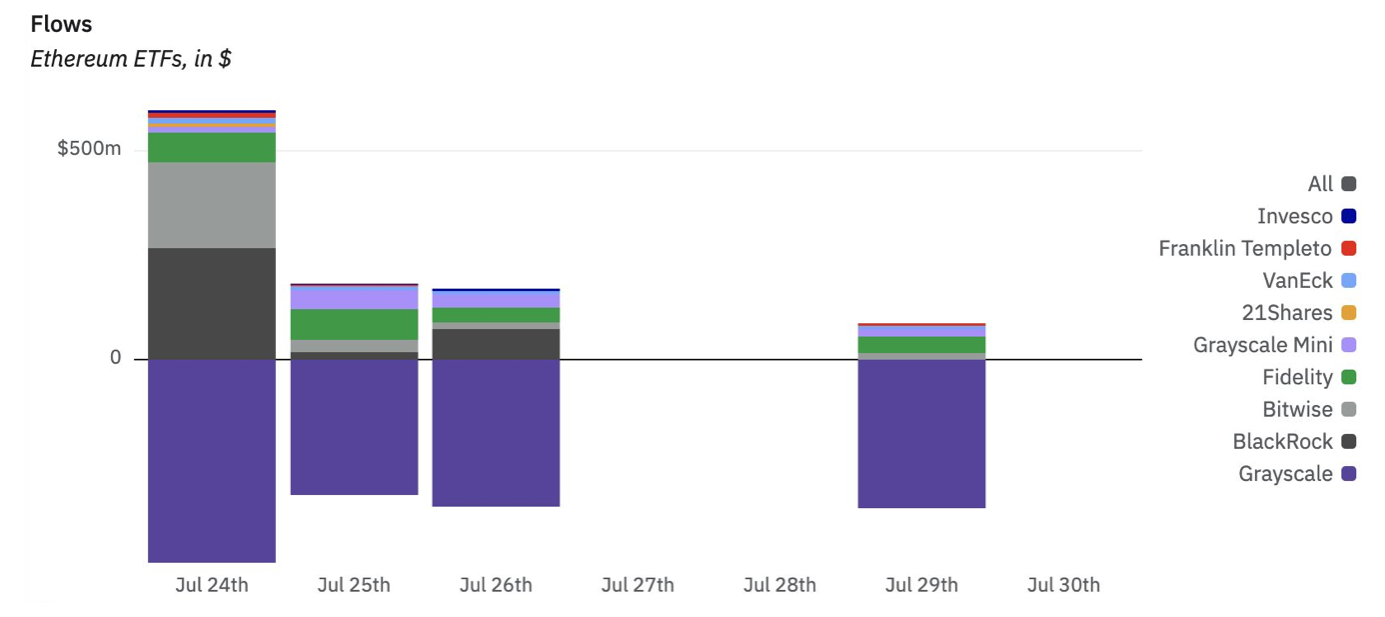

Following the successful launch of the Ether ETF last week, several issuers have already begun trading Ether. Notably, the Grayscale Ethereum Trust (ETHE) has been the top contributor to Ether outflows, selling off nearly $2 billion worth of Ether since its conversion into a spot ETF. In contrast, BlackRock, Fidelity, and Bitwise collectively contributed to approximately $1.2 billion worth of Ether inflows. This indicates a significant redistribution of Ether holdings in the market, with Grayscale reducing its position while other major institutional players are increasing their investments.

The remaining issuers of Ether are also contributing to the positive inflow of purchases. However, their combined total inflows are just over $100 million, which is considerably smaller compared to the substantial inflows from major firms like BlackRock and Grayscale. This difference highlights the significant market influence and investor confidence commanded by these larger institutional players.

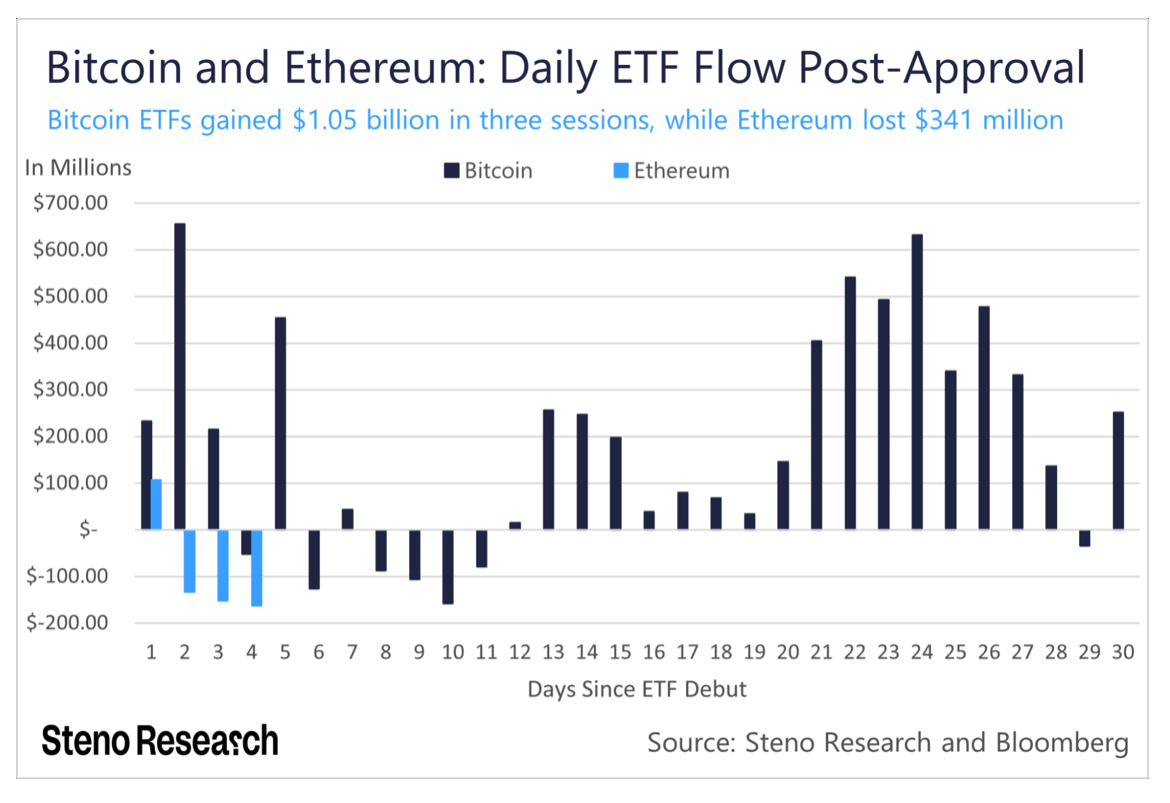

With the Ether ETF launch still in its early stages, the market is adjusting to the new dynamics of inflows and outflows, leading to expected volatility in Ether’s price action over the coming weeks. An interesting aspect to observe is the comparison of ETF flows between Bitcoin and Ether following their respective ETF launches. Bitcoin experienced over $1 billion in inflows, whereas Ether saw an outflow of $341 million in the initial sessions. Although these events occurred at different times, this contrast suggests that institutional investors may have a stronger preference for Bitcoin, reinforcing its dominance in the cryptocurrency market.

Despite Grayscale’s aggressive offloading of funds, Ether’s price action showed great resilience before the release of the monetary policy data. At the start of the week, Ether was trading at $3,275.00, and by Friday it had only modestly declined to $3,195.00, a drop of just 1-2%. However, this stability was short-lived. The negative jobs data released on Friday afternoon triggered the largest price drop Ether has seen all year. In hindsight, Grayscale’s significant selling pressure may have been an early indicator of the subsequent sell-off.

Pre-release of the NFP Data:

Post-release of the NFP Data:

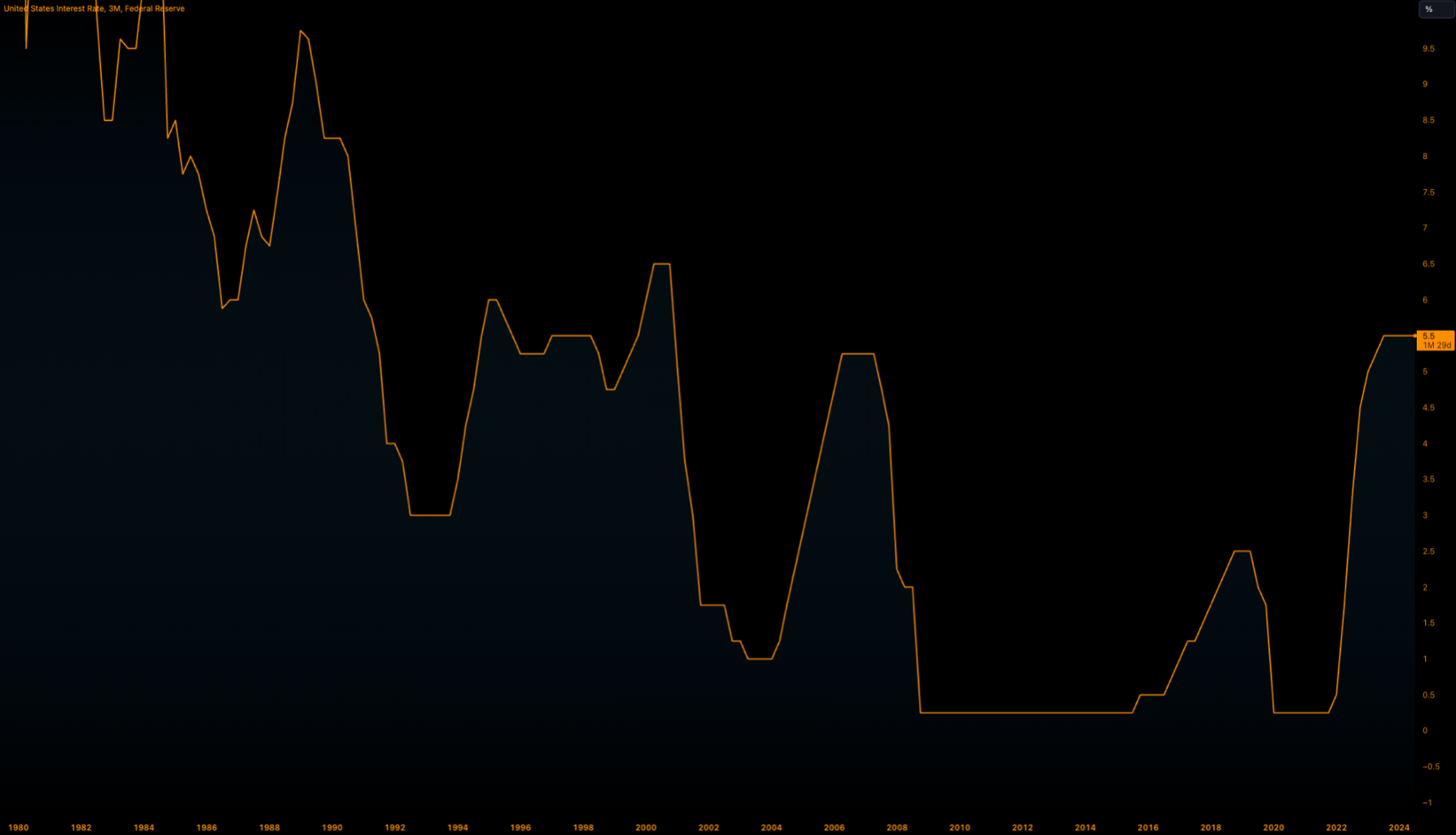

Interest Rate decision outcomes – FED (FOMC), BoE, BoJ

The Federal Reserve announced last week that they will keep interest rates unchanged, maintaining its current monetary policy stance. However, the Fed indicated that a potential rate cut could be considered at its next meeting in September if two economic conditions were met:

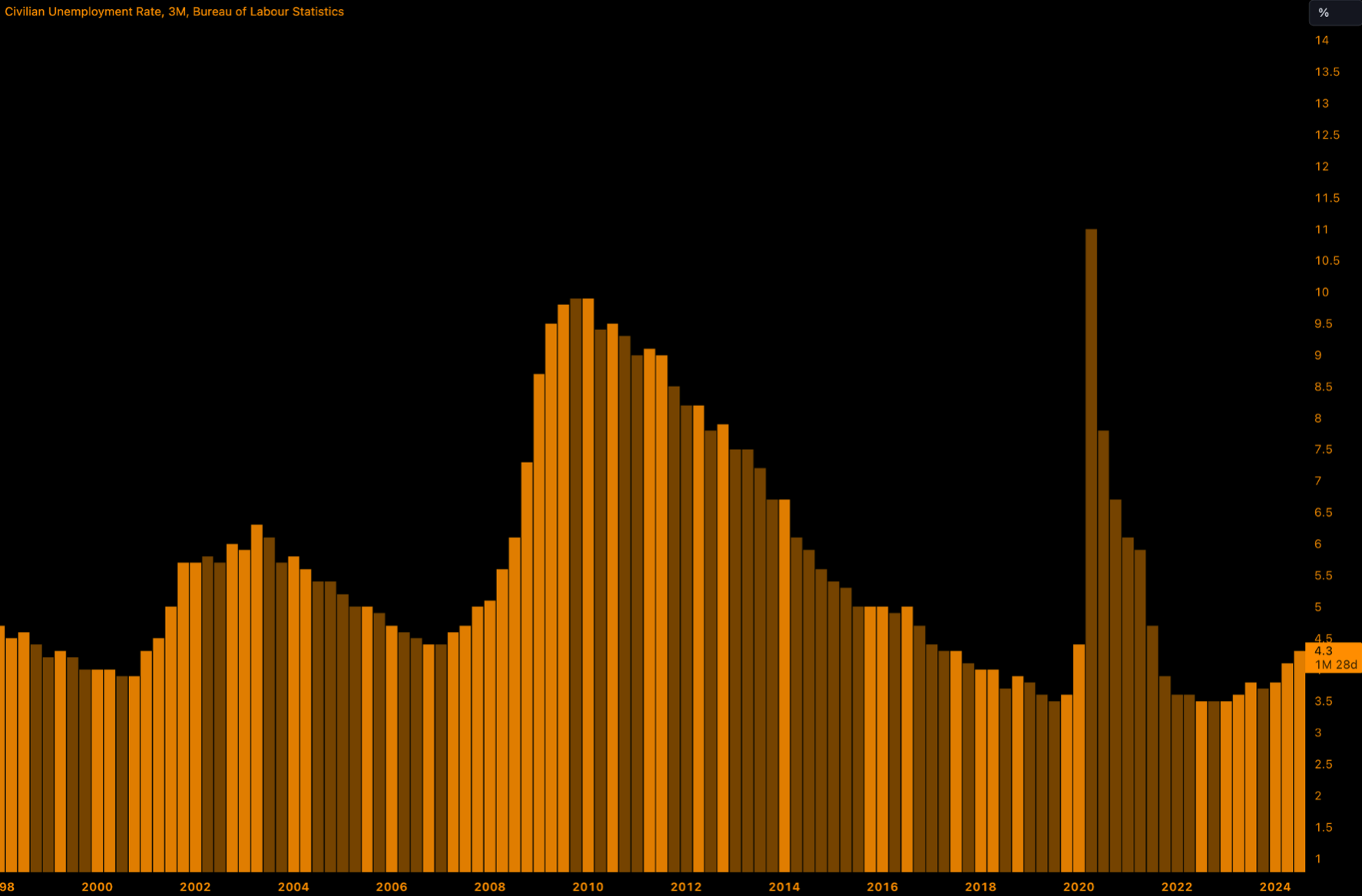

- U.S. Labour Market: The labour market needs to continue cooling off. This involves a reduction in employment growth rates and possibly a higher unemployment rate.

- Inflation: Inflation needs to keep declining towards the Federal Reserve’s target of 2%. Currently, the inflation rate is at 3%. The Fed is closely monitoring inflation trends to ensure they are moving in the desired direction.

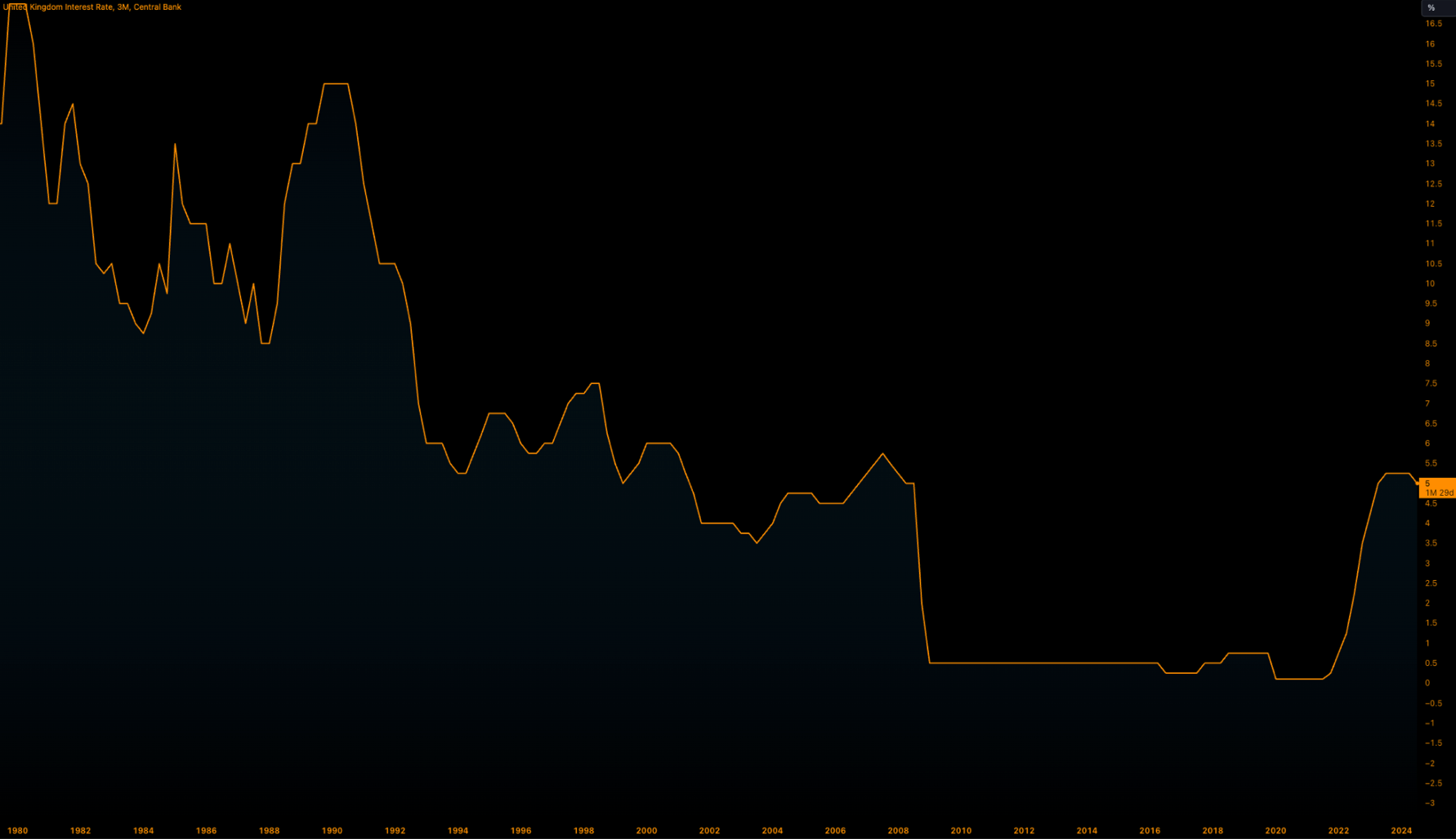

The Bank of England (BoE) has reduced interest rates by 25 basis points (0.25%), to 5%, marking its first rate cut since the onset of the COVID-19 pandemic in 2020. This move comes amid ongoing efforts to support the UK economy in the face of various economic challenges. Following the BoE’s decision, traders are anticipating additional rate cuts throughout the remainder of the year.

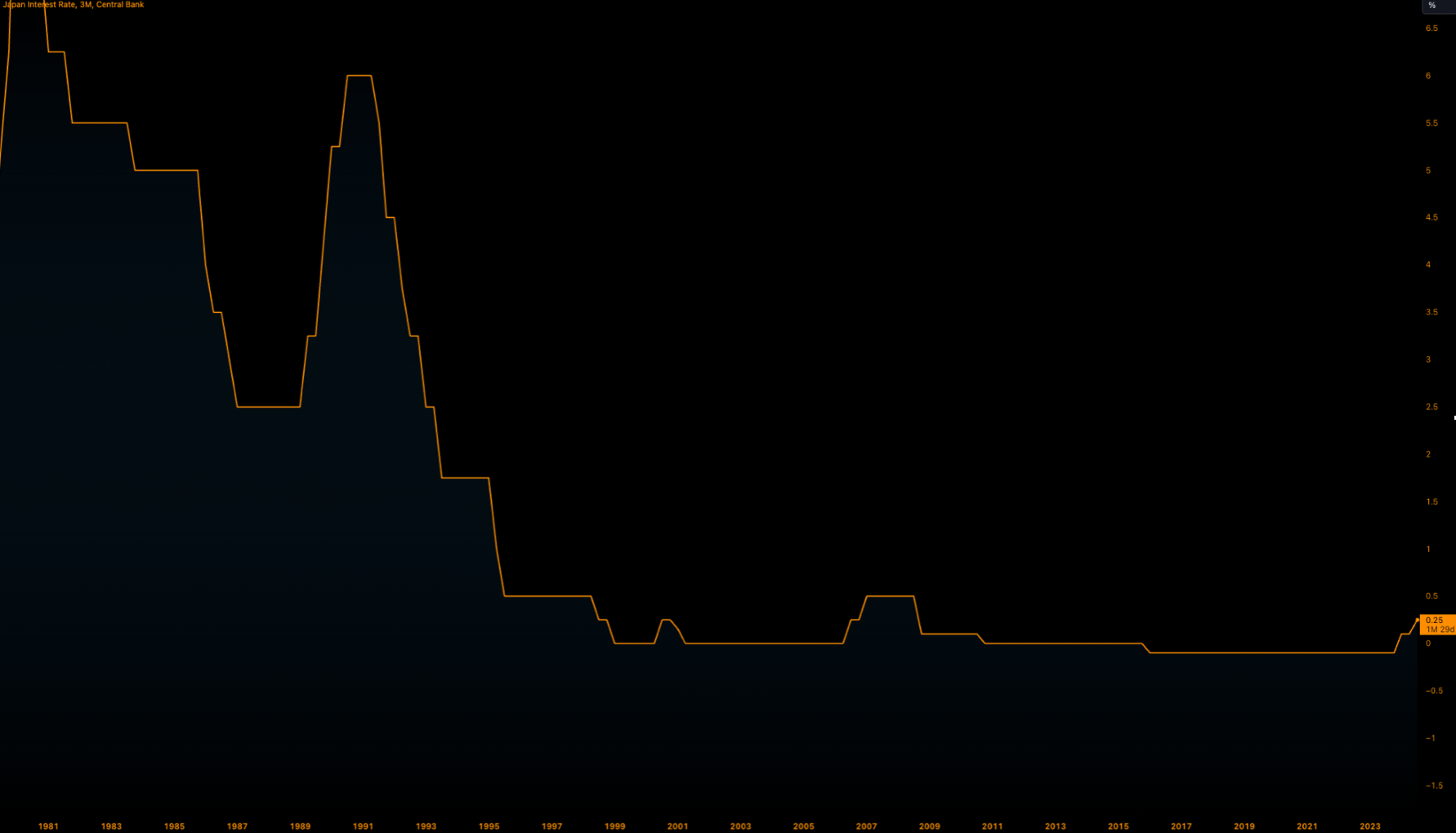

In a significant policy shift, the Bank of Japan (BoJ) has raised interest rates for only the second time in 17 years as part of its efforts to normalise monetary policy. The BoJ increased the interest rate from 0.1% to 0.25%, signaling a move towards tighter financial conditions. The BoJ projects that inflation will hover around its 2% target in the coming years, supporting the rationale for the rate hike.

BoJ Governor Kazuo Ueda has indicated that another potential rate hike could be on the horizon later this year if economic conditions warrant further adjustments. The BoJ’s hawkish comments had an immediate impact on currency markets, pushing the USD/JPY exchange rate below 151 for the first time since March of this year. Price action for the dollar against the yen, closed as low as 146 on Friday afternoon.

Has the FED waited too long to act?

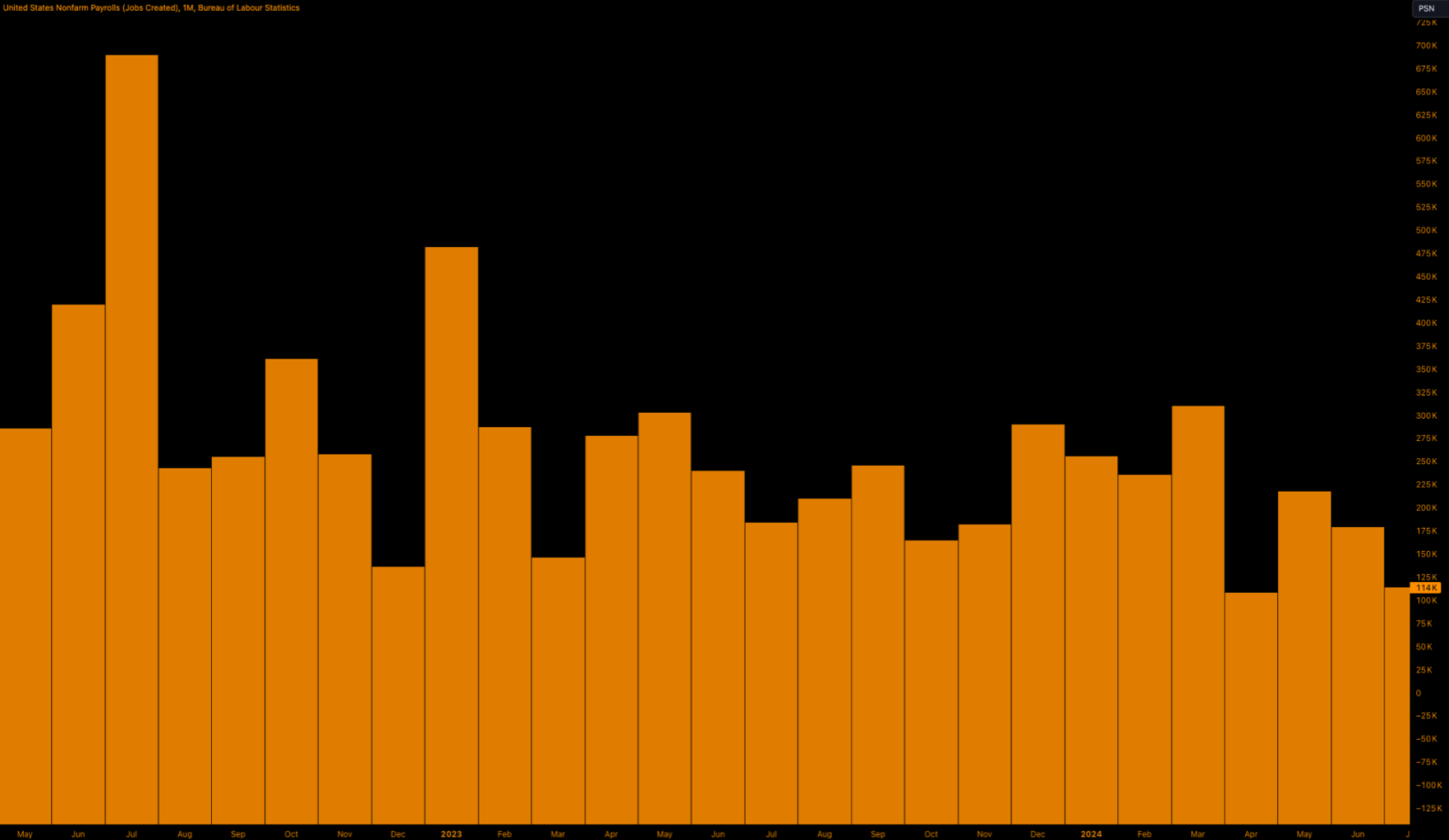

The highly anticipated Non-Farm Payroll (NFP) results were released last Friday, providing crucial insights into the U.S. labour market’s health. Market expectations were for a slight decline in job creation, with forecasts set at 176,000 new jobs compared to the previous month’s 179,000. However, the actual results were significantly lower, with only 114,000 jobs created in July.

The unexpected weak NFP data triggered increased volatility in currency markets on Friday afternoon. The U.S. Dollar Index (DXY) dropped by over 1% on the day, reflecting investor concerns about the labour market’s strength and the potential implications for future monetary policy. The decline in job creation suggests that the U.S. economy may be losing momentum, which could lead to expectations of more accommodative monetary policy from the Federal Reserve with traders forecasting a 90% chance of a rate cut in the next policy meeting in September. As a result, further dollar weakness is anticipated in the coming month.

This increased volatility added uncertainty to the U.S. stock market following an already cautious earnings report release earlier this week. Late Friday afternoon, approximately $2.9 trillion was wiped from the U.S. stock market, primarily from tech stocks. This development signaled fears that the Federal Reserve may have delayed their rate cut decision too long, as the unemployment rate rose to 4.3% following the release of the NFP results.

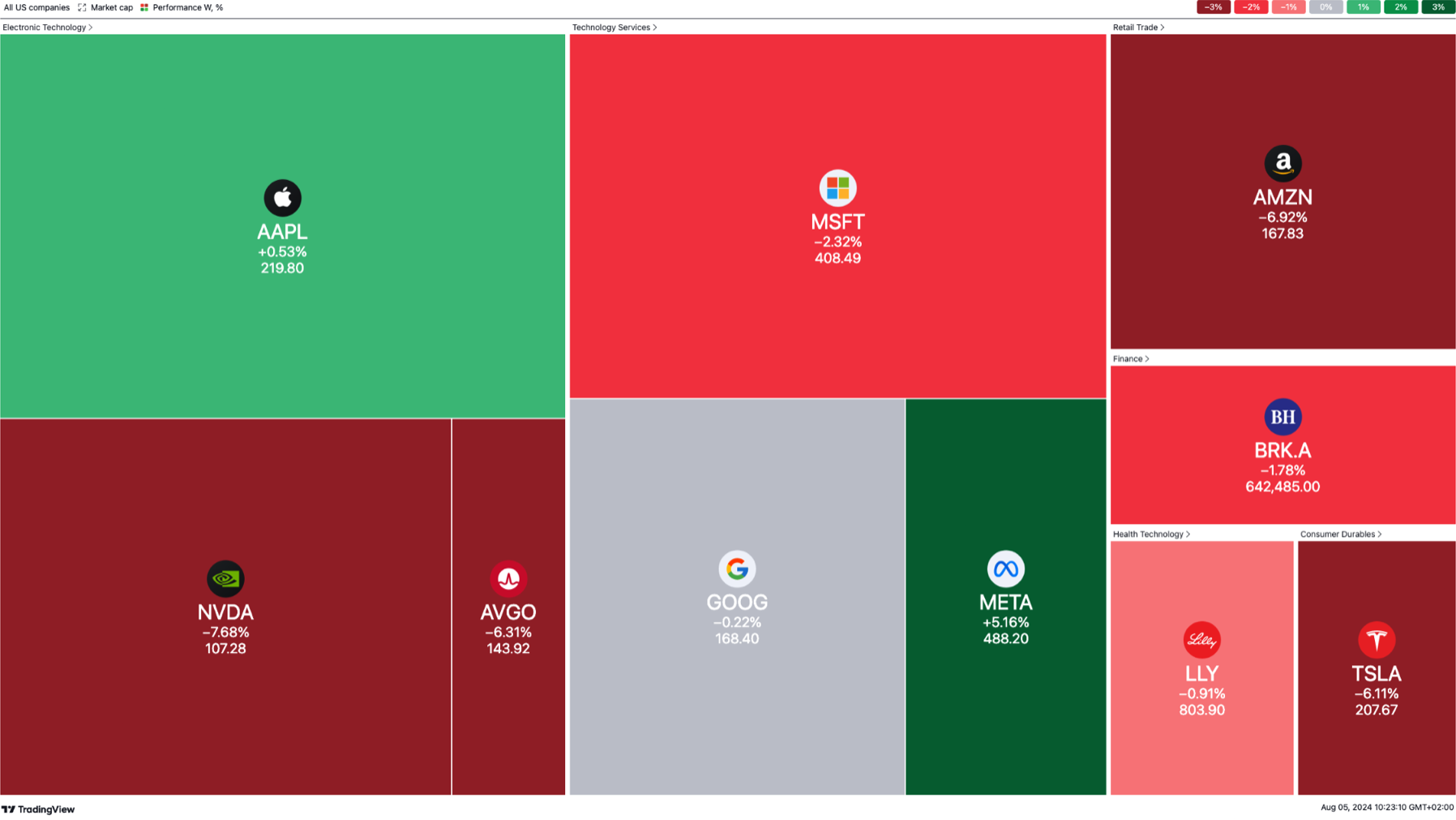

Notable selloffs post earnings report week in the stock market

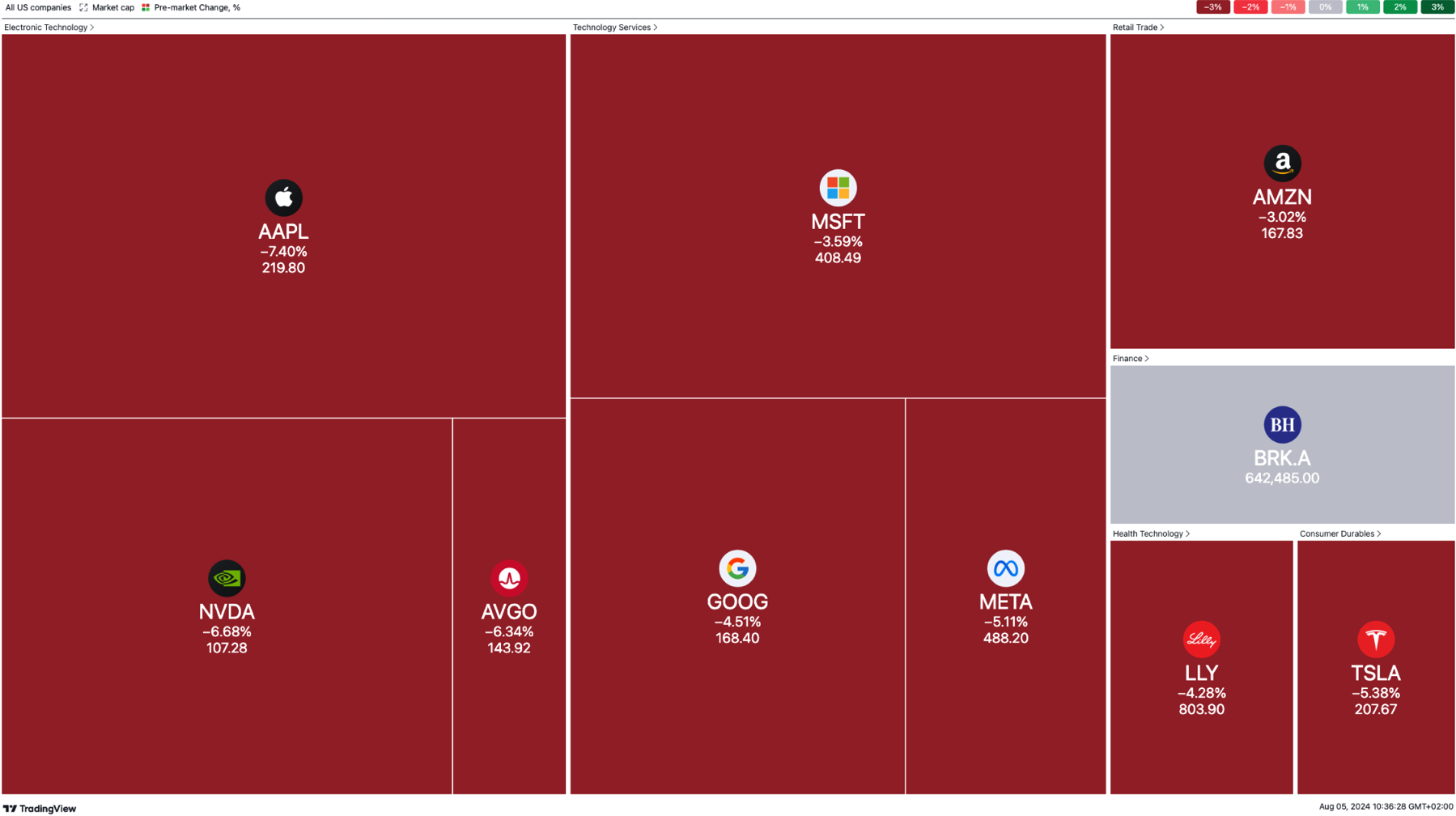

Although the previous weekly changes for notable tech companies weren’t as grim as current headlines suggest, the $2.9 trillion wiped from the U.S. stock market late Friday afternoon paints a different picture. Pre-market price changes indicate that this afternoon’s New York session will likely see significant volatility. This follows poor monetary policy data and disappointing earnings reports from tech giants such as Amazon (AMZN), Alphabet (GOOGL), and Intel (INTC).

Previous weekly price closes:

Pre-market price changes:

Further notable sell-offs included Warren Buffett’s Berkshire Hathaway (BRK.A), which offloaded roughly half of its position in Apple (AAPL) following the latest earnings report. This move increased Berkshire Hathaway’s cash reserves to over $277 billion. Such actions are typical for the company when it struggles to find businesses or individual stocks available at fair prices. At the time of writing, Apple is trading at $219.86, but the pre-market price of $205.89 suggests an interesting New York session open later today.

As we await the outcome of the rumoured emergency Federal Reserve meeting, we can expect a volatile week across all asset classes in the markets.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.