Bitcoin fell over the first four days of last week, dropping to a low of 65.5k before rebounding on Friday to end the week almost flat at 68.8k, still below the key 70k resistance. Heading into the new week, BTC briefly rose above 70k but has fallen back below the key psychological level.

Across the past 7 days, BTC trades 1.7% lower, and altcoins are also a sea of red. Ethereum underperformed, declining by more than 5%; Solana traded 1.9% lower, and XRP fell 1.5%. Smaller altcoins were also under pressure, with DOGE dropping 7% and HBAR 5%.

The broader cryptocurrency market capitalisation is down 2% at $2.36 trillion as of writing, roughly in line with where it was this time last week. This remains more than $1 trillion below the peak market cap late last year.

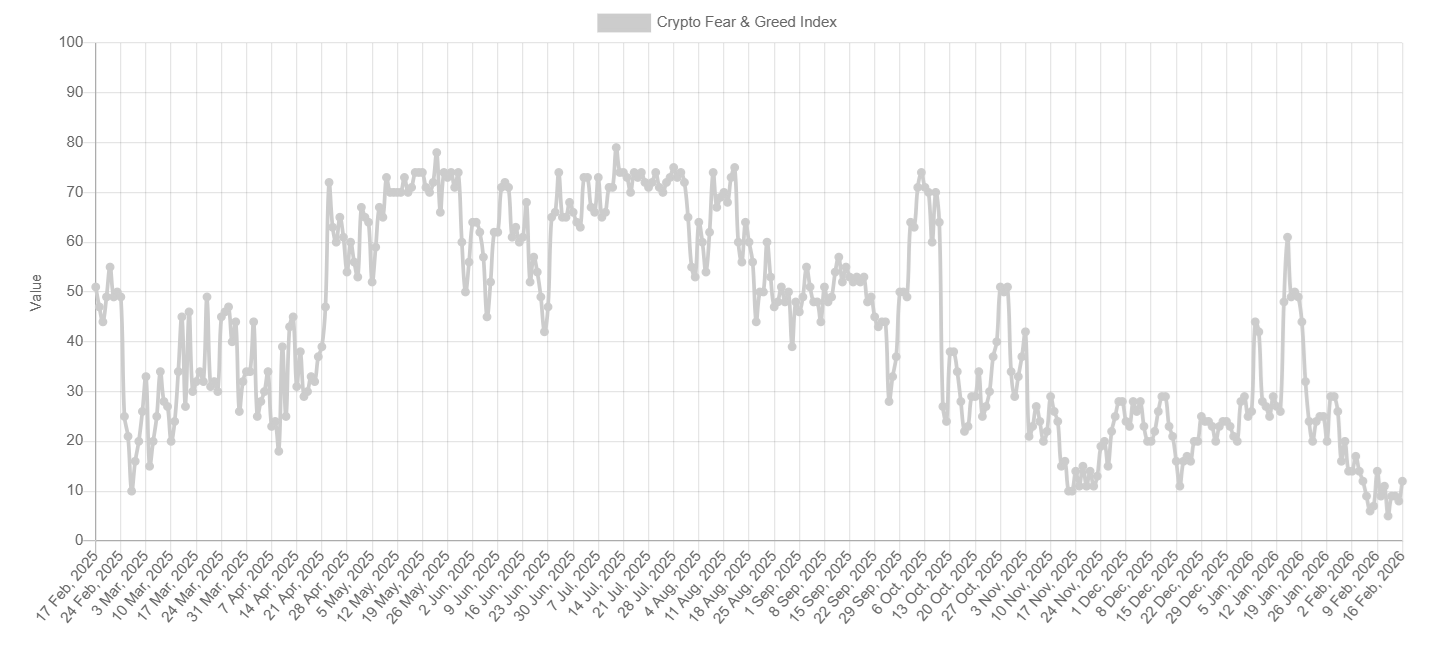

Sentiment analysis shows that sentiment toward crypto remains weak at 11, indicating extreme fear. This is up slightly from 8, the extreme fear level and a record low last week. Similar levels were observed during major stress events, such as the March 2020 COVID-19 crash and the 2022 FTX collapse. It means that market participants are prioritising risk avoidance and remain cautious about re-entering the market.

Extreme Fear does not necessarily signal an immediate recovery. Historically, such conditions have marked the early phase of a bottom formation process rather than the beginning of a new uptrend. Recovery requires time and capital flows.

Institutional demand remains weak

Institutional demand for Bitcoin continued to fade last week, according to you, so the value of BTC ETFs recorded net outflows of $359.9 million last week, marking the fourth consecutive week of net outflows. Since the start of November, BTC ETFs have seen only four weeks of net inflows, putting pressure on BTC prices. If this trend continues, BTC will likely remain under pressure.

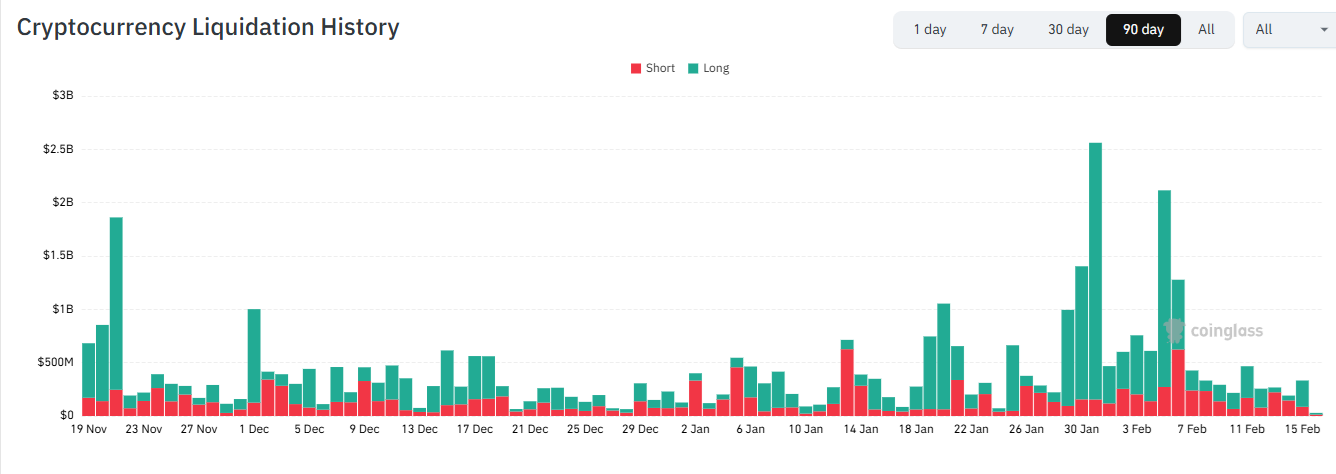

Bitcoin liquidations

Bitcoin liquidations remained relatively low last week compared to earlier in the month. The picture was more balanced between long and short liquidations as the price fell to 65.5k before recovering to 68.5k at the time of writing.

Macro backdrop

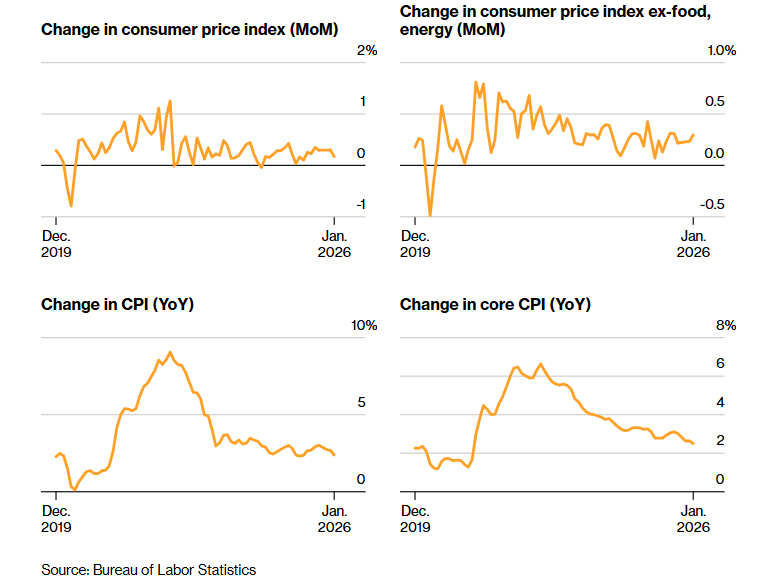

Last week, the market was stress-tested by back-to-back key US data releases that surprised the market without driving a meaningful reaction.

Last week, US non-farm payrolls data were stronger than expected, with 130k jobs added versus 70k expected, and unemployment fell to 4.3%, pointing to the stabilisation of the labour market. According to the data, market expectations for a Federal Reserve rate cut were pushed back to July from June. BTC extended declines along with the broader market.

However, cooler-than-forecast CPI data on Friday drove a rebound. CPI eased to 2.4% YoY from 2.6%. The data supported market expectations that the Federal Reserve could cut rates twice in 2026.

BTC rallied after the data, in line with US equities. Risk assets such as BTC and equities often perform well in low-interest-rate environments owing to greater liquidity.

Looking ahead, US data this week, including core PCE, the Federal Reserve’s preferred gauge for inflation, Q4 GDP and FOMC minutes, will provide further clues over the Fed’s likely path for rates. Data supporting further Fed rate cuts could lift BTC.

Bitcoin will also continue to eye the moves in tech stocks. When tech stocks fall, BTC has also been coming under pressure. Bitcoin has been closely tied to moves in the Software sector, which has been hit hard by AI disruption fears. Should this sector continue under pressure, BTC could fall further.

Where next for BTC?

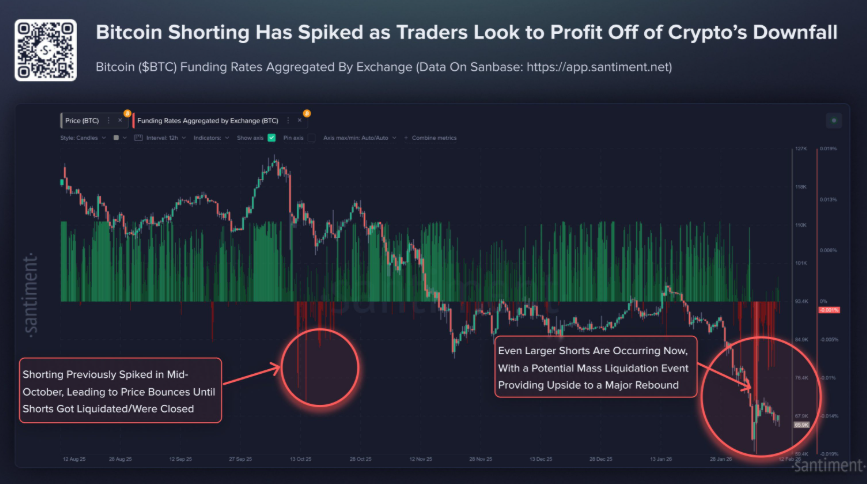

Bitcoin attempted to break toward 70k, a key psychological threshold. A decisive break above this level could shift sentiment meaningfully. However, persistent bearish positioning suggests that volatility could intensify before clear trends emerge.

Aggregated funding rates across major crypto exchanges indicate a pronounced surge in short positioning. Current negative funding levels are at the deepest level since August 2024 and that ultimately marked a significant Bitcoin bottom.

In August 2024, traders crowded into downside bets as funding rates plunged. Instead of continuing lower, Bitcoin reversed sharply, triggering widespread short liquidations that fueled an 83% rally over the following 4 months.

Deeply negative funding rates signal heavy bearish positioning; this comes along with widespread fear, uncertainty, and doubt, FUD. This setup doesn’t guarantee immediate upside; it points to a fragile structure. If prices increase for short coverings, this could amplify volatility, accelerating upward moves.

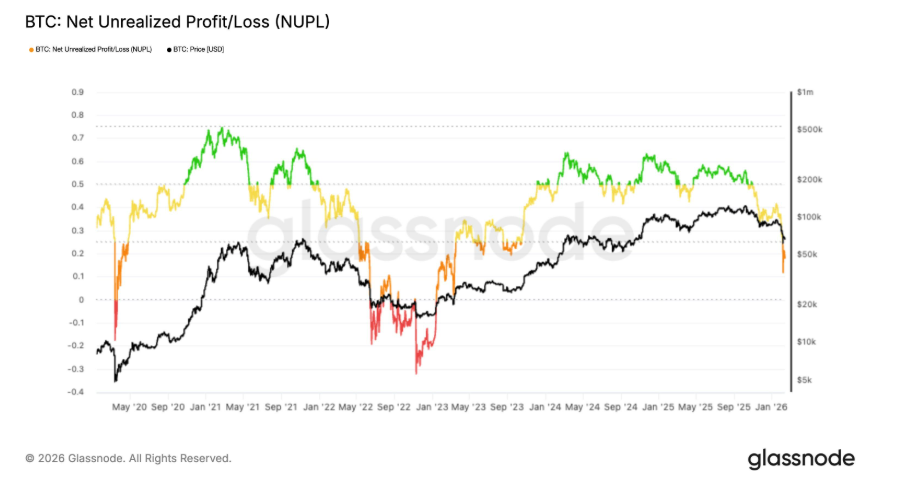

The net unrealised profit and loss (NUPL) indicator has moved into the Hope/Fear zone near 0.18. This reading indicates that profit cushions among holders are thin, and that when this level is reached, market behaviour tends to become more reactive.

Historically, declines into this zone precede extended weakness. Panic selling typically intensifies before a sustained floor. Unless capitulation resets sentiment, Bitcoin may remain vulnerable to a deeper pullback before stabilising.

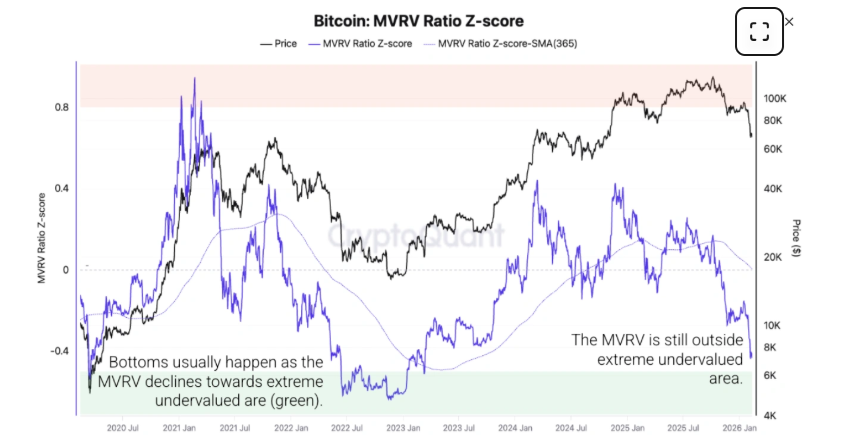

Separately, the Market Value to Realised Value (MVRV) ratio remains outside the extreme undervalued area shown in green on the chart below, where historically market bottoms have formed. Moreover, once MVRV enters this zone, the market has generally required four to five months to establish a sustainable base.

Is 50k coming?

Major players have been scaling back their Bitcoin forecasts. Standard Chartered, for example, recently cut its year-end 2026 target from 150K to 100K, its second reduction in just three months; however, it also warned that BTC could potentially correct to 50K.

At first, this may sound extreme, as the price is still 23% above this level; however, if you incorporate CryptoQuant metrics, this forecast appears more credible and less speculative.

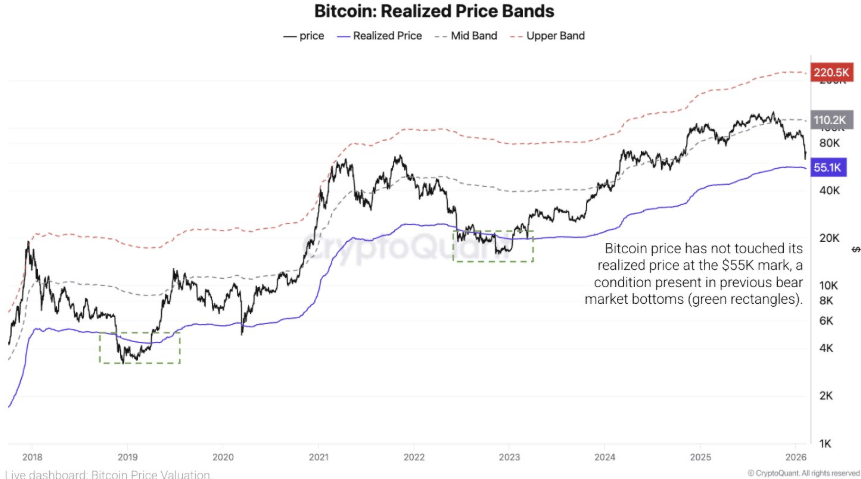

Based on the numbers. 55K marks the Bitcoin realised price, a level historically tied to market bottoms. In previous cycles, BTC has traded 24% to 30% below this level before stabilising. Currently, it trades 18% above it.

Standard Chartered set a 50K target amid a weaker macroeconomic backdrop, heightened risks of delayed Federal Reserve rate cuts, and recognition that Bitcoin has already declined by over 40% whilst investors have withdrawn almost $8 billion from USD spot ETFs.

Trading involves risk.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.