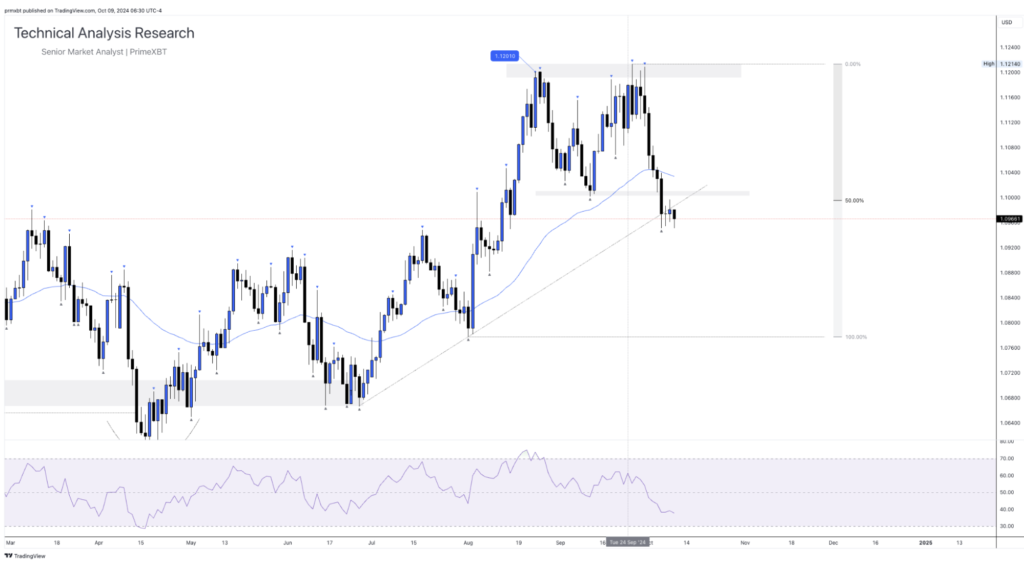

EURO VS DOLLAR (EUR/USD):

The Euro-Dollar pair has seen a notable move to the downside over the past few weeks. In a previous article, I expressed curiosity about how the price would react to the 1.11800 resistance level. Since then, it has dropped back to the 1.09800 region, where it appears to have found temporary support along an ascending trend line.

This short-term support zone also aligns with the 50% Fibonacci level. If we fail to hold this support, which seems to be happening at the moment, I’d be interested to see how the price reacts to lower levels for potential short-term rebounds. The RSI indicator currently suggests the pair is “oversold,” so further downside wouldn’t be surprising.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.