After hitting a four-year high of 1.2080 on 27 January, EUR/USD has now successfully retested and bounced off the breakout level and previous range highs, a range that was first established when price entered it back on 12 June 2025. This is a significant long-term rectangle pattern, and the fact that what was once resistance is now acting as support is one of the most reliable signals in technical analysis.

From a fundamental perspective, the macro backdrop continues to favour euro strength. The European Central Bank (ECB) held rates unchanged at 2.15% last week, with President Lagarde describing policy as being in a “good place,” while the Federal Reserve sits at 3.50-3.75% with markets pricing in growing odds of a rate cut as early as March. That narrowing rate differential is a structural tailwind for EUR/USD, and it’s worth noting that multiple major banks including Deutsche Bank, UBS, and Goldman Sachs are projecting the pair to reach 1.20-1.25 by year end.

So with the fundamentals aligned, what are the charts telling us?

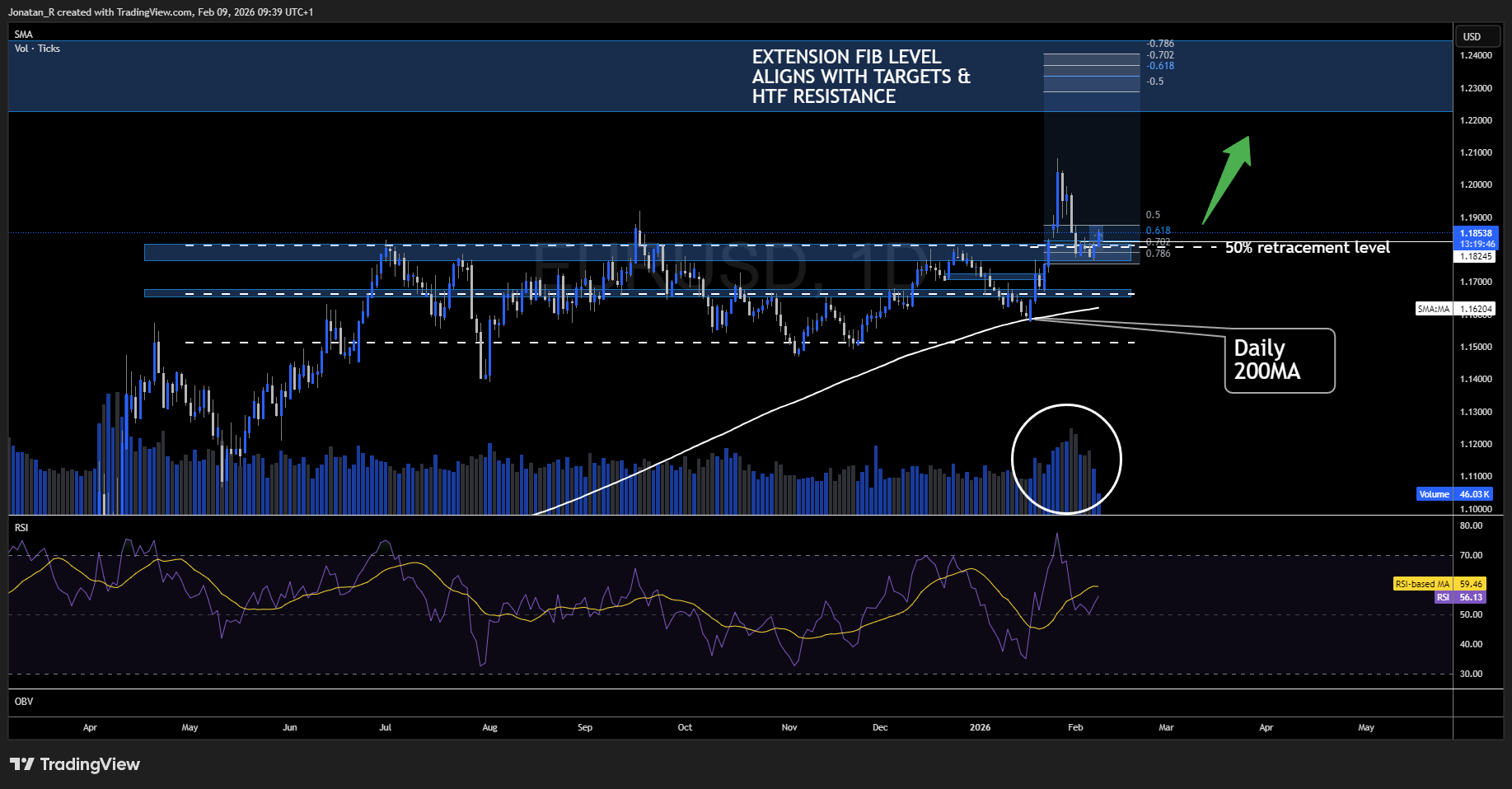

Daily chart: break, retest, and a potential Cardwell RSI confirmation

After bouncing off the daily 200 SMA on 19 January, EUR/USD saw an explosive move to the upside where it broke above the critical 1.18 resistance level and reached that four-year high of around 1.2080. Since then, price has retraced down to retest the 50% Fibonacci retracement level of that explosive upward move, which also happens to be confluent with the local long reload zone and the previous range highs. That’s a lot of confluence stacking up in one area, and it’s exactly the kind of setup that tends to hold.

As we can see on the daily chart, we now have a potentially confirmed bounce at this level, suggesting that buyers are stepping in to defend the breakout zone.

What makes this setup particularly interesting from a momentum perspective is what’s happening with the Relative Strength Index (RSI). The daily RSI is currently printing at around 56, having found support right at the 50 midpoint level during the pullback. This appears to be a textbook example of what’s known as a Cardwell RSI range shift, a concept developed by Andrew Cardwell, often referred to as “Dr. RSI.”

For those unfamiliar with this framework, the traditional way most traders use the RSI is to look for overbought readings above 70 and oversold readings below 30. But Cardwell’s work showed there’s more to it than that. He observed that during established uptrends, the RSI doesn’t oscillate through its full range. Instead, it shifts into a bullish operating range between roughly 40 and 80, where the 50 midpoint level acts as dynamic support during corrective pullbacks. In downtrends, the opposite occurs, with RSI operating in a bearish range between 20 and 60, where the 50-60 zone acts as resistance.

The key signal to watch for is the transition between these ranges. On our EUR/USD daily chart, we can see that the RSI pulled back toward that 50 zone during the correction from the January highs and is now turning back up from it. If this were a genuine trend reversal rather than a healthy pullback, we’d expect the RSI to break below 40 and start operating in the bearish 20-60 range. That hasn’t happened. The 50 level is holding as support, which suggests the broader uptrend remains intact and the recent pullback was corrective in nature.

We’re also seeing good volume confirming the original breakout above the range, and volume is now picking up again on this retest and bounce, adding further conviction to the bullish case.

Looking higher on the chart, there’s an interesting confluence zone sitting between approximately 1.23 and 1.24, where the Fibonacci extension reload zone aligns with a high-timeframe resistance area. This is notable because it also happens to fall right within the range where major banks are projecting EUR/USD to head this year, adding a layer of fundamental and technical agreement that could act as a magnet for price if the current bullish momentum continues.

Trading involves risk.

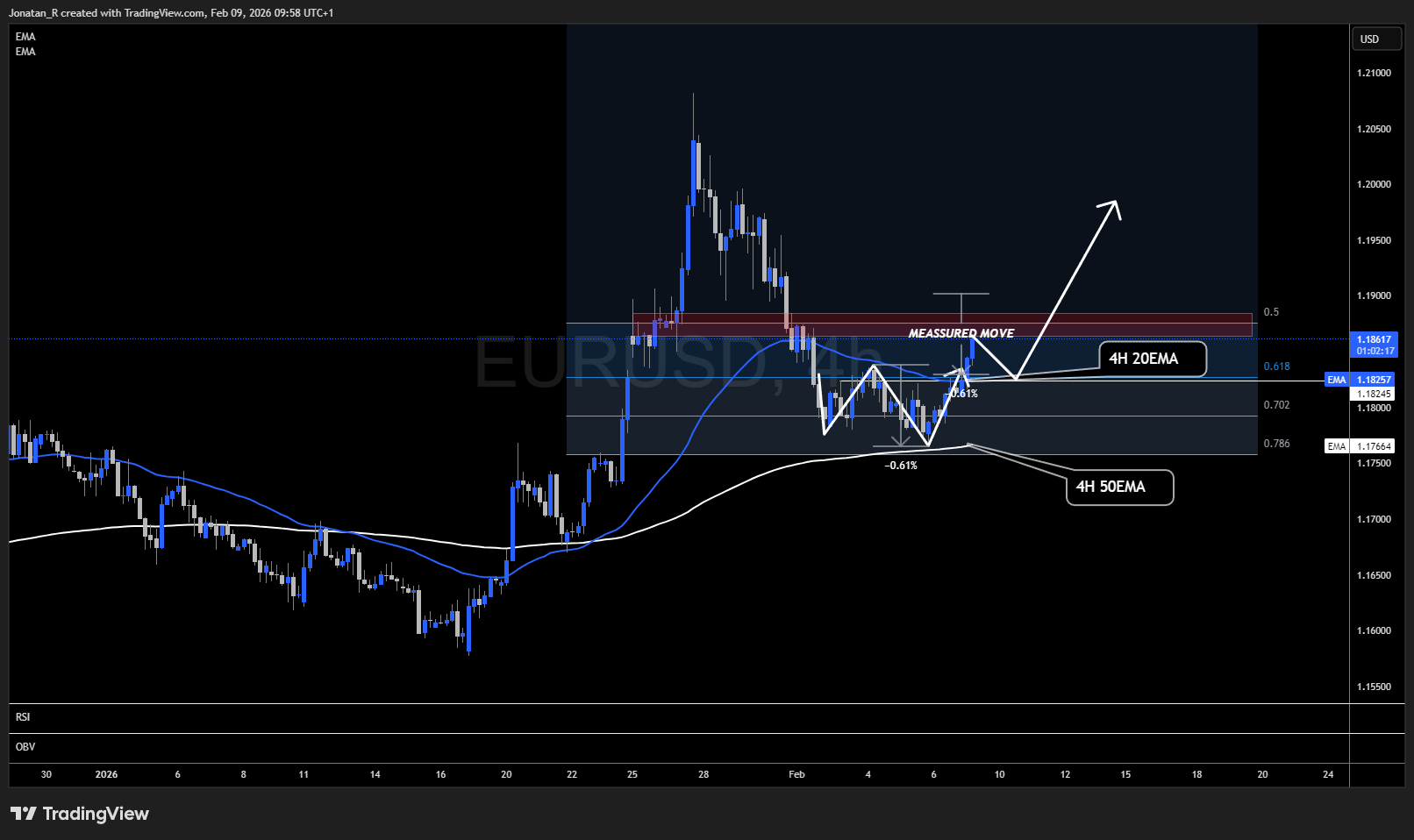

4-hour chart: double bottom formation adds confluence

Dropping down to the 4-hour timeframe, a clean double bottom pattern has formed inside the long reload zone, with the lowest leg finding support on the 50 EMA. Price has since broken above the neckline of the pattern, which is confluent with both the 0.618 Fibonacci level and the 4-hour 20 EMA. Applying the measured move rule, the upside target sits at around 1.19, though a resistance area near 1.188 where the 50% Fibonacci retracement also comes into play could potentially cause price to stall around current levels. If that happens, a retest of the double bottom neckline area looks like the logical zone to watch for bulls to step in and defend the structure.

Trading involves risk.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.