After reaching an all-time high of 126.1k earlier in the week, the euphoria was short-lived. On Friday, BTC tumbled over 10% at one point to a low of 102k in the day, marking its largest one-day sell-off since February, taking the price to its lowest level in four months. The rollercoaster shows few signs of slowing, with BTC bouncing back to 115k at the time of writing.

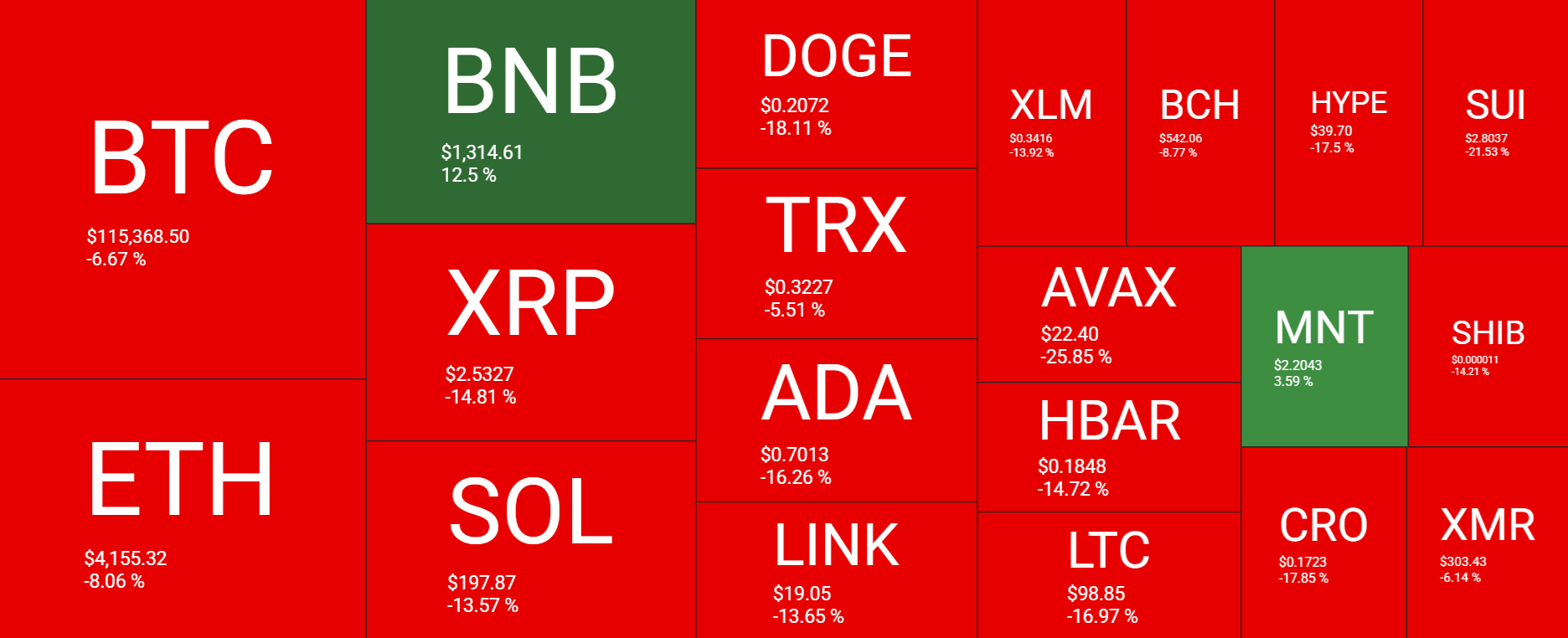

The steep selloff and subsequent rebound were not confined to Bitcoin. Altcoins have experienced elevated volatility. Ethereum fell 12% on Friday before recovering 10% on Sunday, but still trades 8% lower across the week. SOL tanked 14% on Friday to rise 13% on Sunday, and Ripple fell 15% on Friday to recover 6% on Sunday.

The total crypto market capitalisation tanked 20% erasing $500 million in market cap in a single day from a record high of $4.27 billion reached earlier in the week, crashing to a low of $3.65 trillion, a level last seen in August. The total cryptocurrency market cap has rebounded 6.6% over the past 24 hours to $3.92 trillion.

Sentiment analysis reveals a rapid shift in mood from Greed (71) last week to Extreme Fear (24) on Friday, as the crypto market experienced a significant sell-off. The mood, while still weak, has improved modestly to Fear (40) at the time of writing. This reflects a return to confidence that the worst is over, and if it improves further, it could fuel renewed accumulation.

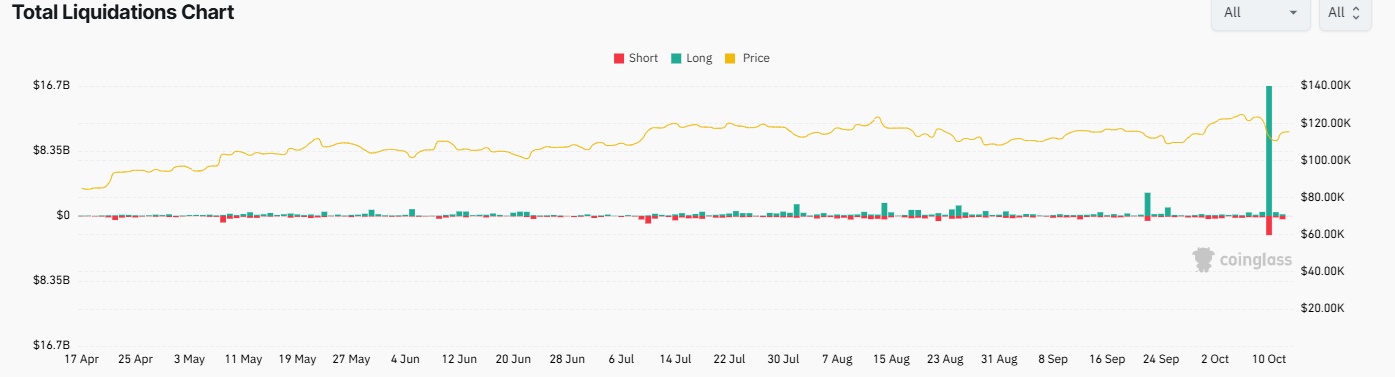

Record liquidation resets leverage

The crypto market erased over $19.5 billion in leveraged positions on Friday, marking the most chaotic 24-hour period in crypto’s history. The crash saw 1.6 million traders wiped out. To put this into context, the liquidation surpassed all previous records by almost 10-fold, surpassing the record set by the FTX collapse and the March 2020 crash. For example, the February liquidation event this year saw only $2.2 billion liquidated.

The liquidation was clearly one-sided, with $16.7 billion of the $19.38 billion being long positions, which is a 6.7 to 1 ratio compared to shorts. Almost every exchange saw over 90% of liquidation hitting longs. The largest ever liquidation event has reset leverage across the ecosystem, paving the way for potentially healthier and more sustainable uptrend in the weeks ahead.

What’s quite remarkable about the quick downturn was that the crypto Fear and Greed index was above 60 at the time as BTC traded around record highs.

Why did the market crash and bounce back?

The reason behind Friday’s crash is attributed to a market correction following BTC’s all-time high and rising tensions over Trump’s tariffs on China, combined with mysterious whale activity at a time when liquidity was low.

After the stock market closed, Trump announced 100% tariffs on all Chinese imports and threatened to impose export controls on all key software from November 1. The crypto market was the only functioning market at the time, absorbing the full impact. BTC dropped to 102k, and most altcoins fell 30% to 50%.

The market turmoil was then amplified by Binance’s front-end briefly showing $0 price on several altcoins, as well as the USDe synthetic dollar de-pegging on Binance due to an international oracle issue.

This event appears to be technical rather than fundamental, as it bears the hallmarks of a reset rather than a long-term change in fundamentals. The open interest in crypto derivatives, which had been a source of pressure on the market, has now been completely reset. This meant the market was poised to rally if good news emerged, which it did. Trump said, ” Don’t worry about China, it will be fine!” And the market rebounded. What happens from here depends in part on how China responds and whether it retaliates with countermeasures.

Trump’s comments appear to have steadied sentiment for now, and the rebound in crypto is taking hold; prices are recovering from Friday’s flash crash. While prices haven’t fully rebounded, the recovery could still pave the way to further gains this year.

Signs of market recovery

On-chain data support the view of stabilization. Exchange inflows have declined, suggesting that forced sellers have largely exited; meanwhile, long-term holders remain unmoved, continuing to accumulate during the downturn. This divergence between speculative traders and long-term investors has historically marked the beginning of market recovery phases.

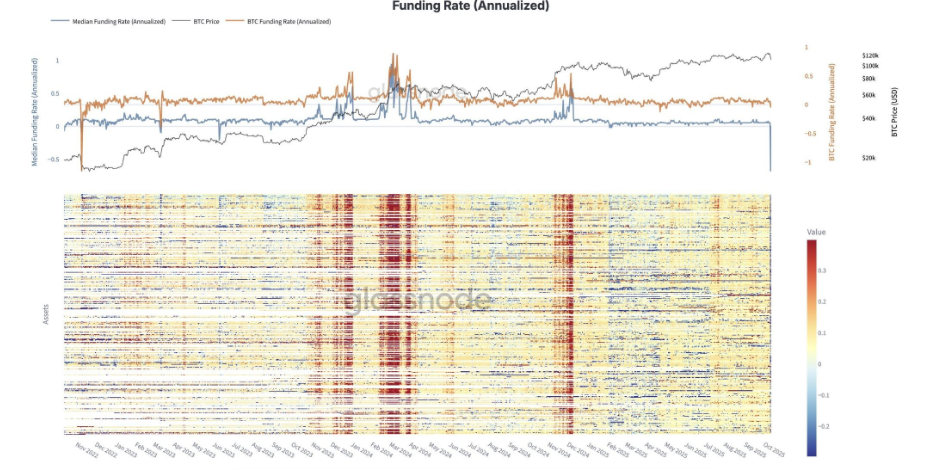

Funding rates drop to 2022 lows

Funding rate across the crypto derivatives market plunged to the lowest level since the depths of the 2022 bear market, as short sellers mounted over the weekend, according to Glassnode data.

Funding rates are periodic payments between traders in the most popular crypto derivatives, perpetual futures contracts, which are designed to keep perpetual contracts anchored to the spot price. When funding rates are extremely low or negative, there are more short positions than long, and it often signals that the derivatives speculators expect prices to fall, so they are willing to pay to hold short positions.

However, extremely low funding rates, such as the current situation, can actually be bullish because the market may be oversold with too many shorts creating the potential for a short squeeze if prices start to rise.

This could potentially be the case, as the CoinGlass data shows the long-short ratio has turned bullish. Around 54% of sentiment is bullish or very bullish, while 16% remains neutral, and 29% is still bearish. CoinGlass data also notes that long accounts currently comprise 60% with 40% still going short.

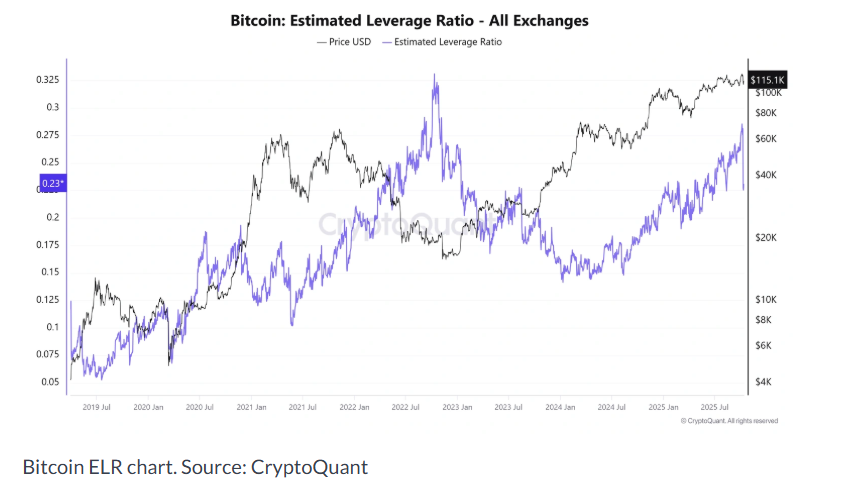

Leverage positions decline

CryptoQuant data showed that BTC Estimated Leverage Ratio (ELR) indicates a significant reduction in leverage positions and the potential cooling of speculative activity in the market, mainly owing to Friday’s steep liquidations. This paves the way for a more stable base to build on towards new higher highs, especially as institutional demand remains strong.

Institutional demand remains strong

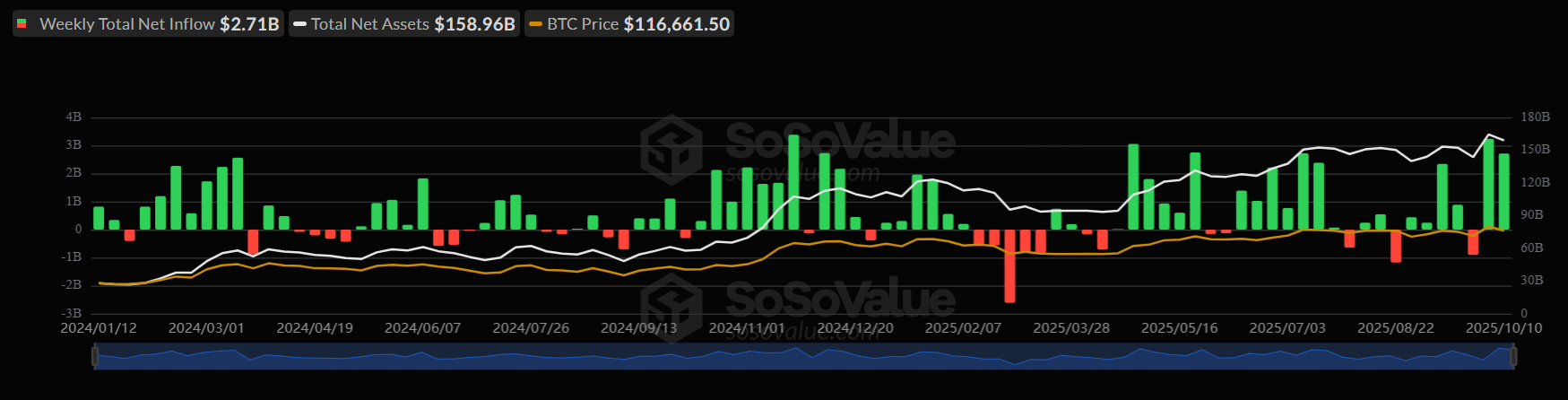

Institutional demand remained strong last week despite the massive price volatility, according to SoSo Value data. Bitcoin spot ETFs recorded inflows of $2.71 billion, marking a second straight week of positive inflows. The price swings further on Friday, with Bitcoin recording only an outflow of 4.5 million, compared to the strong demand seen earlier in the week, suggesting that investor confidence remains intact, mainly despite the price swings.

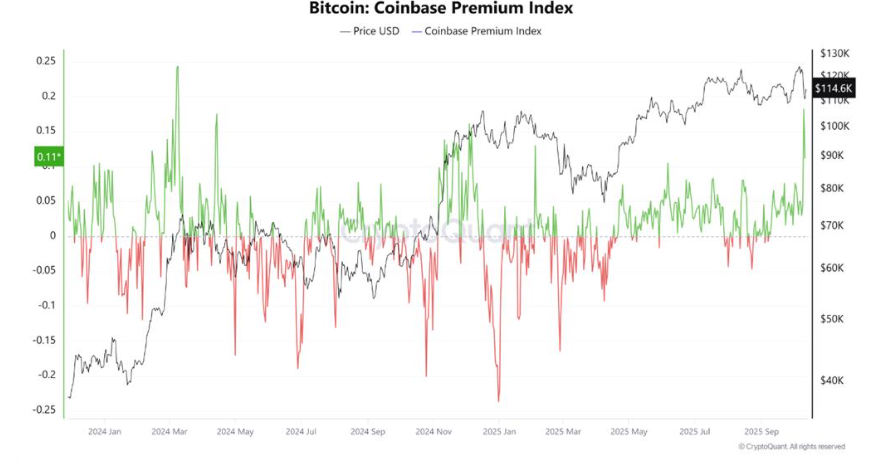

Furthermore, the Coinbase premium, which measures the difference between the Coinbase Pro price and the Binance price, increased to 0.18 on October 10, marking its highest level since March 2024. It has since decreased to 0.09, which is still the highest since June.

What’s interesting here is that despite the market’s “Black Friday” panic sell-off, Bitcoin’s Coinbase Premium hit a 19-month high, signaling major institutional accumulation. When the rest of the market was panicking, accumulation around 110K suggests the formation of a solid support zone.

Friday’s flash crash may have shaken confidence. Still, the swift rebound, persistent institutional inflows, and sharp drop in leverage suggest the market reset could pave the way for a more sustainable uptrend in the weeks ahead. This also depends on the fundamental backdrop, including US-China trade relations and the Fed’s outlook for rate cuts. It’s also worth noting that the whale that placed the mysterious short ahead of Trump’s announcement has opened another short position.

Trading involves risk.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.