Bitcoin had a turbulent week last week, with sharp declines and massive liquidations fueling uncertainty. Bitcoin lost 4%, marking the second straight weekly decline. The world’s largest cryptocurrency started the previous week at 100k before spiking to a low of 91.2k and briefly recovering above 100,000. BTC remained around the 96 level over the weekend and started the new week modestly higher at 97k.

While Bitcoin fell last week, its market dominance rose to 61% as altcoins dropped by more than Bitcoin. Ethereum was hard hit, losing over 11% last week, although the price was down 30% at one point. XRP also fell 9%, and Solana dipped a more moderate 2%. Elsewhere, ADA fell 16% and XLM 13%. A few tokens booked gains, including LINK, LEO, and TRX.

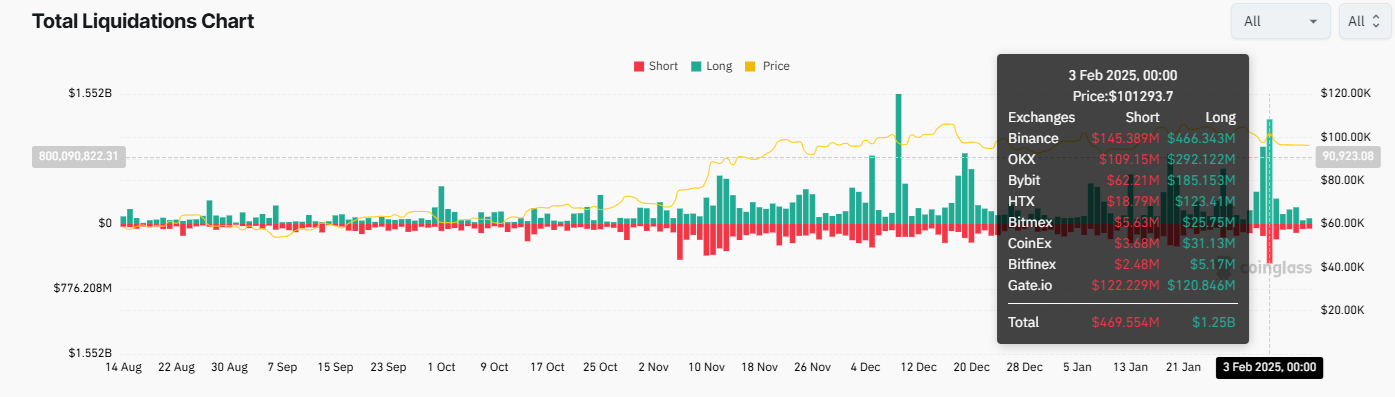

Crypto liquidations jumped as Trump implemented tariffs

Bitcoin started last week with a sharp correction, falling to 91.2 K as President Trump announced tariffs on trading partners Canada, Mexico, and China, fuelling risk-off trade. Conversations on Monday between Trump and Canadian President Justin Trudeau and Trump and Mexican President Claudia Sheinbaum resulted in 25% tariffs being paused for 30 days, allowing Bitcoin to recover back above 100k. However, the price drop triggered $1.72 billion in total liquidations in the crypto market, with almost $373 million in Bitcoin alone. These moves help to clear excess and stabilise the market for future growth. Forced liquidations can pave the way for a rebound.

Bitcoin, Ethereum ETFs

Despite the selloff in BTC throughout the week, spot Bitcoin ETFs saw net inflows of $203.5 million, marking the sixth straight week of positive inflows.

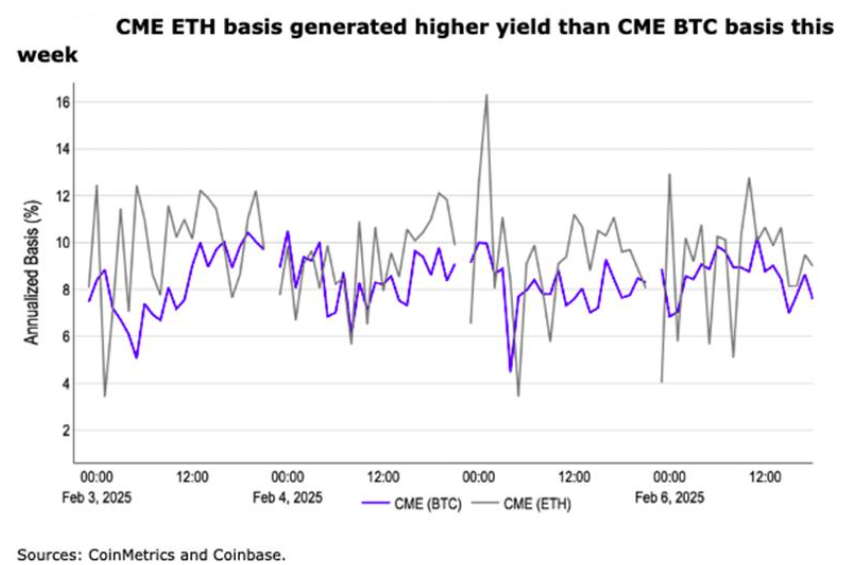

Interestingly, Ethereum spot ETFs started February on a firm footing, booking $420 million in net inflows, double that of Bitcoin. These strong inflows coincided with a bearish trading week, which saw Ethereum fall over 10%.

This development has been attributed to a spiked interest in ETH as a preferred asset for CME basis trade over Bitcoin. The CME basis trade is a strategy where market participants go long on an asset in the spot market and short in the futures market to profit from the difference in market prices. Over the last week, the ETH CME basis trade produced a 16% gain against 10% for Bitcoin, which increased institutional interest in the ETH ETF.

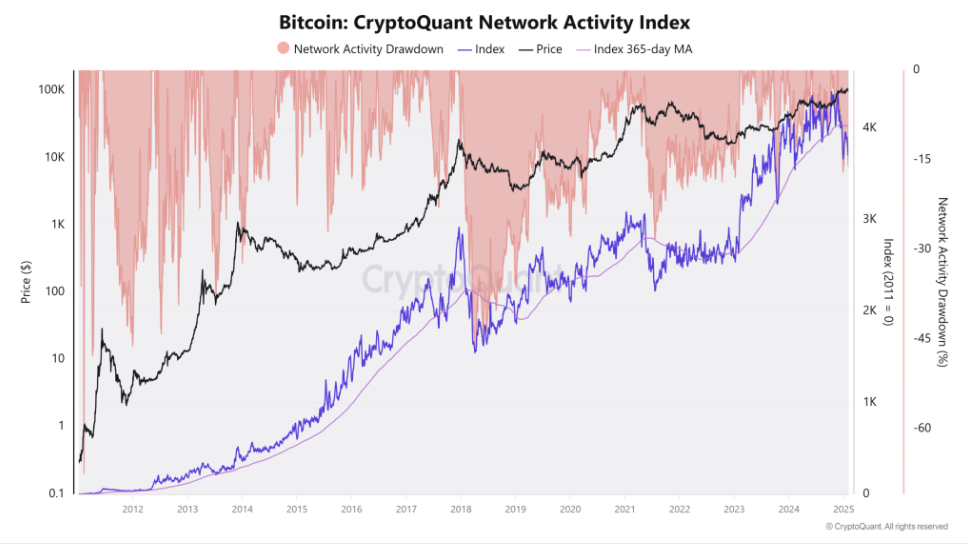

Bitcoin network activity plunges to a yearly low

According to CryptoQuant’s Bitcoin Network Activity Index, Bitcoin usage has fallen 15% since November 2024’s record high and was at 3760 on Friday, its lowest level since February 2024. The index is a cumulative measure of active addresses, transactions, block size, and fees, among other metrics, which indicates growth or a decline in Bitcoin usage.

A sharp decline in the number of transactions indicated a drop in activity. Total daily transactions were 346k on Friday, down 53% from the peak of 734k. Moreover, the index has fallen below its 365-day moving average for the first time since July 2021 (when China banned Bitcoin mining). The downturn in the index suggests reduced participation, lower network congestion, and a slowdown in transaction demand.

These dips have historically been linked to periods of market uncertainty and /or profit-taking, raising the question of whether the current Bitcoin price is justified.

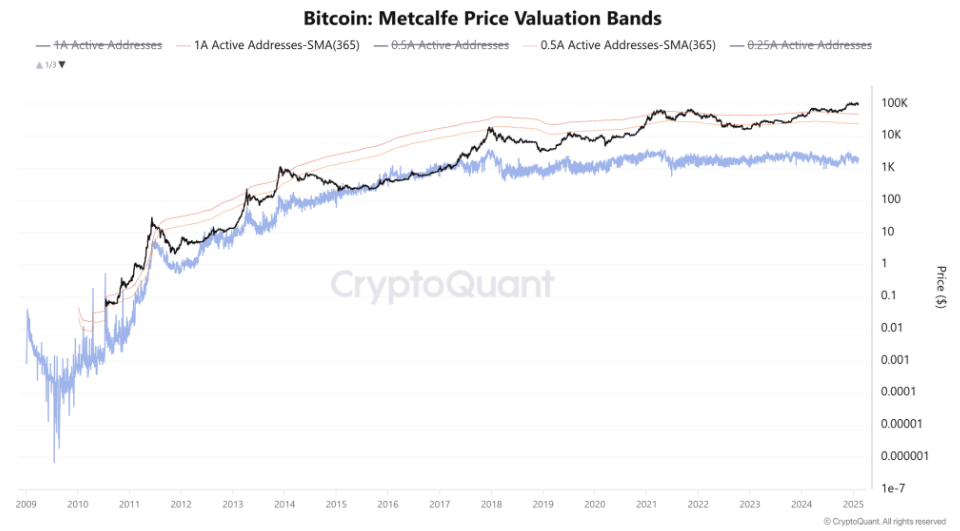

Is Bitcoin overvalued?

According to Metcalfe’s law, which considers a network’s value based on the number of active users, Bitcoin’s fair value falls between 48k and 95k. When Bitcoin trades above this range, its ability to sustain the level is questioned.

The Metcalf Valuation Bands have historically guided BTC’s price. Since February last year, the Bitcoin price has remained mainly between the red 48k and blue 95k bands. However, the price has risen above the upper band more recently, suggesting a speculative premium.

With network activity at a 12-month low and the price exceeding its fair value, Bitcoin could be overvalued. External factors, such as institutional demand and macro trends, could sustain a rally. However, on-chain metrics point to a more cautious picture.

Fundamental drivers

Both crypto and broader risk assets, such as US stocks, came under pressure last week as Trump followed through with his threat of tariffs. The pause negotiated with Canada and Mexico helped recovery from the lows. However, retaliatory measures from China and fresh 25% tariffs on all steel and aluminum imports into the US have added to a cautious market mood.

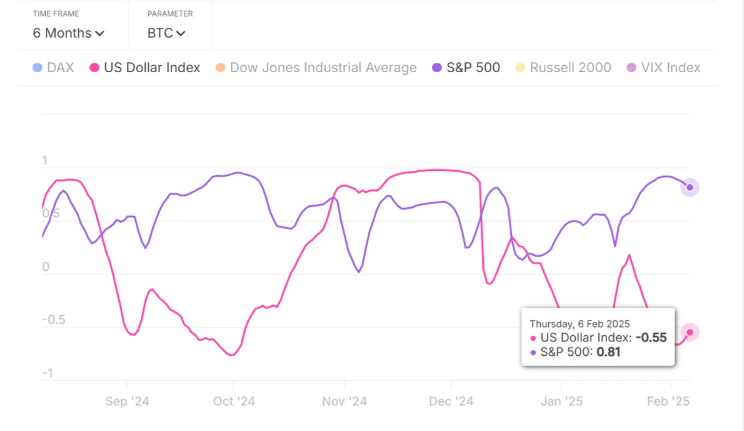

While trade tariffs don’t directly impact crypto-related activities, they indirectly impact macroeconomic factors. Due to Bitcoin’s recent strong correlation with the S&P 500 (at 0.81 over 1), these tariffs created downward pressure on crypto.

It’s still too early to say how the Federal Reserve may react to trade tariffs and the potential increase in price pressure, particularly as these could come at a time when the US economy is performing well, with growth at an above-average clip of 2.8% annualised and inflation still sticky.

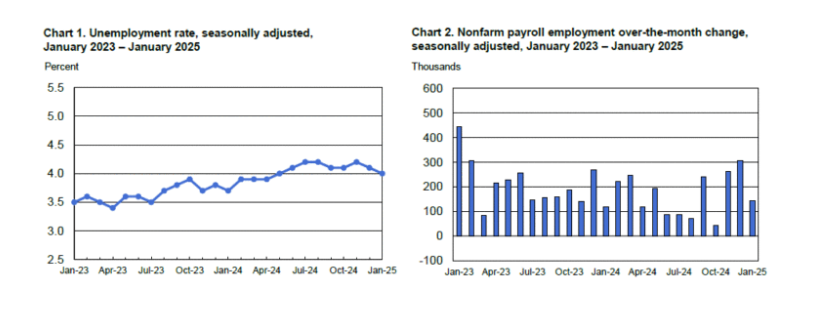

Last week’s US non-farm payroll report highlighted the ongoing resilience in the US labor market. Headline job creation was 143k in January, below the impressive 256k in December. However, the unemployment rate unexpectedly declined to 4% from 4.1%. The data supports the view that the Fed will likely keep interest rates on hold again in the March meeting.

The prospect that the Fed is unlikely to continue cutting rates for now hurts demand for riskier assets. Should US economic exceptionalism combine with Trump trade tariffs, the Fed may not cut rates again this year or even hike them (although this is not our base case scenario). The prospect of rates remaining high for longer could be a headwind for Bitcoin, crypto, and US equities.

Week Ahead

Any announcements from Trump could influence market sentiment and impact price action in Bitcoin and US stock indices.

In the absence of any developments from Trump, attention will be paid to US inflation data (CPI) for further clues about the path for future rate cuts from the Federal Reserve. Expectations are for CPI to rise 0.3% month over month.

Fed Chair Powell will also testify before Congress on Tuesday and Wednesday. His comments will be watched closely for clues over the outlook for rate cuts.

FTX repayments

FTX is expected to initiate repayments to creditors based in the Bahamas on February 18th, which could bring some volatility to Bitcoin. The move comes following the exchange filing for bankruptcy in November 2022 after a severe liquidity crisis, which led to its swift downfall. The repayment will begin with creditors with claims under 50,000 – these creditors will receive 100% of the claim and an additional 9% interest. Bitgo, a digital asset custody provider, will process the payment.

FTX is preparing to disperse over $16 billion to its users, although the timeline surrounding this remains unclear.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.