The perfect storm for Bitcoin appears to be here. Last week started off on a positive note for the digitally scarce cryptocurrency, with Federal Reserve Chairman Jerome Powell making positive comments about digital currency issuance. At this point, it’s not a matter of if nations will adopt a digital currency, but when.

Following up that bullish news, Bitcoin blasted off with an over $1,000 intraday move, breaking above the previous 2020 peak and reaching above $13,000, where it is now consolidating. The rally in Bitcoin took place simultaneously while the stock market further weakened due to the ongoing stimulus deadlock. The downside in stocks and rise in crypto has led to talk of a potential decoupling. Here’s how it all went down last week and what to watch for in the weeks ahead.

PayPal To Support Bitcoin And Other Cryptocurrencies, BTC Spikes To $13,000

While the week itself was jam-packed with other news and positive events in the cryptocurrency space, everything was easily eclipsed by the monumental impact PayPal’s support will have on the industry and how it could hasten adoption.

At one point, a former PayPal CEO claimed Bitcoin was a scam, and the payments provider once blocked customers from making crypto-related transactions. Now, the corporation is welcoming the emerging technology with open arms.

PayPal will support the purchase and sale of cryptocurrencies Bitcoin, Litecoin, Ethereum, and Bitcoin Cash within the next few weeks but will eventually allow them to be used at over 26 million of the company’s merchants by early 2021.

Immediately after the news broke, Bitcoin surged by over $1,000 and set a new 2020 high. The report also caused PYPL shares to reach an all-time high. Bitcoin has to take out resistance first above $13,200 then can make an attempt at last year’s peak above $13,800. Beyond that, a retest of the asset’s former all-time high is likely.

Litecoin Outshines Other PayPal Supported Altcoins, Even Bitcoin

In addition to Bitcoin surging on the news, so did Litecoin, the “silver” to Bitcoin as “digital gold.” Litecoin had the most massive response with an over 20% gain. Litecoin hasn’t had positive news in ages and has become a dormant and long-forgotten asset in the crypto community. Negative sentiment still lingering from the asset’s creator selling his holdings at the peak of the crypto bubble has also kept the altcoin lagging behind the rest of the market. At the same time, the likes of Ethereum and Bitcoin surged all year long.

PayPal offering Litecoin alongside only three others will bring much-needed awareness and new investors to the asset, which could help valuations grow into the future. According to the LTCUSD price chart, if the asset can get above $65 and flip resistance to support, the next significant resistance will be $85.

Lack Of Stimulus Prior To Election Sends Stocks Overboard

The stock market had a predominantly negative week, despite the incredibly positive outlook in cryptocurrencies. Between Google being slapped with another anti-trust lawsuit making tech investors cautious, and hopes of a stimulus deal being inked before the November 3rd election slipping away, the stock market is feeling the sting. Investors and traders are ditching their positions in major US indices ahead of any uncertainty that’s to come due to the campaign trail coming to an end.

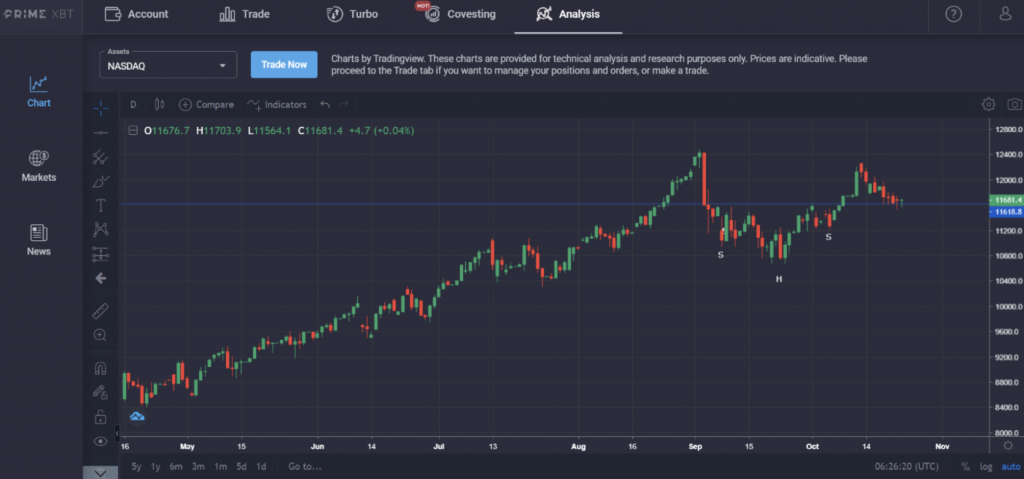

The Dow closed last week at 28,335, the Nasdaq at 11,548, and the S&P 500 at 3,465. All three majors indices have since slid further and could potentially only be the start of a steeper selloff ahead of the election. Potential double-top formations paint an ominous picture about the future of the stock market, which may be pricing in a possible victory from democratic nominee Joe Biden, who is expected to impose unfavorable tax laws on the wealthy and may change capital gains taxes in the US.

The Nasdaq is currently testing support from the neckline of an inverse head and shoulders at around 11,600. Traders only need to fear the double top confirming if the price closes below 10,700. Patience is necessary, and until that level is breached, we cannot presume that the stock market will break down.

Crypto Market Decoupling Driven By Institutions, Continued Adoption

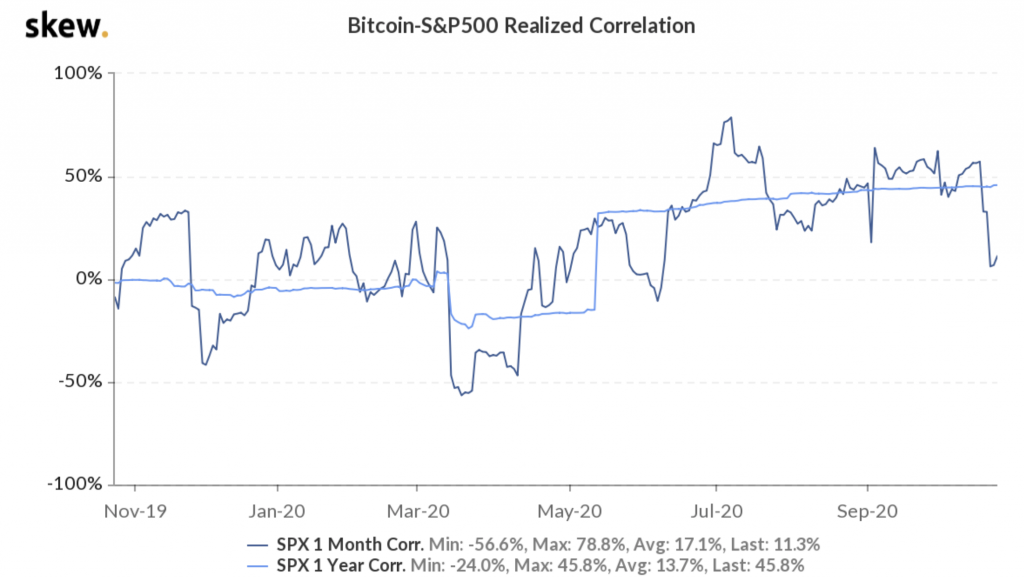

While Bitcoin and the rest of the cryptocurrency market have exploded higher, the stock market diving has created buzz and discussion surrounding a “decoupling” of the ongoing correlation between Bitcoin and the S&P 500.

The two very different asset classes have traded at almost the exact pattern throughout 2020, starting with the February high and Black Thursday collapse. But the divergence has caused the correlation to drop from a 56% correlation to almost zero following the PayPal announcement.

The decoupling could very well continue as institutions absorb the extremely limited BTC supply. For example, Grayscale investments reported net inflows of $300 million in a single day after the PayPal news, totaling $1 billion for the week.

Following Square Inc. and MicroStrategy adding BTC to their corporate treasuries, the UK listed firm Mode Global Holdings has allocated 10% of its treasury funds into BTC. Around 3.8% of the BTC supply or approximately 786,000 BTC are held by just 23 companies, highlighting how little Bitcoin there is to go around.

Bitcoin bull Raoul Pal predicts that firms like Apple and Microsoft will need to buy BTC within the next five years, while billionaire hedge fund manager Paul Tudor Jones claimed investing in Bitcoin now is like investing in Apple and Google early.

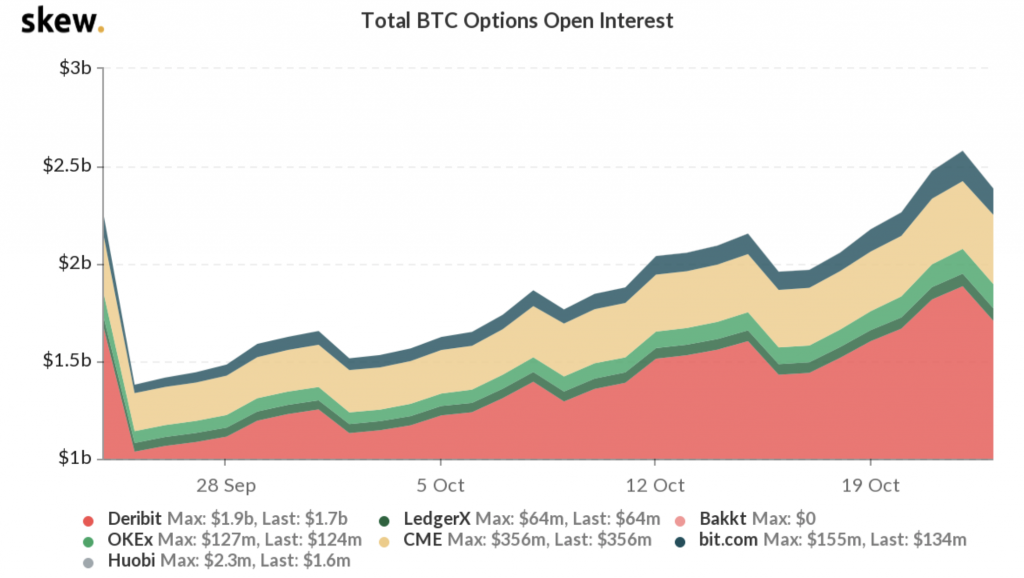

Finally, at CME – the largest institutional Bitcoin futures platform – open interest saw a major jump.

With so much positive going on in the cryptocurrency industry, and the stock market struggling, the decoupling could be here and is likely to continue into the future.

Information provided in PrimeXBT’s market report includes information provided by Kim Chua, Lead Market Analyst for PrimeXBT, in addition to charts from various data sources.

About Kim Chua, PrimeXBT Market Analyst:

Kim Chua is an institutional trading specialist with a track record of success that extends across leading banks including Deutsche Bank, China Merchants Bank, and more. Chua later launched a hedge fund that consistently achieved triple-digit returns for seven years. Chua is also an educator at heart who developed her own proprietary trading curriculum to pass her knowledge down to a new generation of analysts. Kim Chua actively follows both traditional and cryptocurrency markets closely and is eager to find future investment and trading opportunities as the two vastly different asset classes begin to converge.

The information provided does not constitute, in any way, a solicitation or inducement to buy or sell cryptocurrencies, derivatives, foreign exchange products, CFDs, securities and similar products. Comments and analysis reflect the views of different external and internal analysts at any given time and are subject to change at any time. Moreover, they can not constitute a commitment or guarantee on the part of PrimeXBT. The recipient acknowledges and agrees that by their very nature any investment in a financial instrument is of a random nature and therefore any such investment constitutes a risky investment for which the recipient is solely responsible. It is specified that the past performance of a financial product does not prejudge in any way their future performance. The foreign exchange market and derivatives such as CFDs (Contracts for Difference), Non-Deliverable Bitcoin Settled Products and Short-Term Bitcoin Settled Contracts involve a high degree of risk. They require a good level of financial knowledge and experience. PrimeXBT recommends the consultation of a financial professional who would have a perfect knowledge of the financial and patrimonial situation of the recipient of this message and would be able to verify that the financial products mentioned are adapted to the said situation and the financial objectives pursued.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.