NASDAQ trading is when a trader implements technical and fundamental analysis to determine the best price levels at which they can make a trade on the NASDAQ stock exchange. Trading at NASDAQ is possible for traders of all levels, and it gives them exposure to a wide range of companies.

What is the NASDAQ 100 Index?

The NASDAQ 100 index is an index that is used to track the price movement of a group of shares. This index works similarly to the S&P 500 or the Dow Jones Industrial Average. In the NASDAQ 100, there are 100 of the largest non-financial companies that have been listed on NASDAQ.

Traders that invest in the NASDAQ 100 can track the price movements of some of the top companies in NASDAQ by market cap. Most non-financial companies that have performed quite well over the past decade are technological companies, and these comprise a significant share of the NASDAQ 100.

Some of the larger market-cap companies in the NASDAQ 100 include Tesla, PayPal, Google, Amazon, Microsoft, Apple, Meta, and more.

How often do NASDAQ 100 companies change?

The NASDAQ 100 is reconstituted every year in December. During this time, NASDAQ will review the performance of the companies in the index and those not on the index. It will then re-rank all the eligible companies and adjust the index.

There are other instances where a company can be delisted from the NASDAQ 100. These circumstances include the delisting of a company, mergers and acquisitions, or when a company declares bankruptcy. A company is also dropped from the index if they do not account for a one-tenth percentage of the index weighting for two consecutive months.

How is the NASDAQ 100 calculated?

The value of the NASDAQ 100 depends upon the performance of the share prices of the companies listed on the index. If the share price of NASDAQ 100 increases, it is attributed to gains in one company or a group of companies in the index.

On the other hand, if the NASDAQ 100 is dropping, companies listed on the index are witnessing a dip in their share price. NASDAQ 100 is the weighted average of the share prices of the top 100 non-financial companies by market cap. Companies with a higher weighting have a major effect on the index’s performance.

Benefits and Drawbacks of Trading the NASDAQ 100

NASDAQ 100- Benefits

The NASDAQ 100 is one of the popular indexes for investors that want to gain exposure to the top companies. The NASDAQ 100 is not only a considerable investment for US residents, but it sparks global attention. Below are the benefits of trading the NASDAQ 100:

- Good performance – the NASDAQ 100 index is well-selected and reconstituted each year, depending on a company’s performance. The top companies on this list have witnessed notable gains in their share prices over the past decade, making them ideal investments.

- Exposure to technology stocks – the NASDAQ 100 is concentrated on technology stocks. Therefore, it is a considerable investment for a trader that wants to gain exposure to these stocks.

- Top global index – The NASDAQ 100 is a top global index usually referred to when market analysts evaluate the financial market’s performance. Therefore, investing in NASDAQ 100 gives you access to one of the world’s top indexes.

NASDAQ 100- Drawbacks

While there are notable benefits to trading the NASDAQ 100, the drawbacks are worth considering. Assessing the drawbacks of the index can help you make an informed decision. These drawbacks include the following:

- High concentration in technology stocks – The NASDAQ 100 is concentrated on technology stocks. They comprise around 50% of the index, which could be a major drawback to someone looking for a well-diversified index. When technology stocks are dipping, the NASDAQ-100 tends to be affected.

- Narrow scope – the NASDAQ 100 has a narrower scope than other indexes such as the S&P 500 or even the NASDAQ Composite. It only includes the top 100 companies, which can limit investors seeking exposure to the broader stock market.

- Price movements – the index’s price movement can be affected by a company with the largest component stocks. However, the impact is limited by NASDAQ’s methodology to determine the index weighting.

What drives the NASDAQ 100’s price?

To realize profits from NASDAQ, you need to learn the best times to enter or exit a trade. To do this, you need to understand the factors that move the price of this index. The price of NASDAQ 100 is influenced by the following factors:

Events that impact the NASDAQ 100

One of the factors that affect the price of the NASDAQ 100 index is economic events that can affect the performance of the US economy. The economic environment affects the stock prices of companies listed in this index.

One is recommended to analyze the economic events to determine the best time to open or close a trade. It is also important to note that some economic situations might be good for one company but bad for another.

US dollar’s impact on NASDAQ 100

The strength of the US dollar can also result in dips or gains in the price of the NASDAQ 100. For instance, companies based in the US with a large portion of offshore sales might perform better if the US dollar weakens. Such companies receive payments in foreign currencies that could be outperforming the US dollar.

On the other hand, a weak US dollar can affect a company that is heavily reliant on local sales. With a weak dollar, the company could be unable to buy more, resulting in a decline in the sales revenues.

News and announcements

Developments in the macro environment can also affect the performance of this composite index. Announcements from the central bank, the release of stimulus packages or other similar news can affect the performance of share prices, which in return affects the value of the NASDAQ 100 index.

Company earnings

The earnings reports submitted by companies can also play a role in influencing the price movement of the NASDAQ 100. A company with a strong earnings report will witness a rise in the share price, while a company with a weak earnings report will witness a drop in the share price.

Earnings reports can be released on a monthly, quarterly or annual basis. As a trader investing in the NASDAQ 100, it is best practice to watch out for the earnings reports of the firms listed on the index.

Weighted by market capitalization

The NASDAQ 100 index comprises the top non-financial companies. By weighting the market caps of these companies, it results in larger companies having a greater impact on the value of an index. Therefore, you should monitor the performance of large companies on the index to predict performance.

Top Strategies for Trading NASDAQ 100

There are many ways to trade the NASDAQ 100 index, whether you are a new investor or an experienced one. Choosing the trading method is critical because it can impact your gains. Below are the ways that you can trade NASDAQ 100:

NASDAQ 100 CFDs

You can trade NASDAQ 100 using contracts for difference (CFDs). CFDs are derivatives products whose price is determined by the underlying market prices. In this case, a CFD will derive value from the NASDAQ 100.

With CFDs, you are not taking ownership of any asset. Instead, you speculate if the index prices will fall or gain.

NASDAQ 100 futures

You can also trade NASDAQ 100 through futures contracts. Futures contracts are agreements between traders to exchange an asset at a predetermined date and price.

When using futures on NASDAQ 100, you do not have ownership of an underlying asset that you will exchange once the expiry date is reached. Because it is an index, you will only be holding numbers that will represent the stock prices of companies included in the index.

NASDAQ 100 stocks and ETFs

You can also trade the NASDAQ 100 using exchange-traded funds (ETFs). ETFs are investments that comprise a group of stocks. In this case, it will be the shares of the companies included in the index.

Many NASDAQ ETFs are available in the market to track the basket of equities included in the NASDAQ 100. Moreover, a trader can choose to trade the stocks included on the NASDAQ 100 individually, giving them a chance to focus on sectors where they have a greater interest.

NASDAQ 100 options

With options, a trader has the right to buy NASDAQ 100, but they do not have an obligation to fulfil the contract specifications. You can buy or sell the index at a predetermined price or date with options.

Understanding NASDAQ 100 Trading Hours

The NASDAQ is only open during business hours, from 9:30 am to 4 pm Eastern time, from Monday to Friday. There is also a pre-market trading session that can start at 4:00 am and go to 9:30 pm. After-hours sessions after market close can also span from 4 pm to 8:00 pm.

Tips for Successful NASDAQ 100 Trading

When trading the NASDAQ 100, you can consider the following factors that will aid in your decision making:

- Have a trading style

You need to choose a trading style that you will use to conduct your NASDAQ 100 trades. Some of the popular trading styles available in the market include day trading, scalping, swing trading and position trading.

If you are trading NASDAQ 100 for the short term, day trading and scalping techniques will be suitable. However, if you are trading for the medium term or long term, you can consider position trading or swing trading.

- Use charts and patterns

The other tip is to use charts and assess the previous market performance. A trader can analyze the current market sentiment with daily and weekly charts and predict if the prices will gain or dip.

The charts and patterns needed to analyze the performance of stock prices and indexes can be found on various platforms. It is always recommended that traders combine different charts because this will give them a more accurate prediction.

- Focus on technical analysis and indicators

The best trading strategies usually adopt the use of technical analysis and indicators. With these components, you can have a better understanding of the market. You can also identify trading signals and trends within the market to help you make informed trading decisions.

- Identify trading signals

Trading signals are also crucial to helping you determine the current trend in the market. The market trend can be bullish, where the market is steadily gaining, or it can be bearish, where the market is steadily declining.

To confirm the market’s trend, you can adopt the use of momentum indicators. Such indicators include the relative strength index (RSI) and the stochastic oscillator.

- Choose a reliable broker

You can trade NASDAQ 100 using a brokerage firm. However, the brokerage firm that you will use can have a major impact on the trading experience that you will have.

A brokerage platform should be able to keep you aware of your trading positions so that you can make adjustments where necessary. This can be achieved through trading alerts sent to your device promptly.

- Be informed

The other tip to follow is to always be informed about the developments taking place in the market. The share prices will be affected by the news surrounding the company or the entire industry. Therefore, watch out for any developing news that could lead to gains in the share price of NASDAQ 100.

News in the macroeconomic environment, such as political news or the pandemic, can also influence trader behaviour and trigger a significant price movement.

Why trade NASDAQ 100 with PrimeXBT ?

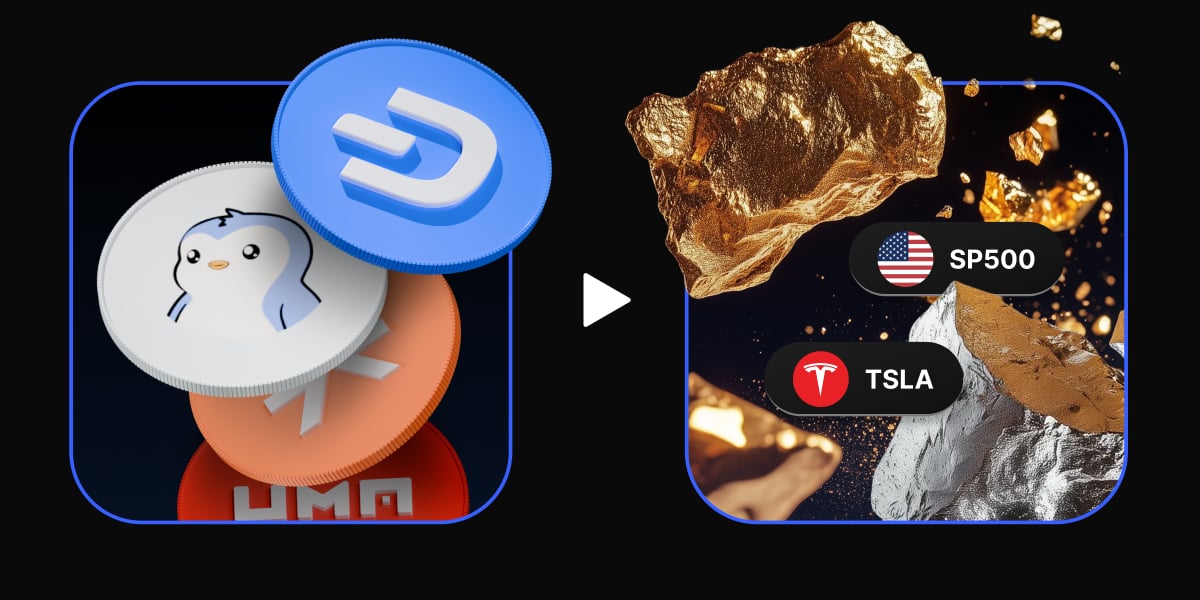

PrimeXBT is an award-winning platform that enables traders to trade NASDAQ 100 and other stock indices. At PrimeXBT, a trader can access advanced features allowing them to get the best out of their trading experience:

- User-friendly – Trading on PrimeXBT is quite easy. Getting started is through a simple and fast registration process. The minimum deposit on the platform is also low.

- Low trading fees – Trading NASDAQ 100 also comes with low trading fees. Traders can open and close their positions without worrying about massive deductions in trading fees.

- Secure trading – Trading at PrimeXBT also has a high sense of security. The advanced security features ensure that users’ personal data and funds will be safe.

Best in-class trading platform – PrimeXBT comes with advanced software that gives users access to professional trading tools. With a single account, a trader will not only access NASDAQ 100 but also a wide range of other stock indices.

What is the NASDAQ 100 Index?

The NASDAQ 100 is a stock market index that tracks the performance of 100 of the largest non-financial companies listed on the NASDAQ stock exchange. It includes major technology giants like Apple, Amazon, Microsoft, and Tesla.

What are the benefits of trading the NASDAQ 100?

Trading the NASDAQ 100 gives you exposure to top-performing companies, especially in the technology sector. It is a globally recognized index with strong historical performance and liquidity, making it an attractive option for traders and investors

What factors influence the price of the NASDAQ 100?

The NASDAQ 100’s price is influenced by economic events, company earnings, the strength of the US dollar, and market news. Major changes in the share prices of large companies in the index can also significantly affect its value

What are the best strategies for trading the NASDAQ 100

Popular strategies include trading CFDs, using technical analysis to identify trends, investing in ETFs for diversification, or trading futures contracts. Your choice of strategy depends on your trading style, risk appetite, and market knowledge

Can beginners trade the NASDAQ 100?

Yes, beginners can trade the NASDAQ 100. It's important to start with a reliable broker, use charts and technical indicators for analysis, and stay informed about market news. PrimeXBT offers user-friendly tools to help new traders get started

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.