It has been another promising week across most markets as in the cryptocurrency space, the leader of the pack Bitcoin once again looks like it could be pushing for new all time highs. Additionally, the altcoin market is also performing really well as under-fire coin XRP has managed to triple despite the ongoing SEC investigation into its status as a security.

Outside of the cryptocurrency space, there have been positive moves in the market spurred on by meetings of the Federal Reserve. The Fed’s March meeting has shown that the central bank is optimistic about a sustained rebound in inflation.

For investors, this is exciting news, and it was seen as both the Dow and S&P smashed new all time highs because of institutional investors being more and more bullish. Even the precious metals, like Gold and Silver, look to be on the comeback trail as banks are buying up more gold and silver mints are hoarding more silver.

An Optimistic Rebound

Minutes from the Fed’s March meeting, released on Wednesday, showed that central bank officials are optimistic about a sustained rebound in inflation. They reiterated their commitment to keep their easy monetary policies unchanged until employment recovers fully from the pandemic-led economic aftermath.

Chairman Powell in particular, warned about mutations in Covid virus being a high-risk event that could deter economic recovery and said the Fed needed to continue its asset purchases until substantial inflation and employment goals have been achieved.

The markets reacted positively to the dovish affirmation, and more so after a worse-than-expected jobless claims number gave traders more reason to believe that the aggressive monetary easing measures will not be removed anytime in the near-future.

After the Fed minutes were released, many institutional investors became more bullish about the markets, with Wharton professor Jeremy Siegel saying the stock market could surge another 40% before it staged a 20% correction.

The Dow and S&P cruised to yet another ATH of 33,770 and 4,130 respectively, with the uptrend firmly on track for higher prices ahead. Nasdaq is also recovering after the tech selloff weeks ago and is just inches away from its ATH of 13,910 and will likely break it soon.

Meanwhile, the DXY, which tracks the USD movement against six major foreign currencies, initially rose to the Fed’s continued dovish stance, but fell afterwards, reigniting bearish calls on the USD. The DXY ended the week lower at 92.15 and opened the new week unchanged.

Gold and Silver advanced, with both looking like the worst could be over for their prices. Central Banks were rumoured to be buyers of physical gold again while some silver mints were said to be hoarding their physical silver products to sell them later at higher prices.

Crypto Market First Fall but Rebound as Market Cap Crosses $2 Trillion

On the back of dovish governments and increased institutional participation, cryptocurrency market cap crossed $2 trillion for the first time, led by a strong altcoin season even as BTC consolidated ahead of $60,000.

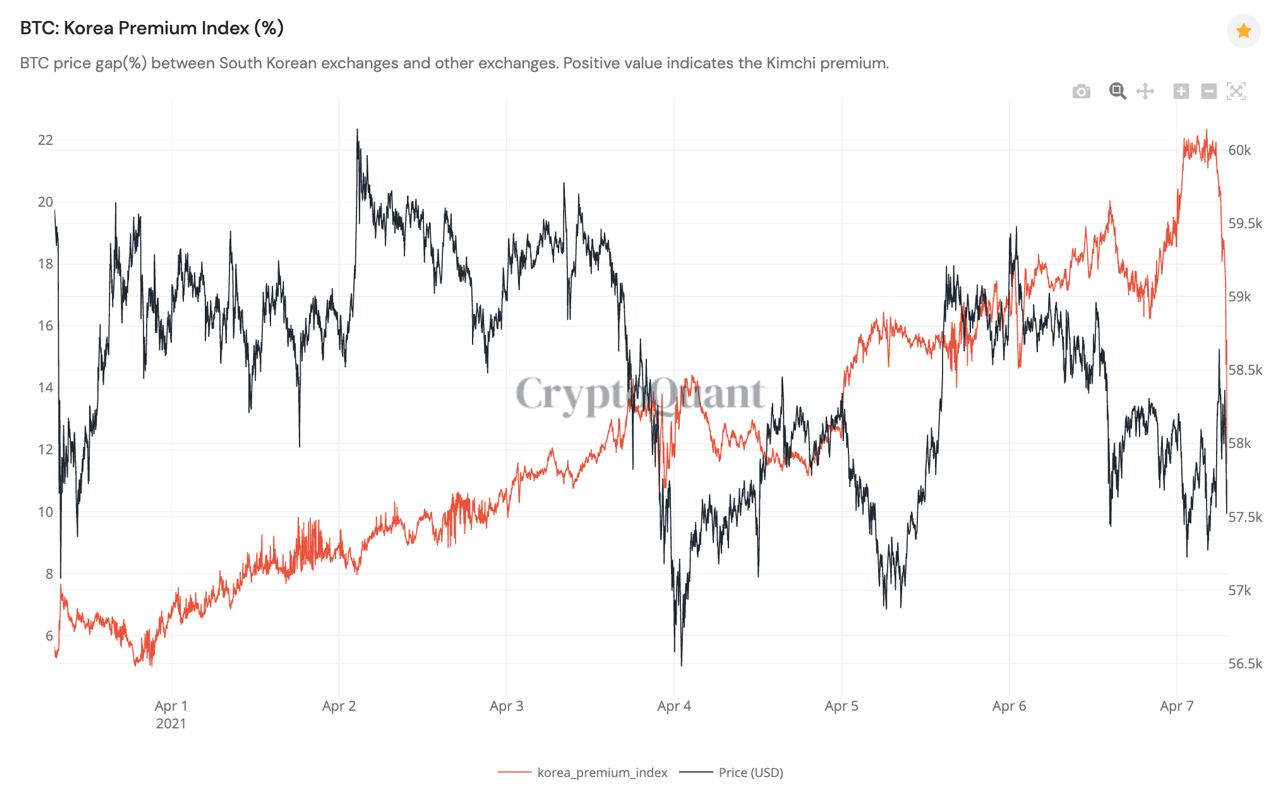

As demand from Asia grows, the price of BTC in South Korean exchanges starts to trade at a premium against that of other countries, a phenomenon known as the Kimchi Premium.

In 2017, at the height of the bull market, the Kimchi Premium was consistently at 20% before the crypto market slumped into a bear market. Last week, the Kimchi Premium rose to a dangerous 20% as the crypto market cap crossed $2 trillion, causing some traders to take profit, resulting in a market decline, with BTC losing almost 3%. Nearly $1.7b worth of derivative contracts were liquidated in the first 24 hours of the pullback.

Market subsequently recovered after the Kimchi Premium fell back to around 10%, with BTC breaking the psychological $60,000 early Saturday morning.

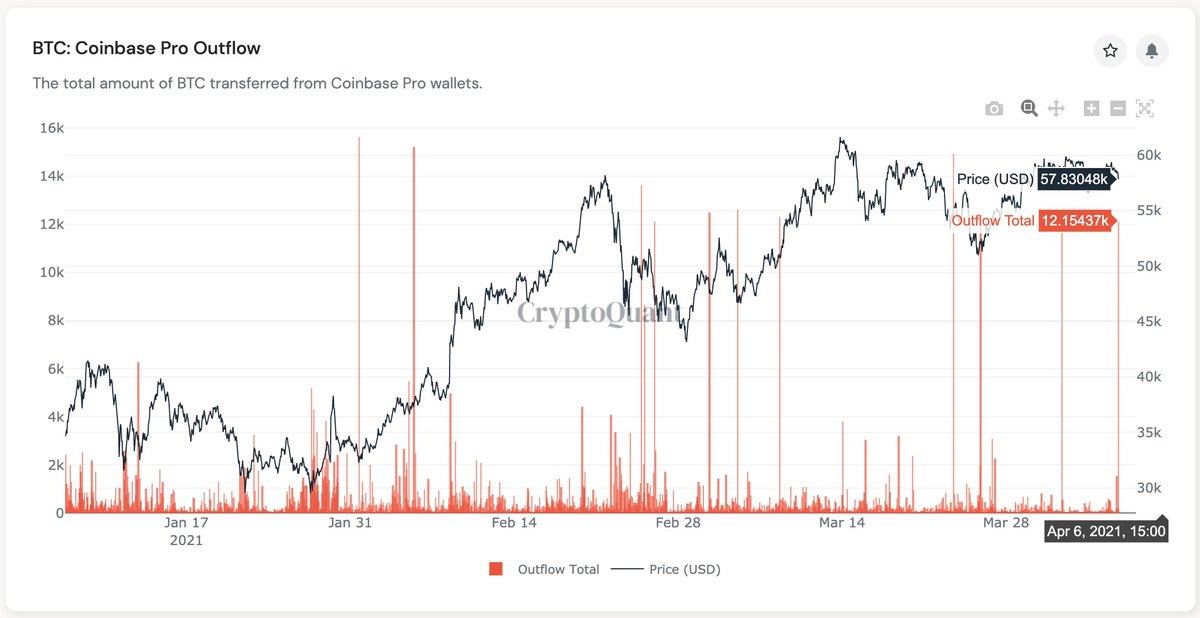

In hindsight, the $60,000 break was inevitable as US institutional buyers remained undeterred, and continued buying the dip and withdrawing BTC from exchanges. Coinbase saw another outflow of around 12,000 BTC on 6 April.

Market is getting excited over the listing of Coinbase shares on 14 April, with experts having mixed reactions as to how it will affect the crypto market. Some experts think that the positive sentiment will spill over to the crypto-verse and send the crypto market surging around the 14 April date, while others think that some liquidity from the crypto market will flow out to purchase Coinbase shares, causing a mini-selloff in the crypto market.

Crypto Market Liquidity Surging as Record Amount of Stablecoins Minted

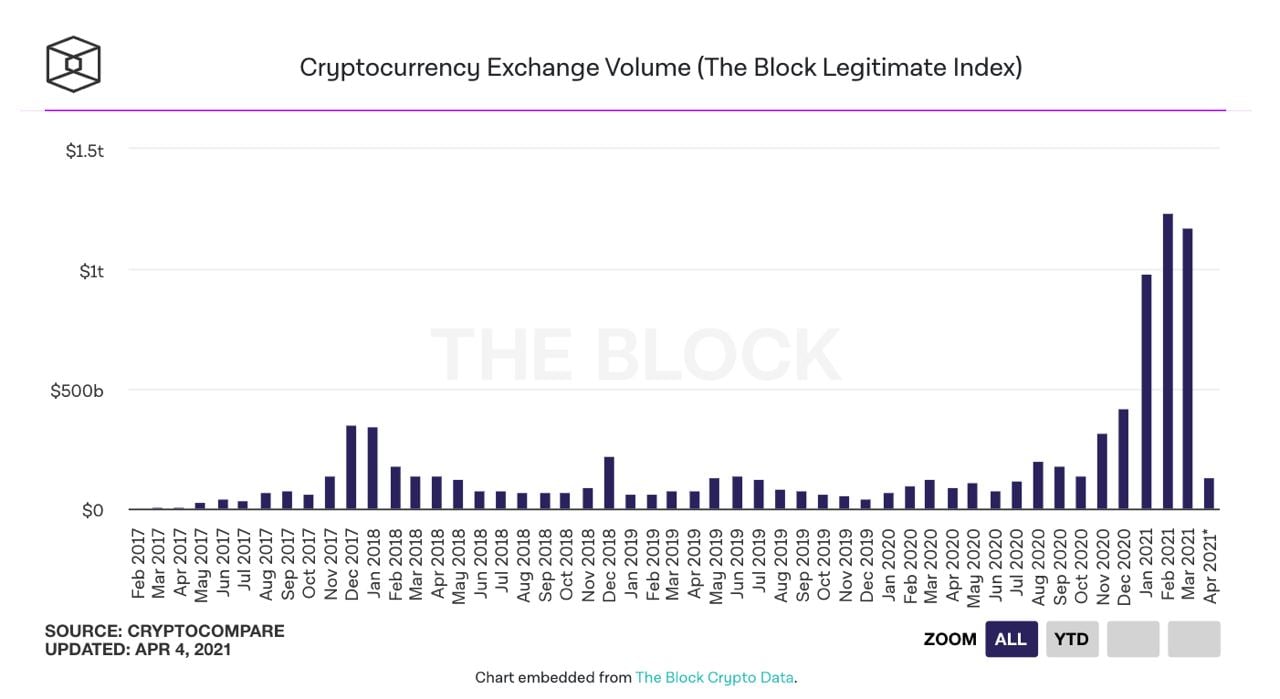

Proponents of a liquidity drain may be overly pessimistic as interest in trading cryptocurrencies is at an ATH. This year’s trading volume at crypto exchanges have increased five to tenfold that of last year, which means many more traders are entering the market.

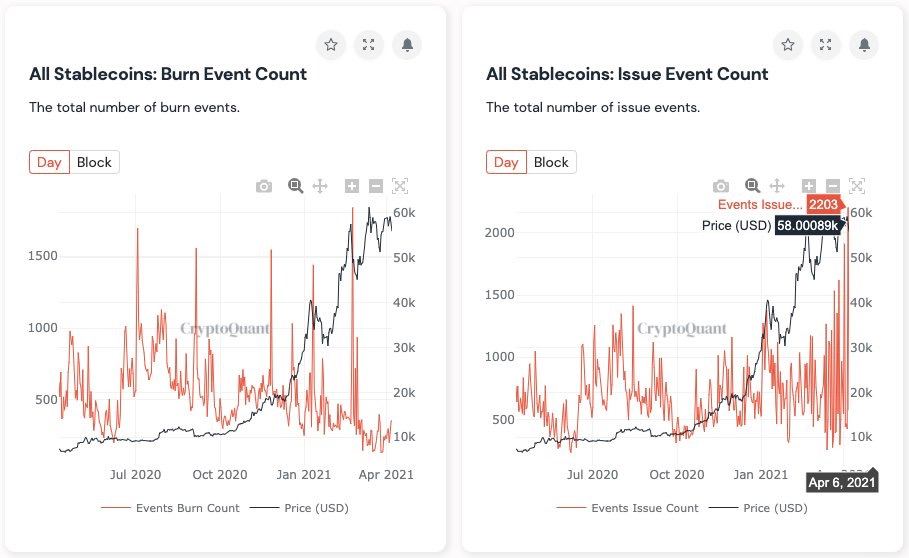

In line with the increase in trading volume, a lot more stablecoins have been minted, while the amount of stablecoins returned to issuers and burned is at an all-time-low. This means that a lot more fiat is being converted into stablecoins in order to enter the crypto market, a sure sign of an increase in liquidity which will not easily leave the crypto market because of a new listing in the stock market.

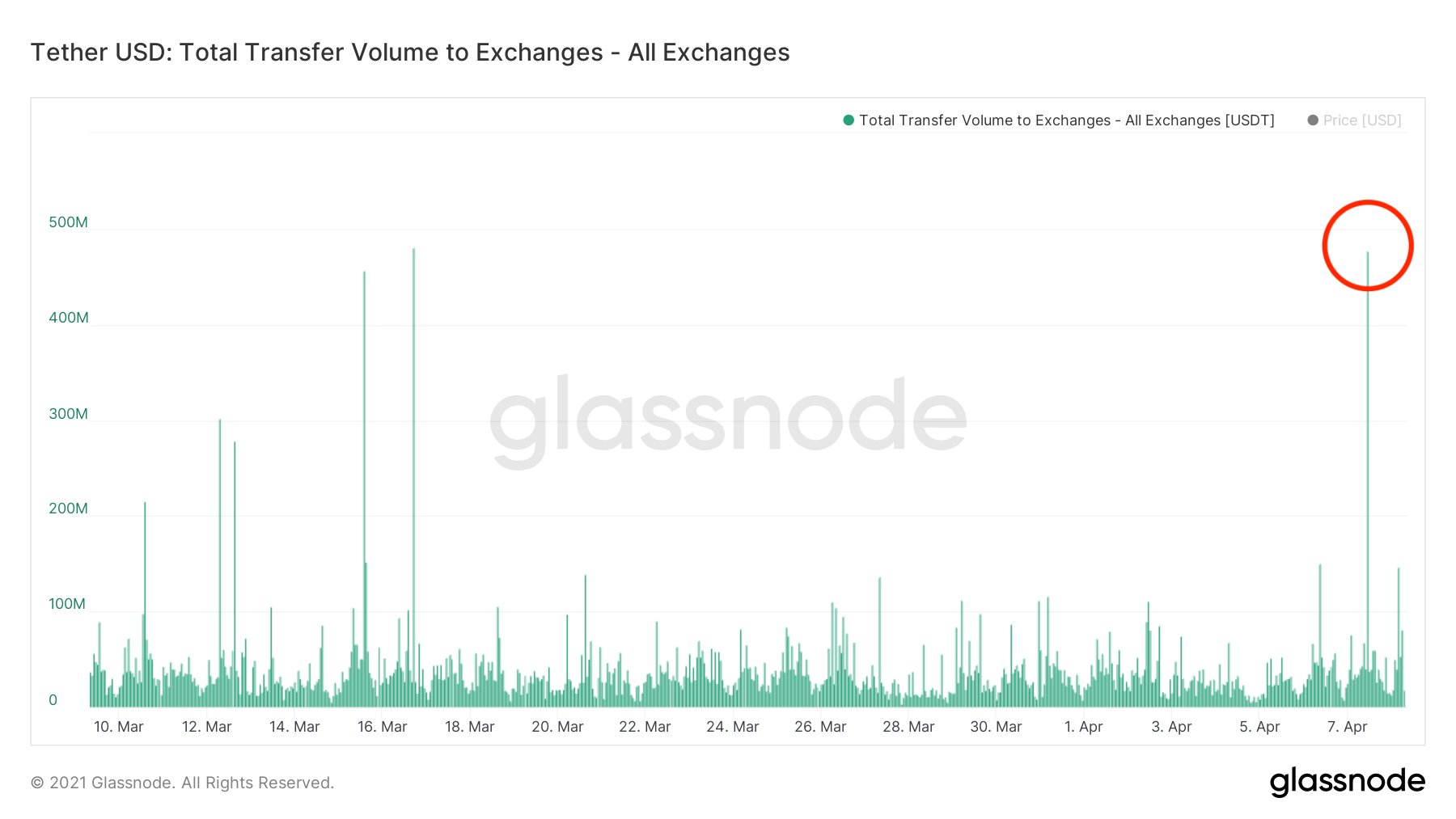

Indeed, another $476m of USDT was observed to have been deposited to exchanges on 8 April over the span of one hour, with a total of $2b worth of it being deposited in the 6 days prior, thereby raising the market cap of USDT, the largest and most used stablecoin, to $42b.

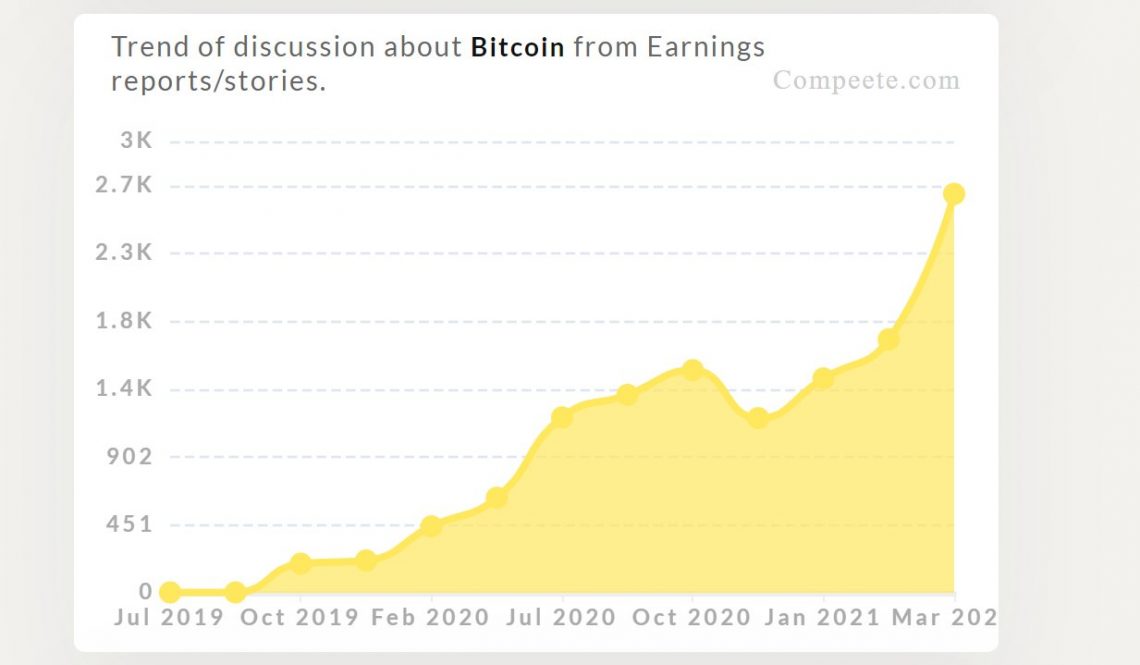

More Corporates are Looking at BTC

According to data, the total mentions of BTC in company earnings reports has skyrocketed, signalling more and more companies are getting interested in BTC.

Existing corporate owners of BTC in the meantime just cannot get enough of it, as MicroStrategy and Meitu continue to add BTC to their portfolio. MicroStrategy said it bought another $15m worth of BTC, while Meitu said it purchased another 175 BTC to reach the $100m mark it set for itself in its Cryptocurrency Investment Plan.

The plan called for Meitu to add $100m in BTC and ETH to its treasury, both as an investment and preparation for future initiatives. Meitu intends to use some of the ETH to launch decentralized apps in the future.

Further to that, a new BTC corporate endorsement came from American real estate company Caruso, led by billionaire Rick Caruso. The firm revealed late last week that it would begin accepting BTC for rent payments at both retail and residential properties, and that it also bought BTC as part of its treasury reserve. It however did not reveal how many BTC they bought.

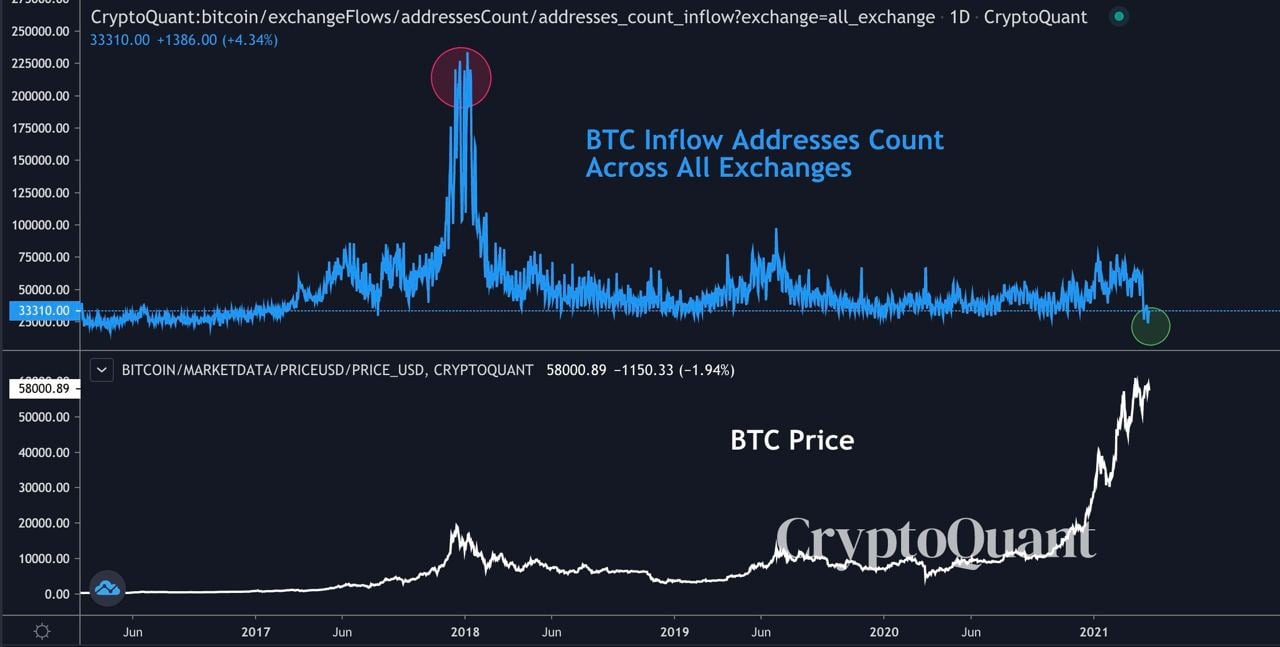

As more corporates purchase BTC for safekeeping, the net flow of BTC into exchanges has become negative, implying that there is now more outflow than inflow of BTC into exchanges. This means more buyers are removing BTC from exchanges than there are sellers depositing BTC into exchanges for sale, which is a bullish sign that buyers are hodling, not selling.

BTC Miners Turning Hodlers a Very Bullish Sign

So far this year, miners have been the main movers of BTC into exchanges, with them accounting for most of the exchange inflows since Jan. However, that trend has reversed and miners are now accumulating instead of sending them to exchanges.

Not only has outflows from miners’ wallets stopped, miners are now observed to be hoarding BTC. In a statistic that tracks miners’ BTC movement called the Miner Unspent Supply, miners’ BTC holding has reversed from a sharp drop in Jan to a steady increase currently, showing that miners have not been sending out their newly mined BTC but are instead, hodling them.

The last time such a trend reversed, the price of BTC increased four-fold from under $5,000 to $20,000, and subsequently went even higher to where it is currently.

With BTC flirting with $60,000, ETH also posted gains, finally being able to carve out a new ATH of $2,200, while rotational action on altcoins continues into different names.

Ahead of its stock market listing, Coinbase added 4 listings to its stable, causing the prices of ENJ, 1INCH, OGN and NKN to rise by as much as 50% over the week. Altcoins continue their rotational play, KAVA carving out new ATHs of $8.17 and BNB almost doubling to near $600.

XRP Price Explodes on Relisting Chatter

The star of the week however, was XRP, which saw its price triple, rising from $0.60 to a high of $1.50, trouncing its Feb high of $0.71. Developments in the SEC lawsuit that is widely deemed to be in favour of Ripple is causing sentiment to improve greatly for XRP.

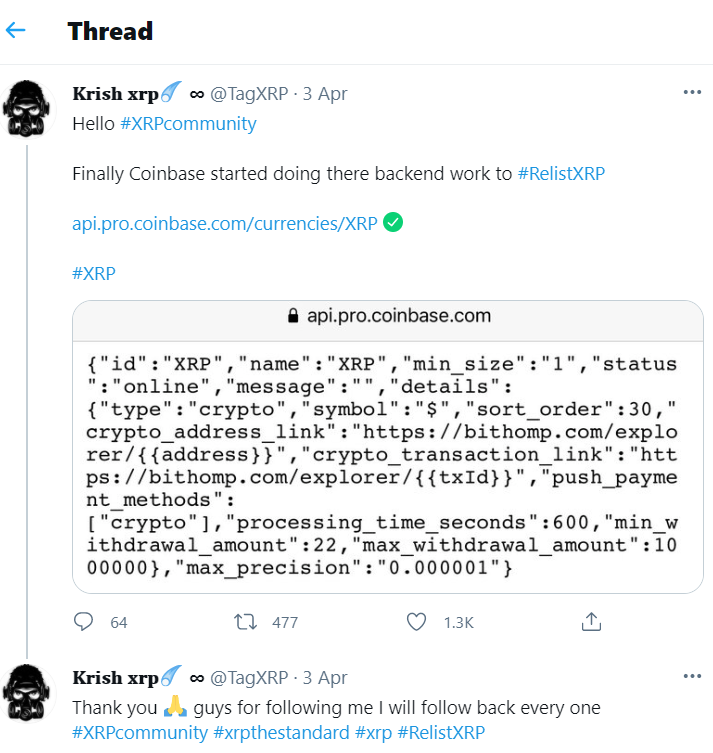

The large spike in price was sparked by a rumour that claimed Coinbase was planning to relist XRP. Someone posted a picture on Twitter claiming that Coinbase was preparing to relist XRP, and that sent sparks flying as the rumour started making its rounds.

Last Monday, after a Swiss crypto exchange relisted XRP, the market experienced a FOMO, which sent the price of XRP price surging very quickly.

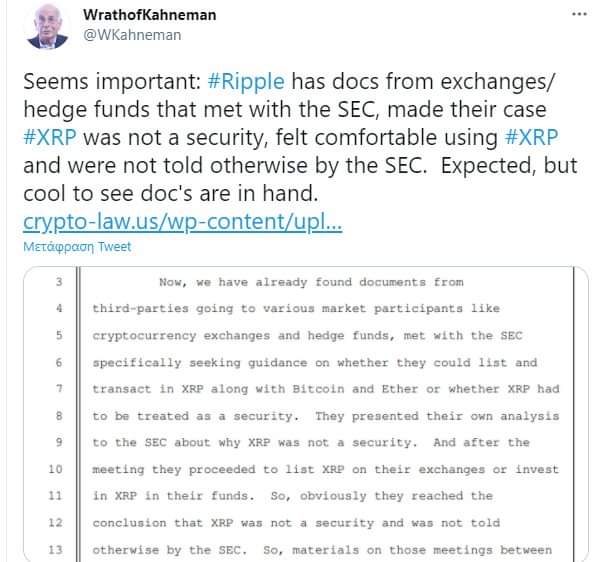

The surge was exacerbated by positive developments in the April 6 hearing, where Ripple was granted access to SEC’s internal documents about BTC and ETH. This will help Ripple in its case should Ripple be able to find any suggestion that the SEC did think that XRP and BTC and ETH were similar. Already, someone had found some “incriminating evidence” against the SEC and posted it on Twitter.

With the lawsuit looking more and more in favour of Ripple, an XRP fan even started a petition to ask the SEC to drop the lawsuit. Crypto & Policy founder, Thomas Hodge, has started a Change.org petition directed at SEC chairman nominee, Gary Gensler, asking him to end the SEC’s lawsuit against Ripple once he’s confirmed as chairman of the commission.

XRP has been able to hold on to its gains and continue higher beyond $1 for the first time in 3 years. As the case develops, any more positive developments may send its price up further as the hearing continues. The technical chart is also looking bullish for XRP, pointing to a possible testing of its ATH of $3.30 soon.

About Kim Chua, PrimeXBT Market Analyst:

Kim Chua is an institutional trading specialist with a track record of success that extends across leading banks including Deutsche Bank, China Merchants Bank, and more. Chua later launched a hedge fund that consistently achieved triple-digit returns for seven years. Chua is also an educator at heart who developed her own proprietary trading curriculum to pass her knowledge down to a new generation of analysts. Kim Chua actively follows both traditional and cryptocurrency markets closely and is eager to find future investment and trading opportunities as the two vastly different asset classes begin to converge.

The information provided does not constitute, in any way, a solicitation or inducement to buy or sell cryptocurrencies, derivatives, foreign exchange products, CFDs, securities and similar products. Comments and analysis reflect the views of different external and internal analysts at any given time and are subject to change at any time. Moreover, they can not constitute a commitment or guarantee on the part of PrimeXBT. The recipient acknowledges and agrees that by their very nature any investment in a financial instrument is of a random nature and therefore any such investment constitutes a risky investment for which the recipient is solely responsible. It is specified that the past performance of a financial product does not prejudge in any way their future performance. The foreign exchange market and derivatives such as CFDs (Contracts for Difference), Non-Deliverable Bitcoin Settled Products and Short-Term Bitcoin Settled Contracts involve a high degree of risk. They require a good level of financial knowledge and experience. PrimeXBT recommends the consultation of a financial professional who would have a perfect knowledge of the financial and patrimonial situation of the recipient of this message and would be able to verify that the financial products mentioned are adapted to the said situation and the financial objectives pursued.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.