Things have been rather dire for the price of Bitcoin this last week as the coin struggles to make it out of the lower reaches of the $30,000 range. However, even with this weak price action, and a huge swath of shorts, the coin is managing to hold above the $31,000 mark.

But, the news is mixed as there has been a rather large drop in general cryptocurrency volume, and a spike in Bitcoin exchange inflows. However, news out of the Americas continues to be positive as Brazilian securities regulators approved its first ETH ETF while PayPal has raised cryptocurrency limits for its U.S. customers to $100,000 per week without an annual purchase limit.

Square has also outlined plans to build an open developer platform focused on creating Defi Services on the Bitcoin blockchain. This could increase the usage for BTC and help make crypto far more mainstream.

Elsewhere, in the US stock market, the week ended on a lower note after investors took some money off the table in a mixed week which saw a stronger USD despite assurances by Fed Chair Powell that the Fed is still way off from altering policy.

Mid-week, the markets fell after the release of blowout inflation numbers, which saw a 5.4% y/y and 0.9% m/m increase, way higher than expectations, and the largest m/m increase since 2008. However, after the Fed Chair’s assurance when he spoke at the testimony to the House of Financial Services, markets calmed down and recovered some of their losses, with the exception of tech stocks.

The Fed expects inflation to moderate despite current higher-than-expected CPI and PPI readings. Powell continues to say that even though conditions in the labour market are starting to improve, there is still a long way to go before substantial further progress, and is of the opinion that inflation has “increased notably” due mostly to temporary factors and will recede in a few months.

US bond yields have dropped in response to Powell’s dovish message, falling to 1.295%, while the 3 main US indices finished the week lower after better-than-expected retail sales numbers released on Friday failed to lift stocks. Retail sales rose 0.6% in June, well above consensus expectations for a 0.4% decline. For the week, the Dow fell 0.5%, the S&P dropped 1%, while tech stocks continued to get hit, with Nasdaq the worst performer with a 1.8% drop.

Precious metals were flat for the week after giving back their gains made mid-week. Gold begins the new week unchanged at around $1,813, while Silver has broken its recent low of $25.50 and looks to be heading lower.

Oil was the most consistent underperformer amongst commodities, dropping to a low of $70 after a double whammy of supply increase news and increasing crude oil inventory out of the USA. Oil prices started falling on Wednesday after Reuters reported Saudi Arabia and the United Arab Emirates had reached a compromise that would unlock an OPEC+ deal to boost global oil supplies, and saw further southward action after the USA reported sizable crude oil inventory. Oil is starting the new week still on the backfoot, trading near $70.

The currency market saw some surprise central bank action last week, with the RBNZ leaving the official cash rate unchanged at 0.25% as expected but shockingly announcing that it will cease its asset purchasing program. This has caused the NZDUSD to shoot up above $0.70, setting the stage for further gains in the New Zealand dollar.

The Bank of Canada also reduced monetary stimulus but their adjustment was less significant compared to the RBNZ. They scaled back bond buys for the second time in a row by $1 billion per week, which was more than the consensus forecast for an overall reduction of $1 billion. Unlike the New Zealand dollar however, the Canadian dollar weakened rather than strengthened due to the selloff in oil price.

Upcoming this week, the ECB will be the next central bank to meet – on Thursday, July 22. While consensus expects no change in policies, traders do keep in mind the meeting during which higher-than-usual volatility could be seen in EUR trading pairs.

Crypto Trading Volume Falls 40% From May

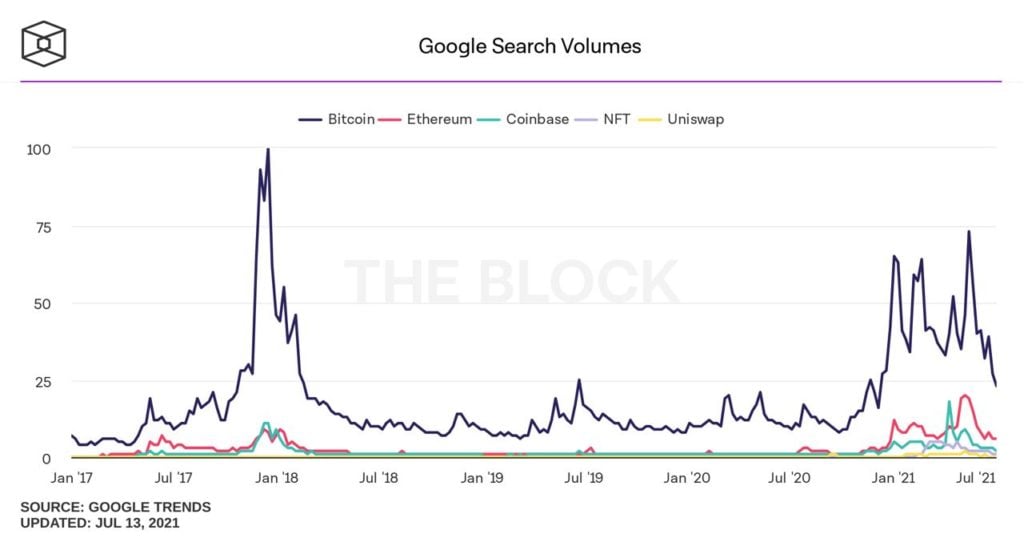

Cryptocurrency trading volumes decreased significantly in June according to data. Volumes traded diminished by at least 40% month-on-month, with spot and derivatives trading both suffering due to the mining and trading crackdown in China, amongst other factors. The resulting volatility seems to have made many traders lose interest. Google search volume on BTC and other crypto assets have also fallen drastically, with search volume on various crypto-related subject matters at the lowest point of the year.

As the market searches on for a catalyst, rumours of large companies having bought BTC started making its rounds last week. Perhaps conjured up by the rumour mill to incite some positive excitement into BTC’s price, early last week heard the rumour of Apple having bought $2.5 billion worth of BTC and by mid-week, the target had been changed to Microsoft after Apple failed to make any announcement on the matter. Needless to say, Microsoft also did not mention anything. The rumours did not even manage to cause a ripple in BTC price since most traders did not believe them.

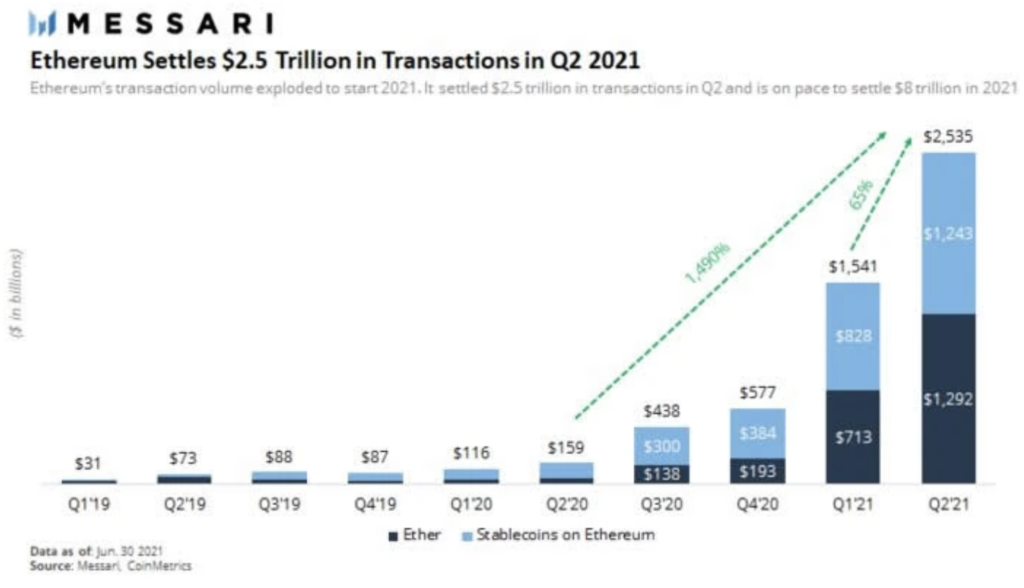

ETH Network Transaction Value Jumps

However, despite the drop in price and a general lack of interest, transaction value on ETH blockchain has continued to spike, with the value of transactions clocked on ETH network increasing by 65% in 2Q compared with 1Q 2021, and is up 1,400% from barely a year ago. This goes to show that the usage of ETH blockchain has picked up significantly and is gaining traction at top speed, which could eventually be positive for its price in time to come.

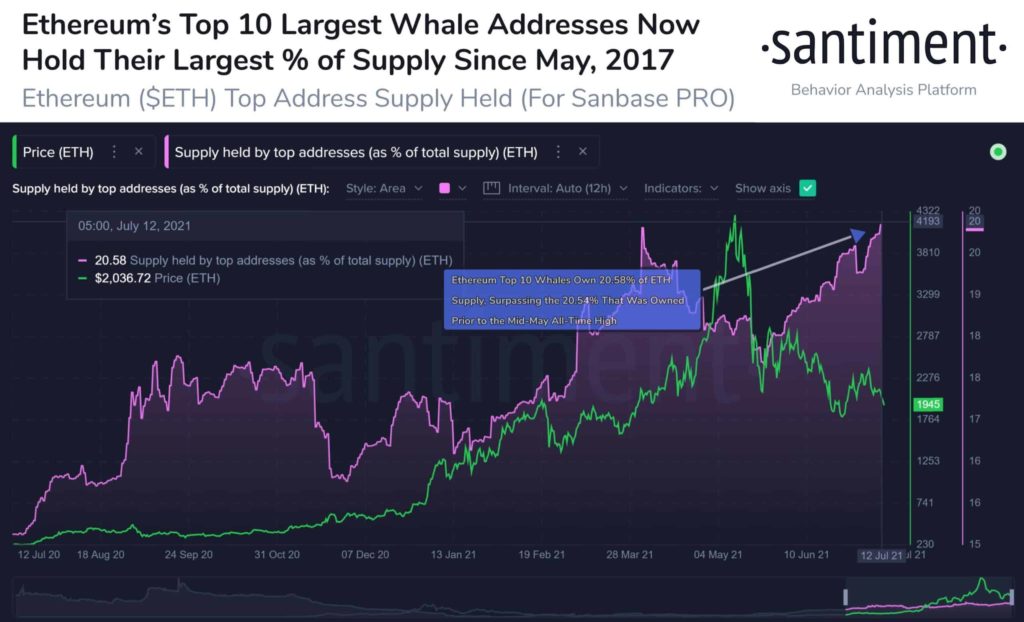

ETH Metrics Shows Strong Re-accumulation

Many ETH bullish whales could have seemingly caught up with the data and took the dip to add even more ETH to their stash, increasing their holdings by more than 2% in 40 days. These ETH wallets now own about 20.58% of all the asset’s overall supply, an increase from its highest holdings this year of 20.54% at the end of March. These whales subsequently reduced their holdings just before prices started to crash in April 2021.

Coincidentally, these whales have started to accumulate ETH again in June, and have now acquired 20.58%, a level which was only last seen in May 2017 when the price of ETH first started to spring up from under $100 in the initial stages of the bull run of 2017-2018 where ETH eventually went to a high of $1,400. Could this re-accumulation be a sign of things to come?

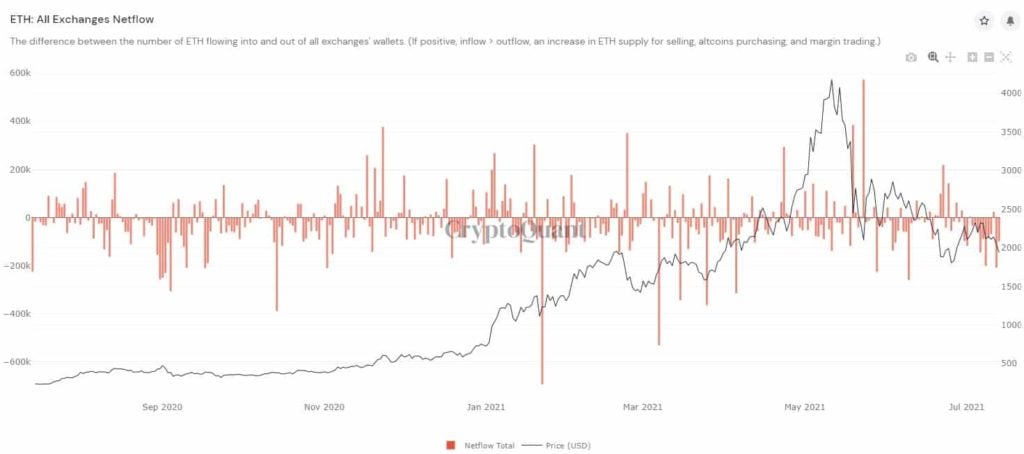

Also, for the whole month of July, the net flow of ETH in/out of exchanges has been negative, implying that more ETH has been moved out from exchanges than being moved in, a sign of accumulation.

The amount of ETH held at exchanges is also falling sharply since July to a year-low, suggesting that the pace of removal of ETH from exchanges has quickened since July.

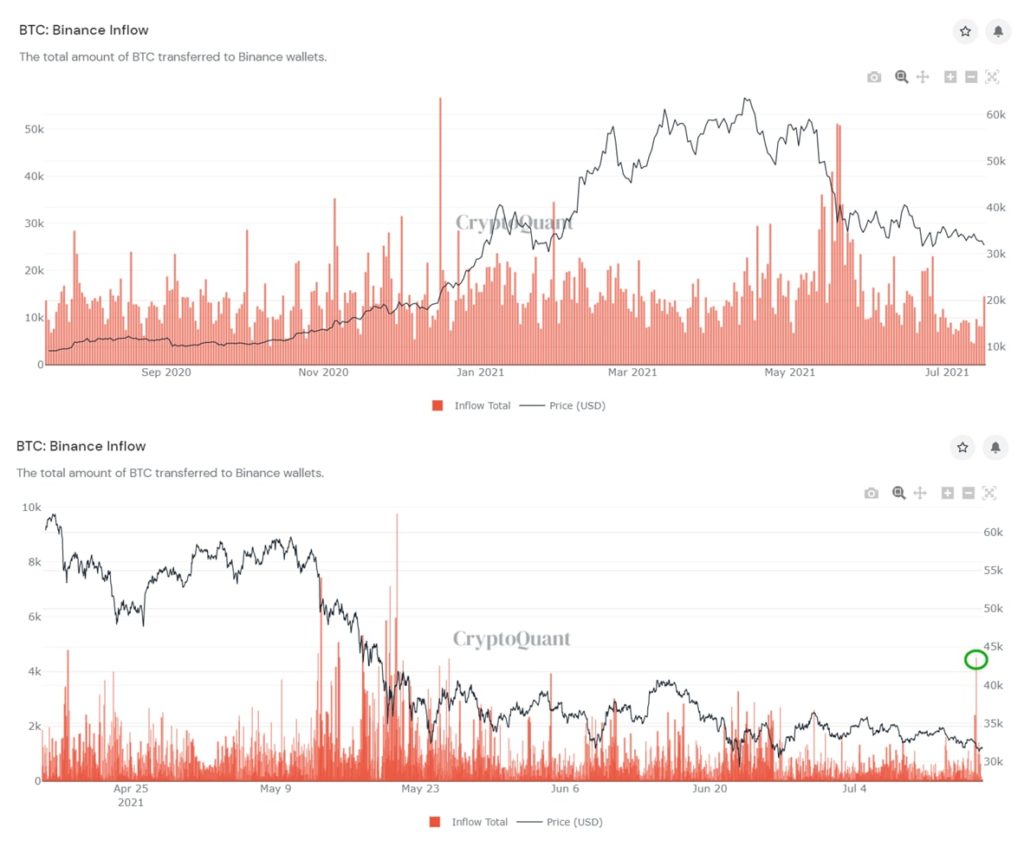

BTC Sees Large Exchange Inflow As Weekend Looms

Short-term metrics for BTC did not look bullish as BTC clocked one of its largest single day exchange inflows since May 20. Late Thursday, around 4,550 BTC were moved onto Binance exchange, in addition to a 18,000 BTC short position that was opened at Bitfinex as the weekend and that July 18 GBTC unlock D-Day loomed.

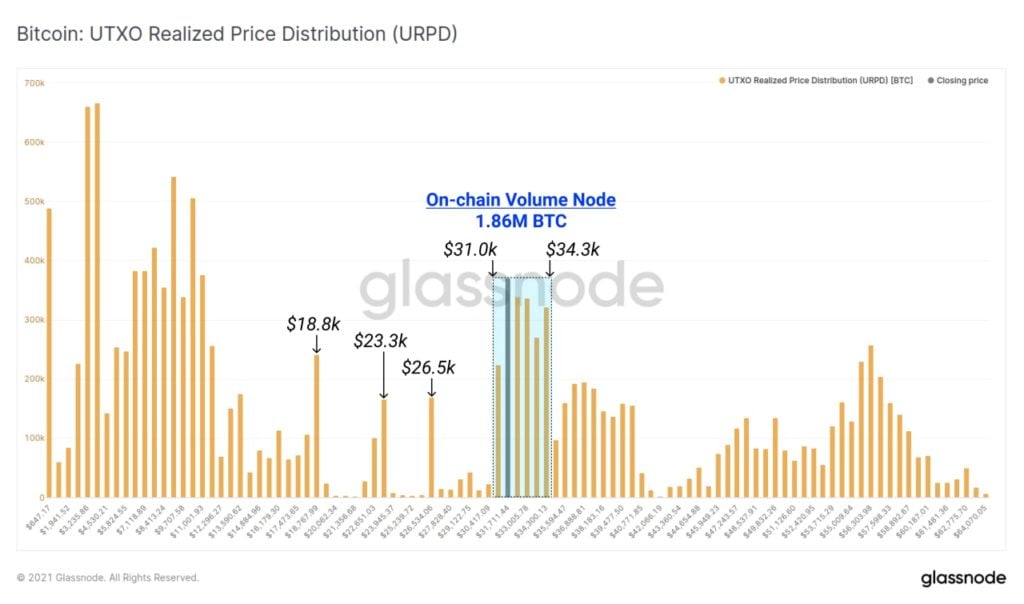

However, BTC price has not caved below $31,000 despite the increase of short positions across all exchanges. Buyers emerged to support price as the price of BTC again approached its highest onchain volume cluster. Between $31,000 and $33,500 lies the highest on chain volume clusters where the highest number of BTC were transacted. Bulls are protecting the low of $31,000 to prevent price from breaking down.

Crypto News Out of The Americas Still Positive

Despite short-term trader’s bearish positioning, news for BTC out of the Americas continues to be positive.

Brazilian securities regulator approves its first ETH ETF. The fund, which will trade on Brazil’s B3 stock exchange, uses custodial services provided by the Winklevoss twins’ United States-based Gemini.

PayPal has raised cryptocurrency limits for its U.S. customers to $100,000 per week without an annual purchase limit.

Square has outlined plans to build an open developer platform focused on creating Defi Services on the Bitcoin blockchain. This could increase the usage for BTC.

As market digests the D-Day of GBTC unlock, traders should also be on the lookout for another event, The B-Word talk show about why institutions should invest in BTC. The show is organized and hosted by Jack Dorsey, with invited speakers like Elon Musk and Cathie Wood. The event is scheduled to take place on July 21. BTC’s price reaction post this event will be keenly watched to see if a recovery is in the works, or if further downside is imminent.

With long-term holders continuing to accumulate on any weakness, while positioning across most retail exchanges are on the short side, a short-squeeze could be imminent should the GBTC unlock event fail to create more selling pressure on the market.

However, as Monday gets going, Treasury Secretary Janet Yellen has called for a meeting today, July 19, with US lawmakers to discuss regulations regarding stablecoins. This meeting could cast a dark cloud of uncertainty as traders ponder over the kind of regulations and what their impact would be on the crypto market. From the various events outlined, this week is setting up to be one of tension for BTC and the broad crypto market. Both bulls and bears will be under pressure as long as the price of BTC remains undecided. Will BTC make up its mind and set a clear direction this week?

About Kim Chua, PrimeXBT Market Analyst:

Kim Chua is an institutional trading specialist with a track record of success that extends across leading banks including Deutsche Bank, China Merchants Bank, and more. Chua later launched a hedge fund that consistently achieved triple-digit returns for seven years. Chua is also an educator at heart who developed her own proprietary trading curriculum to pass her knowledge down to a new generation of analysts. Kim Chua actively follows both traditional and cryptocurrency markets closely and is eager to find future investment and trading opportunities as the two vastly different asset classes begin to converge.

The information provided does not constitute, in any way, a solicitation or inducement to buy or sell cryptocurrencies, derivatives, foreign exchange products, CFDs, securities and similar products. Comments and analysis reflect the views of different external and internal analysts at any given time and are subject to change at any time. Moreover, they can not constitute a commitment or guarantee on the part of PrimeXBT. The recipient acknowledges and agrees that by their very nature any investment in a financial instrument is of a random nature and therefore any such investment constitutes a risky investment for which the recipient is solely responsible. It is specified that the past performance of a financial product does not prejudge in any way their future performance. The foreign exchange market and derivatives such as CFDs (Contracts for Difference), Non-Deliverable Bitcoin Settled Products and Short-Term Bitcoin Settled Contracts involve a high degree of risk. They require a good level of financial knowledge and experience. PrimeXBT recommends the consultation of a financial professional who would have a perfect knowledge of the financial and patrimonial situation of the recipient of this message and would be able to verify that the financial products mentioned are adapted to the said situation and the financial objectives pursued.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.