After plunging to a low of 53,500 on July 7, Bitcoin recovered last week, booking gains of 4.5%. The largest cryptocurrency has continued its recovery as the new week begins, rising back towards 63k and into the familiar 70k-60k range it has traded in since March.

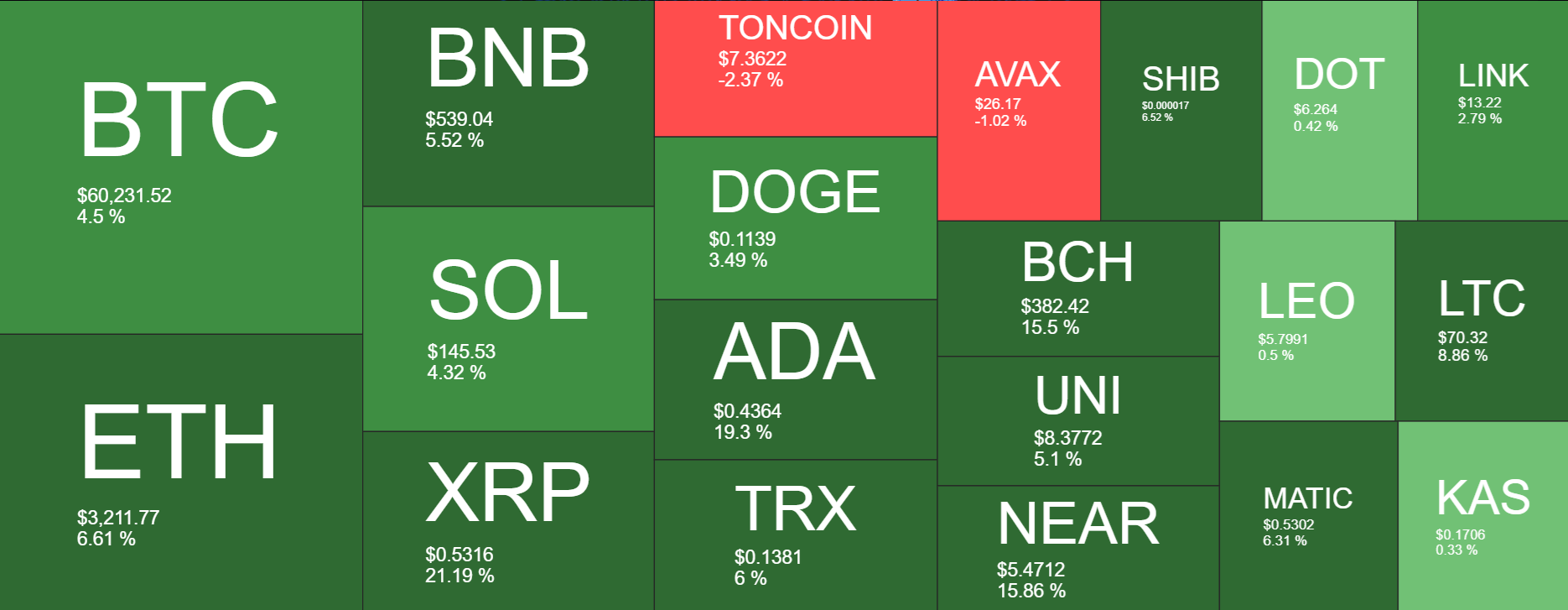

The recovery was seen in Bitcoin and across the altcoin market, with Ether rising 6%, BNB gaining 5%, and XRP as a standout performer gaining 20%. Cardano was also a winner, up 15%. Meanwhile, TON and AVX were among the few tokens that fell across the week.

Supply overhang worries ease

Bitcoin sold off sharply at the start of Q3 amid supply concerns generated by large-scale selling from key sources. The German government discriminately started selling its supply of seized Bitcoin on June 19th, averaging around $85 million a day. This is small relative to the daily Bitcoin volumes of $10.6 billion a day, but the indiscriminate selling still unnerved the markets, putting pressure on the price.

However, Arkham intelligence data points to the German government having finished reducing its holdings from around 50,000 BTC to 0 BTC. Given that this selloff is over, this market distortion is likely done, helping the price recover.

Meanwhile, Mt Gox rehabilitation trust repayments started on July 5th and also played a part in the supply overhang. However, what needs to be clarified is how much of the repaid Bitcoin is being sold. Approved exchanges include Bitbank, BitGo, Bitstamp, Kraken and SBI VC Trade; however, the processing times can vary on the exchanges depending on internal verification procedures. Given that the market hates uncertainty, this lack of clarity could be considered more worrying than the actual selling. It’s also worth considering that the tokens could be sold gradually, which would mean a less acute impact on the market.

Fed rate cut bets rise

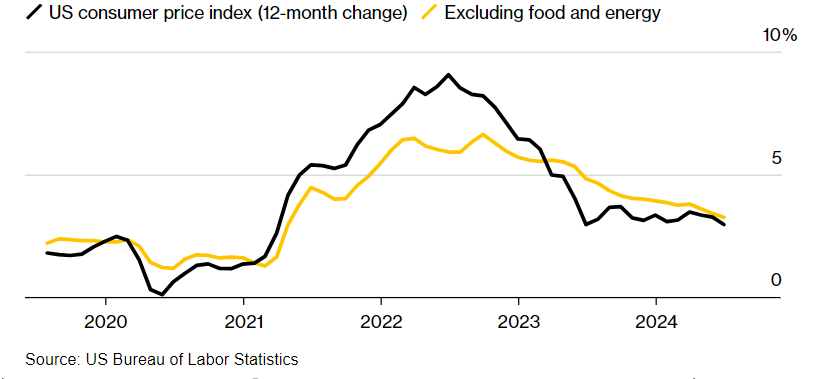

Simultaneously, data indicates that the US economy is beginning to experience a slowdown in inflation and the labour market. The US inflation report for June, released last week, revealed a -0.1% drop in the Consumer Price Index (CPI) month-on-month and a 3% rise year-on-year, below the consensus estimates of 0.1% and 3.1%. This cooling inflation trend supports a more dovish stance from the Federal Reserve.

Last week, Federal Reserve chair Jerome Powell acknowledged that progress was being made with inflation and that the labour market was cooling, fueling optimism among market participants that the central bank would cut interest rates sooner rather than later. The market is pricing in a 93% probability now that the Federal Reserve will cut interest rates in September, up from 45% just a week a month ago. A low interest rate environment benefits crypto, given the increased liquid and improved risk sentiment.

However, there is a scenario where rate cuts may not be bullish for the market, and that is if there is a fear of a more significant economic slowdown. Should weaker US data start raising concerns that the US economy could fall into recession heading into 2025, retail investors will be reluctant to buy into new stock or crypto positions.

US election Trump & Bitcoin

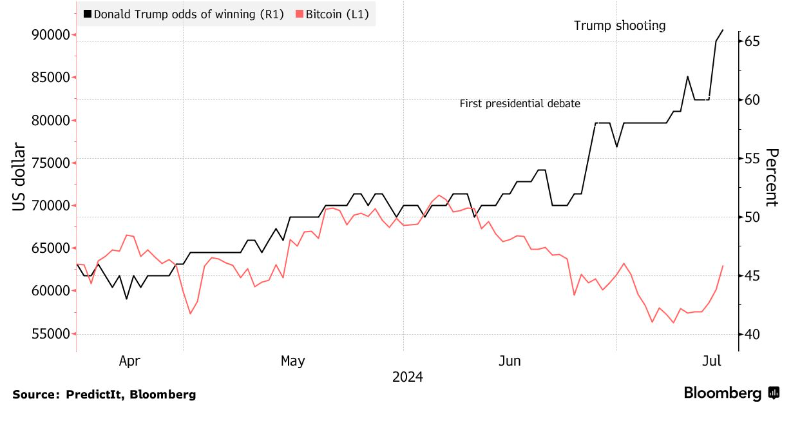

Looking better ahead, it’s also worth keeping in mind that there were the US elections in November where fiscal expansion is likely to be a possibility for whoever wins, which is an incentive to buy Bitcoin as an alternative traditional financial system. That said, given the events this weekend, which saw Trump survive a dramatic assassination attempt, prediction polls are up, pointing to an increased probability of Trump winning. The former President, who positioned himself as pro-crypto, was shot in the right ear at the political by a rally in Pennsylvania on Saturday. Powerful images of a defiant Trump surviving an assassination attempt are in stark contrast to the frail, fragile, and often forgetful Biden who has been on the campaign trail.

According to PredictIt data, Trump’s odds of winning the election increased following the weekend incident. Bitcoin rose above 60k, rallying towards 63k after the developments.

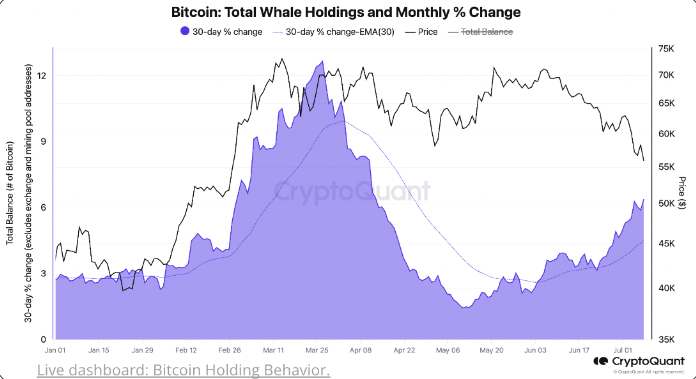

Bitcoin Whale activity increases

An increase in Whale activity has also supported the Bitcoin price. Analytics firm CryptoQuant noted that long-term holders support the price. As the Bitcoin price dropped from 71k to its current range of 58k -59k, the rate of whale accumulation has risen.

Bitcoin whales are increasing their coin holdings at the fastest rate in over a year, indicating demand growth. When the price moved above 70k at the start of June, long-term holders realized solid profits. However, they have since experienced losses due to the lower price and so are less inclined to sell. This could be interpreted as the low last week, which could be a floor.

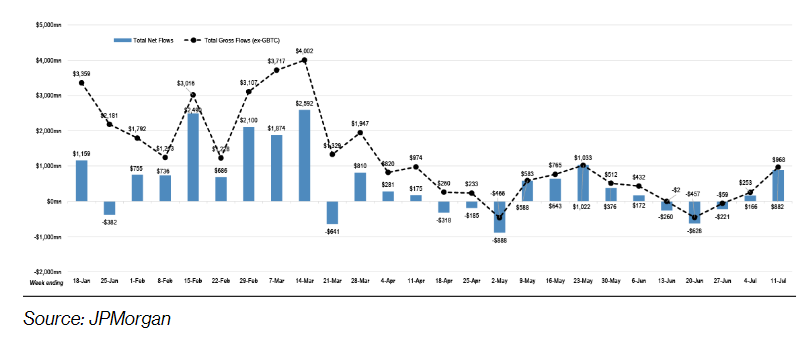

Bitcoin ETFs see the best weekly inflows since May

After Bitcoin fell to its lowest level since February, a week ago, dip buyers returned in a big way, giving Bitcoin exchange-traded funds the best weekly inflows in over a month. Spot Bitcoin ETFs saw flows of $882 million during the week ending 11th of July with an average of $170 million a day, according to data from JP Morgan. This marks the most inflows since the week ending May 23. Black Rock and Fidelity led the surge with over $403 million and $361 million, respectively; meanwhile, Grayscale’s ETF continued to bleed.

This was the second straight week of fund growth after $166 million of inflows last week, which broke a three-week outflow trend.

Looking Ahead

Politics will be in focus this week after President Trump survived an assassination attempt at the weekend at a rally in Pennsylvania. Trump will likely receive his party’s official nomination for the US election this week at the 4-day Republican National Convention.

Along with Trump, eyes will also be on Federal Reserve Chair Jerome Powell, who is due to speak at the Economic Club of Washington, D.C. In his testimony last week, Powell expressed cautious optimism regarding inflation trends; however, he reiterated that more data was needed to confirm that inflation was cooling to the 2% target.

The US economic calendar is quieter this week, with retail sales in focus. Signs of a slowing economy combined with a more dovish Powell could help boost demand for risk assets such as Bitcoin and stocks. The S&P 500 and the NASDAQ rose to fresh record highs last week before falling away as investors rotated out of growth into small cap.

Meanwhile, Gold broke out of range, rising above 2400 as it looks towards 2450 and fresh all-time highs. The prospect of a lower interest rate environment and some safe-haven flow boosts the precious metal. Signs of a slowing economy and a more dovish Fed could see gains extended.

Q2 earnings season has started and will continue on Monday, with Goldman Sachs and BlackRock scheduled to report later in the week. Bank of America, Morgan Stanley, and Netflix will update the market with their earnings results. Wall Street is expecting a strong earning season to support the lofty valuations.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.