While news around the cryptocurrency market has been mostly positive for the past few weeks, it was hit hard by a couple of concerns this week. Fears around crypto business tax as well as news surrounding Mt. Gox repayments saw the market tumble somewhat.

However, even with the market cap across the entire space falling some 20 percent, data on large holders of Bitcoin seemed to suggest that they are still happy to be holding on and even looking to accumulate more coins at these lower prices.

For the traditional markets, there were some big policy changes in the US that played their part in moving this around. The start of last week saw Biden signing the $1.2 trillion infrastructure bill into law, and at the end of the week, the House passed another bill – the $1.75 trillion Build Back Better Act.

Despite having news of two stimulus bills incoming, the markets did not seem bothered – the retail sales number, company results, and the COVID situation were what most traders were more obsessed about.

Stronger-than-expected October retail sales report led US stocks to a positive start and better-than-expected third-quarter results from Home Depot and Walmart continued to boost stocks higher.

The latest retail sales figures for October showed consumers were increasing their spending, with sales jumping 1.7%. That compares to a 0.8% increase in the prior month. The strong report shows that despite record-setting inflation, consumers were still spending.

However, by the end of the week, traders started getting concerned over COVID lockdown situations in other countries and a spat of selling on airlines and travel stocks took place. As a result, the Dow ended down 1.3% for the week, while the S&P managed to finish 0.3% higher. Since technology would not be adversely affected by lockdowns, the tech-heavy Nasdaq got a 1.2% boost.

Needless to say, an increasing number of lockdowns would not benefit oil demand, and as a result, the price of Oil dropped 6% over the week, now firmly below $80 at $75.80.

Gold and Silver were also a tad lower as the USD gained ground over the week. Likewise, a stronger dollar did not benefit the cryptocurrency market as the nascent sector drifted lower all week, only to pose slight gains after the traditional markets came to a close on Friday.

Fear Over Crypto Tax Impact Sent Prices Tumbling

While the passing of a stimulus bill is usually good news for cryptocurrencies, this time is different as this bill includes a tax that would be imposed on crypto businesses. Worries about the definition of crypto businesses that would be subject to tax dragged the market lower all through the week.

To make things worse, the market mood was further soured when it was reported that Twitter’s CFO said that investing in cryptocurrencies like BTC now does not make sense. Then on Wednesday, news that Mt Gox to return around $9 billion worth, or 141,000 BTC to their original owners, sent the price of BTC dipping below $60,000 to a low of $55,500 as the market got worried about the new supply of BTC that could be flooding the market.

Long Term Holders and Whales Unperturbed by BTC Drop

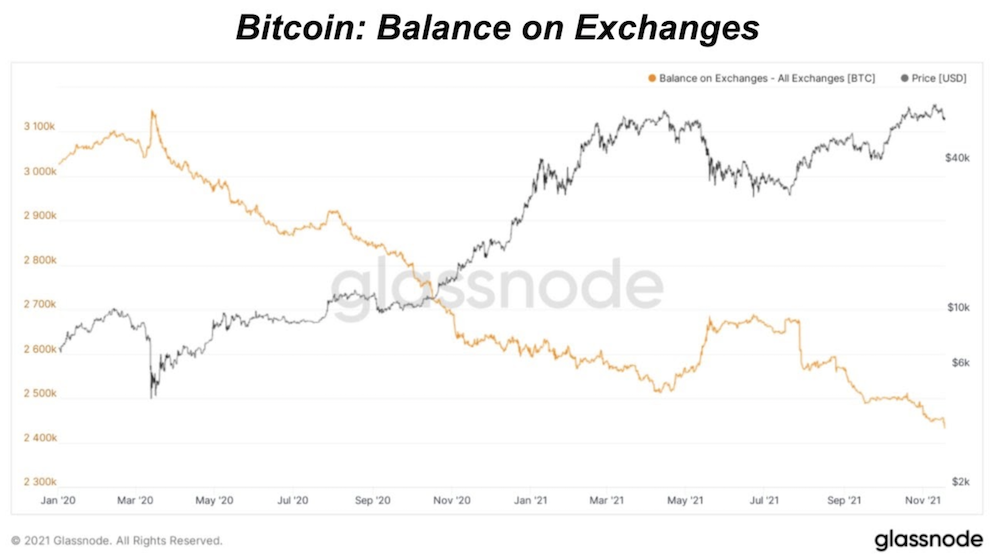

While BTC began a slow grind down 20% over the course of the week, the third-largest BTC wallet was revealed to have been accumulating during the dip. In total, this whale had added more than 3,000 BTC, the most aggressive addition since the September correction. As a result of dip accumulation, the BTC balance on exchanges continues to drop, implying that many had been buying the dip.

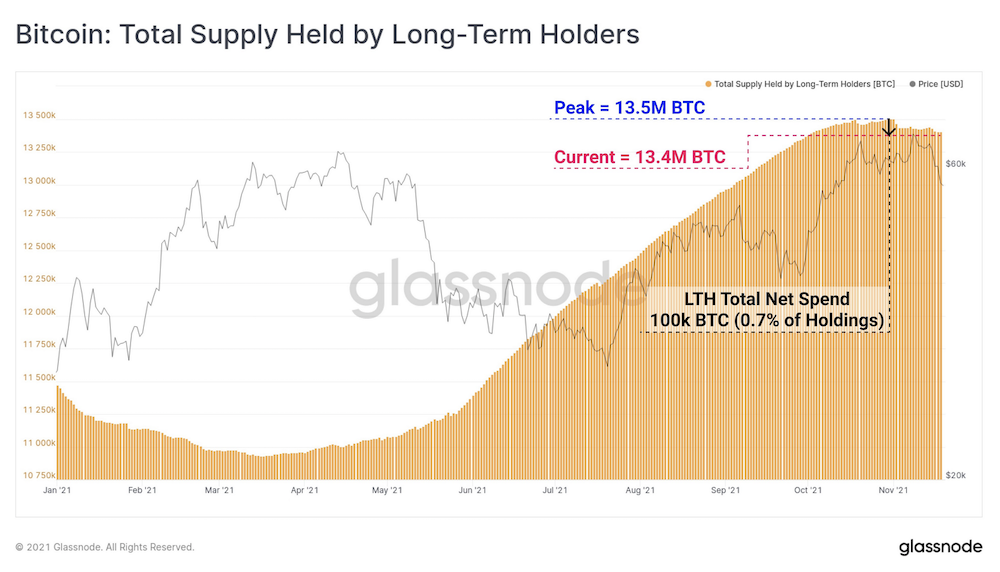

BTC long-term holders (LTH) also did not seem disturbed by the 20% dip in price as not many had sold into the price weakness.

After peaking at 13.5 million BTC, LTHs have only distributed 100,00 BTC over the last month, representing just 0.7% of their total holdings, and did not seem to have sold any BTC during last week’s dip.

Market Could Be Overly Bearish BTC

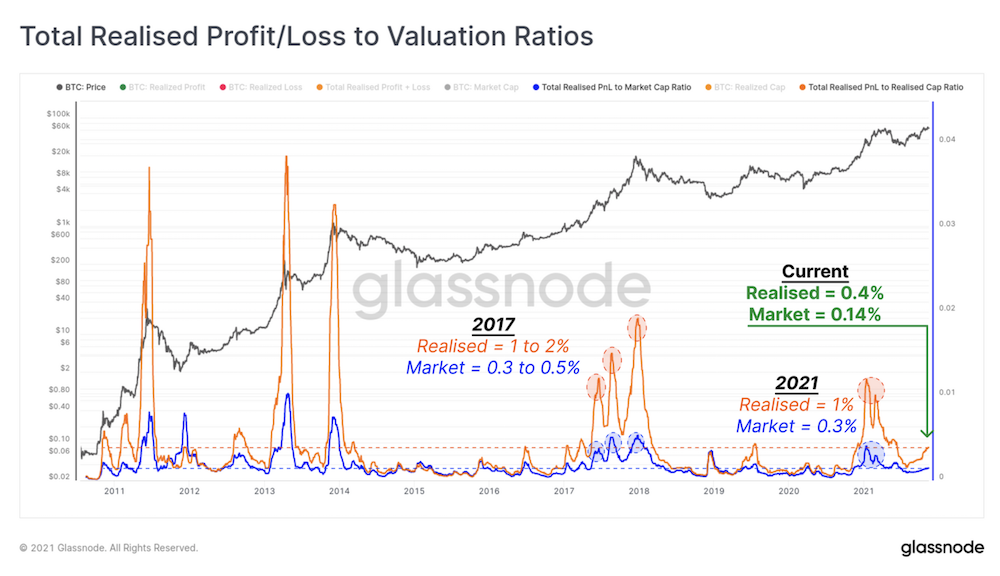

One reason why many LTHs were not worried about the relatively large dip could be because, while the price of BTC had been weakening, its realized value has been trending up, implying an increasing real value of the network. The Market Value to Realised Value (MVRV) has been dropping since November, implying that the market could be overly bearish since market value (perceived value) had been falling in spite of the realized value (actual value) rising.

Previous market tops occurred when total value realized by spending exceeded 0.3% of the market cap, and 1.0% of the Realised Cap (often reaching much higher). In the current market, spending accounts for less than 50% of these thresholds. This provides additional evidence that the current healthy bull market demand should be capable of absorbing significantly more coin distribution.

BTC has other good news in its favor in that payments app Square has launched a DEX for BTC. This DEX is built and runs on the BTC network, aiming to let users participate in DeFi on the BTC network just like those in ETH, and could include fiat currency on top of cryptocurrency.

ETH Falling Out of Favor

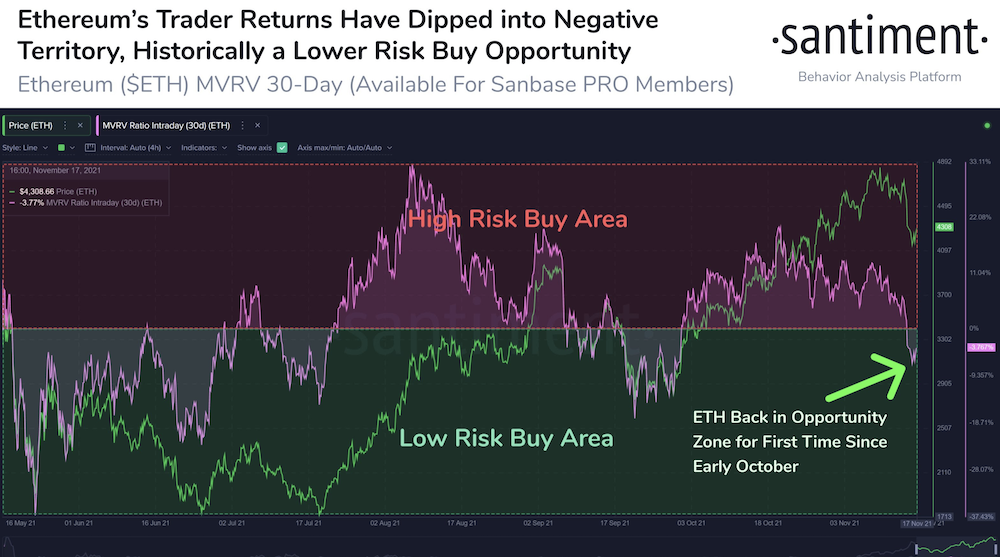

While BTC has positive developments, the situation does not look as good for ETH. While the MVRV of ETH has also fallen into a low-risk buy-zone just like BTC, the interest amongst traders in ETH has been on a decline.

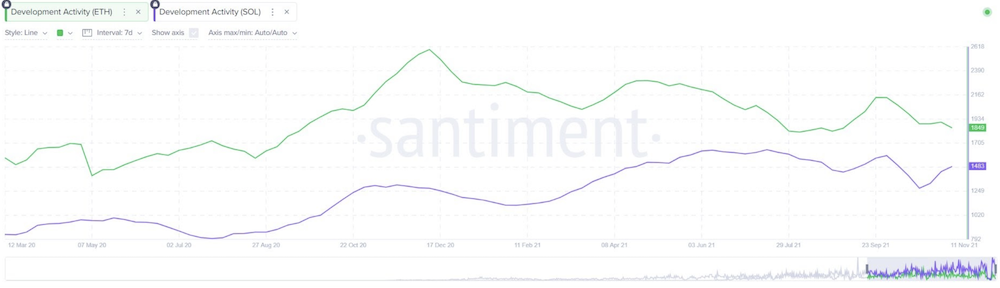

This could be due to better developments on other competitive blockchains like AVAX and SOL. For instance, despite being the chain with the most developer activities, this rate of growth on the ETH blockchain has been on a decline, meaning the number of developers building on ETH is increasing, but on a decreasing trend. However, that of SOL has been on a tear, growing faster than that on ETH. Should this trend continue, developer activity on SOL could eventually beat ETH – this could result in investors buying SOL as a hedge against ETH, or ultimately replacing ETH as an investment.

Some ETH LTHs were seen disposing of the highest amount of ETH ever on Thursday.

More than 1.6% supply of 5 years to 7 years old coins were sold off. The coin days destroyed also included coins between the age of 3 years to 5 years.

This could mean that either LTHs holders of ETH were cashing out, or that they were losing confidence in ETH and decided to take some money off the table.

While ETH could rebound as the rest of the market rebounds, the gains on ETH relative to that of other competitor blockchains could lessen should traders continue to favor other newer blockchains to ETH. In this regard, other blockchains with smart contract capability, like SOL and AVAX, could become the biggest beneficiary.

Current Market Situation

As for the current market situation, even though price has come off by quite a big margin, the amount of liquidation is mild, being less than $1 billion for the entire week. This goes to show that the market is not excessively leveraged, with the average BTC funding rate also at a low positive number.

As the Fear and Greed Index for Crypto finally dips below 50 in “Fear Zone” after a sustained period of being in “Greed” zone, and the RSI for BTC is also at an oversold region of 45, there is a chance the crypto market could stage a bounce in the coming days ahead.

Over the weekend, the price of BTC and most altcoins have managed to stage some kind of bounce, with altcoins like SOL and AVAX outperforming BTC in terms of percentage gains. AVAX has even managed to carve out a new ATH of $147 in the process in what seems like a catch-up play as all its peers have already made a couple of new ATHs.

The rotational theme is also revisiting the Metaverse tokens, with MANA and SAND breaking $4 each, with double-digit price advances daily.

Should the price of BTC continue to stabilize or even move higher, rotational plays on altcoins could continue to give good returns. However, whether or not BTC could continue marching higher from here remains to be seen, as the crypto market is opening the new week continuing last week’s weakness.

About Kim Chua, PrimeXBT Market Analyst:

Kim Chua is an institutional trading specialist with a track record of success that extends across leading banks including Deutsche Bank, China Merchants Bank, and more. Chua later launched a hedge fund that consistently achieved triple-digit returns for seven years. Chua is also an educator at heart who developed her own proprietary trading curriculum to pass her knowledge down to a new generation of analysts. Kim Chua actively follows both traditional and cryptocurrency markets closely and is eager to find future investment and trading opportunities as the two vastly different asset classes begin to converge.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.