It has been an extremely strange time in the cryptocurrency space as many of the major digital currencies feel what it is like to be exposed to mainstream media phenomenon while still being highly volatile assets.

Elon Musk, the eccentric head of Tesla and SpaceX has done a U-Turn on Bitcoin by stating the coin is an environmental threat and that his company will no longer accept the asset as payment for its electric cars.

This take on Bitcoin has been met by resistance from staunch supporters, but the market has reacted poorly as the price of the coin has slumped on the news that Musk is no longer such a huge fan.

However, the altcoin space is also stuffing from its own extraordinary news bursts as Ethereum continues to show its fundamentals and skyrocket in price, but Vitalik Buterin, the co-founder of Ethereum, has done damage to a few dog-themed coins.

A major donation from Buterin in a new coin that took its lead from DogeCoin saw the price of SHIB tank and the rest of the coins that have sprouted up around Doge fall back.

In the mainstream space, things have also been a bit wild as Wall Street had a bloody week as stocks plunged for the most part of the week due to fears about rising inflation. Wednesday’s CPI report showing a sharp rise in consumer prices last month furthered concerns that inflation may lead the FED to raise interest rates sooner than expected, undercutting the year’s massive stock gains.

This is despite earlier assurances by FED Chief Powell that the inflation would be transitory and the FED would not act until there is clear evidence that the economy has mended.

Reflecting the rising fears of inflation, yields on the 10-year Treasury climbed 8 basis points Wednesday to 1.69%, their highest level in more than a month. This prompted FED officials to come out to soothe the markets, reassuring that the inflation was transitory and that the FED had no plan to raise interest rates anytime soon. This finally managed to calm risk-assets and traders turned to buying the dip, with US major indices rebounding around 50% towards the end of the week.

The Dow was down 5% on the week at its lowest point but managed to close only 2.5% lower after reclaiming half of its losses. It was a similar story with the S&P and Nasdaq, both closing the week down 2.5% after recouping losses. S&P closed the week at 4,179, while Nasdaq closed at 13,410.

There was a flight to USD early last week when every other asset sold off, with Gold and Silver also lower, but recovering and moving higher as we start the new week. The DXY fell back to 90.3 after surging to almost 91.0 early week. Gold and Silver may benefit from some fund rotation out of BTC into other inflation hedges after Tesla’s bombshell. Gold is up 0.5% while Silver is up 0.8% and closing in on $28 as chatter about a Silver squeeze intensifies.

Only Oil was somewhat unchanged for the week, with tension between Israel and Palestine expected to put a bid under the energy sector as a whole. Crude closed the week a tad higher at $65.50 but is expected to move higher this week as tensions in the Gaza strip escalate. Oil is opening the new week up 0.5%.

Tesla and Elon Drop Bombshell on BTC

As if it wasn’t already bad enough for cryptocurrencies where stock market fears spilled over to send prices lower, Elon Musk and Tesla made it worse for crypto investors by dropping a bombshell of a news that instantly sent prices tanking within minutes.

Tesla walked back on its previous commitment to allow BTC to be used to make payment for Tesla purchases, not allowing purchases to be made using BTC with immediate effect, citing concerns over the increasing use of fossil fuels for BTC mining and transactions.

This shock came like a bolt from the blue, sending prices across the entire crypto-verse tanking, with BTC falling 15% within 30 minutes to a low of $47,000. While the firm did not rule out accepting other more energy-efficient cryptos, the timing of the announcement, made during the time of the day when liquidity was at its lowest – when US markets had closed while before Asia begins its new day, sent prices cascading downwards very quickly.

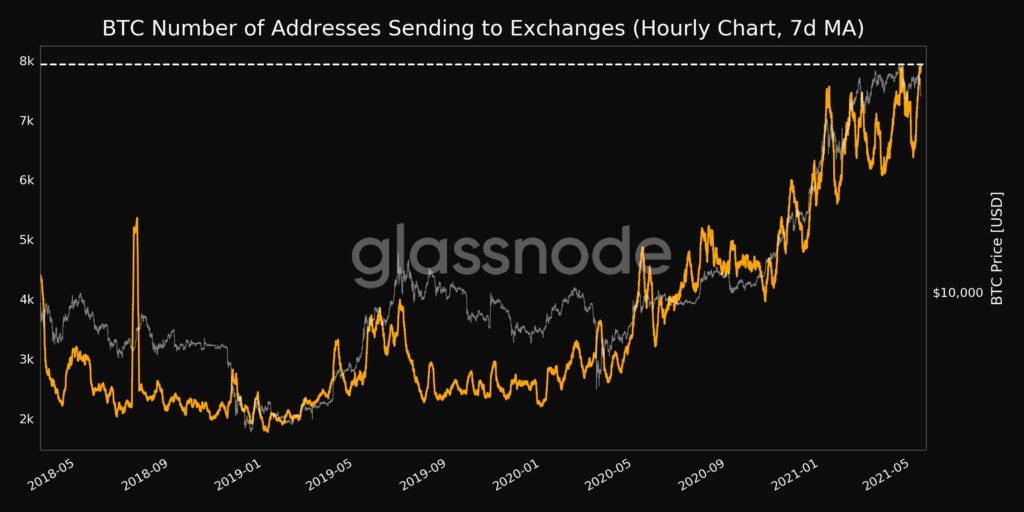

Even though prices fell rather badly, the number of liquidations were somewhat muted when compared with April, perhaps due to the market already looking precarious after BTC was rejected at its $58,700 resistance days earlier. With BTC already showing signs of faltering, the number of BTC addresses that sent BTC to exchanges started spiking up to 7,928, a 3-year high, on 12 May, with the record beaten in just 1 day to 7,932 addresses after Tesla’s announcement.

This suggests that the failure at $58,700 was a key turning point for investors of BTC, at least in the short-term, as BTC was beginning to lose its shine relative to the recent performance of ETH and other altcoins. The situation then got exacerbated by Tesla.

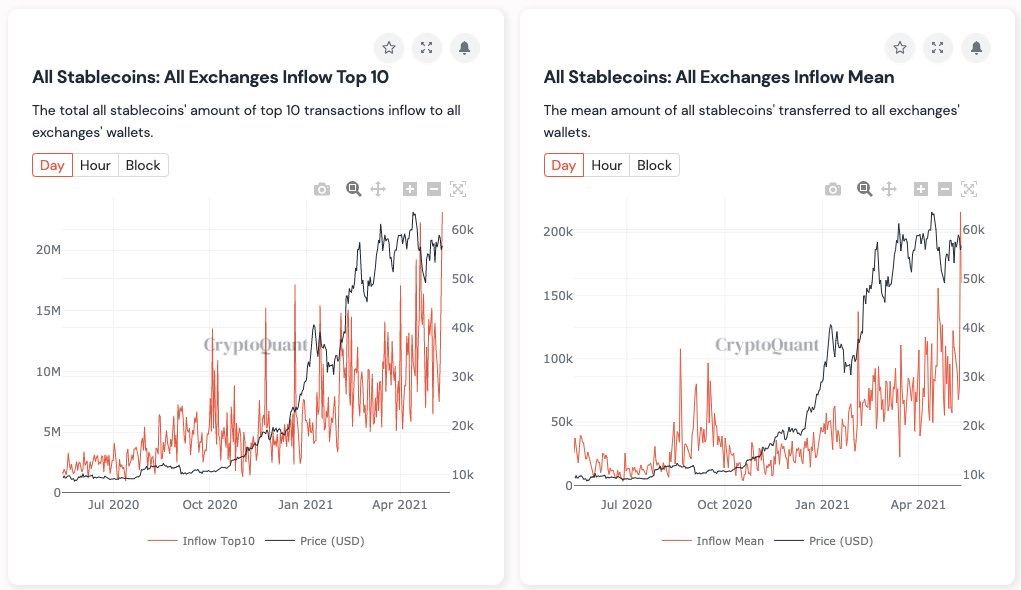

However, crypto prices ex-BTC recovered quite quickly as many investors with stablecoin reserves at exchanges took the opportunity to buy the dip. Stablecoin reserves were at their ATH before the announcement, which meant that a lot of idle crypto-native funds were available to scoop up any firesale quickly.

The price of BTC recovered above $50,000 at one point, but continued to slide as even Square, who used to be an advocate of BTC, also announced that despite still continuing to support BTC, the firm will no longer be adding BTC to their reserves, citing the same environmental concern as Tesla. Only MicroStrategy, BTC’s permabull, revealed that they had added more BTC during the selloff, spending another $15 million to purchase 271 BTC at the average price of $55,387.

This, however, only raised the average price of all MicroStrategy’s 91,850 BTC holding to an average price of around $24,403.

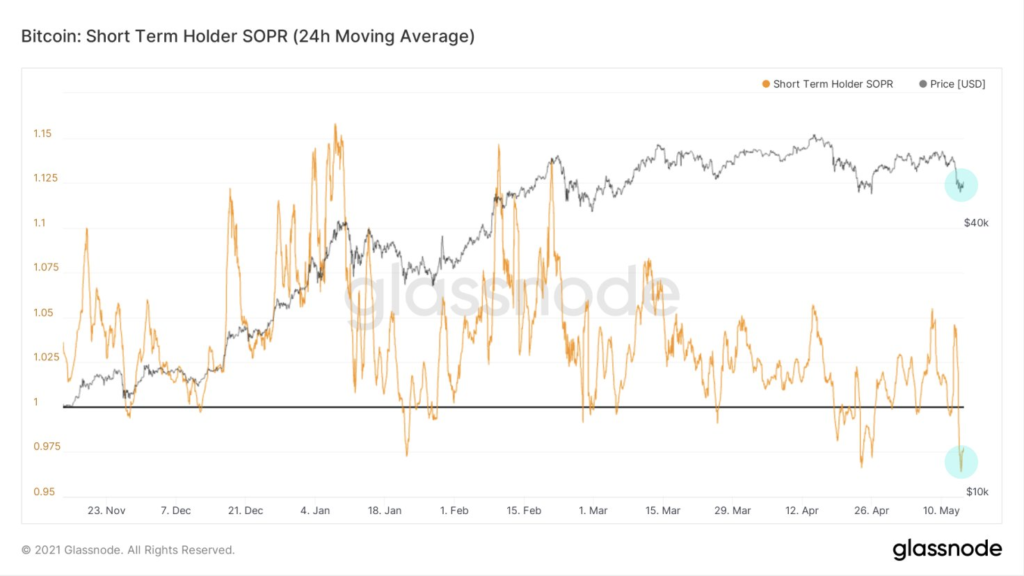

While it looks gloomy for BTC in the near-term, long-term outlook still looks bullish, with the SOPR index indicating a possible bottoming for BTC.

Whenever SOPR goes negative, price may stage a rebound afterwards.

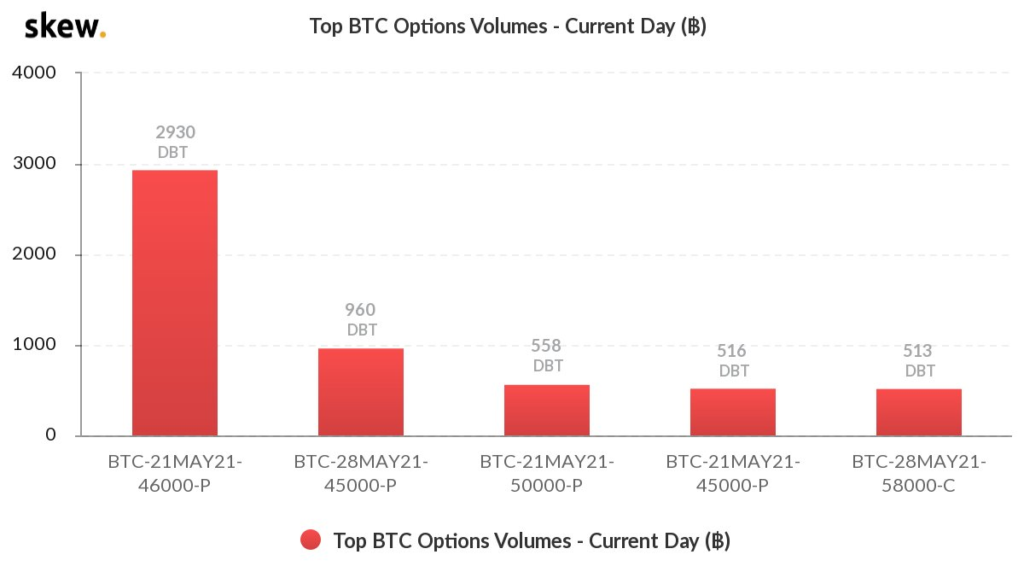

Large Put Option Expiry May Pressure BTC Price

However, one thing to note is that there has been a sharp increase in the number of put options purchased in the BTC options market, suggesting that traders are leaning towards bearishness in the price of BTC. These options have a strike price of $46,000 and will expire this coming Friday, 21 May, which may cap any big movement in the price of BTC until after these options expire. As such, the price of BTC may still come under pressure this week.

BTC has also started trading in backwardation on CME (meaning spot prices are higher than futures price), confirming that institutional investors are getting more bearish on BTC in the near-term. Purpose BTC ETF has also seen a 20% fund outflow in their flagship BTC ETF, putting its AUM now less than $1 billion.

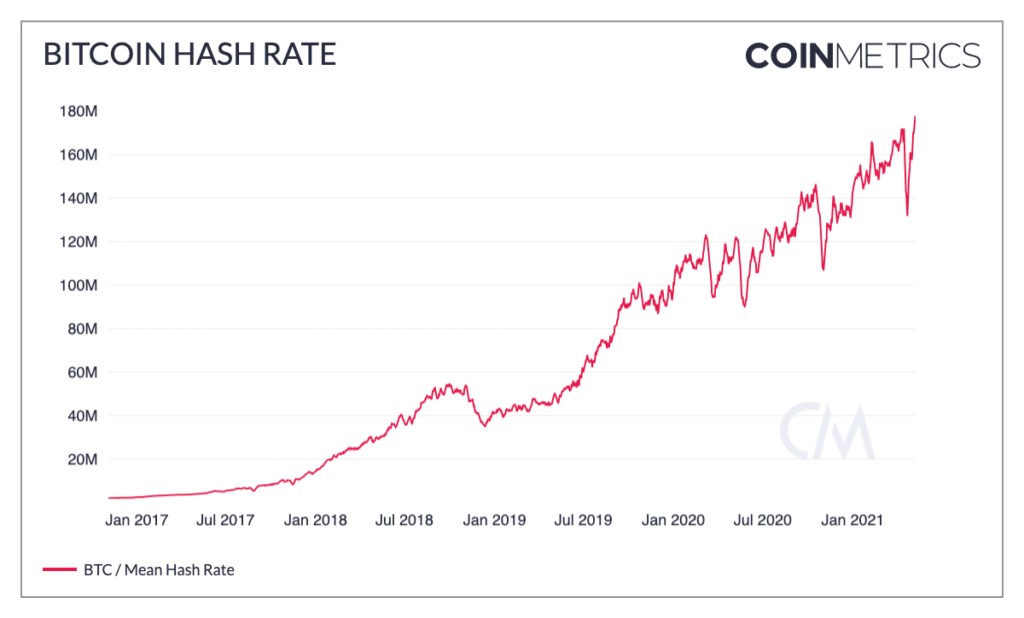

Despite institutions having a near-term bearishness on the price of BTC, network health has returned to previous levels and in fact, has improved further as the hash rate for BTC has fully recovered from the March Xinjiang power shutdown that caused its hash rate to drop by 45% abruptly. This could mean that the price of BTC could eventually recover to move higher after this short-term bearishness is over since price always follows hash rate. A new ATH for BTC hash rate is a positive indication that BTC price could carve out a new ATH not long after.

Furthermore, Tesla has mentioned that it will be happy to accept BTC again when its environmental issues are resolved. Already, Greenidge Generation, a huge natural gas-powered BTC mining operation in upstate New York, announced on Friday that it will go carbon neutral by the start of June. The Tesla setback could only be a temporary pain for a long-term gain for BTC.

ETH Zoomed Pass $4,300 On Liquidity Crisis Buying

It wasn’t all gloom and doom for select altcoins during the week though, the price of ETH exploded past $4,000 to a high of $4,372 before pulling back after Tesla’s announcement. Even though price had pulled back, the outlook still looks good for ETH with only 2 months more to the launch of EIP 1559.

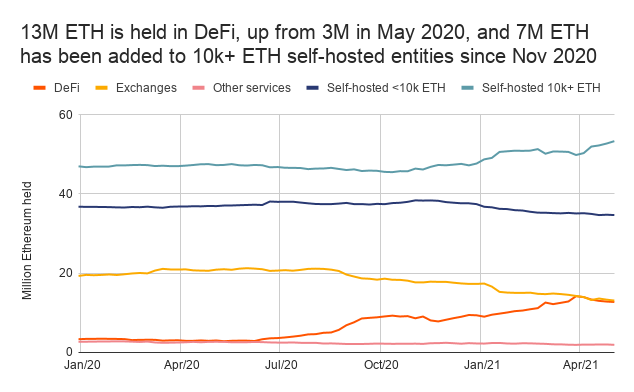

Use of ETH on DeFi continues to see growth, locking up 13 million units of ETH, which is around 11% of the entire supply. Meanwhile, old ETH whales with more than 10 million ETH continue to add ETH, with them accounting for around 39% of ETH’s entire supply now. This means that currently, around half of the entire supply of ETH is being locked away by DeFi and whales. This supply crisis is expected to greatly intensify once EIP 1559 launches in July.

Low-Emission Coins Had Short-Lived Rally After Elon Seems To Only Want DOGE

While BTC came under fire for its damage to the environment, a stage was set for altcoins that are a lot more energy-efficient. Altcoins like XRP, NANO, HBAR, who consume the least energy amongst cryptocurrencies thus saw good double-digit gains.

However, Elon Musk seems only interested in using DOGE, with him tweeting that he was working with DOGE developers to improve the DOGE network after Tesla dropped BTC. This reversed a bad week for DOGE, which saw its price plummet 35% to a low of $.35 before the Dogefather sent it back above $0.50 with this tweet, sending it up 25% within minutes.

Coinbase’s revelation that it would be listing DOGE within the coming 2 months also added lots of cheer to the original Dog-inspired memecoin that was losing its pundits to other series of copycats.

Other dog-themed tokens rallied strongly, with obscure tokens like AKITA, LEASH, KISHU, and SHIB gaining massively. SHIB, an ERC-20 copycat of DOGE, rallied 1,000% on a listing by a popular exchange but has since given up 70% of its gains after Vitalik Buterin, who was gifted 50% of the total supply of SHIB, regifted most of them to an India Covid rescue fund.

Vitalik also gifted 1,500 ETH in total to the fund, which caused the price of ETH to drop back below $4,000. ETH price, however, is finding support around the $3,700 level over the weekend, while the other dog-themed “copydogs” are plunging.

Altcoin Rotation Continues, EOS Jumps On New Crypto Exchange Plan

The week also saw explosive gains for ADA and MATIC. MATIC broke out of consolidation and immediately raced to double its price in a week that was filled with crypto blood, a sign of how undervalued the token is in the midst of exponentially increasing demand for the token from DeFi projects. Cardano, who announced that it was preparing to start its Alonzo testnet on Thursday, saw the price of its native token ADA, spring up 50% after clearing the $1.50 resistance to race towards $2.50.

EOS too, exploded 60% to a 3-year high of $15 as its holding company, BlockOne, secures $10 billion funding to launch a new crypto exchange aptly named Bullish, to be built and run on the EOS network.

The exchange is expected to give current DeFi projects a run for their money with its Central Order Book System where traders can see bid-ask queues like on a centralized exchange, unlike the Automated Market Maker (AMM) System that is the norm of current decentralized exchanges. The ease of trading with a visible order book could potentially bring lots of traders into the EOS ecosystem and revive activity on the EOS blockchain.

Crypto Top 10 Sees a New Entry

Other news that made headlines was the entry of a new token listing into the crypto top 10. Internet Computer (ICP), a new listing on various big exchanges simultaneously last week, immediately hit the number 4 spot on the crypto top 10 straight off the bat. However, heavy selling subsequently sent the price back down and the token settled at number 9, inching out BCH which is now at the 10th place.

ICP aims to solve the problem of centralized server storage. With its network of independent data centers, apps will be able to run on the network itself. This is in contrast to the current internet, where apps run on servers. With ICP, the software has no fixed physical address as it moves between servers run by the independent data centers. This means apps can exist that nobody owns or controls.

With a new entry making its way into the crypto top 10 this quickly, the crypto top 10 is again reshuffling at top speed, with ADA already inching into number 4, hot on the heels of BNB after its steady rise last week. DOGE is now number 5, while XRP maintains the 7th position. However, these positions are highly likely to change again this week.

Tesla and Elon Musk’s decision has drawn the irk of many BTC maximalists, who have taken to Twitter to attack the billionaire for bashing BTC. However, the man responded by criticizing BTC even more, revealing that he thought BTC was too centralized late Sunday night, causing yet another sell-down in crypto prices.

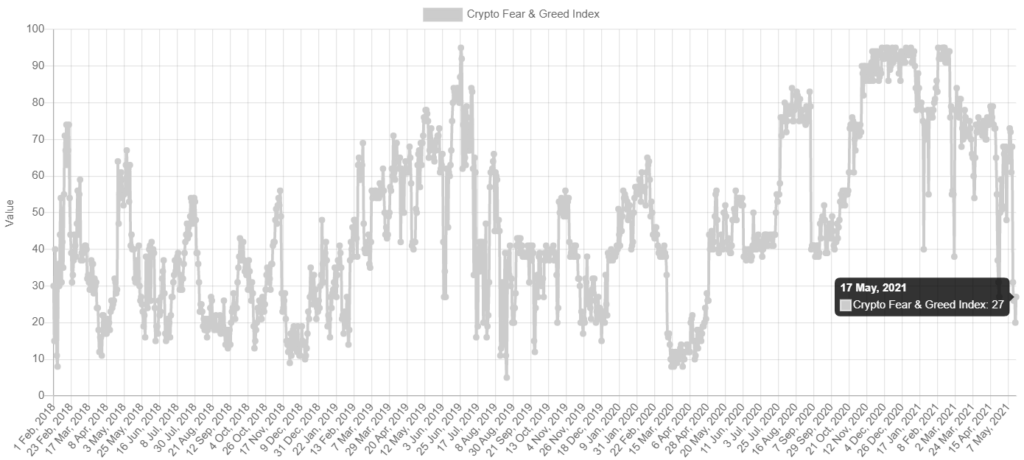

With all that selling, the Crypto Greed & Fear Sentiment Index has finally fallen into the Fear area after remaining at the Greed area for a month. The index is closing in on the level only last seen during the Covid-induced selloff last year, which traditionally indicates that this could be a great opportunity to buy.

About Kim Chua, PrimeXBT Market Analyst:

Kim Chua is an institutional trading specialist with a track record of success that extends across leading banks including Deutsche Bank, China Merchants Bank, and more. Chua later launched a hedge fund that consistently achieved triple-digit returns for seven years. Chua is also an educator at heart who developed her own proprietary trading curriculum to pass her knowledge down to a new generation of analysts. Kim Chua actively follows both traditional and cryptocurrency markets closely and is eager to find future investment and trading opportunities as the two vastly different asset classes begin to converge.

The information provided does not constitute, in any way, a solicitation or inducement to buy or sell cryptocurrencies, derivatives, foreign exchange products, CFDs, securities and similar products. Comments and analysis reflect the views of different external and internal analysts at any given time and are subject to change at any time. Moreover, they can not constitute a commitment or guarantee on the part of PrimeXBT. The recipient acknowledges and agrees that by their very nature any investment in a financial instrument is of a random nature and therefore any such investment constitutes a risky investment for which the recipient is solely responsible. It is specified that the past performance of a financial product does not prejudge in any way their future performance. The foreign exchange market and derivatives such as CFDs (Contracts for Difference), Non-Deliverable Bitcoin Settled Products and Short-Term Bitcoin Settled Contracts involve a high degree of risk. They require a good level of financial knowledge and experience. PrimeXBT recommends the consultation of a financial professional who would have a perfect knowledge of the financial and patrimonial situation of the recipient of this message and would be able to verify that the financial products mentioned are adapted to the said situation and the financial objectives pursued.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.