In a holiday shortened week, a good showing from tech stocks on the last trading day managed to help US equities recoup some losses despite the ADP jobs report warning about a weakening labor market.

For the week, the Dow rose 0.6%, the S&P lost 0.1%, while the Nasdaq fell 1.1%.

The market remained volatile as the latest weekly jobless claims came in higher than expected, adding to recent signals that pointed to slowing job growth. The ADP private payrolls job report released on Wednesday was also well below expectations. With the weaker numbers, the narrative on Wall Street has now shifted into a cautious recession-stagflation play as investors are preparing for more weak economic data to come out from the US, while at the same time, expecting the Fed to remain hawkish in light of high inflation expectations painted by Fed speakers who had voiced their opinions over the past week.

Expectations for the Fed to continue to raise rates in May have been raised after another central bank, this time the Bank of New Zealand, delivered a surprise higher-than-expected 50-bps rate hike last week. This expectation has managed to cap losses on the dollar, which traded flat against a basket of other currencies.

Gold however, managed to climb higher in spite of the firmer dollar, breaking into the $2,000 barrier after gaining 2.56%, while Silver fared even better on talks of a physical supply shortage, rising 4.8%.

Oil rallied after OPEC+ announced an unexpected production cut of 1.16 million barrels per day, a move that oil traders were not expecting. The voluntary cuts by countries in the oil cartel are set to start in May and last till the end of 2023. Both Saudi Arabia and Russia will trim oil production by 500,000 barrels per day until the end of this year, while other OPEC members like Kuwait, Oman, Iraq, Algeria and Kazakhstan are also reducing output.

As a result, Brent rose 8% and the WTI rose 8.2%. With both distillates breaking back into the $80s, talks of $100 oil have resurfaced even amidst threats of a global recession.

In the world of cryptocurrencies, nothing major happened, with prices of most cryptocurrencies still locked in a narrow trading range. BTC was relatively quieter compared with altcoins, coiling around the $28,000 level for the third week. The only major news came from MicroStrategy, which announced that it has acquired an additional 1,045 BTC at an average price of $28,016 per coin. With this purchase, MicroStrategy now holds 140,000 BTC acquired for a total $4.17 billion at an average price of $29,803 per coin.

The lack of breakthrough in the price of BTC has caused some short-term speculators to throw in the towel, as they cut small losses to leave the market instead of holding on to their trades.

BTC Speculators Losing Patience

Last week, traders were transacting BTC at a loss at twice the rate of profit after BTC consolidated for the third week. This is the first time this ratio has been negative in 5 weeks, and is actually a good sign that the speculators are giving up on hopes of a rally.

Whether this phenomenon would cause a contrarian move in the price of BTC upwards remains to be seen, as the selling pressure from these short-term holders may cap any upswing in the price of BTC should their selling be persistent. However, with a major upgrade to take place on ETH this Wednesday, crypto prices may still bounce higher should the effects of the Shanghai upgrade turn out better than anticipated.

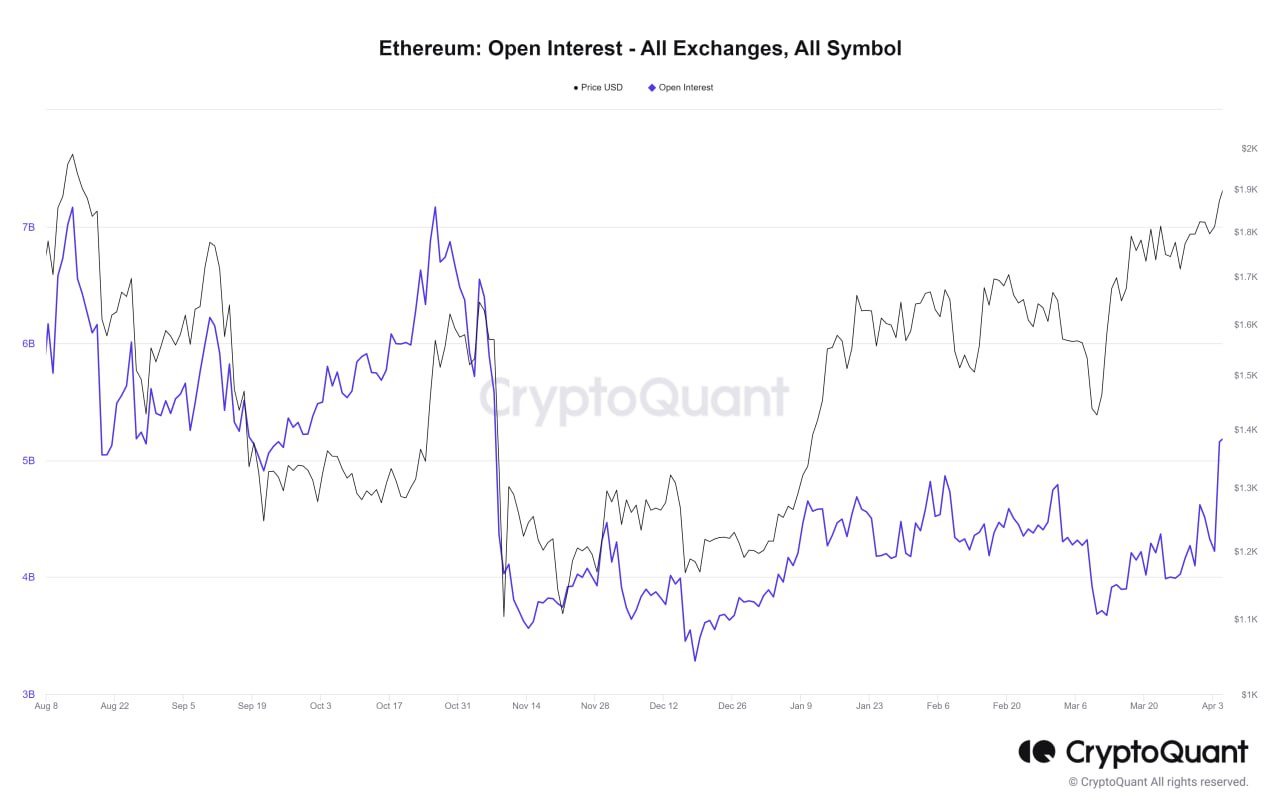

ETH Open Interest Surges as Shanghai Approaches

With the much-anticipated Shanghai upgrade due this Wednesday, 12 April, ETH rallied almost 20% last week to break $1,900 briefly, as investors positioned themselves for a successful upgrade.

As can be seen from the futures open interest on ETH, derivative positions have begun to be built on ETH, with interest seemingly to be on long positions as the open interest surged in tandem with a rise in price. However, price failed to sustain a move above $1,900, which could result in a possible short-term pullback as some over-leveraged positions may get flushed out.

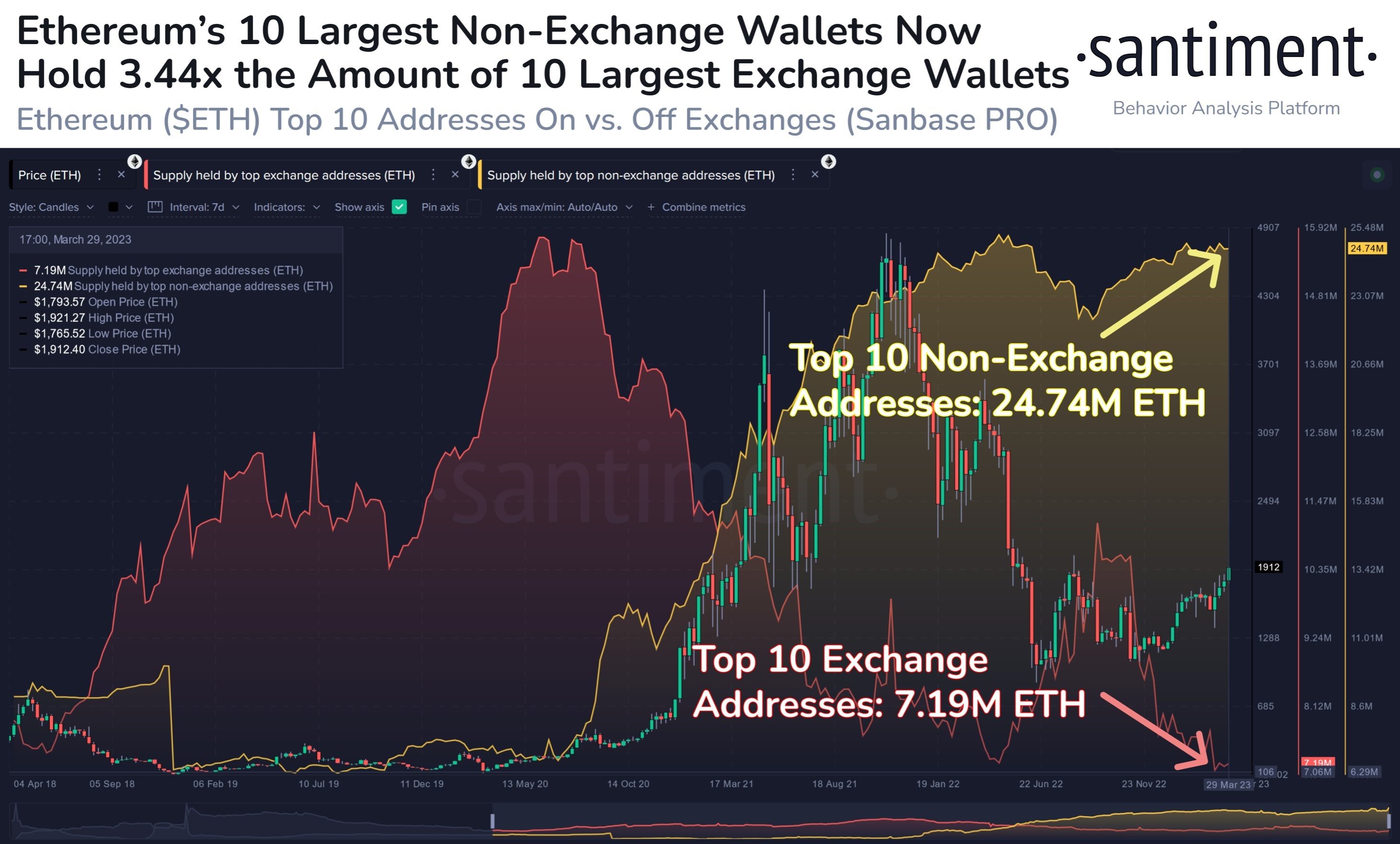

With the first batch of unstaking to come forth once Shanghai has transitioned, an estimated 1.1 million units of ETH are likely to get unstaked and possibly sold by stakers. The impact of this may be a short-term price pullback in the price of ETH, but the long-term aspect of a successful Shanghai upgrade should still hinge more on the positive once the initial batches of unstaked have been sold. This is especially so when the whale accumulation of ETH continues to look optimistic.

According to data, the supply of ETH on top 10 crypto exchange addresses has continued to decline sharply, while that on the top 10 non-exchange addresses has consistently increased. This shows that whales have been consistently buying and removing ETH supplies from the market, which is intensifying its scarcity.

Another ETH metric seems to be supportive of a bullish trend as well, as the MVRV-Z Score indicator is flashing a bottoming signal.

The MVRV Z-Score assesses when ETH is overvalued and undervalued relative to its fair value. As a rule, price moves into the red zone when its market value rises above its realized value, indicative of a price top, while when the opposite happens, it is often an indication of a price bottom when price enters the green zone.

Currently, ETH’s price has just bounced off the green zone, coinciding with ETH’s previous price recoveries in the previous cycles. In the past cycles, the price of ETH rose continuously for three months after a similar occurrence on the MVRV Z-score chart.

Could the same happen this time around?

Further to interest increasing on ETH, ETH liquid staking platform LDO has also seen increased buying interest, with its price rallying more than 13% last week. Should Shanghai be a success this week, the positive sentiment on ETH is expected to spillover to other ETH-related tokens like LDO.

DOGE Jumps Then Reverses Gains on Twitter Roller-Coaster

DOGE rallied more than 30% last week after Elon Musk changed the Twitter logo from the blue bird to the Shiba Inu dog that is the logo of DOGE. Days before the logo change, attorneys of Twitter and Musk asked a judge to dismiss a $258 billion lawsuit from 2022 that accused Musk of DOGE price manipulation. The latest move to change Twitter’s logo to that of DOGE was seen by the market as further hint that the meme coin will be integrated into Twitter’s ecosystem possibly as the main payment token.

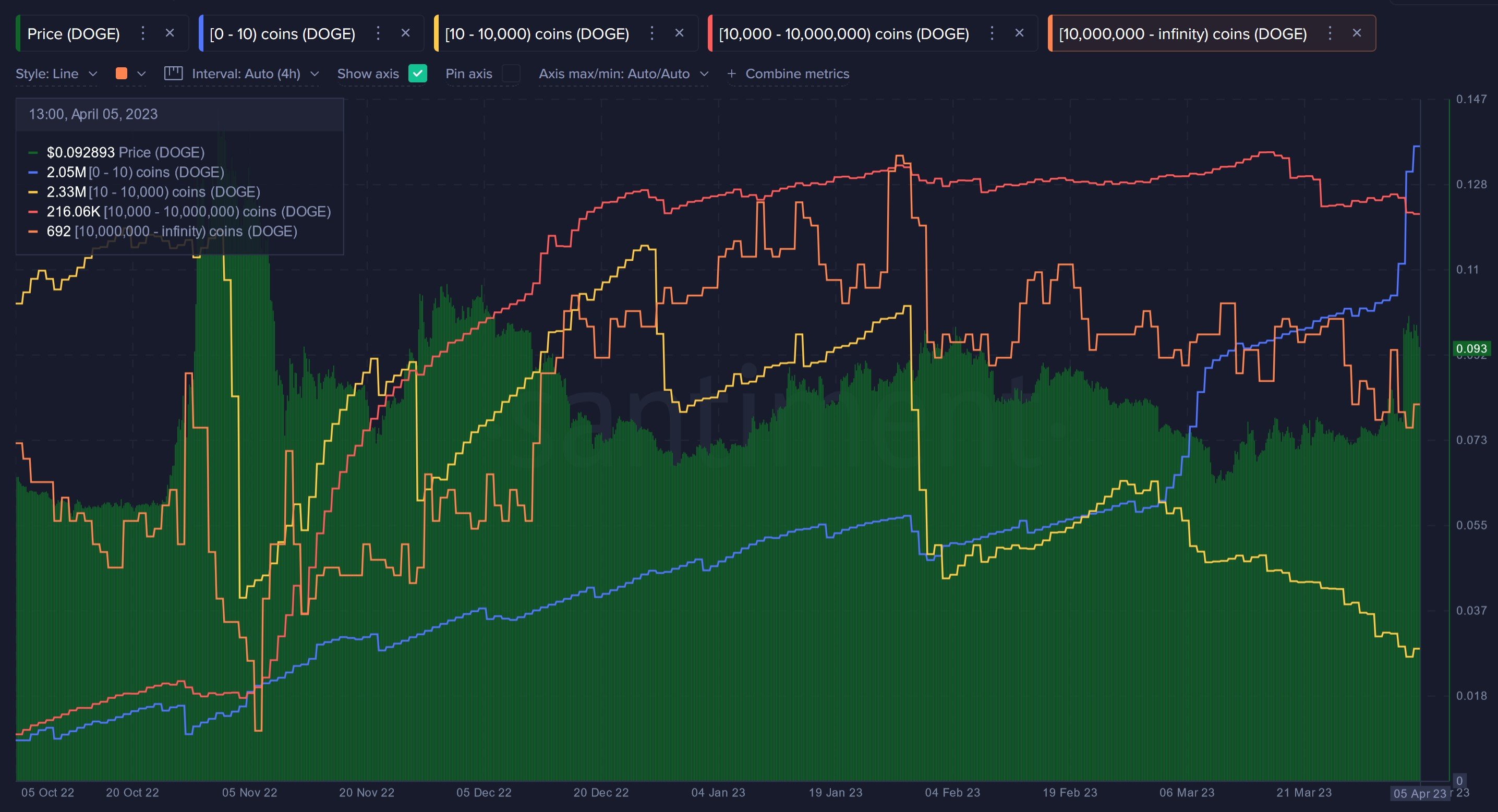

Over the week, as the price of DOGE surged, many large whale transactions have been spotted onchain, with a top-20 wallet sending coins to various unknown new DOGE wallets. This could hint of a top-20 wallet account taking advantage of the price surge to dispose of some coins via OTC transactions.

As can be seen from the data above, various large holders of DOGE are observed to have reduced their holdings while small holders have aggressively added to their holdings as the price of DOGE surged. This selling from whales has caused the price of DOGE to correct heavily in the following days. Further to that, on Thursday, Twitter removed the DOGE logo from its website and reverted to using the blue bird logo. This has caused the meme coin to fall further, giving back almost all of its gains made earlier. With such an episode, it will be difficult for the judge to rule in Elon’s favour regarding his DOGE price manipulation. There was even chatter that the whale wallets that sold the DOGE tokens belonged to Elon Musk.

Regardless of who sold and why Twitter did the reversal, it may be too early to write off the popular meme coin as it could still be possible that a DOGE-Twitter integration would be announced later.

Meanwhile, as the topic of judges has been brought up, the community of XRP were disappointed that the outcome of the Ripple-SEC lawsuit has been delayed as the judge overseeing the case says that she requires more time to properly study the case due to its significance on the entire crypto industry. Ripple was expecting a ruling last week but that has been postponed to an unknown later date. However, the ruling could still come in a matter of days or weeks and traders ought to be prepared for the outcome to come forth anytime. Trading volume on XRP has continued to surge on the back of this anticipation.

US CPI Report This Week To Determine Market Direction

Due to the Good Friday holiday in the USA, the US stock market has not had a chance to react to the non-farm payroll figures that were released on Friday yet. However, the numbers did not come in as a surprise, with nonfarm payrolls growing by 236,000 in March versus consensus estimates of 238,000.

The unemployment rate ticked lower to 3.5% amid an increase in labor force participation, against expectations that it would hold at 3.6%. However, the dollar rose after the release as traders were already prepared for a weak set of numbers after the miss on the ADP, so this came as no surprise.

This coming week, other than a few Fed speakers expected to voice their opinions, traders will be watching the important CPI numbers and poring through the Fed minutes of the last meeting, both to be released on Wednesday. For crypto traders, this Wednesday coincides with the ETH Shanghai fork, so possibly there could be heightened volatility in the crypto market, especially with ETH and ETH-related tokens.

To close off the week, Friday will see the release of the March retail sales number.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.