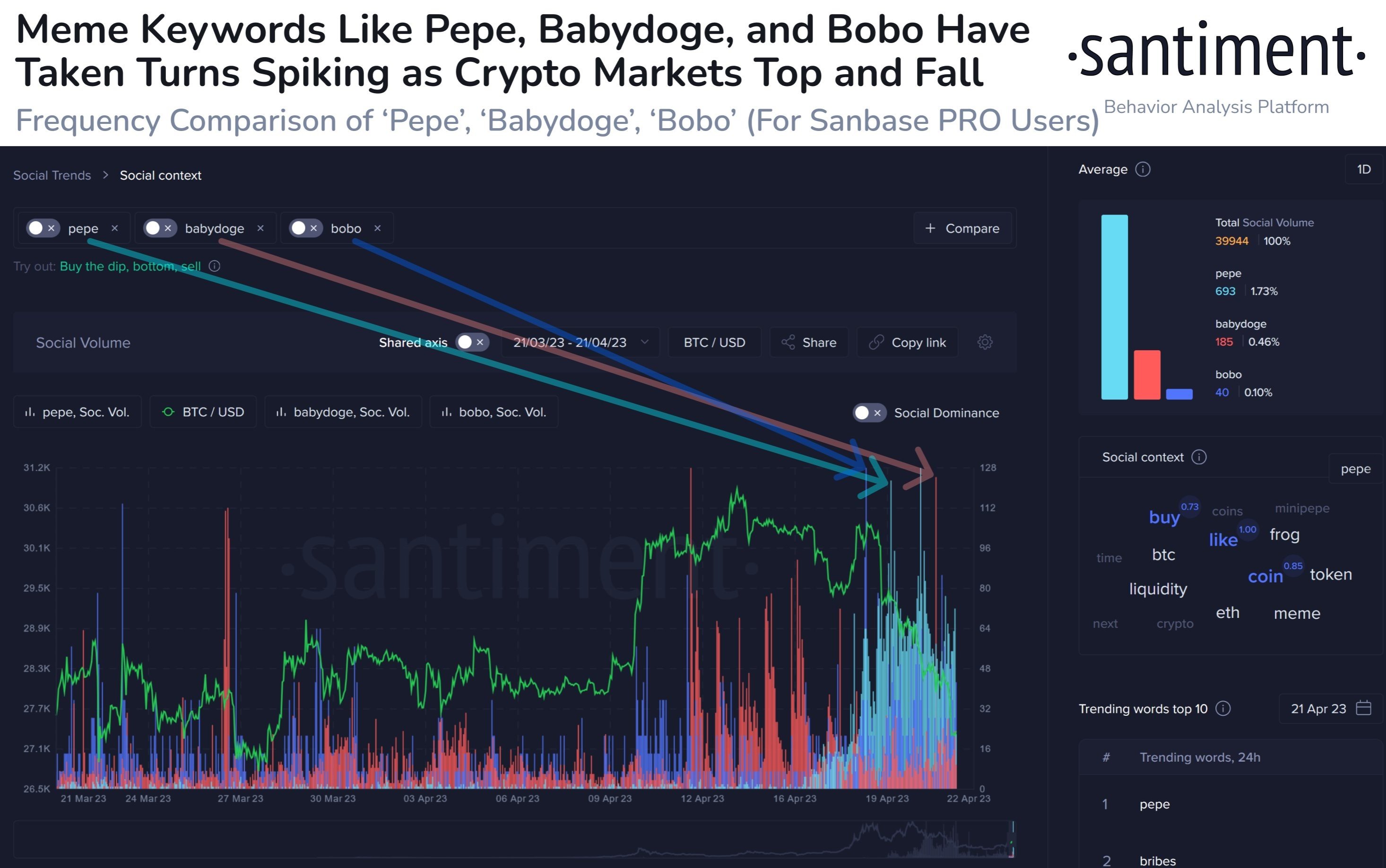

Crypto prices started last week on an optimistic note, with BTC holding above $30,000 and ETH seeming to want to push higher after its successful Shanghai upgrade. Even though both leading cryptos did not show signs of going in either direction, the broad market itself was showing signs of exuberance and frothiness as new meme coins started getting actively mentioned on social media. Previously unknown names like Pepe and Bobo were receiving very active mentions on crypto social media as their prices rose. In the past when similar occurrences happened, the crypto market sold off subsequently.

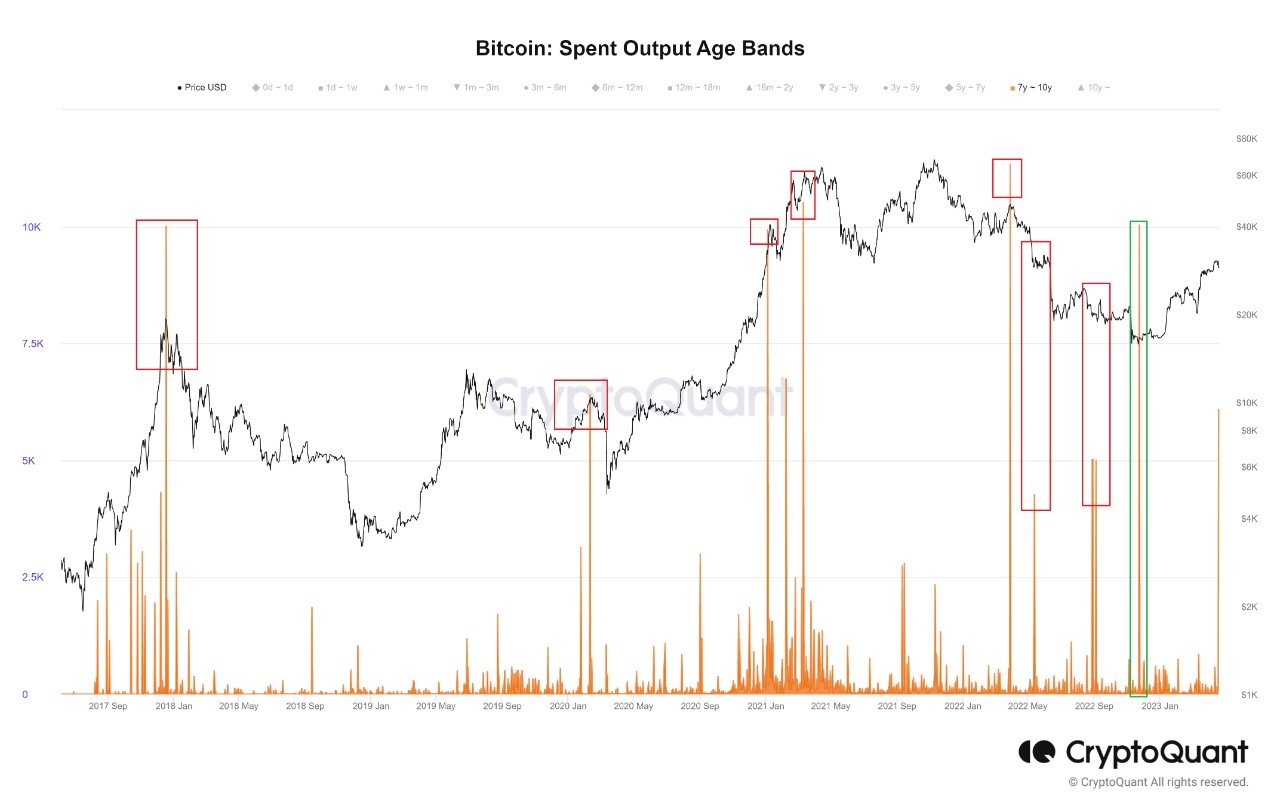

Indeed, as the week progressed and the price of BTC failed to break the $31,000 barrier, the Spent Output from BTC held between 7 to 10 years started to rise significantly – this means that a large number of BTC that has been held between 7 to 10 years have been sold. In most cases in the past where the 7 to 10 year Spent Output spiked suddenly, the price of BTC witnessed a correction almost immediately.

The selloff this time began early Wednesday morning when the price of BTC underwent a flash dip from $30,000 to $29,000 within minutes and subsequently drifted lower. By the end of the week, BTC’s price had fallen to a low of $27,100 and has been consolidating around $27,500 since.

The exact reason for the flash dip is unknown, however, the date of the flash dip coincided with the day that ETH staked through Binance could be withdrawn, which was 19 April. As the price of ETH dipped much more than BTC, crashing 10% from above $2,100 to $1,900 within the same timeframe, it is not unreasonable to assume that the anticipation of a large price dip in ETH may have led some large traders to dump on the market at a time when the funding rates were beginning to show excessive bullishness from retail investors.

Old ETH whales May have caused dip

Further analysis of ETH metrics however, reveals that the ETH price dip was not only led by short-term traders but in a big way, caused by whales who have held ETH since 2018 selling.

According to data, two large whale wallets which had bought 150,000 ETH in November 2018 dumped their entire holdings just one day before the flash dip on the 19th. These two whales bought their stash of ETH when its price was below $125 and held all the way till 18 April when they sold everything. Could their sale imply that they knew something that the market did not, or was it simply a coincidence?

BTC balance on exchanges still high

As for BTC, beginning from the 13th, exchanges have been witnessing an influx of BTC inflow, which usually are sent for sale. Despite the price of BTC having pulled back by 10% since, the amount of BTC sitting on exchanges currently is still higher than it was a week before, which may continue to add pressure on BTC’s price. Another 10,000 to 20,000 BTC could possibly be waiting to be sold.

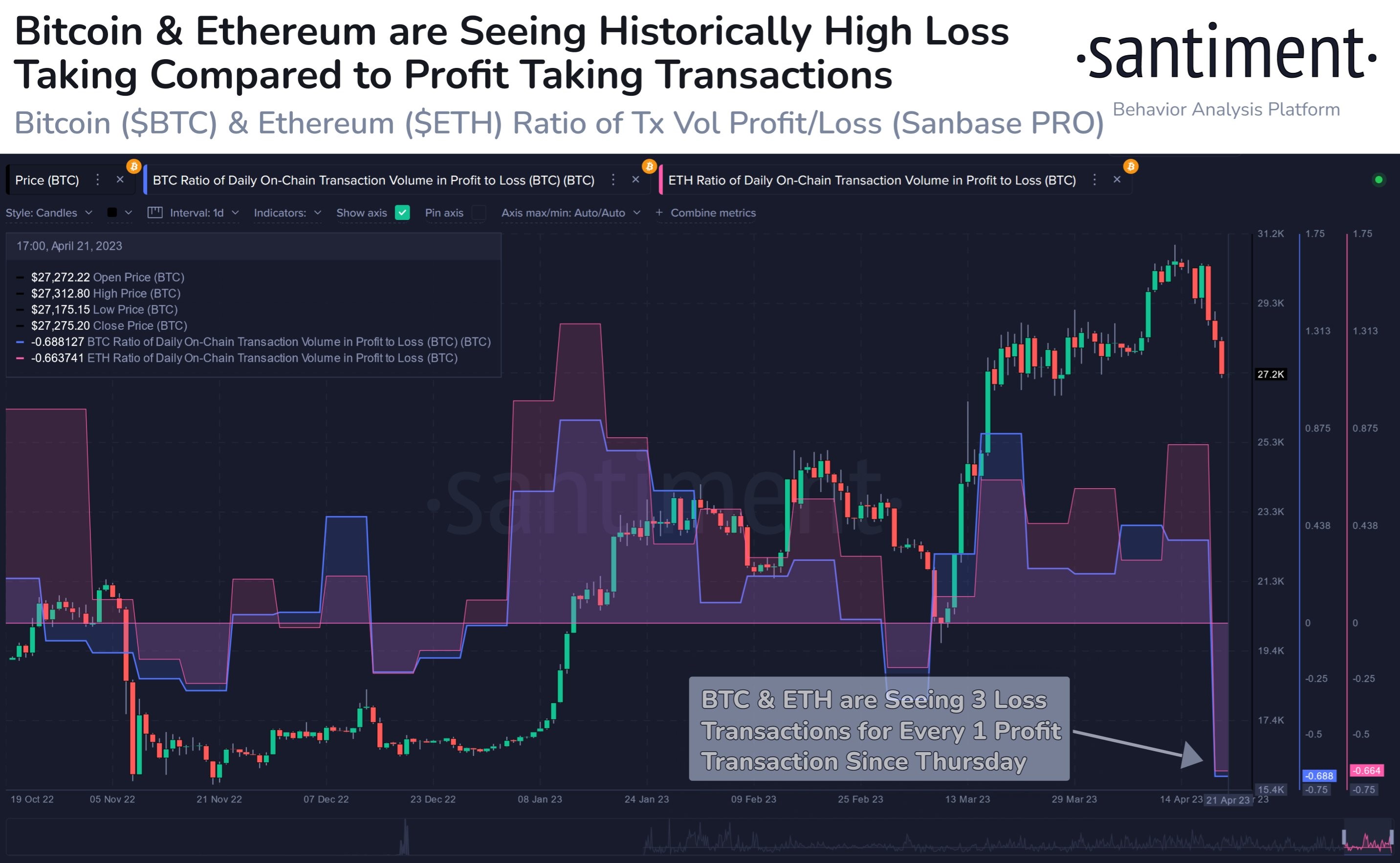

Some of these sellers could be short-term holders cutting losses as evidenced by the large increase in the number of loss cutting trades.

High number of loss cutting as dip deepens

As the price of cryptocurrencies continued to dip without a reprieve even as the week came to an end, the number of transactions moving at a loss increased sharply. There are now three times more transactions that appear to be loss cutting moving onchain than there are transactions in profit. This could be a sign that short-term traders who have entered the market in recent days are cutting losses, which has further driven the price of BTC and ETH lower as the week came to a close.

Despite the large number of traders cutting losses, the long-term trajectory of BTC has not been affected. The MVRV ratio is still showing that we are in the early stages of a recovery and this pull back has not made it any less bullish. The MVRV ratio is currently showing a reading of 1.42, which is a far distance away from a cycle peak reading of 3 and above and a euphoria reading of at least 2.5. While we do not rule out the possibility of a pullback of the ratio, the MVRV chart does give a clear perspective that we are closer to the bottom than we are from the top.

With the current funding rate beginning to reset itself after average crypto prices have come off by more than 10%, there is a chance that a slight rebound could happen this week until more macroeconomic news comes forth next week when the Fed holds its next interest rate meeting on 03 May that could dictate the next direction of the markets.

Gold retreats as dollar finds bids ahead of FOMC

Regarding other assets, after the price of Gold failed to break its all-time-high of $2,080 on 14 April, the dollar started last week with signs of a revival, evidenced by the US 10-year Treasury yield climbing back higher above 3.5%. This rise in yield foreshadowed a fall in gold, crypto and stock prices, as investors got back into the dollar trade in anticipation of another rate hike after several Fed speakers sounded the hawkish alarm last week.

Gold eventually failed to sustain itself above $2,000 and closed the week down 1% at $1,982. Silver also lost 1% and is currently trading below $25 in the new week.

The stronger dollar also caused oil prices to slip, with the WTI losing 5.5% to trade back below $80. Brent Crude also fell 6% to close the week at $81.35. Worries of an economic slowdown in the US, with the possibility of interest rates continuing to rise globally after a surprise higher-than-expected inflation reading in the UK is testing oil traders’ resolve about a recovery in demand. Oil prices have continued to weaken by around 1% at the start of this new week in Asian trading.

A series of weaker-than-expected economic reports released during the week and mixed earnings from companies caused the major US stock indices to end last week in the red. The Dow fell 0.23% to snap a four-week winning streak, the S&P slipped 0.1%, while the tech-heavy Nasdaq saw the biggest decline, losing 0.42%.

This week, the direction of the stock market could be dictated by earnings from several Big Tech companies like Amazon, Alphabet, Meta and Microsoft, which will be reporting their 1Q23 earnings. As for the economic front, the busiest day could be Thursday, with March’s unemployment claims and the advance GDP estimate for 1Q23 to be released together. Late Thursday-early Friday will see the Bank of Japan having its first monetary policy rate meeting under the reins of its new governor, Kazuo Ueno. Market participants are not expecting any surprise to come from Ueno since it will be his first meeting, however, it is always good to be prepared for the unexpected.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.