The BoJ jolted markets with a revision of its yield curve control (YCC), sending the yen surging by more than 3% last Tuesday. The central bank said it will expand the range of 10-year Japan government bond yield fluctuations from its current plus and minus 0.25 percentage points to plus and minus 0.5 percentage points. While the move was intended to “improve market functioning and encourage a smoother formation of the entire yield curve while maintaining accommodative financial conditions” according to the bank, market watchers viewed the move as hawkish and something which would preclude an eventual rise in interest rates in Japan from its current negative state into positive territory eventually. This caused the USD/JPY to fall from 137.30 to 130.50 within Tuesday alone, a huge move of almost 5% in just one day.

This simultaneous unwinding of USD/JPY positions also caused the US dollar to fall against a basket of other currencies as a result, sending the DXY back into the 103s. Furthermore, the PCE price index released on Friday confirmed that inflationary pressures are on the decline, with the rate of inflation slowing to 5.5% in November from 6.1% in the prior month, the smallest increase since October 2021. The core PCE, which is the gauge that the Fed looks at, also reduced from 5% in October to 4.7%.

However, investors aren’t exactly cheering the lower numbers as the Fed has signalled further tightening ahead, stoking fear that the Fed may overtighten and worsen economic conditions, which could lead to a recession. As a result, the markets oscillated between gains and losses through the week, ultimately ending mostly lower. The S&P was down about 0.2%, posting its third straight weekly decline. The Nasdaq, meanwhile, lost 2%, also for the third consecutive down week. The Dow was the outperformer, posting a surprise 0.9% gain.

With the markets seemingly unsure of where the dollar could be headed next due to the conflict between the hawkish Fed and slowing inflation, Gold was caught in a tight range all week, finishing almost where it started at $1,798, while Silver fared better, rising 3% on the back of easing China COVID controls.

Oil also fared well on the China COVID news. Brent gained 5.5% while the WTI rose 5.8% after the EIA reported that US crude inventories fell by 5.89 million barrels, compared with estimates for a drop of 1.66 million barrels. Data from the American Petroleum Institute on Tuesday showed a 3.1-million-barrel drawdown in the week to December 16.

Crypto price action was just as dull as that of Gold, with a lack of interest causing prices to simply drift through the week as we approached the Christmas holidays.

BTC stayed at around $16,800 the most part of the week, while ETH at least moved higher by 3%. Altcoins were a mixed bag, with most not having a clear direction of where they could be headed as we move into the final week of the year where market action is expected to be just as quiet.

Stablecoin Flow to Exchanges Highest in Months

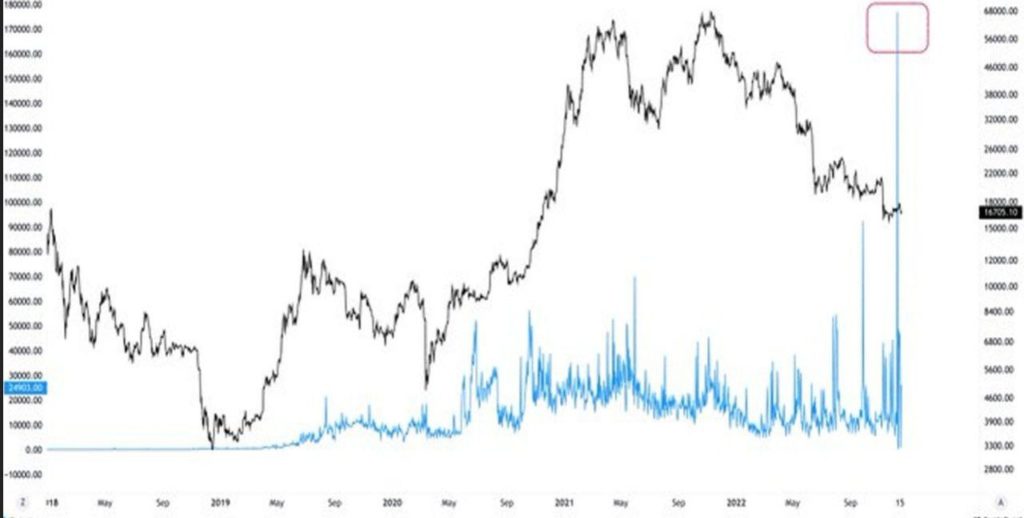

Despite being very quiet on the trading front, stablecoin exchange inflows showed a big spike earlier last week, where large amounts of stablecoins were sent to crypto exchanges, with the bulk of the funds sent to derivatives exchanges.

With such a high volume of stablecoins being sent to exchanges, it leaves one to wonder if the current lull period would soon transition into a major upturn in volatility as it is not often that this much stablecoins get sent to exchanges.

Furthermore, according to market data, the total trading volume of stablecoins set a new record in 2022, reaching $7.4 trillion, surpassing the $6 trillion volume it generated in 2021. This is further evidence to show that crypto adoption is not slowing down, and there might even be more users of stablecoins now as compared with last year during the bull market. It thus may be a matter of time when these stablecoins be used to purchase crypto eventually.

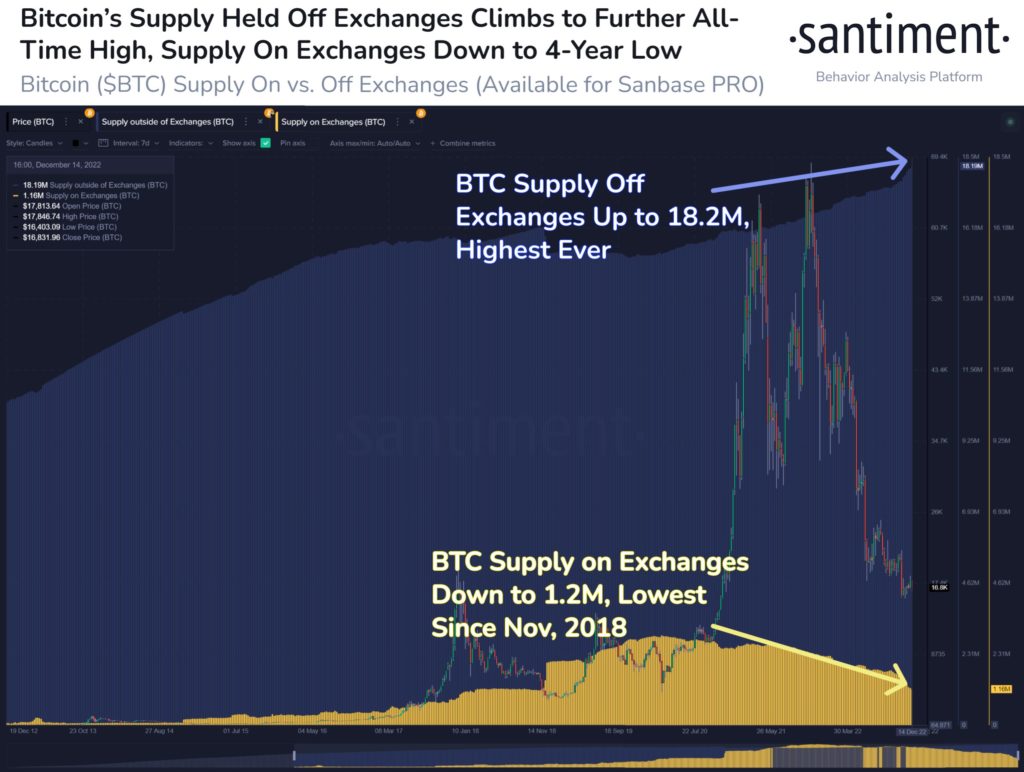

Meanwhile, as an after-effect of the FTX saga, the number of BTC in self custody continues to create a new all-time-high, now standing at 18.2 million BTC. The number of BTC on exchanges is at a 4-year low, at only 1.2 million units.

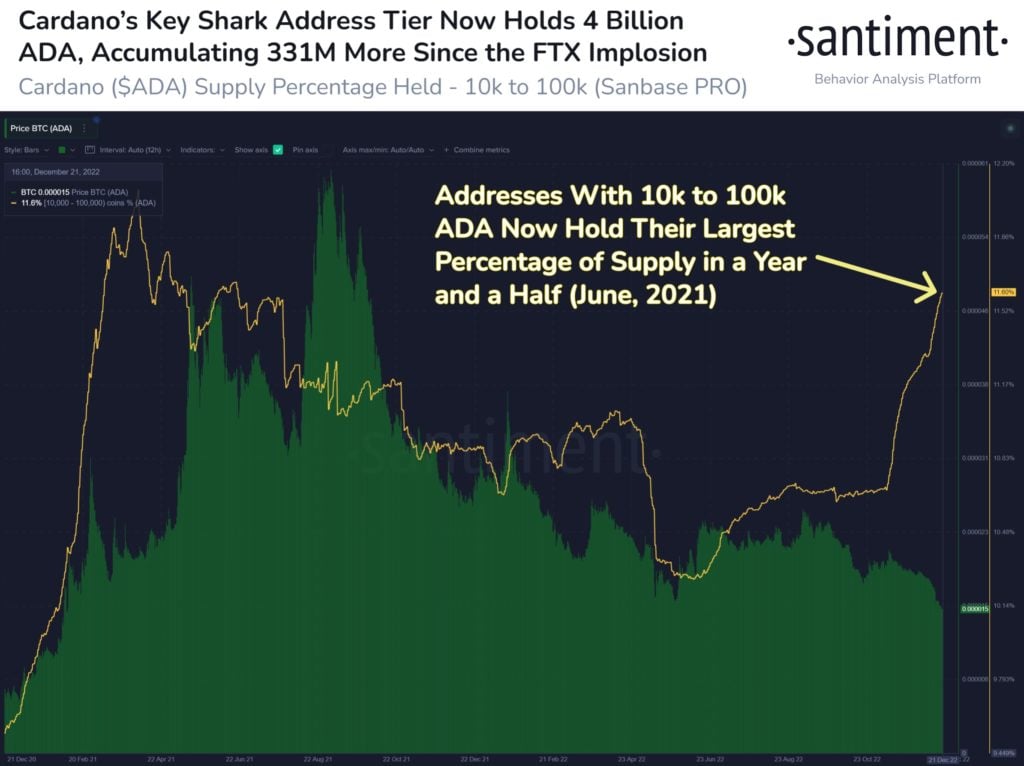

Cardano Whales Hold Highest Percentage of Supply Since June 2021

As the crypto market tries to make sense of what happened at FTX at the US trials while counting down to a new year, some tokens are already seeing whales using the current market dip to accumulate more aggressively.

Cardano whales holding between 10,000 to 100,000 ADA have added 331 million more ADA since November 7 when the FTX saga first began to unfold. They now hold the largest percentage of supply since June 2021 during the peak of the bull market.

With the current high disapproval rating of centralized platforms, a decentralized ecosystem like ADA where even very small holders can stake directly to earn rewards without going through any intermediary could benefit once we enter the next bull market cycle. Could these whales be prepping up for such a time in the future?

DOGE Outperforms by Falling the Least

As the nightmarish year in crypto draws to a close, it is interesting to find that the meme coin DOGE has come off the year as one of the top performers in crypto by having fallen the least. Compared with most coins which have fallen by at least 70%, DOGE’s fall of only 58% ranks it as one of the better performers out there, having fallen from $0.17 where it began the year 2022 to around $0.07 currently as the year draws to a close. Could Elon’s efforts to put DOGE into the Twitter ecosystem finally bring some profits for DOGE holders in the new year?

For the traditional markets, as this week is a holiday shortened week, many markets will be closed both on Monday and Tuesday. As such, trading activities on the traditional markets (even for the crypto market) is expected to be slow as most traders would be taking the entire week off to refresh themselves and return after the new year break.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.