The price of BTC jumped early last week after Google updated its advertising policy to allow cryptocurrency trust products to advertise in the United States. Ads for Bitcoin spot ETFs such as BlackRock, VanEck and Franklin Templeton have appeared on Google search pages, signaling that the competition to bring in new funds into the spot BTC ETFs have commenced.

However, following news updates that both the German and UK police have seized $2.1 billion and £1.4bn worth of BTC from law breakers, worries about more BTC sales quickly resumed, sending the price of BTC reversing from early week gains. A de-risking ahead of the FED meeting on Wednesday could also have been a main culprit for the price retreat. As with BTC, altcoins reversed their gains and started trending lower once again after the FED meeting notes showed that a March rate cut was unlikely.

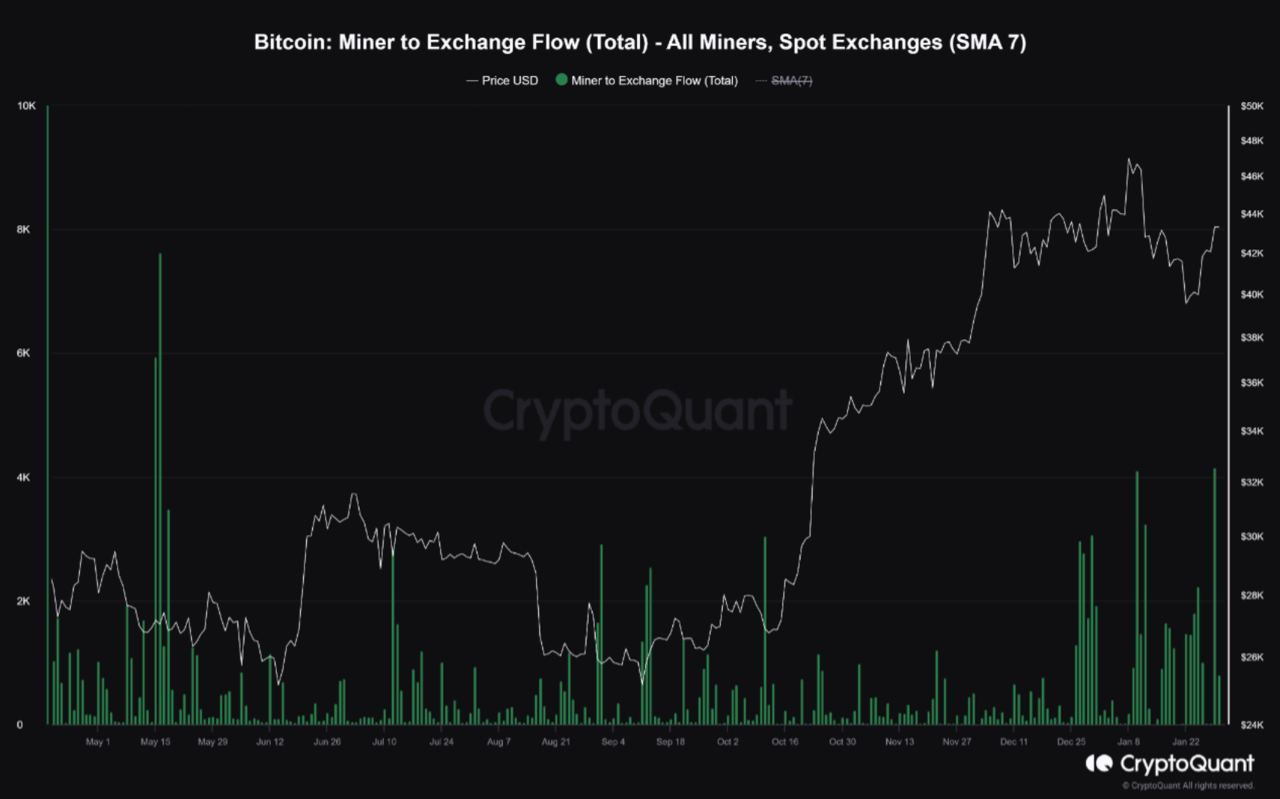

BTC miners sold once again

The group of miners that had sold their BTC around the local top of $48,000 appeared to have moved once again, taking advantage of the early week technical rebound to offload their BTC again. While their size of around 4,000 BTC was not a large number, historically, miners selling their BTC when they were in profit has often been seen as a sign of bearishness and some traders could have gotten wind of this and got out of the market.

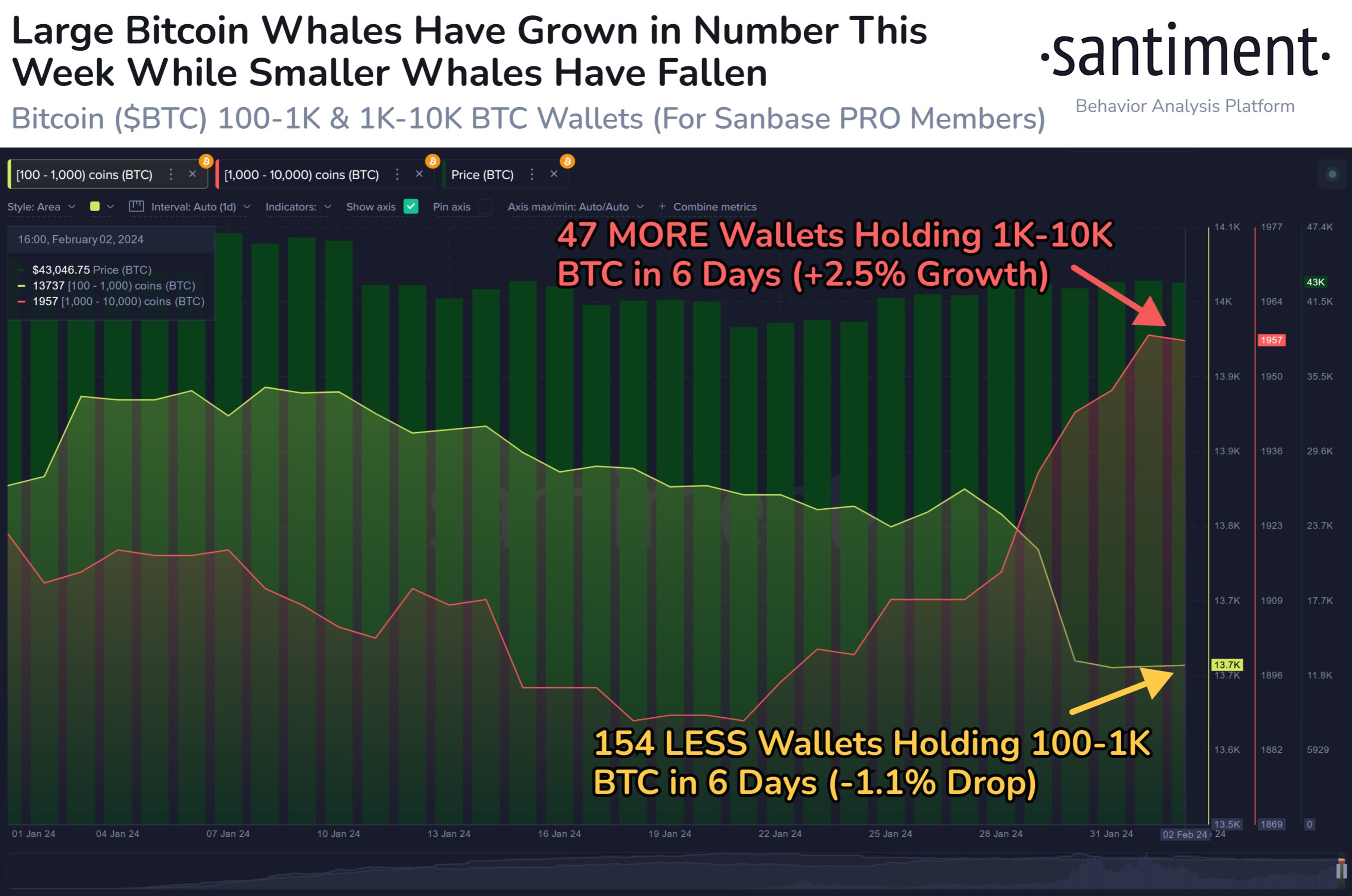

Furthermore, there has also been a reshuffling of BTC amongst the whale community. Smaller whales with 100 to 1,000 BTC appeared to have sold off their BTC towards the end of January and early February, while there has been notable increase in the number of large BTC whale accounts since end January. While this increase could be due to the new spot BTC ETF wallets, it is interesting to note that there were 47 such new wallets while only 11 spot BTC ETFs were approved for listing. Could there be other new whales or new aspiring spot BTC ETF applicants on the way accumulating BTC?

The price of BTC has remained well-supported all week despite the dollar’s strength and continued selling by GBTC, albeit in reduced quantities. This shows that there is underlying support for the price of BTC, at least, currently. However, things may change as we move further into February as new sellers could emerge.

Estates start to sell assets, FTX to repay creditors

One such new seller could be Genesis, another bankruptcy crypto firm, which will be trying to liquidate its GBTC holdings. The estate will be applying to court on 8 February for approval to dispose of around $1.4 billion worth of GBTC shares and another circa $200 million in Grayscales ETH and ETC trusts. While the amount is not particularly large, this news could dampen trader sentiment and cause the price of BTC and cryptos in general to weaken. Furthermore, the sale of Genesis assets could only affect the price of GBTC and the trusts, not the price of the underlying assets like BTC and ETH, as the court order apparently sought to dispose of shares of GBTC and the ETH/ETC trusts, not actual BTC and ETH/ETC.

While the market is showing obvious signs of weakness, some silver lining could be in store for the upcoming months as the other two bankrupt exchanges, FTX and Celsius, have committed to returning creditors in full. The main surprise came from FTX, from which most clients had already written off their investments. While there was a catch, in that both estates would liquidate coins and return creditors in cash according to the market value of their held assets as at November 2022, the headline of these bankrupt firms’ ability to repay creditors is nonetheless a confidence boost in the viability of the crypto sector, which could potentially aid in onboarding new investors.

In any case, while the funds returned are much less than the current market value, their unlocking could potentially spur their owners to make new crypto purchases, especially in altcoins where the potential upside could be higher.

ETH main victim in estate selling

That said, in the short-term, BTC and ETH, the core holdings of both the Celsius and FTX estates, could continue to face selling pressure as the two estates sell the coins to exchange for cash to return creditors.

The impact may be especially evident in ETH as ETH still does not benefit from the strong spot ETF inflows that BTC has to absorb the selling pressure.

For instance, Celsius has been consistently sending ETH to exchanges for sale during every bounce as can be seen below, and the selling has picked up steam in recent times.

LINK surged but unlocked tokens dumped

LINK witnessed an interesting surge in price last week amid the marketwide consolidation, catching the attention of many traders.

After piercing above $18 on Friday, sentiment on the coin has turned optimistic, as transaction volumes on the coin rose significantly, indicating a potential for the price to see increased volatility in the days ahead.

However, LINK whales took the opportunity to dump around 16 million units of LINK tokens early Saturday morning, causing the price of LINK to edge back lower. However, as its recent on-chain activity and chart has turned positive, the price of LINK could still see a possible upside as long as the price of BTC does not dump significantly.

US stocks rose as employment data beats, dollar gains ground

While the ADP private sector employment figures were a miss, the FED’s reminder that rate cuts were still far off and definitely not in the works in March disappointed traders hopeful of a switch to dovishness. While FED chief Powell acknowledged that rates have probably peaked, he insisted that the fight against inflation wasn’t finished. Friday’s release of far better than expected non-farm employment figures also put a strong bid under the dollar, which rose 0.9% for the week for its strongest week in 2024.

The unemployment rate in January was reportedly 3.7%, this was expected to be 3.80% and the previous value was 3.70%. The number of non-farm payrolls in the US increased by 353,000 in January, compared with the expected 180,000 and the previous value of 216,000. The blowout figure immediately caused the 2-year US Treasury spiking from 4.22% to 4.3368% on Friday.

US stocks however, were not affected by the rising yield as traders decided to take the exceptional employment numbers as a positive indication that the US economy was doing strongly. More proof of this could be evidenced by the latest quarterly earnings results from tech firms like Meta and Amazon.

For the week, the S&P added 1.4%, the Nasdaq gained 1.1% and the Dow rose 1.4%. It was the fourth week in a row of gains for the major US key indices after a rocky start to 2024.

As for commodities, Silver lost about 1%, in line with the dollar’s gain, however, Gold price remained well-bid, rising by 0.8% as the coming lunar new year this weekend could have caused the demand of the metal that has an auspicious meaning to the Chinese to rise.

Oil prices took a big dip, giving up all its gains made in the week earlier, with both distillates losing around 8% for the week as talks to pause the Israel-Hamas war reduced oil’s geopolitical risk premium.

Elsewhere, the BoE left rates unchanged, with policymakers mostly divided as to whether the UK should raise or lower rates next.

This week, the economic calendar is fairly muted, with only the RBA to be having its policy meeting on Tuesday. FED Chair Powell has just completed an interview late Sunday night with the 60 Minutes TV program where he maintained the exact same stance as per the FED meeting – that a March rate cut is unlikely. Later in the week, activity out of the Asian markets is expected to dwindle as the Chinese get ready to celebrate the lunar new year on 10 and 11 February.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.