After the media discovered that around $1 billion out of $3 billion that GBTC had sold the week before was from the FTX bankruptcy estate, they started narrating that future GBTC sales would start to get slower, improving the extreme pessimistic sentiment by a big margin.

However, the break of the psychological level of $40,000 still did some damage as around $400 million worth of longs were liquidated in the first two days of the week as the price of BTC dipped to $38,500, closing the CME gap at around $39,400 before finding a temporary footing and rebounded to $42,000 by the end of Friday.

The quick uptick in the price of BTC was a welcome technical rebound after more than a week of losses, liquidating around $90 million worth of shorts. As can be seen from the difference in sizes between long and short liquidations, market participants still had a preference for longs.

Market getting immune to negative news

Despite more negative news about GBTC’s selling and another couple of new “shocks”, the price of BTC held up well as the inflow of buyers through Blackrock remained rather robust.

Other than GBTC’s continued redemption, the US government also filed a notice stating its plan to sell $117 million worth of BTC seized from two individuals including dark web drug dealer Ryan Farace, who used the Silk Road. However, this amounts to only around 9,000 BTC, which the market will not have a problem absorbing, noting that it had already put up with average daily sales of 20,000 BTC for the past two weeks.

Last week, GBTC sold around 68,000 units, almost similar to the amount it sold the week before, however, the price of BTC still managed to rebound, a sign that could imply that either dip buyers were getting more aggressive, or that there was no other seller pushing the price down, or it could be both.

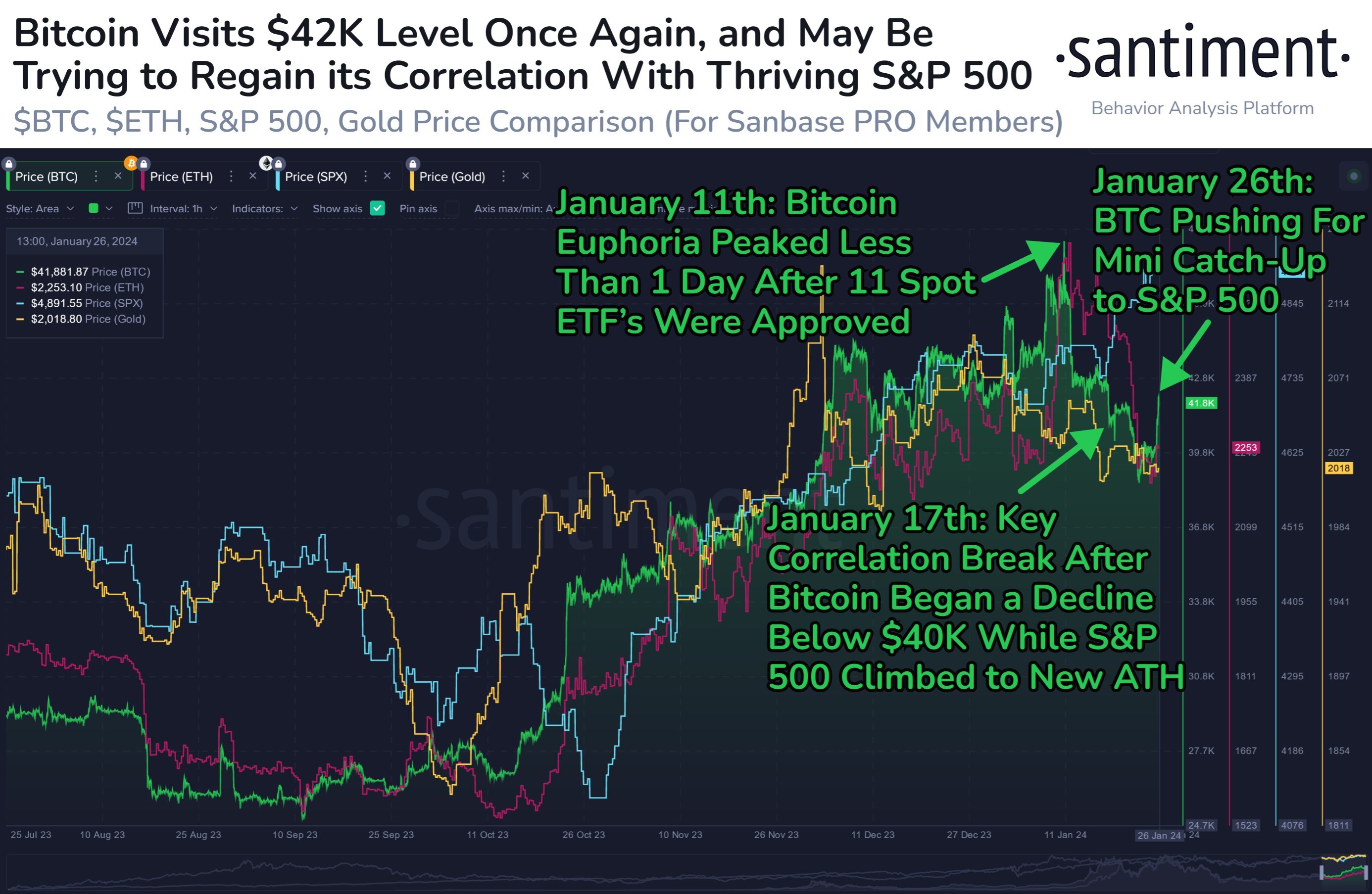

The more aggressive buying could have come from institutional investors with a risk-on mode deploying more capital into other risky assets as the US stock market continues to hit an ATH. The price of BTC has often shown a delayed correlation with the price of US stocks and as a result, we could see further upside in BTC and crypto prices in the short-term as the market tries to rebalance the very oversold condition after selling down for two weeks.

While it is possible that GBTC clients may continue to offload their BTC, they may begin to get more price sensitive and offload slowly as the price of BTC remains well supported.

BTC price could range instead of falling more

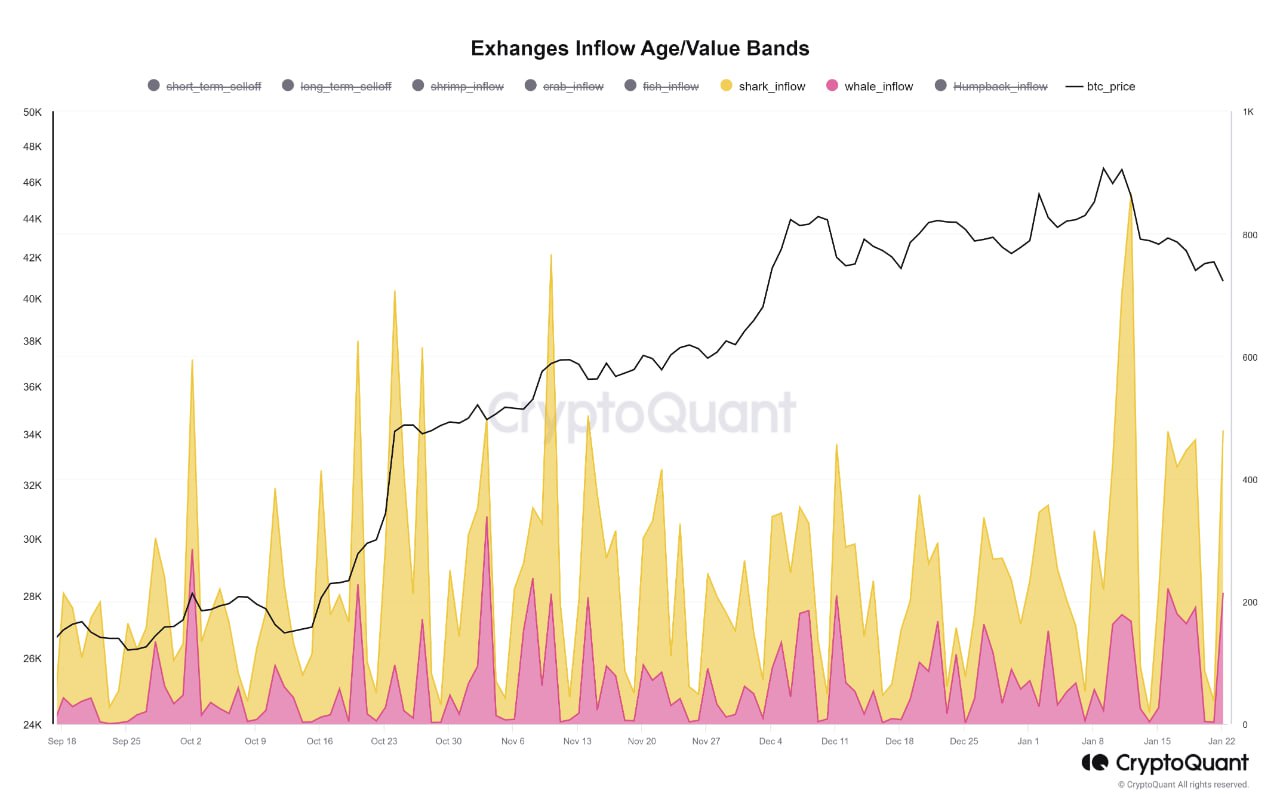

A check on the type of holder that has been selling BTC shows that the larger sharks and whales have been the main culprits, as both categories of holders have sent their BTC to exchanges for sale over the week. This is further evidenced by the large outflow of BTC from GBTC, which has continued to relentlessly dump BTC for the second week.

The good news is that, as shown by the diagram below, the sale of BTC by this particular group of whales did not seem to have a big impact on the price trajectory of BTC in the past. As can be seen below, the price of BTC has often remained flat as this group of investors dispose of their BTC. This could imply that his group of whales are price sensitive sellers who do not crash the price but instead, opt to sell incrementally over a period of time so as not to have a substantial negative price impact.

This tendency was evident last week. With the price of BTC having declined rather substantially to hit a low of $38,500, its price actually rebounded above $40,000 even as these sellers continued to send their BTC to exchanges. This showed that these sellers have turned more price sensitive rather than time sensitive in order to not sell their BTC at “lousy” prices, as opposed to the week before when they were simply dumping en masse.

As a result, there is a chance that further sharp declines may not materialise, instead, we could have more selling pressure come in at “better” prices instead of a fierce dumping action which would send the price of BTC much lower.

Thus, the price of BTC may hover around the $40,000 level for a sustained period of time, which may be frustrating for investors who are waiting to buy at lower levels, unless some macroeconomic tailwind manifests, which is also not entirely impossible.

The good news is that a long period of flat price action for BTC is good news for altcoins, which can take the opportunity to recover. As we had seen over the weekend, many altcoins rebounded in line with the rise in BTC’s price, however, a sustained recovery in their prices still appeared to be elusive. That said, one may choose to build positions in laggard coins that have not moved as much over the past months so as not to get caught up on a hangover.

XRP wallet numbers at ATH

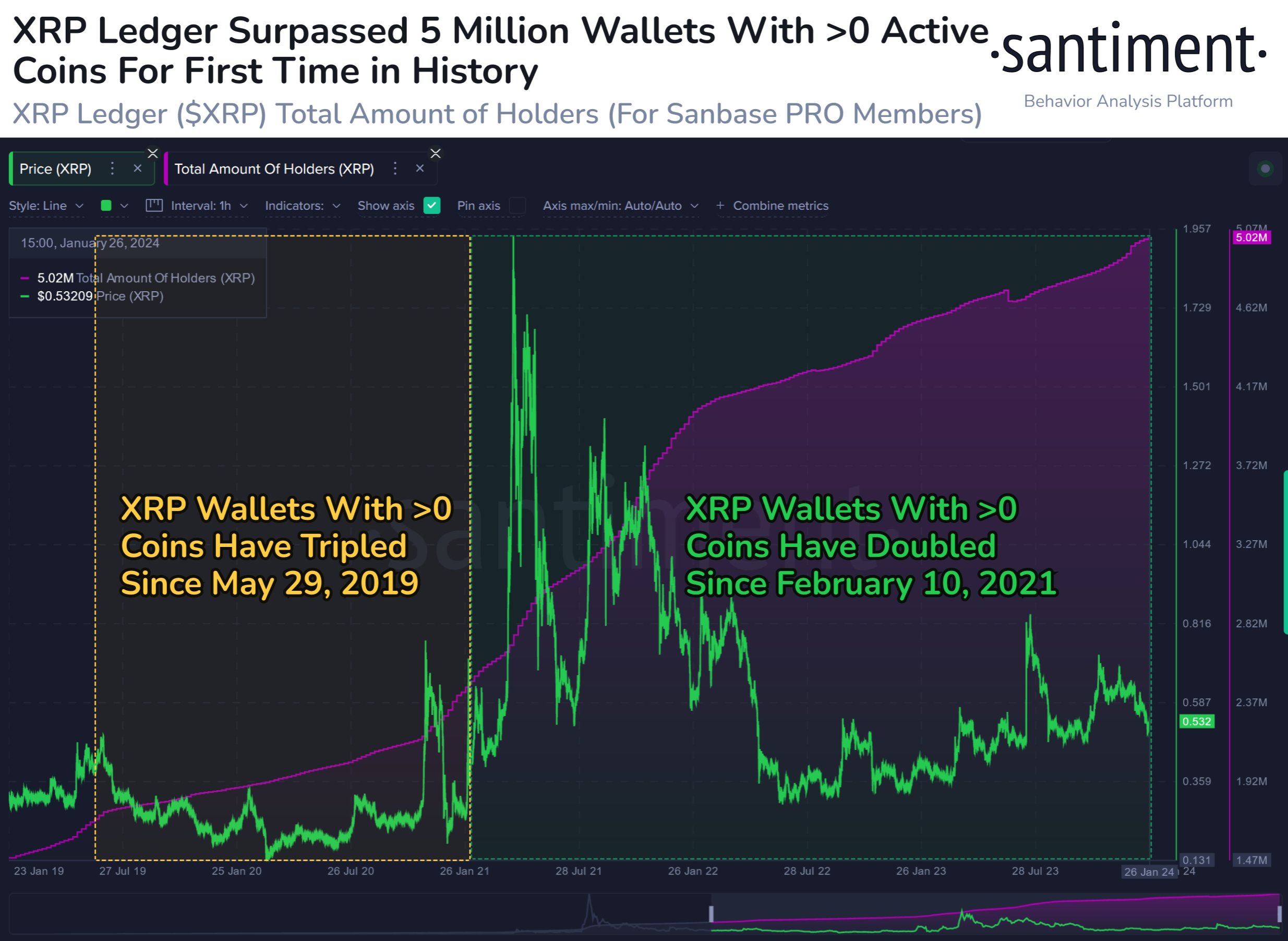

One interesting laggard altcoin which has not seen a notable increase in price but has good on-chain metrics is XRP. For the first time in history, XRPLedger now has 50.2 million distinct wallets with XRP holdings, the most since its inception over 10 years ago. The network has doubled its number of wallets over the past three years even as it was embattled with the US SEC in a lawsuit. Now that the lawsuit has been won, it may be a matter of time that an explosive move comes from XRP since it has been coiling in a range for the past cycle.

Furthermore, there has been chatter about a possible XRP ETF being explored after the Ripple team was seen to have put up a job posting which involves promoting cryptocurrency-related ETF plans late last week. While it is still early days before we could see altcoin ETFs in America, it is possible that altcoin ETFs could get launched in other countries like Hong Kong, which has recently opened up its financial markets to crypto ETFs. Hence, should the latest Ripple job posting get more viral on Twitter, it is possible that XRP may see some movement. However, this conjecture is still rather remote.

Stocks and oil rise on China easing moves

US stocks continued their stellar run as all three index majors closed the week higher after economic figures out in the week were better than expected. The 4Q GDP came in at a blistering 3.3% while the PCE index showed that inflation had continued pulling back, with the core PCE coming in at 2%, lower than expected. The result of the strong economic numbers buoyed another rising week for stocks, with the Dow gaining 0.7%, the S&P rising 1.1% and the Nasdaq adding 0.9%.

With China cutting its RRR and injecting more monies into their financial markets, risky assets across the board traded higher, especially Hong Kong and China stocks which had been battered in recent times. This sentiment boost led the Hang Seng Index to surge more than 7% on Wednesday after the index lost around 50% of its value over the last two years.

While China eased, the BoJ hinted at possibly tightening its ultra loose monetary policy soon at its first policy meeting of 2024 last week. This revelation led to the biggest rise in the yen for over a month as it rose 1% against its peers. Over in Europe, the ECB kept rates unchanged, while signalling a declining trend in inflation, which can be read as dovish.

The dollar rose 0.2% against its peers as the US economy has thus far proven to be stronger than anticipated, while Gold retreated 0.5%. Silver on the other hand, climbed 0.8% as the latest China easing could increase demand for the industrial metal.

Oil prices had its best week this year, with Brent rising 6.2% to once again peek above $80. The WTI too had a similar price increase, rising 6.3%, slightly more than Brent after the IEA reported a higher than expected US inventory drawdown of 9.2 million barrels for the week to 19 January.

With China’s easing expected to continue and the FED possibly signalling a dovish bias in the upcoming FED meeting this Wednesday, oil prices may have found a local bottom and better times could be ahead.

This week, attention naturally will centre on Wednesday’s FED meeting and what FED Chair Powell has to say in his press conference. Employment data is also in the works as Wednesday will see the private ADP employment numbers out before the FED announcement, while Friday will see the release of the non-farm payrolls numbers. Other than the FED, the BoE will also be having its policy meeting, which is scheduled to be on Thursday.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.