Bitcoin saw its worst weekly performance since early April last week, falling 4%. At the start of trade last Monday, Bitcoin fell 4.6%, its largest daily drop in two months. The price dropped from 63,300 on the open on Monday to a low of 58,595, a level last seen on May 2. The price action was choppy across the rest of the week. However, the mood changed on Friday after US inflation cooled and Bitcoin is starting the new week amid an upbeat mood, back above 63k.

Last week’s selloff in Bitcoin bled through into some of the altcoins, but not all. Ether fell 2.5%, and BNB dropped 1.3%. However, it wasn’t all bad news last week. Solana gained over 8.5%, while Avalanche booked gains of 14.5%.

The recent weak performance of Bitcoin and the broader crypto market came amid an absence of bullish crypto-specific catalysts on the immediate horizon, apart from the Ether ETH ETF launch. While the SEC could give the final approval to the ETH ETF launch this week, there are some concerns that flows into the ETF could disappoint.

As a result, the Bitcoin market was driven more by technical factors than fundamentals, including the German government’s sale of Bitcoin, the planned distribution of Mt Gox bitcoins, and Bitcoin ETF outflows.

Mt Gox Payouts

One of the concerns hanging over the crypto market is the imminent sell-off of Bitcoins by Mt Gox, as of early July. Creditors of the defunct exchange are set to receive 140,000 bitcoins worth around $9 billion at the current price, which could significantly impact the market and limit gains for now. The immediate sale of these Bitcoins could create an ample supply and suppress demand, driving down prices. However, not all creditors are expected to sell their Bitcoin right away. A payout over an extended period could mitigate the impact on Bitcoin prices.

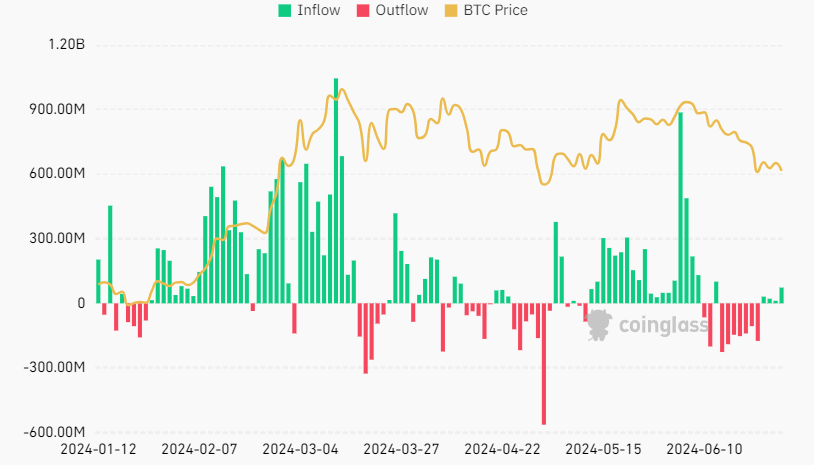

Bitcoin ETF outflows

Bitcoin ETF outflows totaled $38 million this week, marking a third straight week of outflows. On Monday, when the Bitcoin price tanked 4.6%, Bitcoin ETFs saw outflows of $174.5 million. However, last week’s remaining four days saw positive, albeit modest inflows. The positive inflows and the slight improvement in investor risk sentiment helped lift the Bitcoin price at the end of last week.

USD strength

USD strength has continued to be the theme, as the USD rose 1.1% across June, putting pressure on cryptos and other major currencies. The USD/ JPY rose above 160.00 to its highest level in 38 years, mainly owing to the Fed – BoJ interest rate difference. A similar weakening of the EUR, CAD, and CHF has also been evident due to the ECB, BoC, and SNB cutting interest rates. Meanwhile, Fed Governor Michelle Bowman warned that the Fed might not need to cut rates this year and is certainly in no rush.

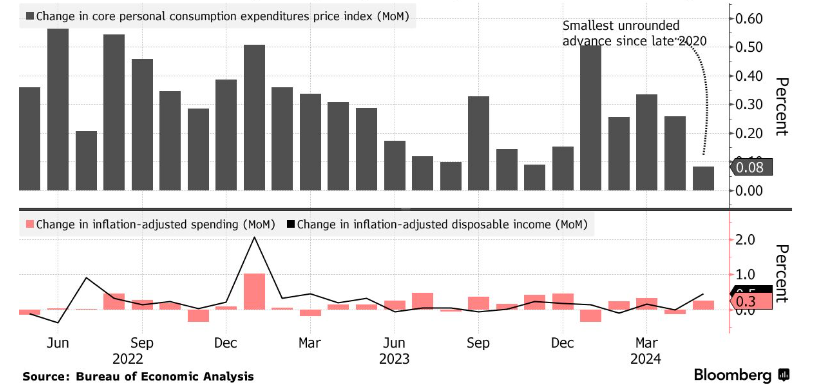

However, as we start the new week and new quarter, the USD is falling following a cooling in core PCE, the Fed’s preferred gauge for inflation. Core PCE cooled to 2.6% YoY, down from 2.8%. On a monthly basis, core PCE was 0.1%, its lowest level in 6 months.

The USD has eased from a two-month high against its major peers, which is also offering some respite to cryptocurrencies and improves the outlook for Q3.

Solana outperforms

Solana rose over 8% last week, even as Bitcoin and Ether fell 4% and 3%, respectively. The move has been helped by several factors specific to the Solana ecosystem, including key technological releases and VanEck’s filing for the Solana ETF.

ZK Compression

On the technological side, Solana has taken a step forward in blockchain innovation by launching ZK Compression on Solana, a major breakthrough for the Solana ecosystem. This technology allows compressing the on-chain state of tokens and accounts, significantly reducing storage costs while maintaining network integrity and performance and improving scalability. As a result, ZK compression paves the way for broader adoption of the Solana ecosystem. Some even consider this a solution similar to Layer 2 but without the usual drawbacks.

This innovation is part of Solana’s ongoing improvement strategy for its infrastructure. It follows the success of meme coins on the blockchain and the Saga smartphone—creations that have contributed to the ecosystem’s growth.

Blinks

The separate announcement of Blockchain links, or blinks for short, is also a revolutionary feature. Blinks allows on-chain transactions to be shared as transferable links, making it possible to initiate Solana actions from almost anywhere on the internet, including X (formerly Twitter), including NFT mints, USDC transfers, DEX swaps, governance proposals, and more. This effectively connects the Solana blockchain to the entire internet. This means that users can link directly to on-chain transactions on any platform that supports URL sharing. While this still has some limitations, with desktop users more fully supported than mobile users, this is still another powerful move by Solana developers.

Solana ETF

On June 27, VanEck submitted an S-1 filing for a Solana-based exchange-traded fund. While the US regulator, the Securities and Exchange Commission, is unlikely to approve the listing, given that it has declared SOL a security in two lawsuits, it could be argued that it is still the right time to try. The regulatory landscape is undoubtedly shifting. If Trump wins the election, a Trump administration in the White House later this year could also ease the regulatory burden further, given his embrace of crypto. However, it is also worth pointing out that the cryptocurrency hasn’t been listed on futures ETF, which seems the standard path for now.

BTC, ETH, and SOL correlations

Correlations between Bitcoin, Ether, and Solana returns have lowered over the past month, marking a divergence from the typical historical trend of an increasing correlation to Bitcoin during market downturns. The 60-day correlation of Ether and Solana against Bitcoin peaked in March before falling in June. This could signify the rising importance of protocol-specific factors, growing acceptance, and a better understanding of the fundamental differences between tokens.

The latest Solana developments, as well as the expectations of ETH ETF approval next week, could have sparked the divergence.

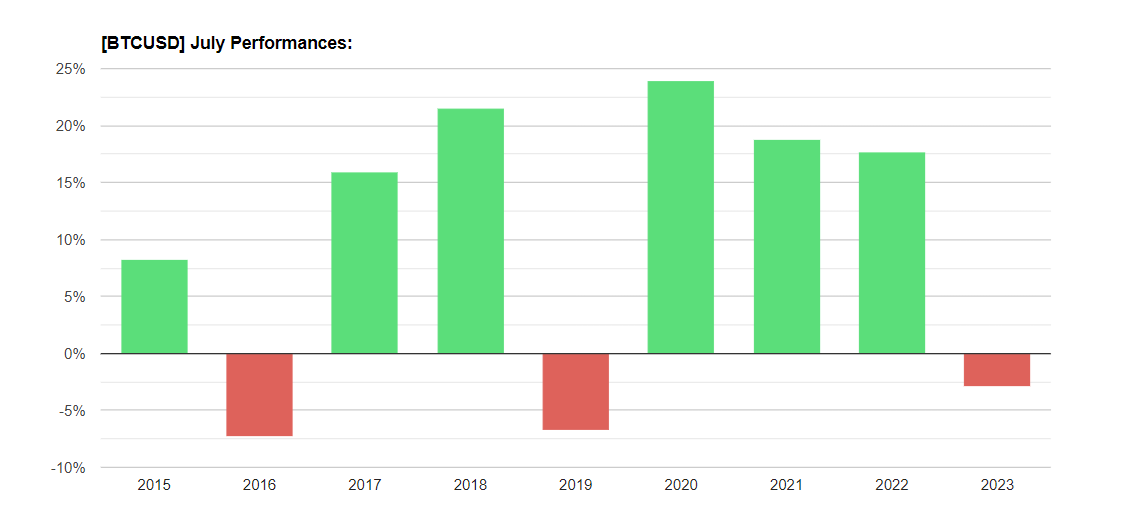

July Seasonality

Heading into July, seasonality could also be relevant. Bitcoin and Ether historically performed well this month compared to other months, particularly when July was preceded by a weak June performance (like we just experienced). Bitcoin ended June 8.6% lower, and Ether ended the month down 8.7%, as daily average volumes for BTC and ETH across global exchanges fell by 16.7% between May and June.

Geopolitics is still a theme in French elections over the past weekend; UK elections will be held on Thursday. The first US presidential debate was held last week, on June 27th. Trump came away the clear winner. However, crypto wasn’t a topic of discussion. Still, with the super PAC Fairshake having raised $169 million for campaigns in this current election cycle, November could be an important catalyst for crypto performance in the second half of 2024.

In the first round of the French elections, Marine Le Pen’s far-right won by a smaller margin than initially feared, raising questions over whether she will be able to win an outright majority in the second round next week. As a result, risk sentiment has improved, lifting risk assets across the board, including cryptos.

Looking ahead

This week sees the expected final approval of ETH ETFs, which could happen as soon as July 4. Eight asset managers are seeking SEC approval; these include BlackRock, VanEck, Franklin Templeton, and Grayscale, among others.

The launch of the spot ETH ETF is expected to be less impressive than that of the spot Bitcoin ETF, and projections for demand vary greatly. Still, this is likely to change the investor landscape, which could support institutional demand and the price over the longer term.

On the economic calendar, the US jobs report will be the highlight of the holiday-shortened week as the markets look for more clarity over when the Federal Reserve may start to cut interest rates. Comments from Fed Chair Jerome Powell and the minutes from the June FOMC meeting will also be closely watched.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.