Crypto prices made their most significant weekly increase since July 2021 last week after the US PPI index came in grossly below expectations on Wednesday. The PPI is usually a leading indicator of how the CPI in the coming months would be, thus, a big fall in the PPI could indicate that the rate of inflation in the USA could be coming off in the coming months. Furthermore, the fast brewing trouble in the banking system was sending investors fleeing from the banks, from selling banking stocks to withdrawing deposits from banks. The trouble is disturbing to traditional investors as it has been rumored that more than 190 US regional banks are in funding trouble needing to borrow from the Fed, which had already pumped in around $300 billion into the banking system just last week alone to prevent liquidity in the US banking system from drying up.

Such moves by the Fed are seen by investors as another form of QE, as it involves expanding the Fed balance sheet, even if they are being packaged as short-term loans. As a result, investors poured in Gold, Silver and needless to say, BTC and other cryptocurrencies. Gold gained 6% while Silver gained almost 10%.

However, the most prominent gainer was still BTC, which gained 13% over the week. ETH, plagued by the SEC chief Gary Gensler’s comments that it is a security earlier on in the week, was a tad weaker and gained only 8%. The bulk of the altcoins also gained relatively less than BTC, which is a sign that investors are currently taking less risky bets and are preferring to put their money into safe havens like precious metals and BTC. There were signs of the altcoin market heating up though, as some recently popular names like CFX, the popular blockchain of China, and MASK, a network that could integrate web3 services to existing web2 platforms, gained more than 100% in the week. Thus, should the current turmoil in the traditional banking system continue to play out, the price of BTC could be well supported, which may eventually bring forth an altseason as investors who made gains in BTC begin to shift some funds into altcoins to capture better returns.

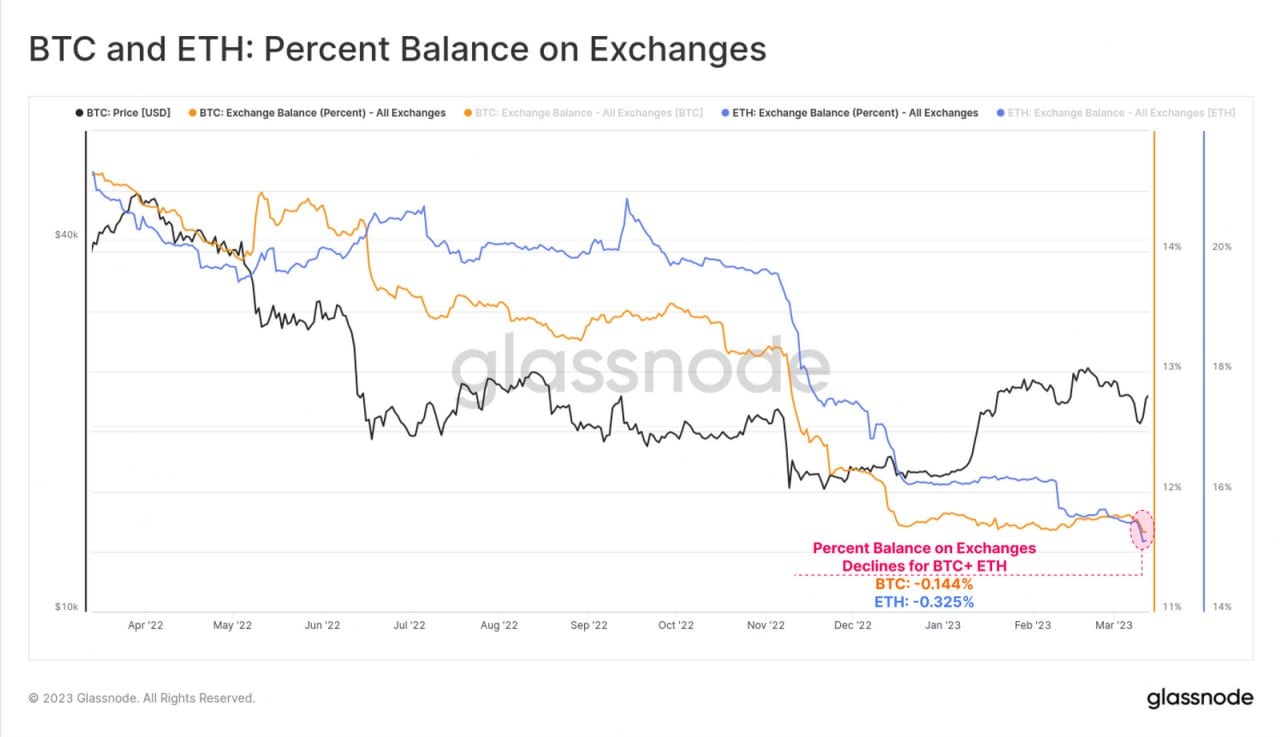

BTC and ETH Exchange Reserves Fall As Buyers Withdraw Coins

With the current stress in the banking system unfolding, BTC and ETH have been actively bought and withdrawn for safe keeping. Exchange balances on both BTC and ETH have seen a relatively large drop as news of the bank failures made their rounds last week. Approximately 0.144% of all BTC and 0.325% of all ETH in circulation was withdrawn from exchange reserves just last week.

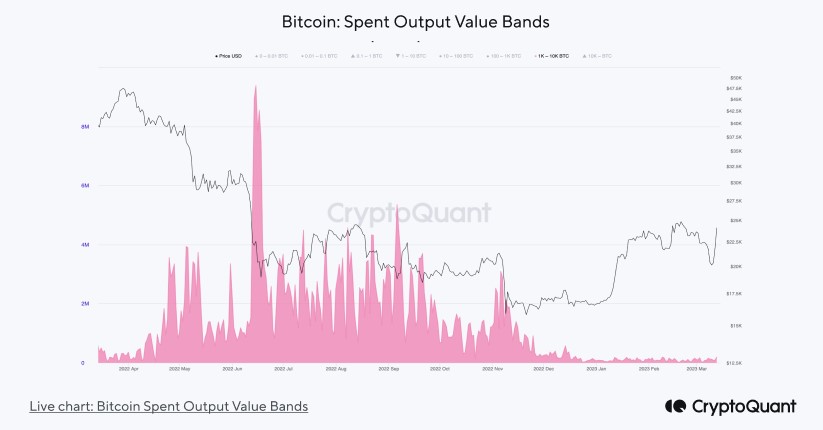

Even though the price of BTC surged above $27,000 by the end of the week, large holders of BTC did not appear to be selling their holdings as the Spent Output Value Bands showing selling activities of wallets holding between 1,000 to 10,000 BTC did not increase. This may be a sign that there could be more upside to come after the weekend consolidation.

ETH Shanghai Date Set for 12 April

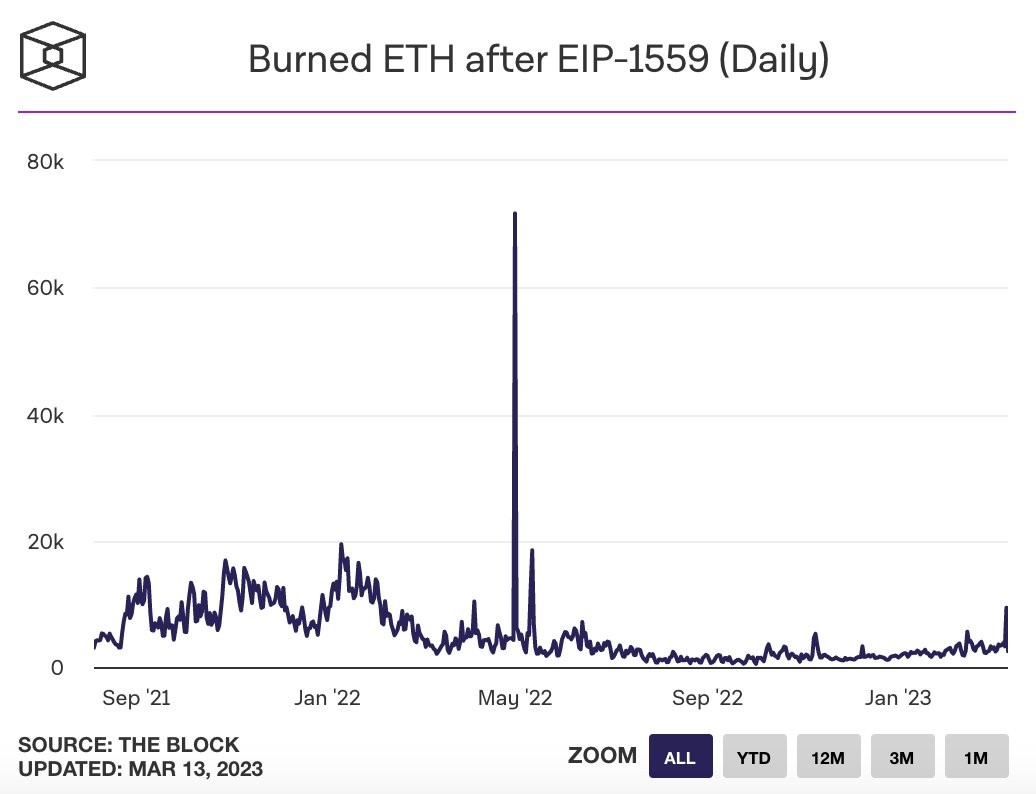

Investors should not shy away from ETH even in spite of the SEC’s comments as the fundamental picture for ETH has continued to improve. Last Sunday saw the highest amount of daily ETH burned post-Merge at 9,400 units of ETH burned as activity on the ETH blockchain spiked as a result of people moving funds around in the wake of the Silicon Valley Bank shutdown.

ETH also had a good week in terms of updates, as the final dress rehearsal for ETH’s upcoming Shanghai upgrade, more accurately known as “Shapella,” was successfully deployed on Tuesday on the Goerli testnet. The test simulated staked ETH withdrawals, bringing the highly anticipated Shanghai upgrade closer to mainnet. In fact, the date for the Shanghai hardfork has already been decided at the “All Core Developers Execution Layer #157 Call” on Thursday, and the big day has been slated to be on or around 12 April 2023.

Market experts are expecting the price of ETH to play catch up and rally strongly once the Shanghai upgrade goes live and withdrawals can be made successfully as that would increase stakers’ confidence to continue staking in ETH.

USDT Market Cap Increase Signals Increasing Fund Flow into Crypto

Since the first news about the US banking system stress hit last weekend, the supply of USDT, the dominant stablecoin, has increased by $3 billion in just one week (new inflow is actually $2 billion as $1 billion out of the $3 billion was a swap from BUSD to USDT), which is the largest increase in recent times. This new mint of $2 billion USDT signals that a large amount of fiat money is coming into the crypto economy as investors flee from traditional finance. This new money entering is a huge boost to the price of cryptocurrencies and a trend may result if the stock market continues to get pressured by the banking sector problems.

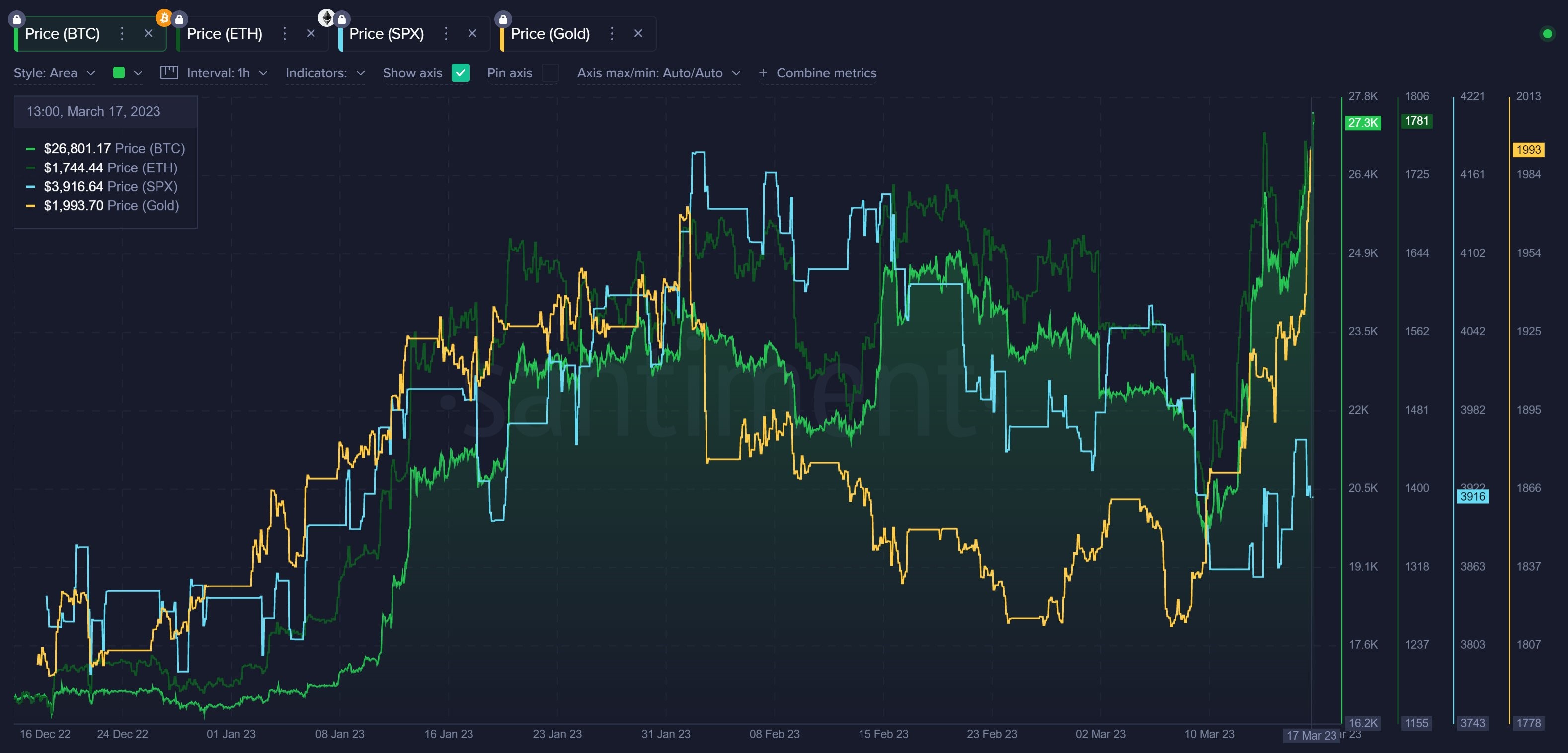

BTC and Gold Finally Decouples from Stock Market

As it is, we can already see the first signs of a decoupling of the different asset classes as the price of precious metals and cryptocurrencies are beginning to rise when stock prices are plummeting. This decoupling could be an early indication that crypto and gold are reverting to their negative correlation to stock prices, which has always been the case before the COVID crash-cum-recovery of 2020.

Should this trend continue, we may see more funds rotate from stocks into crypto and precious metals, which will benefit the prices of cryptos as they have a much higher beta than precious metals, and have a smaller market cap which is more sensitive to an increase in fund flow.

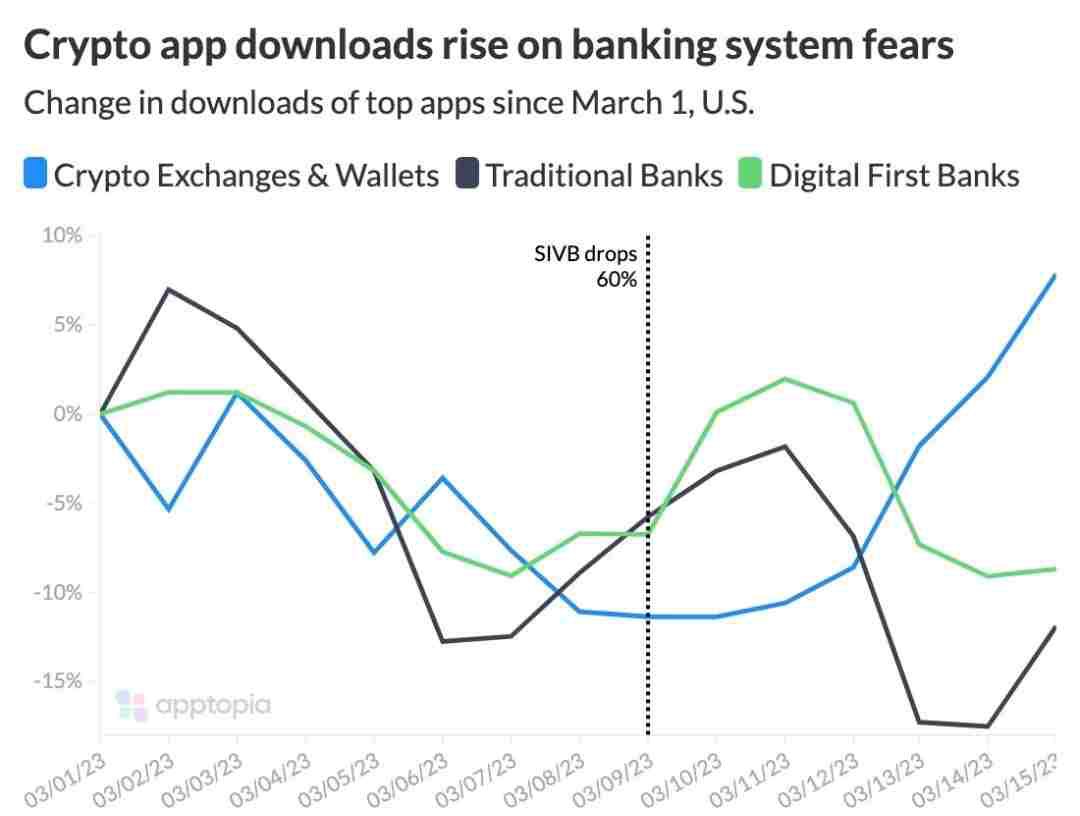

Crypto App Downloads Surge During Week of Bank Trouble

Furthermore, the current banking sector rout is fast increasing the adoption of cryptocurrencies and bringing in new participants into the crypto ecosystem. Ever since Silicon Valley Bank’s implosion, the number of crypto exchange-and-application downloads have been increasing at its fastest pace ever, rising even faster than during previous bull markets. At the same time, banking apps have seen a fast decline. This phenomenon could be underscoring a paradigm shift in the mindset of the mass market user segment from pro-banks to pro-crypto, which could drive adoption on a very big scale and bring in the critical mass that crypto needs for mass adoption. Overall, the current crisis in the banking sector is turning out to be a boom for crypto.

Traditional Finance

As we have already mentioned, global stocks came under pressure again mid-week after troubles at Credit Suisse (CS) once again came into the forthfront, this time dragging European banks down heavily as fears of a global banking system failure spread to Europe. European stocks fell heavily, also dragging global stocks lower until the Swiss National Bank had to loan the beleaguered bank up to $54 billion to tie it over its current liquidity crisis. Over the weekend, Swiss banking giant UBS unwillingly made an offer to buy over CS for around $2 billion, valuing its shares at around $0.50 per share, much lower than the last traded price of CS.

In spite of the market turmoil, the ECB raised interest rates by 50-bps last Thursday while citing that the central bank will do what it needs to support the banking sector. However, market watchers noted that the ECB chief did not hint of more increases to come during the post meeting press conference, which led many to believe that this would be the final rate increase for Europe in light of the troubles within the banking system.

Oil came under pressure after the EIA says global oil markets are contending with a surplus as Russian production defies predictions of a slump while fuel demand is picking up slower than anticipated. With the recent events unfolding in the banking system and stock market mayhem, oil traders are beginning to price in a global recession in the coming months, causing oil prices to dump. The WTI fell 14% while Brent lost almost 13% over the week even when the dollar had been falling during the same period.

This week, all eyes will be on the Fed meeting slated for Wednesday. The entire financial world will be watching to see what the Fed does – markets have already priced in a 25-bps hike this Wednesday. Some traders are even predicting that the Fed may need to cut rates twice by the end of 2023. We will need to see what Fed Chair Powell says in his post meeting press conference to know exactly what Fed officials are thinking. However, most traders may choose to not believe even if the Fed decides to speak hawkishly as bond yields have started to fall drastically last week. Hence, even in the event the Fed hikes rates, any drop in the price of crypto and precious metals may become a good long-term buying opportunity for investors who have not already bought.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.