Bitcoin gained over 10% last week as macro conditions remained a key driver for crypto performance. Bitcoin started the week at 60,800 before surging over 7% on Wednesday, May 15, before hitting a high of 67650 over the weekend. After several weeks of choppy trade, Bitcoin has made a firm rise higher.

Solid gains were not confined to Bitcoin. Altcoins also experienced sizeable gains, with Ethereum rising over 4% and pushing above the key 3000 level. Solana was another notable gainer, rising 14% over the past week, and LINK gained 24%. There were also losers, with Toncoin dropping 10% after its recent outperformance and BNB also falling 2%.

Macroeconomic factors

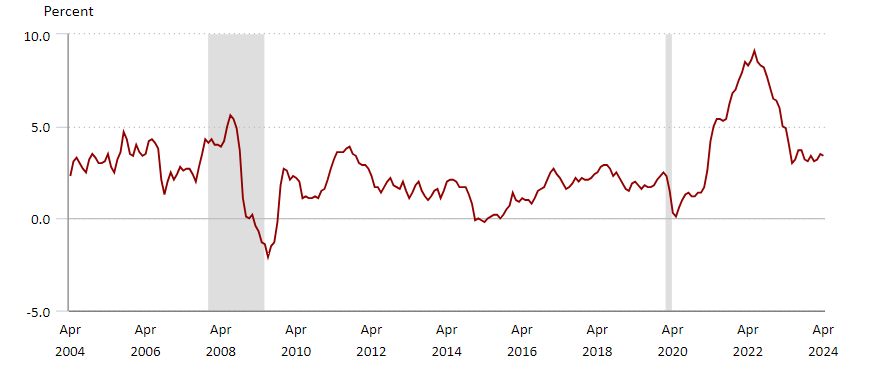

Macroeconomic factors, such as cooling inflation, have been significant drivers of cryptocurrency performance.

The unexpected drop in US inflation data on Wednesday, May 15, was the driving force behind the recent gains in Bitcoin and several altcoins. The Consumer Price Index (CPI) revealed a 0.3% MoM inflation in April, a decrease from the 0.4% in March and below the forecasted 0.4%. This, coupled with the annual CPI easing to 3.4% YoY from 3.5%, marked the first decline this year. The market’s reaction to this data was immediate, with Bitcoin and altcoins experiencing significant gains.

Meanwhile, retail sales were flat in April, missing forecasts of 0.4% growth. The weaker consumer and softening sales could also point to cooler inflation going forward.

The data suggests that inflation may have revived its downward trend and looks like it may reach mid-2% later this year, raising expectations that the CPI rate could be the Federal Reserve could cut interest rates this year. The market is now pricing in the first rate cut in September, with two full 25 basis point rate cuts before the end of the year, which looks appropriate. The USD fell 0.8% last week against its major peers.

A low-interest rate environment, which is currently prevailing, is favorable for riskier assets like stocks and Bitcoin as it improves liquidity and encourages investment.

US stocks rose firmly across the week, with the S&P 500, tech-heavy Nasdaq 100, and the Dow Jones reaching record highs. The Dow Jones even briefly rose above the key 40,000 psychological level.

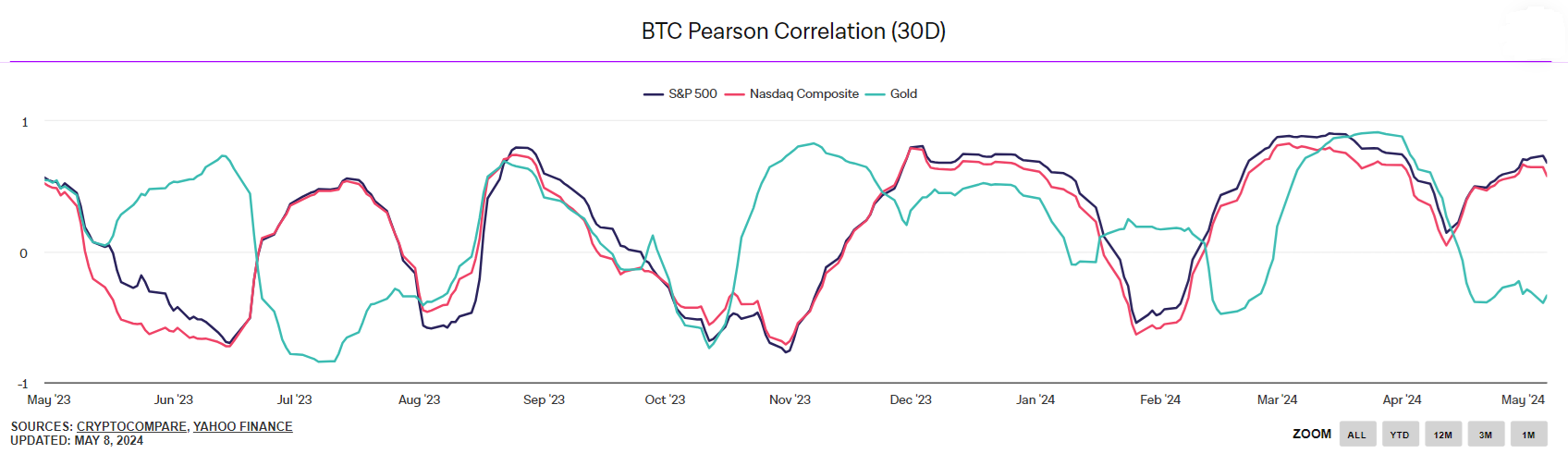

Bitcoin – Nasdaq correlation rises

Bitcoin has shown a strong correlation with technology stocks. The 30-day correlation coefficient between Bitcoin and the Nasdaq reached 0.58. A coefficient of 1 indicates that the two assets move perfectly aligned, and -1 indicates that they move in opposite directions. This could suggest that investors increasingly view crypto as a growth asset due to its technological capabilities and function as a value transfer mechanism rather than just a store of value.

A stronger Bitcoin – Nasdaq correlation coefficient and the Nasdaq 100 trading at fresh all-time highs could bode well for Bitcoin.

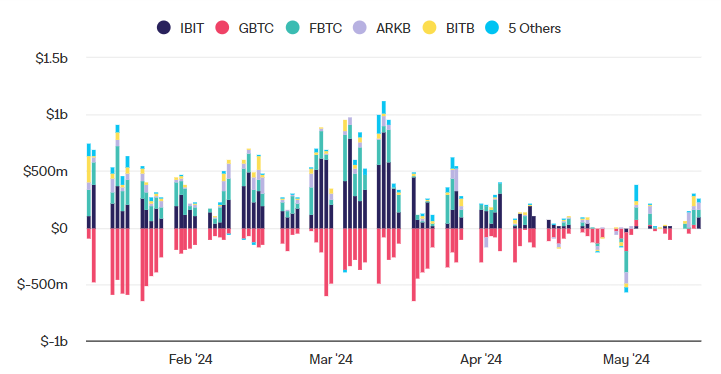

ETF flows

The surge in the crypto markets has also coincided with positive BTC ETF inflows. Inflows in May have already recouped last month’s net outflows. April saw $344 million in net withdrawals from spot BTC ETFs, with $51.5 million leaving on April 29 alone. These outflows have been largely driven by Grayscale’s GBTC fund. Meanwhile, spot BTC ETF net inflows were $1.3 billion over the past two weeks, offering all of April’s negativity and taking inflows to $12.3 billion since launching.

13F filings highlight institutional interest

This week, the final data for institutional investors to disclose their holdings to the Securities and Exchange Commission in a 13F filing was released. The filing reveals who is buying crypto and what their position size is. 937 professional firms invested in spot BTC ETFs, compared to just 95 professional firms investing in Gold in the same period.

Among the professional firms that held Bitcoin ETFs are JPMorgan, UBS, Wells Fargo, and even the state of Wisconsin Investment Board, which revealed over $99 million worth of Blackrock’s IBIT at the end of Q1. The fact that more traditionally conservative funds are adopting BTC ETFs is a positive sign for the adoption of Bitcoin as a well-diversified portfolio.

The 13F filings show that professional investment firms have a growing affinity for Bitcoin, with hedge funds leading the charge. On average, hedge funds allocate 2.1% of their portfolios to Bitcoin, while private equity firms and holding companies follow with 1.5% and 1%, respectively. According to River research, 52% of the top 25 US hedge funds have moved into Bitcoin. Millenium Management filed a significant holding of 27,263 BTC.

While ETF demand is impressive, on-chain Bitcoin transactions show a much more landscape, marked by dwindling transaction volumes.

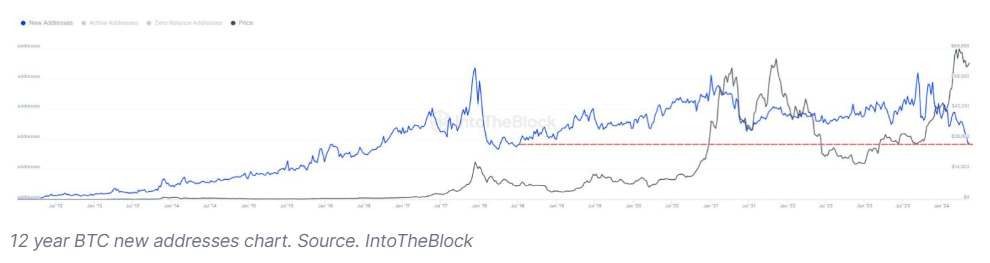

Bitcoin’s new addresses tumble

Bitcoin network activity has plummeted in recent weeks amid a notable downtrend in creating new addresses, which has reached its lowest point since July 2018.

Data from IntoTheBlock revealed a 7-day average of just 276,000 new addresses, suggesting that fewer new investors are entering the crypto space. The New addresses indicator monitors the daily creation of new addresses on the Bitcoin network. A high number of new addresses typically suggests many new investors.

However, the tepid on-chain activity does not necessarily indicate a bearish sentiment. It could just be that more newcomers are turning to ETFs as a preferred route for Bitcoin exposure.

The approval of Bitcoin ETFs earlier this year offers investors another way for investors to gain exposure to the cryptocurrency. The ETFs are a more traditional route and could draw interest away from on-chain Bitcoin transactions.

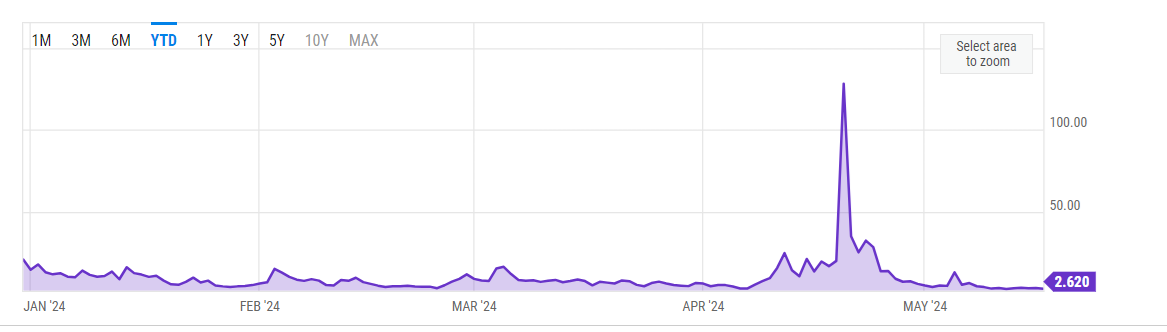

The high transaction fees following Runes also caused a significant drop in active addresses, with the 7-day moving average falling below 70,000 for the first time since March 2020. Fees have since stabilized, with average fees falling from $31.40 on April 23 to $2.97 on May 18.

Gold at record highs

While Bitcoin trades around its highest level in five weeks, Gold has risen to a fresh all-time high at the start of the new week. Increased geopolitical tensions in the Middle East have boosted safe-haven demand for the precious metal. Gold trades 1% higher at $2440.

A helicopter crash over the weekend, which resulted in the death of Irian President Ebrahim Raisi and his foreign minister, has unnerved the market. Gold has previously risen to a record high in April on concerns of a war between Israel and Iran. The prospect of further instability in the region has boosted Gold’s safe-haven appeal.

Meanwhile, the weaker USD is also supporting the precious metal.

Looking ahead: Fed speakers, FOMC minutes & Nvidia earnings

Looking ahead, this week sees a relatively quiet economic calendar, with FOMC minutes and PMI data as the main highlights. The quieter schedule could mean that we see a consolidation after significant moves last week and as investors await fresh catalysts.

Given the lack of data, attention will be on Fed speakers, who could provide more clues about the timing of the first Fed rate cut.

Nvidia, the darling of AI technology, will release earnings after the close on May 22. The earnings will either support or undercut Nvidia’s impressive $2.2 trillion valuation amid the market’s obsession with AI. Strong earnings could help the stock, which is already up 91% this year, rise to all-time highs, lifting the Nasdaq 100 and S&P500 with it.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.