Crypto prices dipped mid last week after a two-week consolidation, leading to around $120 million in positions liquidated, most of them in BTC, which fell from around $27,000 to test the $25,700 support where it found buyers again for the second time. There was no specific trigger out of the crypto markets that caused the price decline, which could explain why prices could not find momentum to drop further. The catalyst could merely be the strengthening of the US dollar, as BTC’s drop happened at around the time when DXY broke out higher from the level of 103.

However, even as the dollar continued to strengthen as the week went on, the price of BTC and other cryptocurrencies failed to fall deeper into the red, which underscores two possible situations, one which is a lack of selling pressure, the other being underlying buyers supporting prices, or both. While data has been thin with regards to any notable accumulation, metrics regarding crypto exchange balances have shown improved dynamics for the two largest cryptocurrencies, which often are a good reflection of the rest of the market.

Lack of Sellers Supporting BTC Price

A check into the exchange balances of BTC shows that the number of BTC available for sale in exchanges has declined since price fell from $27,000. The amount of BTC remaining at exchanges has fallen to a level which saw the price of BTC bounce higher on two occasions this year. While nothing can be certain in trading, if history is a guide, the exchange balance falling back to this “support” zone could imply that there may be a small possibility that the price of BTC could do a small bounce in the days ahead.

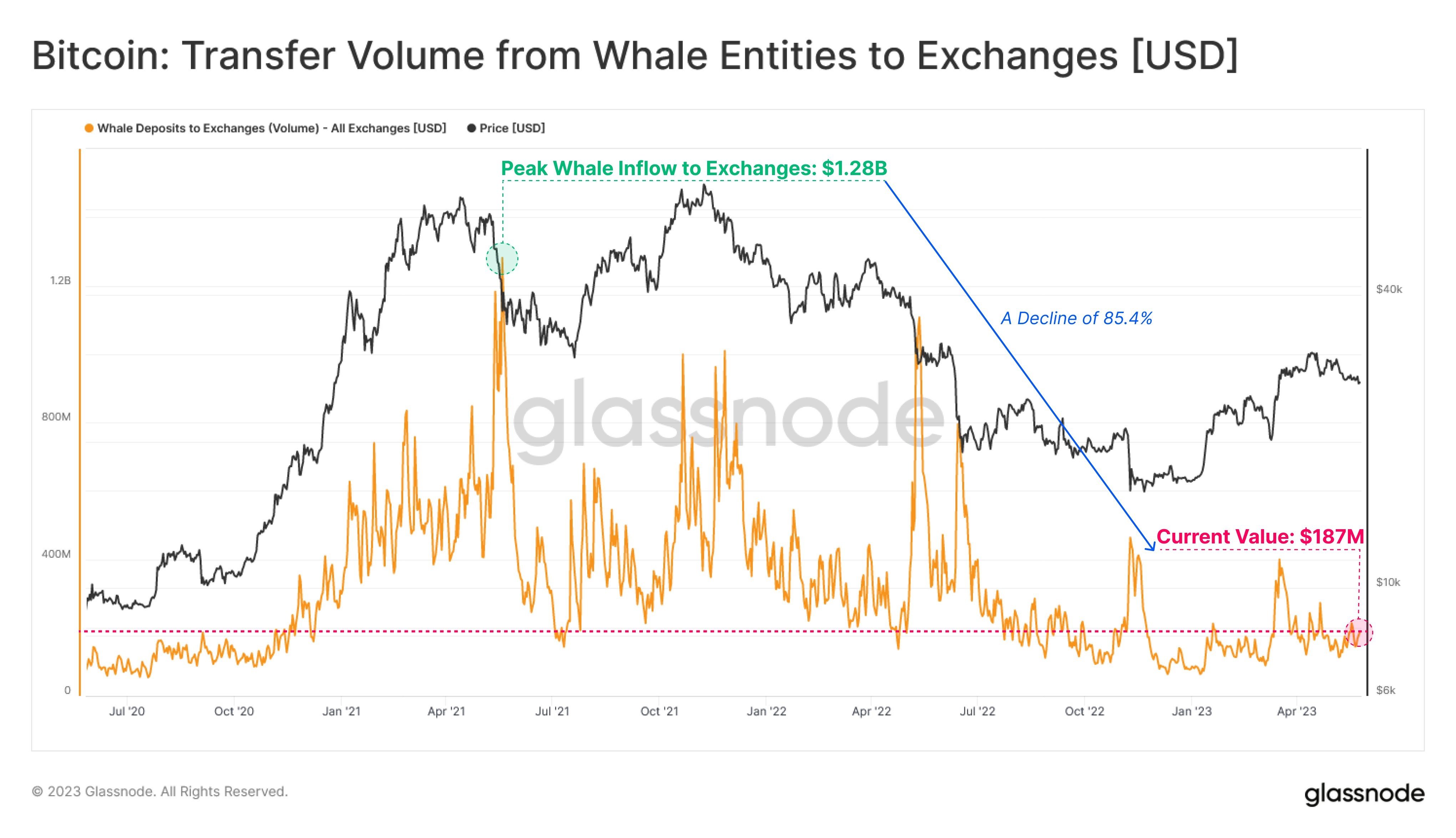

The lack of BTC sellers can be seen in greater detail if we were to study the transfer of BTC to exchanges from whale wallets. From the peak amount of inflows to exchanges during the bull market of 2021 of $1.28 billion, whale inflows to exchanges have declined by more than 85% to only $187 million currently. Even after taking into account the price of BTC’s decline since then, the number of BTC being sent to exchanges for sale has also declined by a significant percentage, which indicates a lack of sellers that can push the price down.

ETH Exchange Balance Back to 2016 Level

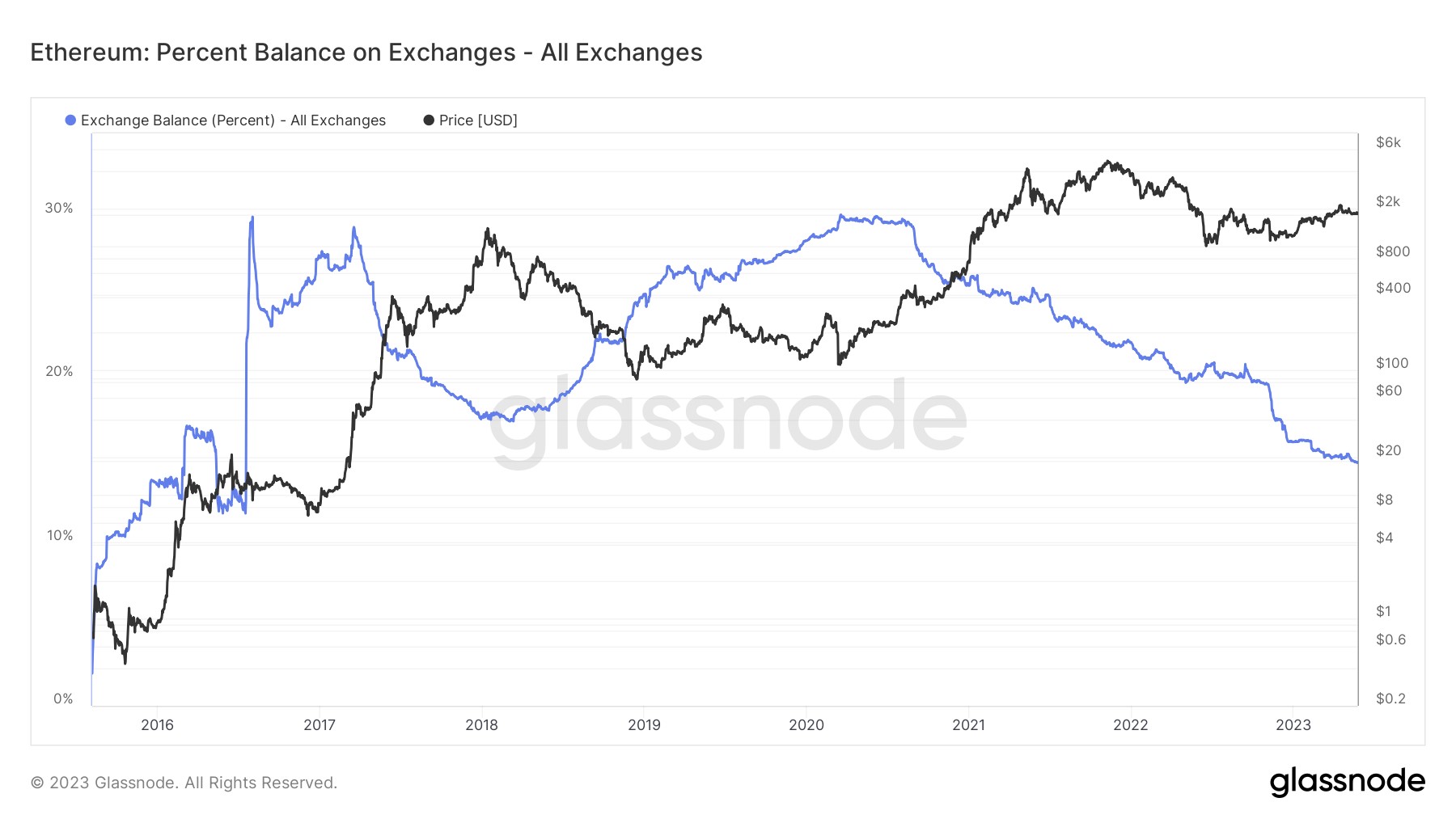

A similar check on ETH balance on exchanges also shows that the amount of ETH available for sale on exchanges has declined last week. While it does not appear as bullish when compared to the BTC data, it nonetheless signals that there is a gradual decline in the selling pressure on ETH, which could explain why its price has failed to convincingly break below $1,800 on several occasions over the past two weeks.

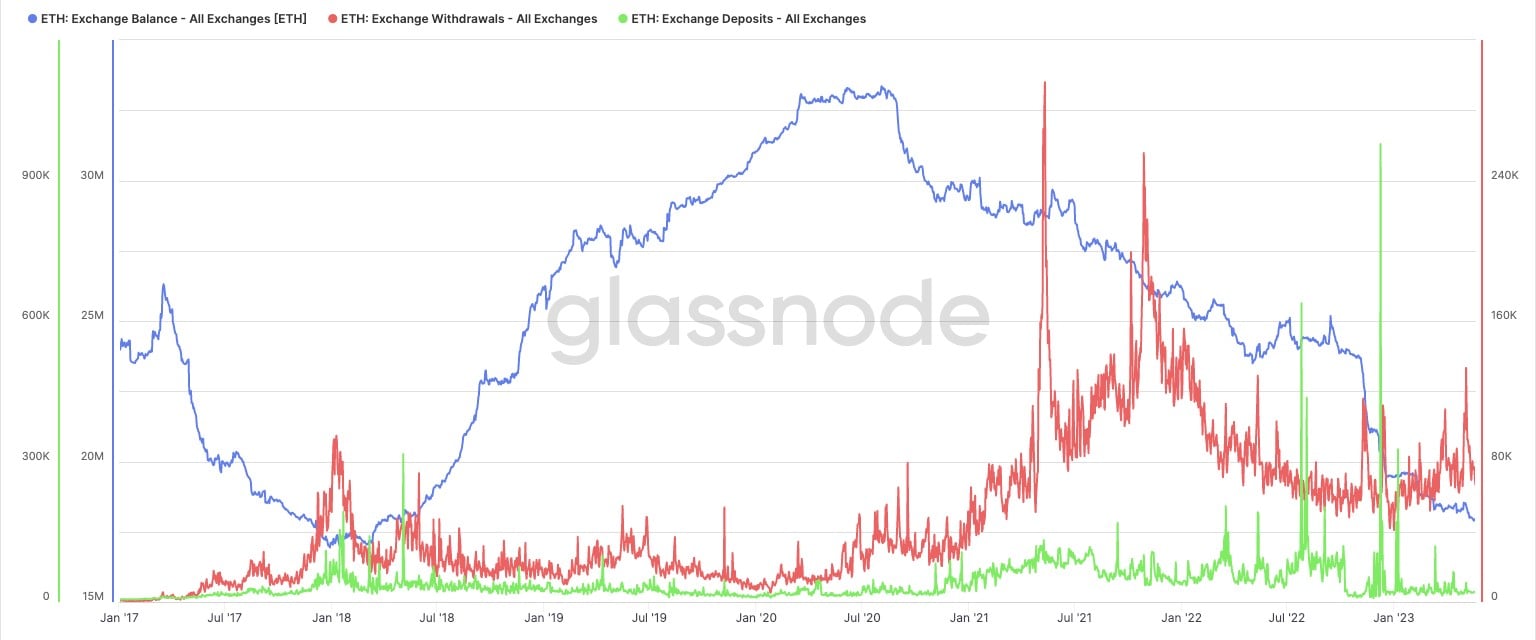

Moreover, ETH withdrawals from exchanges have been outpacing deposits for the most part of this year, resulting in over 1.59 million units of ETH being taken off exchanges.

While the amount of ETH withdrawals last week had fallen, the amount of ETH sent to exchanges for sale has also declined. Such a situation could imply that investors are generally holding a wait and see attitude and not taking sides. Investors displaying such an attitude in the face of a roaring dollar could suggest that the smart investors are either not concerned about the inverse relationship between the dollar and crypto prices, or they do not perceive that the dollar strength could maintain for the long-term. Another way to look at it could be that investors are simply not interested in trading crypto. This phenomenon is especially evident in retail traders.

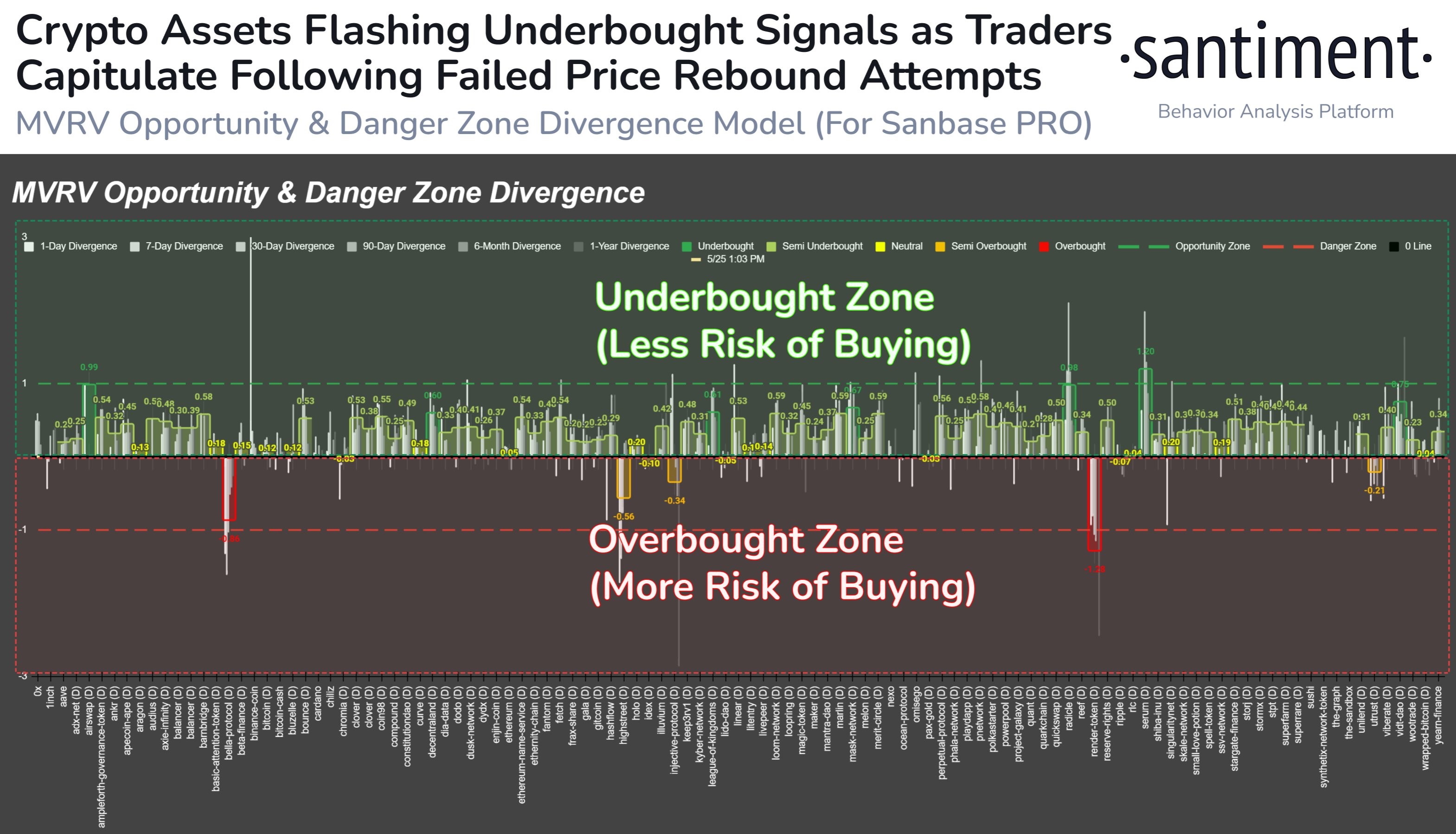

MVRV Index Shows That Altcoins Are Undervalued

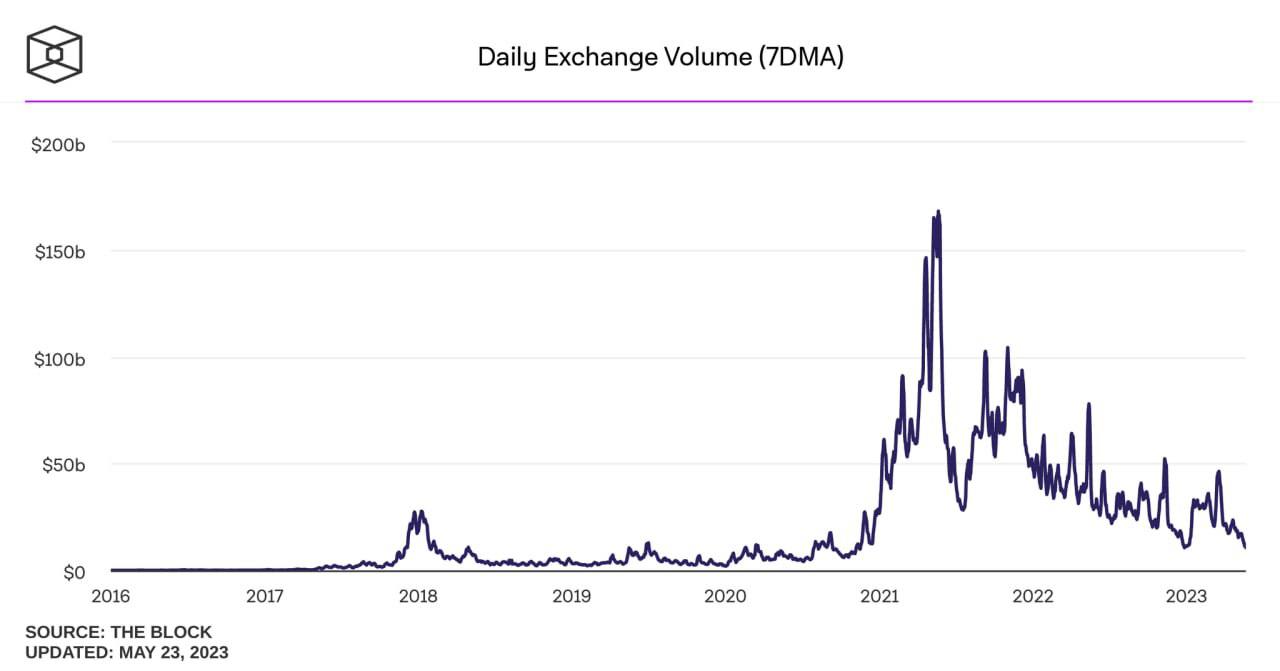

Since the end of March when crypto prices started ranging, retail traders have been losing interest in trading cryptocurrencies. As can be seen below, trading volume across all crypto assets have fallen to their lowest point of the year.

Many altcoin holders even appear to have sold and emptied their wallets and are selling their holdings at a loss. This has resulted in the MVRV index for most altcoins to show undervalued and underbought readings – traditionally a contrarian signal which means this to be a good time to accumulate.

XRP Whale Holdings Rise As Lawsuit Conclusion Imminent

One particular token that has stood out in terms of accumulation in this season is XRP. Between 08 May and last Friday, XRP whale wallets that hold between 10 million and 100 million coins have collectively added over 52 million units of XRP, worth around $22.9 million. After Ripple CEO Brad Garlinghouse commented that the result of the SEC lawsuit could be delivered in a matter of weeks, trading volume on XRP has been rising. The last time this group of whales accumulated XRP as aggressively in February, its price rose around 20% subsequently before their sale caused the price to drop back.

Tech Stocks Surge Despite Expectation of More Hikes Ahead

Last Wednesday’s FED meeting minutes revealed that officials were divided over where to go with interest rates, with some members seeing the need for more increases while others expected a slowdown in growth to remove the need to tighten further. Eventually, FED officials tilted towards a less aggressive policy. Despite the more dovish revelation, the dollar continued to gain ground, especially after the jobless claims report came in less than anticipated mid-week, which proved that the labour market was still strong. With the bulk of companies having reported better-than-expected results as well, traders have gathered that the US economy is far more resilient than they had expected. This caused the 2-year Treasury yield to spike more than 10-bps as traders now expect the Fed to continue hiking rates into the second half of the year.

The PCE index released on Friday gave further credence to the possibility of more hikes to come as it showed that the FED’s preferred gauge of inflation gained 0.4% last month, higher than market expectation of a 0.3% increase.

However, despite the odds of more rate hikes to come, tech stocks demonstrated indifference and rose sharply after results of Nvidia were much better-than-expected and even gave a stronger revenue guidance for the quarter ahead. The positive showing from tech stocks led other sectors to recover from their early week selloffs, with the Nasdaq rallying 2.5% for the week. The early week uncertainty about the debt ceiling negotiations also started to dissipate after US lawmakers were finally close to striking a deal, even as Treasury Secretary Janet Yellen pushed back the deadline to 5 June instead of the originally anticipated 1 June. The week eventually ended with the S&P gaining 0.3% and the Dow losing 1% as gains in the later part of the week could not offset its early week losses.

The strength of the dollar was evident in the price of commodities. Gold fell to a low of $1,935 mid-week and closed the week at $1,945, dropping by 1.75%. Silver lost 2.2%, while the DXY rallied 1% to 104.23. Oil was another big loser, with the WTI losing 5.6% and Brent Crude falling 6.3%.

Main market action this week could kick off later, as major markets in Europe and the USA coincidentally have Monday as a public holiday. However, with the announcement of a tentative deal being struck for the extension of the US debt ceiling late Saturday night, the Asian markets have kick started the new week with a risk-on rally on Monday. Even though the US market will only open on Tuesday, stock futures are trading and are rising higher. The new debt-deal will still have to go to the votes on Wednesday; however, it is unlikely that negative surprises will spring up.

Data-wise, Thursday and Friday will be the key days to watch, as the ADP and Non-farm payroll employment reports will be out on Thursday and Friday respectively. Analysts expect that a stronger than expected labour market would seal the deal for the FED to raise rates on both the June and July meeting, which may see the dollar continue to rise even higher in the near-term.

As for crypto, this Thursday, 01 June ushers in a new exciting phase as Hong Kong investors will officially be able to purchase cryptocurrencies. With this in mind, interest in China-related tokens could return, especially after a Chinese ministry released a report last week which stated that China will be endorsing Web3 developments again.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.