The week started on a bearish note after the IMF cut growth forecast from 2.9% to 2.7% for next year, warning that 2023 will feel like a recession for millions around the world, citing it to be the weakest growth profile since 2001 apart from COVID during 2020.

Further to the warning from the IMF, there were other developments that shows that cracks are beginning to show in world economies, and especially out of the UK.

The BoE had to start additional QE even before the original one ended on October 14, as the central bank increased the limit for its daily gilt purchases on Monday, and then widened the approved purchases to include index-linked gilts from October 11 until October 14 on Tuesday, showing the extent of the desperation shown by UK officials as the gilts continued to see selling pressure. For instance, the 10-year index-linked gilt yields rose by 64-bps to 4.53% on Monday before the QE buying limit was raised, representing a massive 5.5% fall in price before the BoE stepped in to contain it. Moves of such magnitude are highly unusual in developed world sovereign bond markets and could pose a material risk to UK financial stability if allowed to continue, which was the reason the BoE gave for stepping up their efforts again. However, the reaction from the market was muted and as a result, the UK officials have had to keep buying more. We will soon see the actual market condition as the bond buying comes to an end. Traders are expecting the next rate hike from the BoE will need to be a big one to contain the pound exodus.

As for the USA, Fed minutes released showed that officials were surprised at the extent of inflation, which means more rate hikes and elevated rates could be here to stay for much longer than traders expect. The CPI numbers released on October 13 proved their point, coming in hotter-than-expected, rising 0.4% in September and were up 8.2% from a year ago. Traders now expect 75-bps rate hikes in both November and December meetings instead of just in the December meeting previously anticipated. Some traders even expect a 100-bps hike in the November 2 meeting as yields have spiked much higher, with the benchmark 10-year yield now above 4.02%, while the 2-year yield closed the week at 4.51%. This makes the yield curve the most inverted since the 1980s.

While stock traders tried to shrug off the huge recession warning by posting a strong bear market rally on Thursday, tech stocks could not hold on to the gains and the markets closed lower again on Friday. For the week, the Dow was up 1.15%, while the S&P lost 1.55% and the Nasdaq dropped 3.11%.

Recession as a Growth Trigger - Use ItBoJ Dishes Intervention Warning as USDJPY Rockets Higher

With yields surging, the USD rose for the week, although not by a significant amount against other currency pairs except for the Japanese yen. In the latter part of the week, the USD/JPY broke through the level of 145.90 where the BoJ last did the intervention to curb its rise on September 22. The pair easily breezed through its 1998 resistance of around 147.28 with strong momentum and flew to 148.72 to close the week. The pair could be on track to test the psychological area of 150 this week unless the BoJ intervenes again – and the warning has indeed come from Japan’s finance minister, who spoke early on Saturday that they have seen unprecedented one-sided yen moves, which means an intervention could be forthcoming this week.

The strong USD made casualties out of most other assets, with Gold losing 3.3%, while Silver dropped a whopping 10%, giving back all its gains made in early October. Oil too fell, with both Brent and WTI Crude losing around 5.2% each. In early Asian trading in this new week, the USD has eased back by about 0.2%.

Although cryptocurrencies also fell as a result of the stronger USD, their losses were much milder compared with other assets. BTC managed to save itself from breaking through $18,000 on Thursday’s rebound but is still looking precarious even as its price maintains around the $19,000 level for the fourth month, while the selling pressure on ETH appears to be easing. Altcoins fared better overall, with some select altcoins like XRP still managing to carve out some short-lived gains.

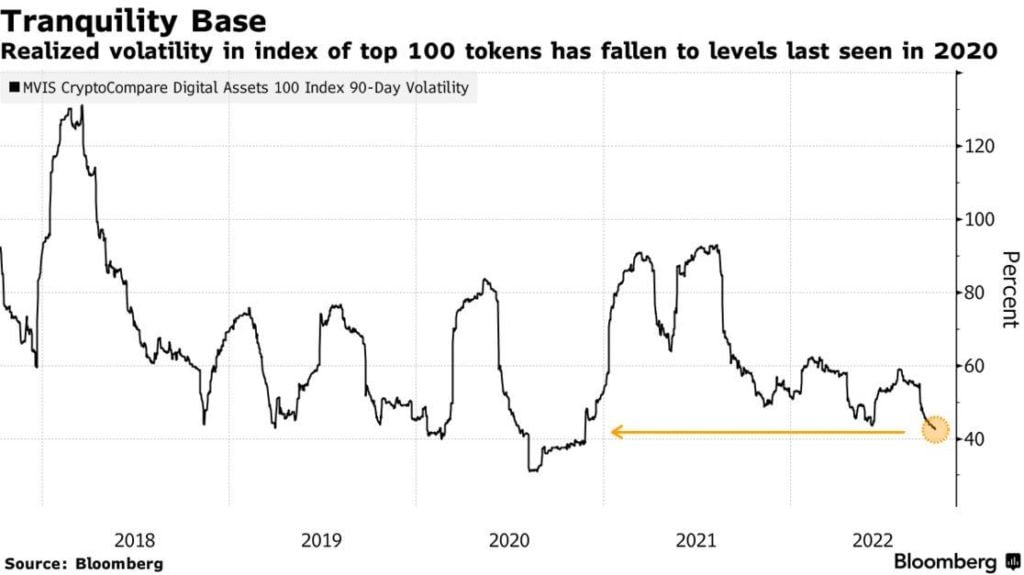

Crypto Volatility Falls to 2020 Levels

As crypto prices hold on to dear life, volatility in the asset class has fallen to a level worth keeping an eye on as historically, large price moves typically come after such a long period of consolidation.

The realized volatility in index of top 100 crypto tokens has fallen to levels last seen in 2020. Could this be the consolidation before the next big move like we have seen in 2020? Only time will tell. For the moment, however, volatility is still lacking in the crypto market.

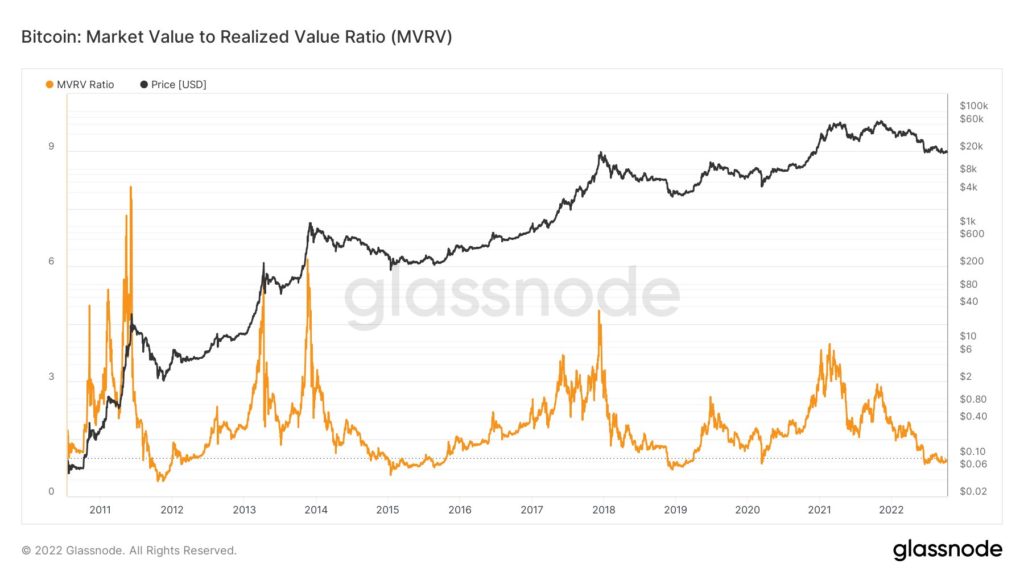

One reason to explain this lack of volatility, or rather, the inability for crypto prices to fall, could be seen in BTC’s metrics, which are showing signs of bottoming. One such metric is the MVRV. An MVRV ratio below 1 indicates that the asset is undervalued and is useful in predicting price bottoms. The BTC MVRV ratio is currently 0.9, indicating that BTC is undervalued. The area around this level previously signalled the bottoms of 2011, 2015, November 2018 to April 2019, and the COVID crash. While we could still be around 0.1 points away from the actual bottom, the actual realized price move down may not be significant.

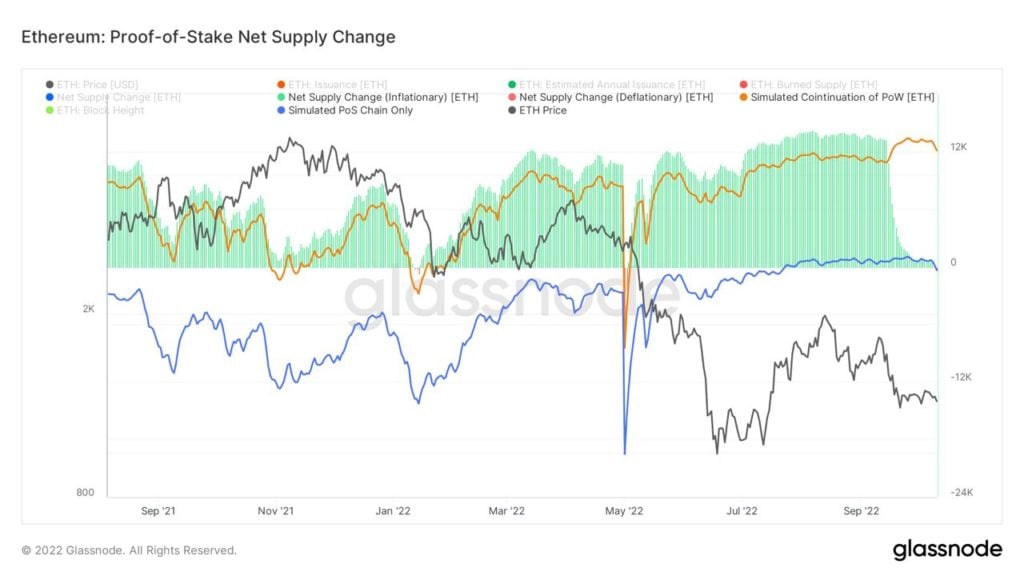

ETH Becomes Deflationary First Time Since Merge

Last week, ETH’s supply growth turned deflationary for the first time since Merge as the circulating supply begins to reduce more than its new coin issuance. As the coin burn in EIP-1559 have stabilized, this trend is expected to continue, making ETH join the ranks of BTC as a deflationary cryptocurrency.

The US economic calendar is rather quiet this week, hence, the market focus could continue to be on the strong USD. The main risks could come in the forex market with regards to the pound and the yen, where the BoJ has already given warning about the yen’s recent weakening.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.