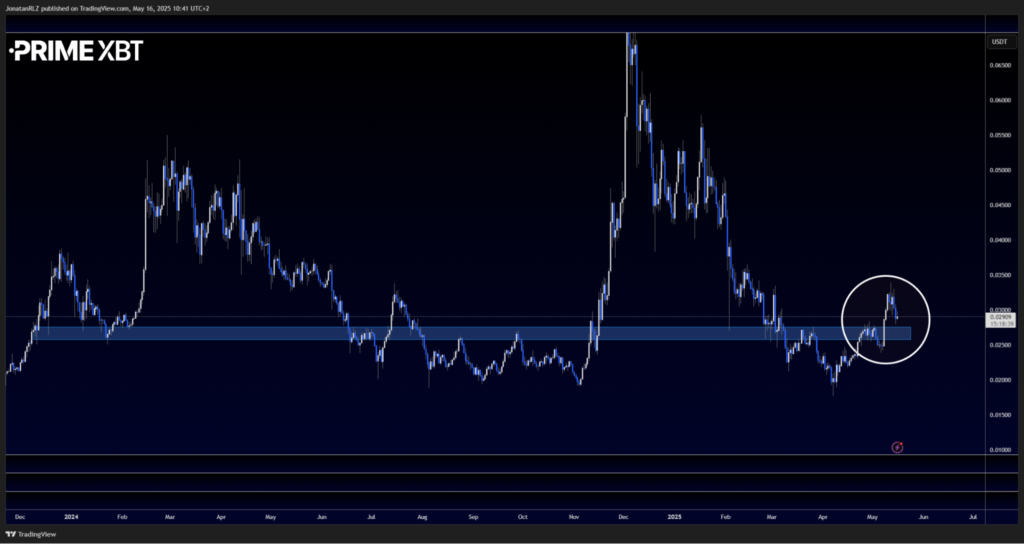

In the first week of May, VeChain (VET/USDT) broke above a long-standing resistance area at 0.0275, a historically significant level that has acted as both support and resistance all the way back to the early days of its price history in 2018. We are now seeing price come back toward this breakout zone, offering a potential opportunity for confirmation of support before continuation to the upside.

Zooming in on the daily chart, we can see that this current move down is approaching a technical cluster of interest. Using the Fibonacci retracement tool anchored from the recent swing low (white up arrow) to the recent swing high (white down arrow), we find that the reload zone, the area between the 0.618 and 0.786 Fib levels, aligns perfectly with the untested breakout zone around 0.0275.

Adding to this, both the 20-day EMA (white) and the 50-day EMA (blue) are now crossing in a bullish manner, with both moving averages also sitting right in the same area as the 0.618 level. This creates a zone of strong technical confluence that could serve as a springboard for the next move higher, if the level holds.

A notable observation is how the Fibonacci extension levels also line up. When projecting the move from the current range, we find the –0.618 extension landing right around the 0.040 area, a high timeframe resistance zone and a potential upside target if momentum continues.

Price is currently testing the daily 20 EMA as initial support. If this level holds, it could be seen as front-running the high timeframe support zone below, something that often occurs when bullish momentum is strong and market participants are eager to position early. It is worth monitoring current price action closely to see whether this front-running dynamic plays out and leads to a renewed push to the upside.

Trade VET

Trading involves risk.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.