Weekly Recap

U.S. stocks ended lower last week, marking the second straight weekly decline. Meanwhile, the USD ended the week flat after a 5-week rally as investors digested mixed data, some disappointment from the Magnificent 7 earnings, and de-risking ahead of this week’s US election.

US inflation data was hotter than expected, and Q3 GDP was slightly weaker than forecast, although it remained well above the historical average. Meanwhile, the US non-farm payroll showed just 12k jobs were added, significantly below the 113k economists had expected, paving the way for the Fed to continue cutting interest rates. The weak jobs data came amid strikes and owing to the impact of hurricanes on the labour market.

Elsewhere, big tech earnings from Amazon and Alphabet impressed well. Meta, Microsoft, and Apple were disappointed with their outlooks and raised concerns over the amount being spent on AI.

Attention is firmly on the US elections, and de-risking ahead of such a key event is not unusual, particularly given how close this election is expected to be. The Nasdaq fell 1.5% last week after 7 straight weekly gains.

US Election

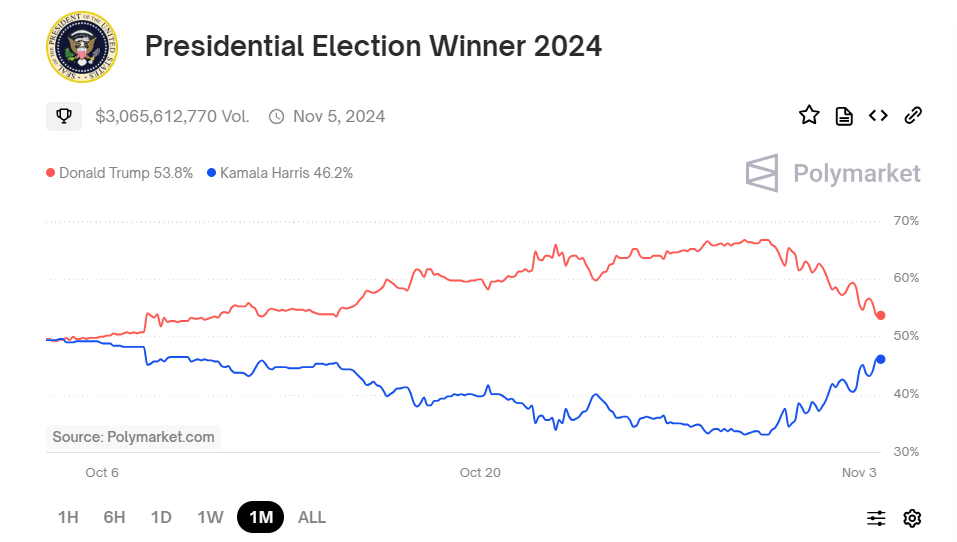

Voting in the US election takes place on Tuesday amid a tight race for the White House between Republican Donald Trump and Democrat Kamala Harris. Official polls over the weekend have given Kamala Harris a slight lead compared to Donald Trump, and the Poly market has seen Trump narrow his lead against Harris. These changing odds could result in volatility at the start of the week.

The market dislikes uncertainty, as evidenced by the derisking across the financial markets at the end of last week.

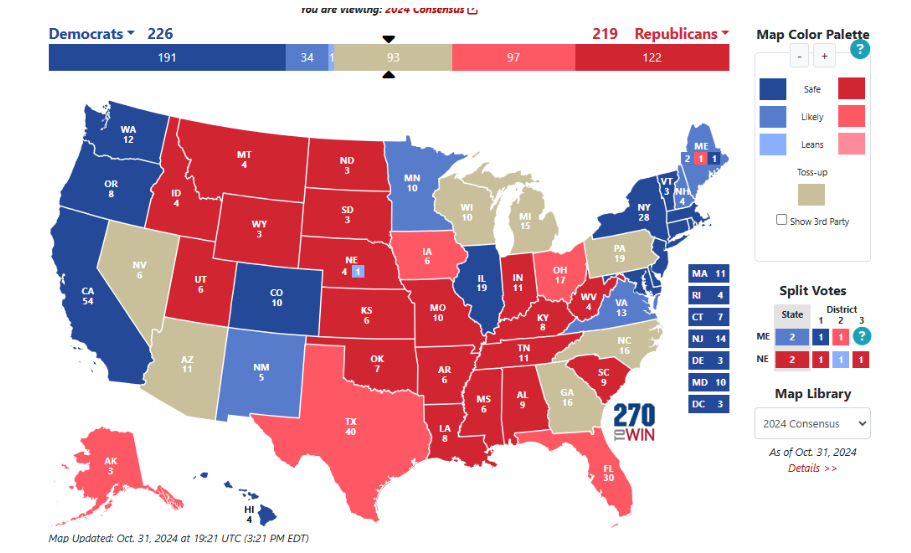

Which states to watch

North Carolina and Michigan are historically the first swing states to be called and are both seen as key election bellwethers. The outcome of these states could set expectations and move the markets.

Pennsylvania is also a key state to watch. The winner here could take it all. Volatility on betting sites surrounding this state has been huge. Trump is back on top at the time of writing, but that could change at any moment.

The exit poll embargos will be lifted at 5:00 PM ET on November 5th. Historically, networks have the US election results around 23:20 ET on the election day. A big concern is that the markets won’t learn of the outcome on Tuesday, and given the late counting of mail-in votes in certain states, it’s a possibility.

What could a Trump win mean for the market?

Should Trump become president and the Republicans control both the House and the Senate ( a red sweep), there is a greater chance of his proposed tax cuts, fiscal measures, tariffs, and deregulation being implemented.

The cleanest way to trade this could be through FX, as the inflationary policies boost the USD in USD/JPY and EUR/USD. US stocks are also expected to benefit from the lower corporation tax and deregulation, helping to raise U.S. stock indices.

Meanwhile, gold is also expected to perform well under Trump as safe-haven demand increases owing to expectations of geopolitical tensions, especially with China.

What could a Kamala Harris win mean for the markers?

Should Harris win, worries over increased taxes and a less favorable corporate environment could see stocks initially move lower.

The Trump trade could also unwind, so the USD could fall lower, recouping some recent gains. EUR/USD could rise as the pair benefits from the weaker USD. However, the move higher may lack durability as attention returns to central bank expectations and growth divergence.

Federal Reserve rate decision

The market is widely expecting the Federal Reserve to cut rates by 25 basis points at the conclusion of its latest FOMC meeting on Thursday. The move comes after the central bank reduced rates by 50 basis points in the September meeting and would mark the second straight interest rate cut this cycle.

Recent data showed the labour market is gradually cooling, and inflation is also close to the central bank’s 2% target. The market will be watching closely to see whether Federal Reserve chair Jerome Powell believes the US economy’s resilience may continue. If so, Powell could cut interest rates more gradually, which would support the US dollar, lifting USD/JPY.

BoE rate decision

The BoE will announce its interest rate decision on Thursday, November 7th, less than a week after Britain’s pivotal budget, which saw the Labour government announce higher taxes, borrowing, and investing, with higher growth and inflation expected next year. As a result, the markets are pricing in at least one less rate cut next year, and there has also been a slight increase in uncertainty over whether the central bank will cut rates on Thursday. Still, the market considers that a rate cut is more likely than not, with an 80% chance of a 25 basis point cut priced in, taking the rate to 4.75%.

The BoE’s outlook will be watched closely, with Andrew Bailey not expected to raise hopes of a further rate cut this year. While inflation is below the BoE’s 2% target, dropping to 1.7% YoY in September, service sector inflation remains sticky at 5.6%.

RBA rate decision

The RBA will announce its interest rate decision on Tuesday and is widely expected to keep rates at 4.35%. The central bank is not likely to start cutting rates until February next year, as resilient economic activity and sticky inflation still require a cautious approach.

Inflation was 2.8% last quarter, within the Reserve Bank of Australia’s 2 to 3% target for the first time in three years, but core inflation remained elevated.

With the jobs market still strong and interest rates at a relatively lower peak, the RBA is likely to be slower to ease policy than other central banks.

Earnings

169 S&P 500 companies reported last week; a further 8% will report this week as the Q3 earning season remains very much in focus. Figures from Panatir, Ferrari, Super Micro Computer, Qualcomm, and ARM Holding are due this week and could continue influencing investor sentiment and the major U.S. stock indices.

Oil

The markets are expected to remain volatile amid geopolitical risk premiums offsetting concerns over rising supply and weaker demand.

Prices jumped over 2% on Friday on reports that Iran could prepare retaliatory strikes on Israel within the coming days as tensions in the region remain elevated. Oil prices are also being boosted by expectations that OPEC+ could delay its planned increase in oil production from December by a month or so, owing to concerns of soft demand and rising supply and demand. A decision is expected to be made as soon as this week.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.