Weekly recap:

U.S. stocks fell last week, with the S&P 500 declining 1.4%, marking the worst weekly performance since mid-November. While equity markets started the week on the front foot, they quickly retreated amid concerns about AI capital expenditure and technology disruption.

A stronger-than-forecast jobs report dented hopes for Federal Reserve rate cuts, while cooler inflation at the end of the week helped stocks off the lows. The USD fell across the week.

Data this week had a whipsaw effect on rate cut expectations. Data showed the US economy added 130,000 jobs in January, ahead of the 70,000 forecast, marking the largest gain since December 2024. The unemployment rate unexpectedly eased to 4.3%. The market pushed back Federal Reserve rate-cut expectations to July from June. However, CPI was cooler than forecast at 2.4% YoY in January, down from 2.6%, and core inflation cooled to 2.5%, its lowest level since March 2021. The data lifted expectations for a third rate cut to 50% from 40%.

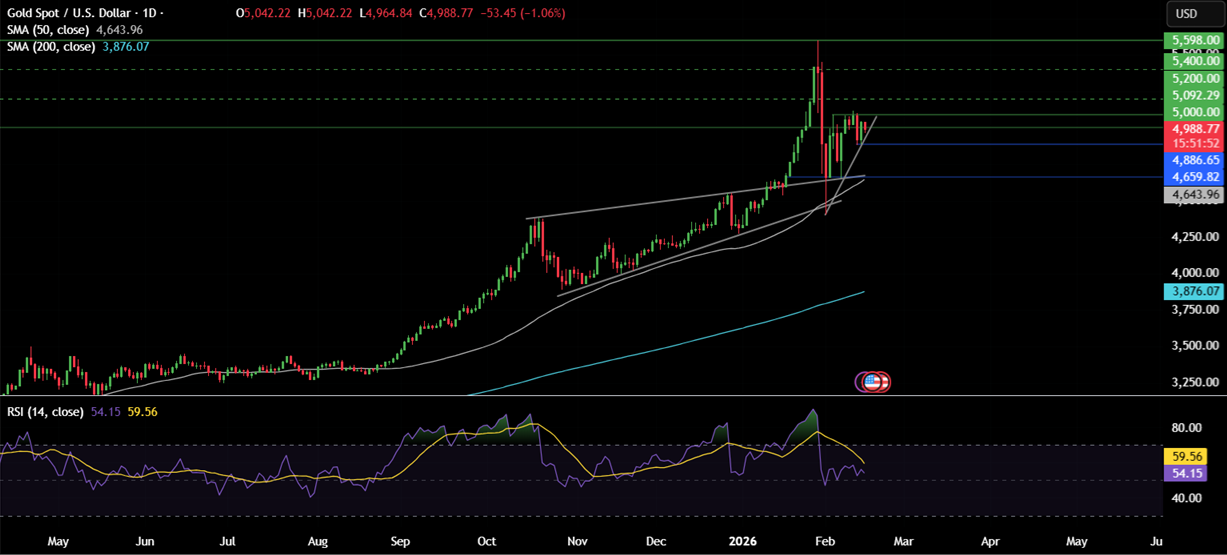

Precious metals saw another volatile week. Gold ended the week 1.6% higher, despite a 3% drop on Thursday. Silver ended flat despite dropping 10% on Thursday. A stronger NFP and a cooler CPI fueled moves in precious metals. Volatility was also elevated amid a strengthening positive correlation between precious metals and tech stocks.

Monday, the US is closed for Presidents’ Day, so volumes are expected to be low.

RBNZ rate decision (Tuesday)

In the final meeting of 2025, back on November 26, the Reserve Bank of New Zealand cut its official cash rate to 2.25%. The 25-basis-point reduction was approved by a 5-to-1 vote, bringing total easing in the cycle to 325 basis points. The RBNZ said it was confident that medium-term inflation would return around the 2% target. Inflation was at 3% in the September quarter but was projected to fall to around 2% by mid 2026 as price pressures ease.

The forward guidance from the meeting shifted from dovish to data-dependent, suggesting that future moves will depend on the outlook for medium-term inflation and the economy. Expectations are for one more cut this cycle, but the central bank considers that its rate-cutting cycle is largely complete. No rate cut is expected in this meeting amid cooling wage growth, labour market slack, and spare capacity in the market and the economy. There is no rush to tighten rates further. However, after the RBA hiked rates, there is more attention on the RBNZ. A more hawkish-sounding RBNZ could lift NZD/USD.

UK CPI (Wednesday)

UK inflation data will be watched closely and could be the tipping point for whether the Bank of England cuts interest rates at its March meeting. In the February BoE rate decision, there was a tight 5-4 vote to keep rates on hold, which meant that the bar to cutting rates has fallen sharply in the last few weeks. The Bank of England expects inflation to fall towards the 2% target by spring this year; however, this could be challenging, given that wages and service-sector inflation remain above the 2% target.

In December, headline inflation rose to 3.4%, up from 3.2%. However, January could see cooling inflation owing to lower energy bills and discounting in January sales, which could introduce a downward bias. A fall towards or even below 3% could support rate cut expectations for next month and pull GBP/USD lower, although the market is pricing in a 25 basis point rate reduction in April.

FOMC minutes (Wednesday)

The minutes relate to the February meeting, which saw the Federal Reserve leave interest rates unchanged, with two dissenters, Miran, who voted to cut rates, joined by Fed governor Christopher Waller. He may have hoped a dovish vote would secure his nomination as Fed chairman. Instead, Trump announced that Kevin Walsh will be replacing Powell in May. Still, with little evidence of a significant slowdown in the US economy, inflationary pressures are easing, and jobs data are stabilising.

The Fed is weighing up a mixed picture. The market will closely monitor arguments about inflation and the jobs market outlook, which could impact the USD and stock indices like the Nasdaq.

Eurozone PMIs (Friday)

Expectations are for full-service PMI to inch up from the prior reading, while the manufacturing component could return to expansionary territory. As a result, the composite PMI, a good gauge of business activity, is expected to rise to 51.7 from 51.3. The data comes after eurozone retail sales fell 0.5% in December and German industrial production missed forecasts by quite a wide margin, underscoring the uneven nature of the country’s recovery.

However, the data is unlikely to affect the ECB’s monetary policy, with the central bank reiterating that its policy remains sound. The ECB has recently described growth as resilient and reiterated its data-dependent approach. Strong data could support EUR/USD.

Japan CPI (Friday)

Japanese CPI is expected to slow sharply, with headline inflation seen at 1.5% year on year, down from 2.1%. This deceleration is largely due to government energy subsidies and a steadying in food prices. Inflation could moderate further in the coming months, reinforcing expectations that price pressures could remain contained in the near term.

The data is specifically in focus after the GDP data at the start of the week, given the strong moves in the yen following Takaichi’s landslide victory in elections earlier this month. Takaishi is expected to bring growth to Japan. However, the BoJ will likely wait until the Shunto spring wage negotiations to assess the path for further hikes.

US Core PCE (Friday)

This data is critical for policymakers in weighing up the outlook for interest rates. Expectations are for the Federal Reserve’s preferred gauge of inflation to tick higher to 3% YoY in January, up from 2.9% in December. This comes as food and producer prices point to upside risks and from price increases caused by tariffs. This comes despite the cooler CPI reading on Friday, as PCE data gives greater weight to categories where prices are rising more sharply.

The Fed pencilled in one further rate cut this year, although policymakers have indicated that this is dependent on progress in inflation. The market sees two rate cuts in 2026. Cooler-than-forecast PCE data could lift market rate-cut expectations, pulling the USD lower while boosting Gold and stocks. Hotter inflation could have the opposite impact.

US Q4 GDP (Friday)

The US economy expanded at an annualised pace of 4.4% in Q3 of 2025, its strongest advance in two years, and accelerating from Q3’s 3.8%. The strong growth was driven by resilient consumption and robust exports, whilst imports and inventory adjustments provided headwinds. Overall, the data showed the economy was resilient despite the tariff uncertainties and the softening labour market.

However, the 43-day U.S. government shutdown last year will have impacted growth, with GDP expected to moderate to 3.5%. That said, the effects should be short-lived, and a rebound from the shutdowns’ impact could come in Q1. Strong growth could support a rotation away from tech stocks into cyclicals and lift the Dow Jones and the USD.

Trading involves risk.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.