Bitcoin rallied from a low of below $60,000 on Friday to a peak of 67,000 earlier today, boosted by optimism surrounding the Bitcoin halving event at the weekend.

While the price has since eased modestly lower, traders are still optimistic about further gains. In the previous halving cycles, Bitcoin’s price has rallied to fresh ATHs in the months following halving.

- Bitcoin has risen from 60k to a peak of 67k post halving

- Social media volumes are rising for altcoins

- PEPE coin rises with Coinbase listing in focus

- Book of Meme sees social media volumes jump 166% in 24hrs

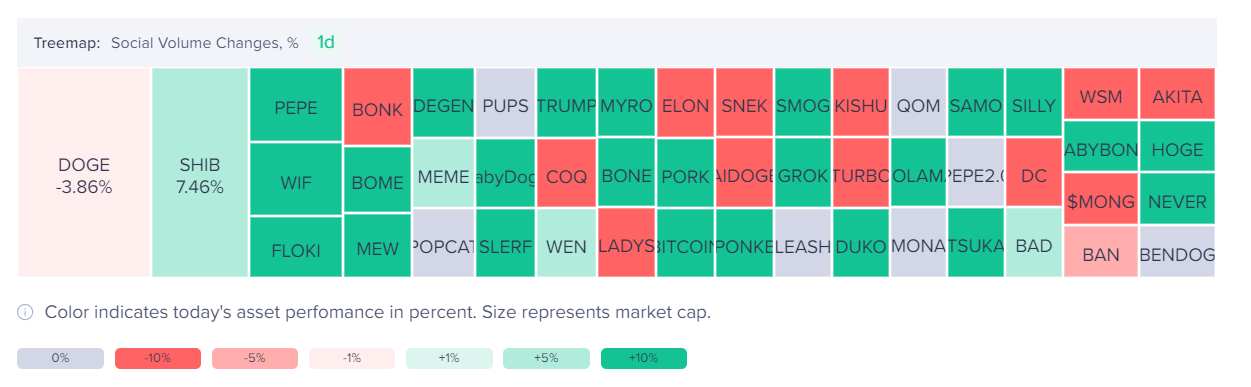

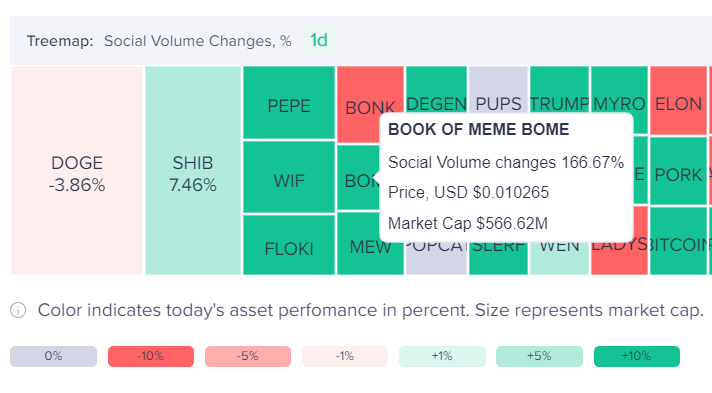

Altcoins have seen strong price gains over the past seven days and have been riding the Bitcoin optimism wave higher. According to data from Santiment, some meme coins are experiencing a surge in social media volumes.

PEPE

The data shows that PEPE’s social media volumes have rebounded over the past 24 hours, and the price has also recovered. Social media mentions are up 61%, while the price has jumped 5%. The surge in this popular Solana meme coin comes as Pepe Coin perpetual futures are listed on the Coinbase international exchange after being pushed back from a listing on April 18 due to technical reasons. The listing of PEPE is significant because it adds liquidity and increases the coin’s exposure.

As a result of the listing and the increased interest, the PEPE price has rallied, and the PEPE trading volume rose 12.3% to $1 billion. According to Coinglass data, PEPE open interest surged 9.35% to $64.59 million. Higher open interest often signals more active trading and higher speculation, while lower open interest could signal a lack of confidence in the market trend.

On the 4-hour chart, PEP/USD is attempting to rise above the 200 Simple Moving Average; a close above this resistance could spark a meaningful move higher.

Book of Meme

The Book of Meme coin has experienced a surge in social mentions, which are up 166% in the past 24 hours. However, the price has so far failed to follow higher. The Book of Meme has fallen 4% over the past 24 hours and is down 6% so far this week, but it still trades an impressive 917,24% higher since its inception, indicating resilience despite short-term fluctuations.

BOME is the 25th largest cryptocurrency

According to data from CoinMarketCap, with a market cap of $566.62 million, BOME is the 25th largest cryptocurrency.

Book of Meme is a recent addition to the Solana ecosystem. It has garnered over 80,000 active holders as it continues to try to prove itself as more than a fleeting trend.

The BOME/USD chart shows that the price has traded in a rising channel since mid-April. However, the price is in danger of falling out of that channel as it tests the lower band of the channel and the 50 Simple Moving Average (SMA), which could spur a deeper selloff.

Sources

https://coinmarketcap.com/currencies/book-of-meme/

https://app.santiment.net/

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.