Bitcoin is falling for a second straight day as the market’s attention turns to the US election next week and ahead of the US non-farm payroll report later today.

Bitcoin has fallen by over 3% in the past 24 hours and by almost 5% over the past three days as it continues to retreat from 73,600, the second-highest level this year, to trade at current levels of 69,500.

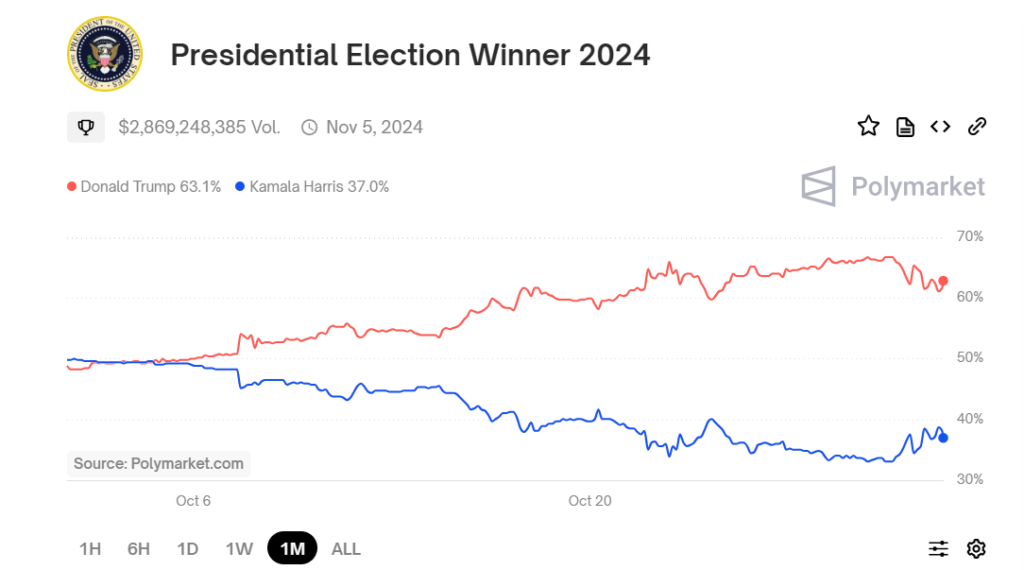

Trump’s lead narrows in the Polymarket

The fall in Bitcoin’s value comes amid an unwinding of the “Trump trade” yesterday. The official election polls show that the race between Donald Trump and Kamala Harris remains close. However, Polymarket predictions are starting to shower a shrinking lead for Trump over the Democratic presidential candidate, Kamala Harris.

Trump has had a comfortable lead in all swing states over the past week; however, there has been a reversal in Michigan and Wisconsin with a recent jump in the odds for Kamala Harris in Michigan, where she’s back again on top. Wisconsin, another key swing state, is also on the cusp of going blue.

Bitcoin has been considered a “Trump trade” owing to the Democratic nominee’s strong support for the crypto sector throughout his election campaign.

Earlier in the week, when Trump took the larger lead against Harris, Bitcoin came within a few hundred dollars of its record high.

Furthermore, the selloff in Bitcoin could also be a sign of de-risking in the market, as seen in the days leading up to the US elections in 2020 and 2016. Other risk assets, such as stocks, have also fallen from record highs.

Bitcoin technicals

Bitcoin price decline could also be seen as part of an overbought correction. The cryptocurrency has been declining since its daily relative strength index (RSI) crossed the 70 level, which indicates overbought.

When the RSI tips into overbought territory, it points to an overextended rally. This is often followed by a period of consolidation or a move lower to cool an overheated rally.

How could the US NFP move BTC?

Attention is turning to US non-farm payroll data, which is due later today. Expectations are for 113k jobs to have been added in October, down from 254k. Meanwhile, unemployment is expected to hold steady at 4.1%.

A sizable increase in jobs and falling unemployment could see the market lower Fed rate cut expectations going forward.

The data comes after figures yesterday showed that the core PCE index, the Fed’s preferred gauge for inflation, was hotter than expected at 2.7% YoY, and personal spending rose by 0.5% more than forecast.

While the Fed is still expected to cut interest rates by 25 basis points in November, strong data could result in the Fed adopting a more gradual pace to rate cuts next year. This bodes poorly for risk assets such as Bitcoin, owing to lower liquidity.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.