Bitcoin is moving higher and trades at the upper end of the 94k to 98k range, within which it has moved for the past two weeks. The price recovered from a spike lower of 93.3k on Tuesday and is trading at 98.4k at the time of writing, a weekly high. A rise above here opens the door to 100k.

The rangebound move in Bitcoin comes as traditional assets—the S&P 500 and Gold—set new record highs. Gold has soared on safe-haven demand amid ongoing worries about trade wars, as US President Trump threatens trade tariffs on Canada, Mexico, and Europe.

While Bitcoin was previously considered “digital gold,” its recent price movements suggest that it has traded like a risk asset since BTC ETFs were launched. Meanwhile, the S&P 500 has rallied to a record high, largely driven by a surge in chip stocks. Still, the fact that the S&P 500 trades at record levels while Bitcoin is still some 10% away from its ATH points to the BTC S&P500 positive correlation slowing.

Increasing narratives towards Bitcoin and creating a Bitcoin Strategic Reserve could shift some attention towards Bitcoin.

Progress toward establishing Bitcoin as a strategic reserve would imply that the cryptocurrency is a resilient asset, adding to its legitimacy. It’s worth monitoring developments at a state level for clues over the likelihood of a national Bitcoin strategic reserve.

Utah Bitcoin reserve bill advances

The news that the Utah Senate Revenue and Taxation Committee passed a Bitcoin reserve bill supports BTC. The reserve bill will head to a second and third reading in the Senate before a final vote in the chamber. If it clears the Senate, it would go to Governor Spencer Cox to be signed into law. The state of Utah has made the most progress with a crypto bill, which would give the state treasurer the authority to invest public money into Bitcoin. Positive developments regarding state Bitcoin reserves could boost the BTC demand outlook and pave the way for a national strategic reserve.

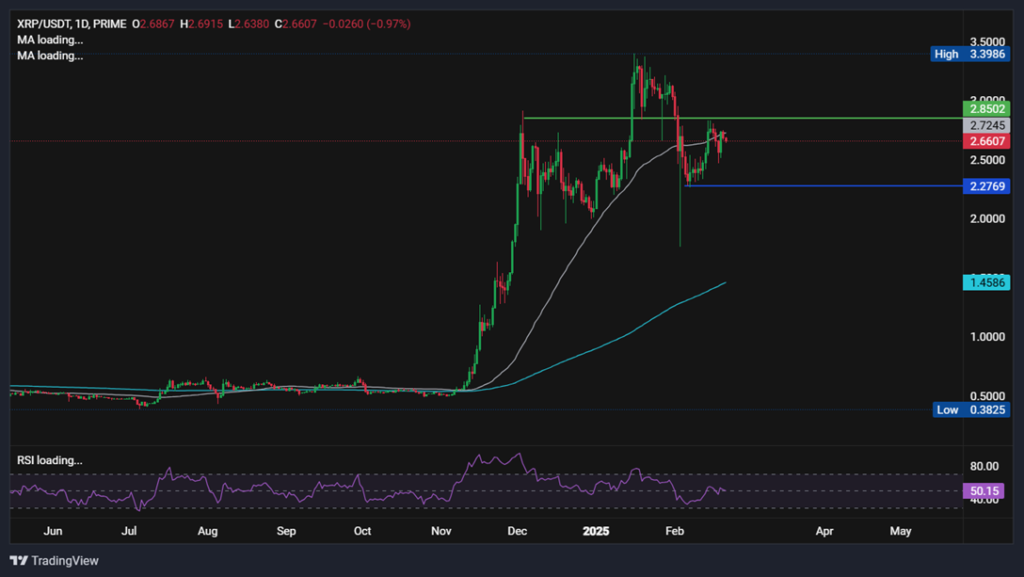

XRP struggles as it awaits SEC news on the appeal

XRP is falling but holds onto most of Wednesday’s 6% gain amid changes at the Securities and Exchange Commission, which could pave the way for the end of the SEC vs Ripple case.

The SEC has announced a significant restructuring of its crypto enforcement division to focus on fraud relating to blockchain technology and crypto assets. The restructuring supports the view that the SEC will shift its focus away from non-fraud cases. This latest development comes after chief crypto litigator Jorge Tenreiro was moved to another department.

These changes, along with the formal acknowledgment of XRP ETFs, have fueled speculation that the SEC could withdraw its appeal challenging part of the ruling in the Ripple case. Still, the SEC’s silence on its appeal strategy is creating some caution toward XRP.

Should the SEC approve XRP ETFs and drop its appeal against Ripple, XRP could surge above 3.550 its record high towards $5.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.