Bitcoin is extending its rally, which started after the Federal Reserve cut interest rates on Wednesday. The largest cryptocurrency has reached over 64k.

Altcoins followed Bitcoin higher, with Ether breaking above $2500 and BMB soaring past $517. However, Solana is leading the pack today, having surged over 10% to $150.

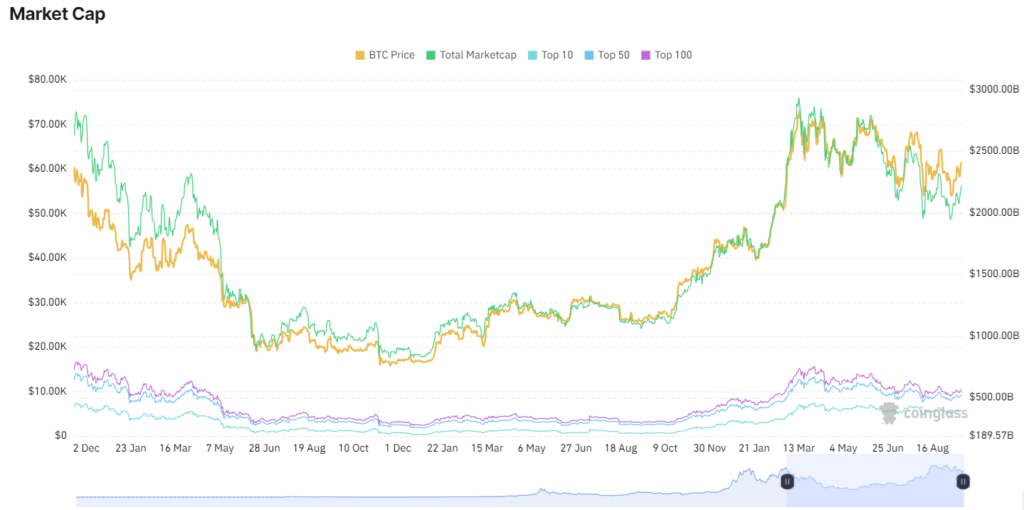

According to data from Coinglass, the crypto market cap has gained $70 billion overnight and is now above $2.3 trillion.

While Bitcoin has risen to a 2 week high, the US S&P 500 has also reached a record high of over 5700, while the Dow Jones also closed above 42,000 for the first time. Risk assets across the board are benefiting from the Federal Reserve’s bumper rate cut and optimism that the US economy will avoid a hard landing.

The correlations between crypto and traditional investments such as stocks have increased recently in a sign that macroeconomic data has been influencing the digital markets.

An aggressive start to the Fed’s rate-cutting cycle has been excellent news for riskier assets. This was followed by US jobless claims data yesterday, which saw initial claims come in lower than expected at 219k, down from 230k in the previous week. The data supported the view that the US labour market is holding up the day after Federal Reserve chair Jerome Powell called the US economy strong.

Bitcoin forecasts – BTC tests key resistance

Technically, the picture is turning constructive for Bitcoin as it’s testing the resistance of the 200-day moving average at 64,000. A rise above here and 65,000, the late October high, sees Bitcoin create a higher high, which sets the stage for a move towards the upper band of the descending channel at 68,000.

SOL soars after Seeker mobile announcement

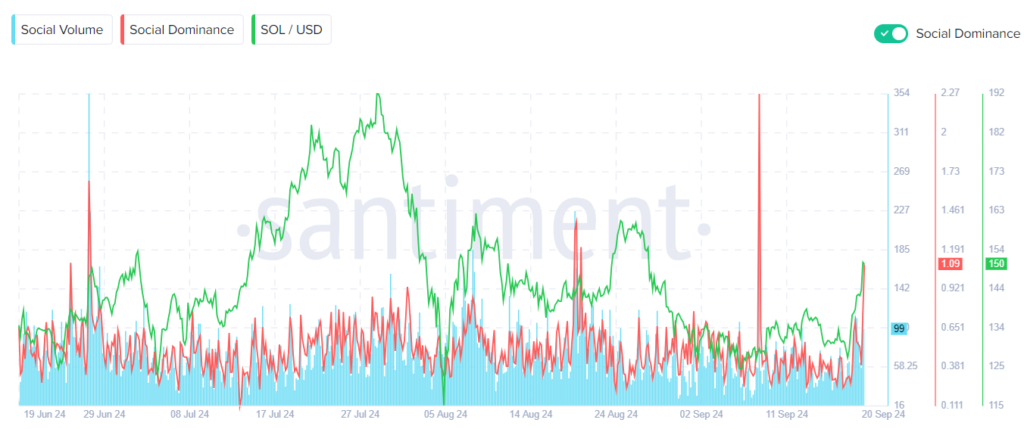

Meanwhile, Solana has outperformed Rising 12% to reclaim 140. According to sentiment data, social volume surrounding Solana has increased 32% over the past 24 hours, well ahead of its peers.

Solana is boosted not only by the broad upbeat mood in the market but also by an announcement by Solana mobile, which is Solana Labs phone designing subsidiary, that it will ship its second crypto phone next year; the announcement came at the Token 2049 conference yesterday with the significant improvements Ava salon’s first mobile phone.

This phone, called the Seeker, incorporates improvements specific to Crypto, such as a specially built crypto wallet that ties to the device’s partition seed vault key storage. The wallet will allow users to execute crypto transactions more easily on the seeker than on its predecessor, Saga.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.