- Bitcoin ETF inflows reach a 19 days record

- Why aren’t record inflows taking Bitcoin price to record highs?

- What to expect from the US non-farm payroll (NFP)

Bitcoin is holding steady as the price continues to consolidate around 71k and as the market weighs up exceptional ETF flows and muted Google search trends ahead of the key US non-farm payroll report.

Bitcoin ETFs see a record 19-day inflow.

Bitcoin ETFs have performed remarkably since they were approved in January. Recent data shows significant inflows, with $880 million and $488.1 million recorded on June 4th and 5th, respectively. Inflows have also reached a record 19-day run, and while the BTC price has pushed above the key 70K level, it still hasn’t surpassed its all-time high of 73,750.

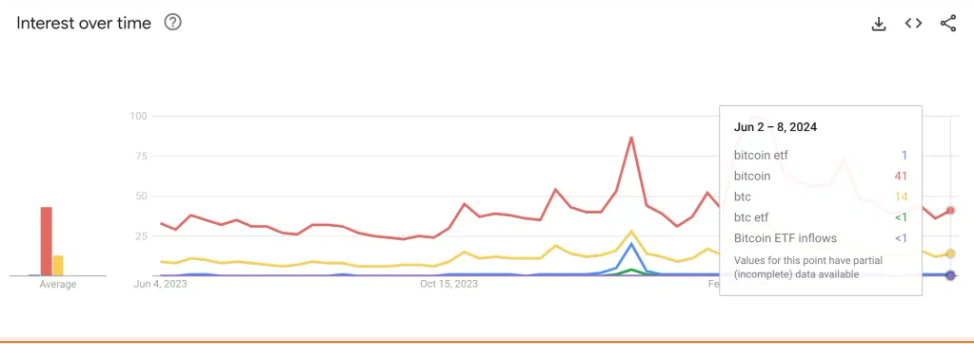

Meanwhile, while ETF inflows are breaking record levels, Google data shows that search interest is notably low compared to the 2021 bull run. According to Google Trends, terms such as “Bitcoin” and “BTC” scored 41 and 17 out of 100, respectively, while phrases such as “Bitcoin ETF” and “BTC ETF” registered a score of less than one.

This tells us that retail investors, an important market segment, have yet to engage with Bitcoin ETFs fully.

Why aren’t record ETF flows boosting BTC price?

The other point to remember is that while Bitcoin ETFs have seen record-breaking inflows, the Bitcoin price has not broken new records for several months. This could be because Bitcoin ETFs still make up just a small part of the broader global holding of Bitcoin. According to HOLD15Capital, ETF holdings are still relatively low, holding just 5.2% of Bitcoin’s circulating supply.

This means that while ETF flows are record-breaking, they are still not strong enough to exceed and overshadow other areas of the market, including spot futures and options. As a result, Bitcoin’s price is still more heavily influenced by macroeconomic, geopolitical, and sector-specific events.

While a more crypto-specific narrative builds macroeconomic events, they remain particularly important for Bitcoin, as it is susceptible to global liquidity trends. Bitcoin will benefit from a looser monetary policy as this implies more funds are available to chase higher returns.

What to expect from the non-farm payroll report?

Key macroeconomic data, the US nonfarm payroll report, is due today, which could provide further clarity over when the Federal Reserve may start cutting interest rates.

Expectations are for 185,000 jobs to be added in May, up slightly from 175,000 in April. The lead indicators this week have painted a mixed picture. The ISM services and manufacturing report employment subcomponents increased, while the ADP payroll came in weaker than expected, and jobless claims rose.

In addition to the headline job numbers, attention will also be paid to the unemployment rate and wage growth. Signs of a softening labour market could support the view that the Federal Reserve could cut interest rates as soon as September, boosting Bitcoin.

The market is pricing in a 65% probability of a September rate cut up from 50% last week.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.