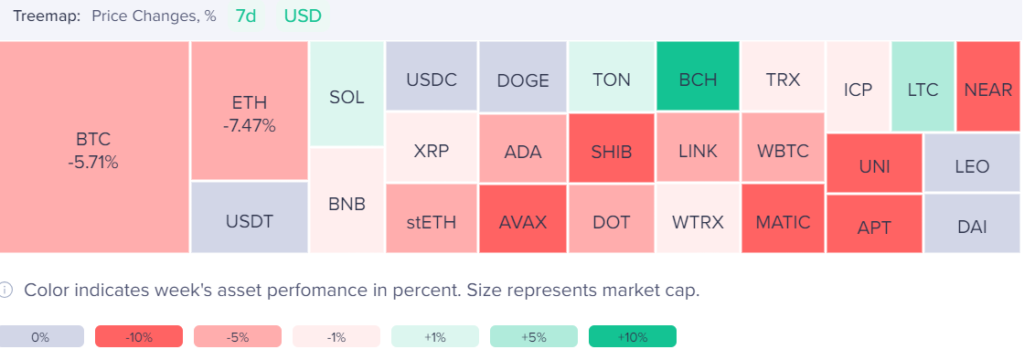

As Bitcoin bulls pause for breath, Litecoin has recently posted substantial gains, standing out from altcoin peers. The Litecoin price has recently peaked at $112 amid rising trading volumes. Is this paving the way for Litecoin to perform strongly in April?

- Litecoin rose 20% last week.

- The CFTC declared Litecoin a commodity.

- Miners accumulate LTC holdings.

- Open interest rises.

- Litecoin social volume outperforms.

20% gains last week

Litecoin has surged in recent weeks, boosted by a combination of technical factors, strong investor interest, and miners’ accumulation. LTC/USD rose over 30% in March compared to Bitcoin’s 17% rise and soared over 20% across last week, pushing above the key psychological $100 mark. This uptick follows a 40% year-to-date gain, while daily traded volume has soared as an influx of traders returned to Litecoin.

LTC vs. BTC chart

Litecoin is a commodity

A significant non-technical event that has likely contributed to Litecoin’s rise to $100 was a recent statement by the Commodity Futures Trading Commission (CFTC). In a lawsuit against the cryptocurrency exchange KuCoin, the CFTC declared Litecoin, along with Ethereum, a commodity. Crucially, this puts Litecoin outside the scope of the Securities and Exchange Commission (SEC), which regulates securities and imposes stricter regulations on coin issuers. In short, Litecoin is being declared a commodity, and there is less fear of the SEC attempting enforcement actions.

Miners accumulate LTC

Another key factor supporting the rise in Litecoin has been miners accumulating the cryptocurrency. According to data from IntoTheBlock, miners have been accumulating LTC at a solid rate throughout March, increasing their reserves by a healthy 150,000 LTC, taking the total holdings from just over 2 million to 2.2 million LTC at the end of March.

Accumulation by miners means a reduction in newly mined coins entering the market. This strategy reduces selling pressure on the coin, reflecting miners’ confidence in the cryptocurrency’s price outlook as they opt to hold onto coins in anticipation of further gains.

Open interest rises

According to Coinglass data, open interest (OI) in Litcecoin futures rose to a peak of $707.92 million on March 30. The surge reinforces the cryptocurrency’s recent price rise: it signals rising optimism among traders regarding the price trajectory and highlights positive sentiment demonstrated by traders’ willingness to bolster long positions.

Will April be a strong month for Litecoin?

At the start of this month, the Litecoin price has seen some volatility around the $100 level. Investors are wondering whether the bullish run will continue.

According to Santiment data, the coin’s social volume was high, indicating its popularity in crypto. Over the past seven days, LTC was one of the few altcoins to see a rise in social volume.

Technically, buyers will need a rise above the 115.00 resistance level, the 2023 high, to extend gains towards $150. On the downside, buyers will need to defend the $94 level, as a break below here could spark deeper losses.

Sources

https://decrypt.co/224102/litecoin-price-spikes-cftc-calls-commodity-bitcoin-ethereum

https://coingape.com/litecoin-ltc-price-breaks-past-105-major-price-rally-expected-in-april/

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.