- Turkey is in the final stages of preparing a draft law on crypto assets.

- The regulation aims to protect customers, driving innovation

- This contrasts with the US’s hostile court-based approach

New legislation soon

Turkey’s fintech sector, including the crypto sector, saw rapid growth and investment in 2023. As the sector expands, Turkey is on the brink of introducing its first-ever legislation to regulate the sector. A draft bill regarding the detailed regulation of crypto assets and platforms has been submitted to Parliament for review, and significant new legislation is expected to be introduced in the coming year. There will also be a series of amendments to Capital Markets Law No. 6362.

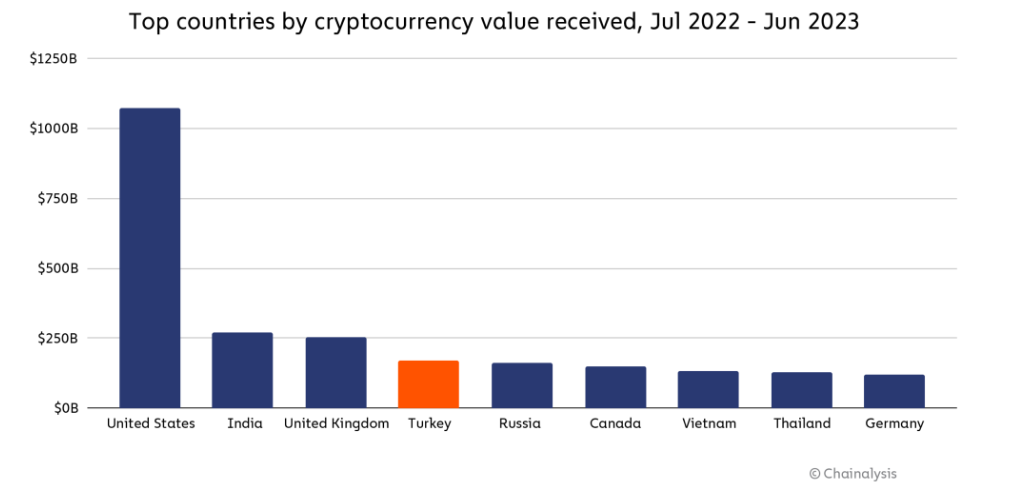

Turkey’s crypto adoption

The desire to regulate the sector comes as Turkey has seen a sharp rise in crypto investors in the country as it battled with soaring inflation (64.8% in December) and a steep devaluation in the Lira, which fell to a record low against the USD last year, fueling distrust in fiat currencies and financial institutions. Many looked to move their funds into crypto as an alternative safe haven, lifting Turkey to the fourth largest crypto trading country with transactions totaling $170 billion, according to Chainanalysis. This is a large investor group currently operating without safeguards.

Introducing crypto legislation is also a critical step for Turkey to leave the Financial Action Task Force’s (FATF) grey list.

What might the legislation contain?

As demand surges, Turkey seeks to create and implement regulations and legislation to protect investors in the local cryptocurrency market by creating a clear pathway for industry participants.

According to reports, the new regulation is expected to cover a legal definition for cryptocurrency assets, define crypto service providers (CASPs), taxation, licensing of platforms, and disclosure. They could also include capital adequacy requirements and measures to improve digital security and custody services.

The Capital Markets Board will become the crypto sector’s main regulatory and supervisory authority. The CMB’s responsibilities will include creating secondary legislation.

Collaborative vs. US hostile approach

Just this week, the ruling party’s deputy chairman, Omer Ileri, who oversees Information and Communications Technologies, consulted with a team of crypto experts on the matter, highlighting the country’s efforts to create market-friendly legislation.

This starkly contrasts with the US, where industry participants criticize the Securities and Exchange Commission’s policies. The latest SEC crackdown has seen the regulator file several lawsuits against cryptocurrency firms in what appears to be a more hostile, court-based approach to regulation. Major players have moved away from the US due to its tougher regulatory stance or lack of clarity.

Rather than following in the footsteps of the US, Turkey aims not only to protect users but also to drive innovation in the sector while creating regulatory balance. Its more collaborative approach to connecting with stakeholders is similar to the pathway adopted in Dubai, where the regulator VARA bases its success on the underpinning philosophy of finding the highest point of convergence as a threshold rather than a minimum standard baseline.

Conclusion

Reasonable, fair, and collaborative regulation should ensure transparency, accountability, and stability in the sector, working to attract investors and foster innovation rather than scaring away participants. Successfully implemented, it could establish a robust foundation for crypto assets, generating opportunities for foreign investment and helping Turkey in its quest to be a crypto hub.

Sources

Turkey’s crypto rules seen addressing licensing, taxation after boom | Reuters

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.