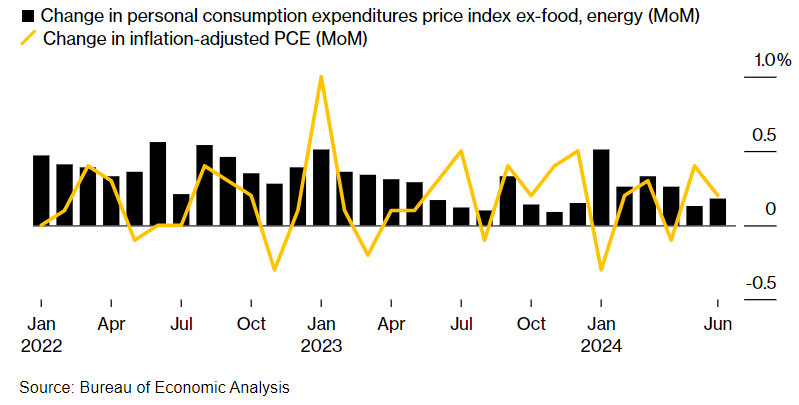

Economists expect Personal Consumption Expenditure (PCE), the Federal Reserve’s preferred gauge for inflation, to show another month of encouraging data, which could give the central bank more confidence to start a rate-cutting cycle in the September meeting.

Economists believe the PCE index will rise 0.2% monthly and 2.6% annually. Meanwhile, the core PCE measure, which discounts volatile items such as food and energy prices, is expected to rise 0.2% monthly and 2.7% annually. This would be slightly hotter than June’s core PCE reading, which showed inflation at 0.1% month over month and 2.6% annually.

Even if core PCE rises slightly higher, overall inflation continues to trend lower. According to historical data, the PCE met expectations 70% of the time since January 2023.

Cooling inflation should increase the Federal Reserve’s confidence that the inflation outlook is cooling towards the 2% target, encouraging the start of a rate-cutting cycle.

At the Jackson Hole symposium last Friday, Federal Reserve chair Jerome Powell said that the central bank was increasingly confident that inflation was cooling towards the 2% target. Instead, Powell highlighted risks to the US labour market as more of a concern.

Yesterday’s jobless data showed that the US jobs market was holding up well. 231,000 Americans applied for unemployment benefits for the first time, down slightly from 233,000 in the previous week. US nonfarm payroll data will be released next Friday and will be closely watched ahead of the Federal Reserve’s interest rate decision on September 18th.

According to the CME Fed watch tool, the market is 100% certain that the Federal Reserve will cut interest rates in September but remains uncertain about the size of the cut. The market is pricing in a 33% probability of a 50 basis point rate cut.

Should inflation cool by more than expected, this could raise expectations of a larger interest rate cut.

However, if inflation is hotter than expected, this could see the market raining expectations of multiple rate cuts across the rest of the year.

How might core PCE influence Bitcoin?

Bitcoin and other risk assets such as stock indices can benefit from a lower interest rate environment because this increases liquidity, meaning that more money is available to invest. Moreover, expectations of further rate cuts could also lower the USD, which is also beneficial for BTC/USD.

Therefore, all things being equal, cooler-than-expected inflation could help lift the Bitcoin price. Meanwhile, hotter-than-expected inflation could see the market rein in expectations of multiple rate cuts this year and put pressure on Bitcoin.

Ahead of the release, Bitcoin is holding steady below 60k. After rising 7% in the previous week, Bitcoin is on track to fall 7% this week.

How might core PCE influence Gold?

Gold is USD-denominated and non-yielding. This means it performs better in a lower interest rate environment and when the USD weakens.

Gold has risen to record highs this month, partly due to expectations surrounding Fed rate cut bets and the USD falling to a 13-month low.

Should today’s data support further rate cuts by the Fed, Gold prices could be supported higher. However, hotter-than-expected inflation could pull Gold prices lower by lifting the USD.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.