Bitcoin’s price is rising on Wednesday, reaching a 2.5-month high and on the verge of breaking out. The move higher comes amid optimism that the US elections could bring a more crypto-friendly regulatory environment and capital inflows.

The world’s largest cryptocurrency appears to be breaking out of a range that it’s traded in since March, rising above 66.5k to create a higher high. BTC is testing the falling channel resistance with a rise above here, bringing 70k, 73750, and fresh all-time highs into focus. The latest moves have renewed optimism that the Uptober rally could extend the digital assets’ bullish momentum.

US elections a win-win for crypto?

Sentiment towards cryptocurrencies has improved this week after Democratic presidential candidate Kamala Harris pledged a more definite regulatory framework for crypto. Although her comments were short on details, they are of a supportive nature and suggest that she may not continue with the Biden administration’s tough regulatory crackdown on the sector under the Securities and Exchange Commission. Harris’ more crypto-friendly stance means that both the frontrunners for the next US president are adopting a crypto-friendly position ahead of the November 5th vote.

Donald Trump, the Republican candidate and former president, has maintained a pro-crypto stance throughout the 2024 election campaign. Trump announced a Bitcoin Strategic reserve proposal and even signaled the removal of the SEC’s Chair Gensler. His Trump World Liberty Financial crypto project went live this week and has reportedly raised around $220 million in token sales.

While the polls remain tight between Harris and Trump, Trump has recovered some lost ground. Given that he is considered the more pro-crypto candidate of the two, his recovery in the polls is also Bitcoin-positive.

That said, the rally in Bitcoin ahead of the election suggests that the market increasingly sees the US election as a win-win event for crypto.

The upbeat mood towards crypto has also been boosted by growing institutional enthusiasm amid improved capital flows.

Markets show a strong appetite for digital assets.

Bitcoin spot ETF inflows reached $371 million on October 15th, following $556 million during Monday’s trading. This is a multi-month high, and inflows of this level were last seen on June 4th.

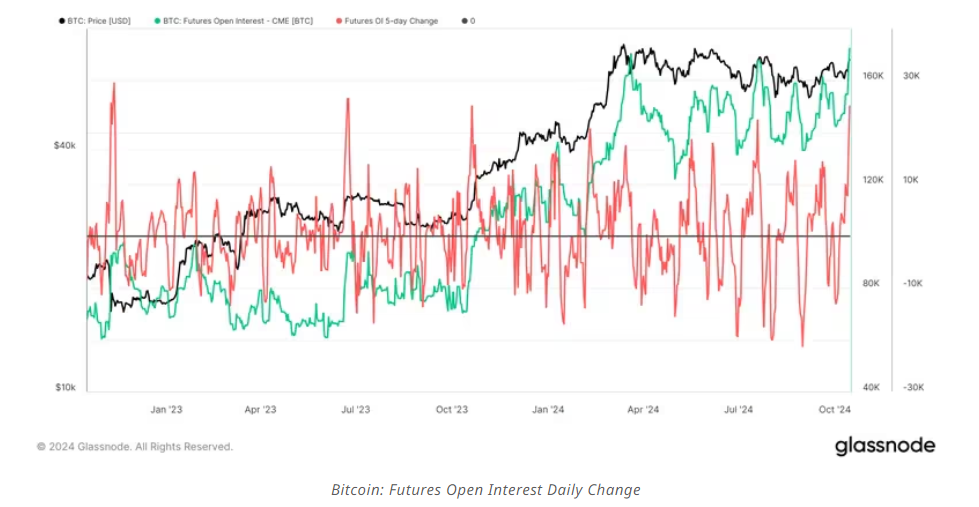

Meanwhile, Bitcoin futures open interest, which refers to the number of open or active futures contracts at any given time, on the CME has hit an all-time high of 172,430 BTC.

Over the past five days, CME has seen open interest ramp up by 25,125 BTC, marking one of the highest levels recorded over five days in recent history.

This rising appetite for Bitcoin suggests that the rally could have further to run.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.